Answered step by step

Verified Expert Solution

Question

1 Approved Answer

