Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sullivan, Inc. sells tire rims. Its sales budget for the nine months ended September 30, 2024, and additional information follow: (Click the icon to

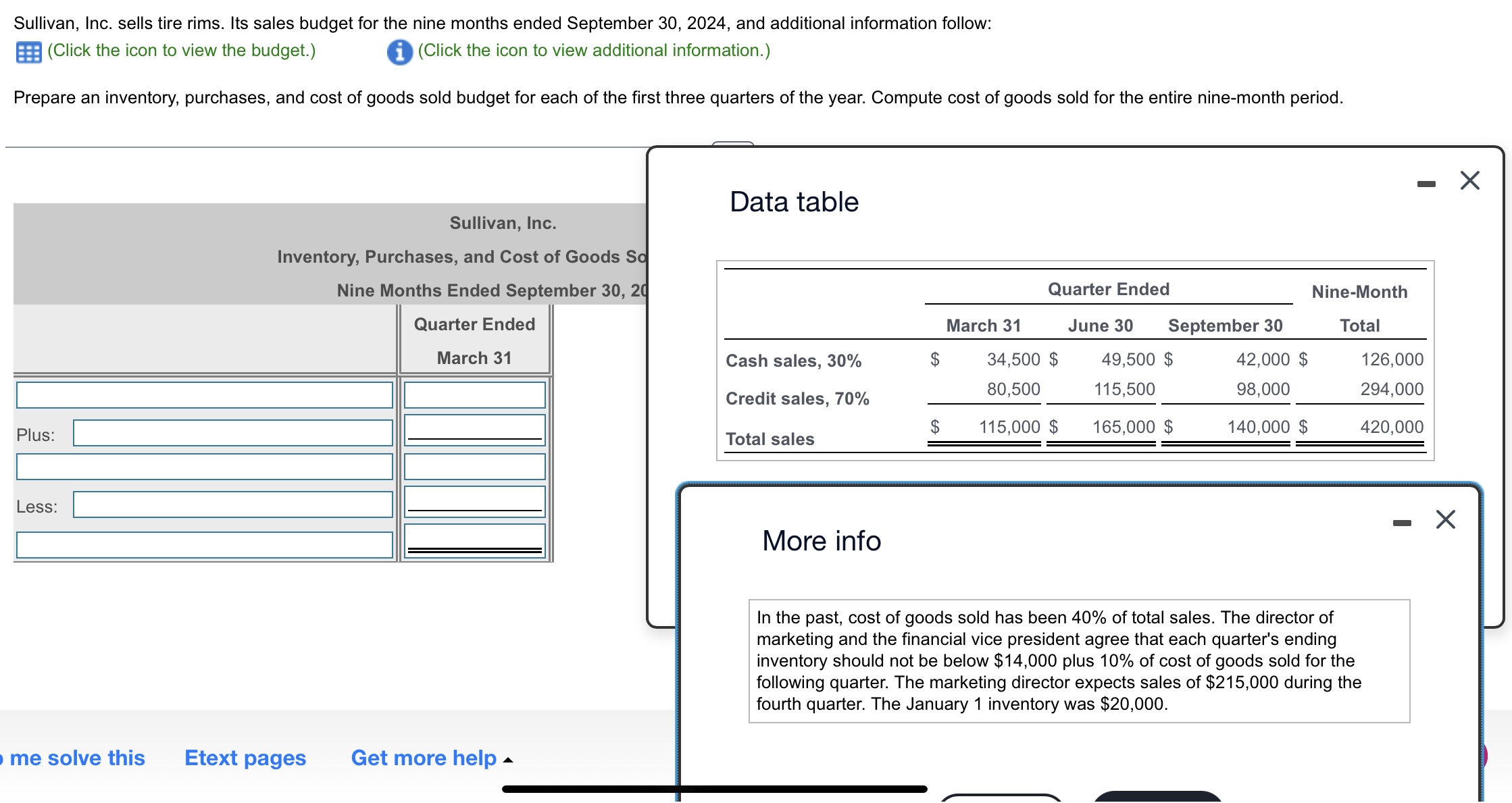

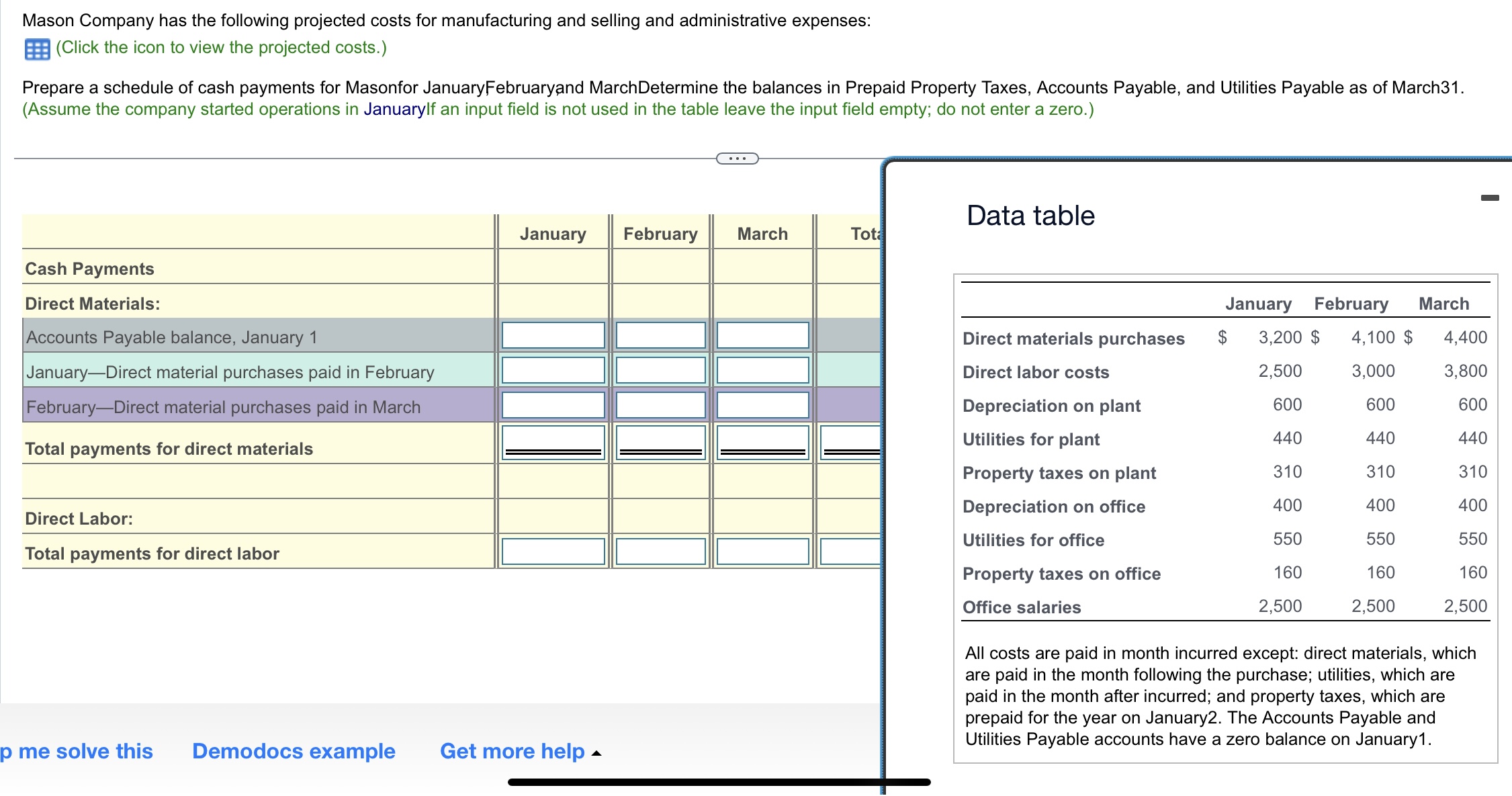

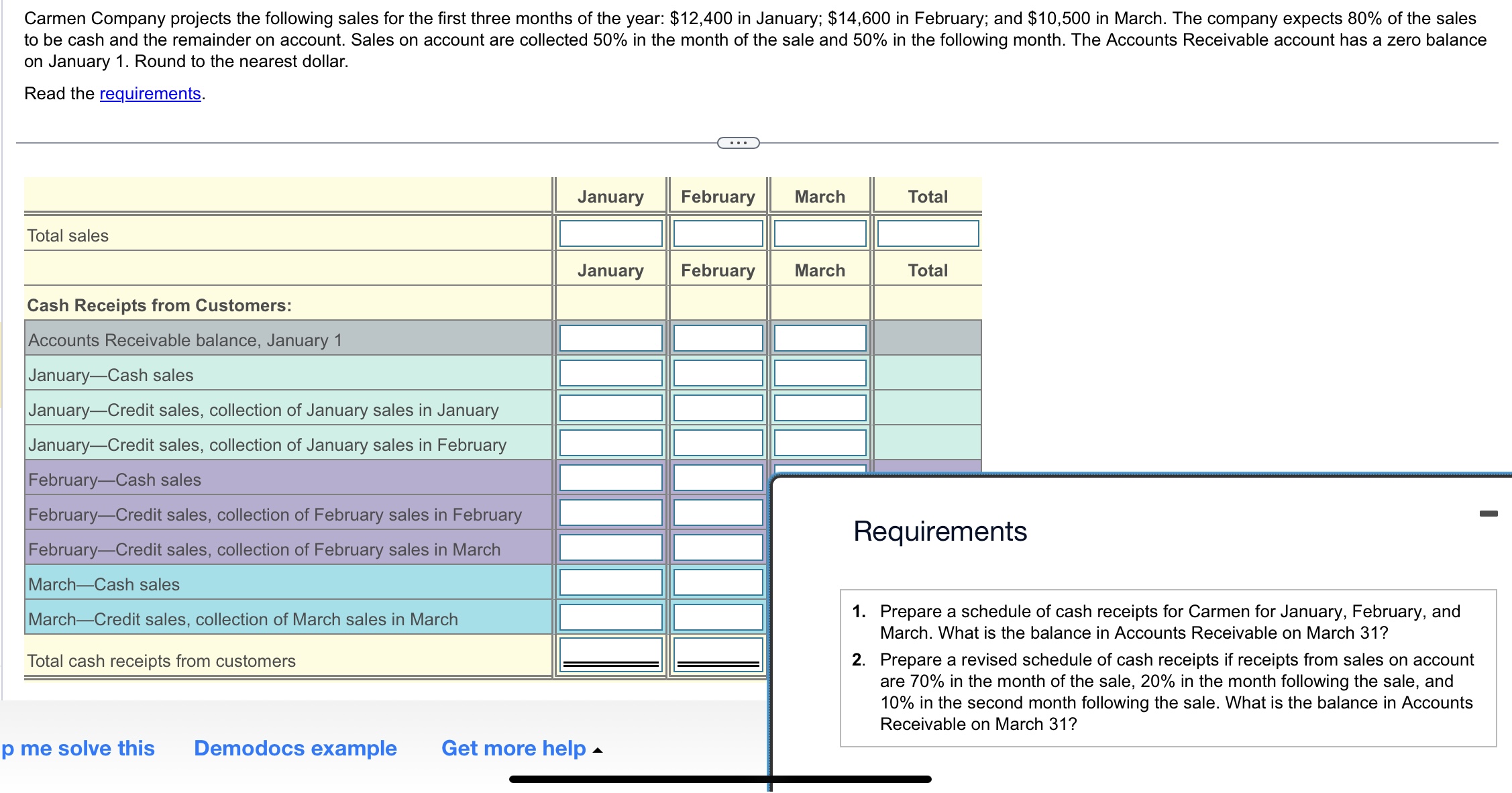

Sullivan, Inc. sells tire rims. Its sales budget for the nine months ended September 30, 2024, and additional information follow: (Click the icon to view the budget.) i (Click the icon to view additional information.) Prepare an inventory, purchases, and cost of goods sold budget for each of the first three quarters of the year. Compute cost of goods sold for the entire nine-month period. Plus: Less: Sullivan, Inc. Inventory, Purchases, and Cost of Goods So Nine Months Ended September 30, 20 Quarter Ended March 31 me solve this Etext pages Get more help Data table Quarter Ended Nine-Month March 31 June 30 September 30 Total Cash sales, 30% Credit sales, 70% 34,500 $ 80,500 49,500 $ 115,500 42,000 $ 126,000 98,000 294,000 115,000 $ 165,000 $ 140,000 $ 420,000 Total sales More info In the past, cost of goods sold has been 40% of total sales. The director of marketing and the financial vice president agree that each quarter's ending inventory should not be below $14,000 plus 10% of cost of goods sold for the following quarter. The marketing director expects sales of $215,000 during the fourth quarter. The January 1 inventory was $20,000. Mason Company has the following projected costs for manufacturing and selling and administrative expenses: (Click the icon to view the projected costs.) Prepare a schedule of cash payments for Masonfor January Februaryand March Determine the balances in Prepaid Property Taxes, Accounts Payable, and Utilities Payable as of March31. (Assume the company started operations in Januarylf an input field is not used in the table leave the input field empty; do not enter a zero.) Cash Payments Direct Materials: Accounts Payable balance, January 1 January-Direct material purchases paid in February February-Direct material purchases paid in March Total payments for direct materials Direct Labor: Total payments for direct labor p me solve this Demodocs example ... Data table January February March Tota January February March Direct materials purchases $ 3,200 $ 4,100 $ 4,400 Direct labor costs 2,500 3,000 3,800 Depreciation on plant 600 600 600 Utilities for plant 440 440 440 Property taxes on plant 310 310 310 Depreciation on office 400 400 400 Utilities for office 550 550 550 Property taxes on office 160 160 160 Office salaries 2,500 2,500 2,500 Get more help All costs are paid in month incurred except: direct materials, which are paid in the month following the purchase; utilities, which are paid in the month after incurred; and property taxes, which are prepaid for the year on January2. The Accounts Payable and Utilities Payable accounts have a zero balance on January1. Carmen Company projects the following sales for the first three months of the year: $12,400 in January; $14,600 in February; and $10,500 in March. The company expects 80% of the sales to be cash and the remainder on account. Sales on account are collected 50% in the month of the sale and 50% in the following month. The Accounts Receivable account has a zero balance on January 1. Round to the nearest dollar. Read the requirements. Total sales Cash Receipts from Customers: Accounts Receivable balance, January 1 January-Cash sales January-Credit sales, collection of January sales in January January-Credit sales, collection of January sales in February February-Cash sales February-Credit sales, collection of February sales in February February-Credit sales, collection of February sales in March March-Cash sales March-Credit sales, collection of March sales in March Total cash receipts from customers January February March Total January February March Total p me solve this Demodocs example Get more help Requirements 1. Prepare a schedule of cash receipts for Carmen for January, February, and March. What is the balance in Accounts Receivable on March 31? 2. Prepare a revised schedule of cash receipts if receipts from sales on account are 70% in the month of the sale, 20% in the month following the sale, and 10% in the second month following the sale. What is the balance in Accounts Receivable on March 31?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started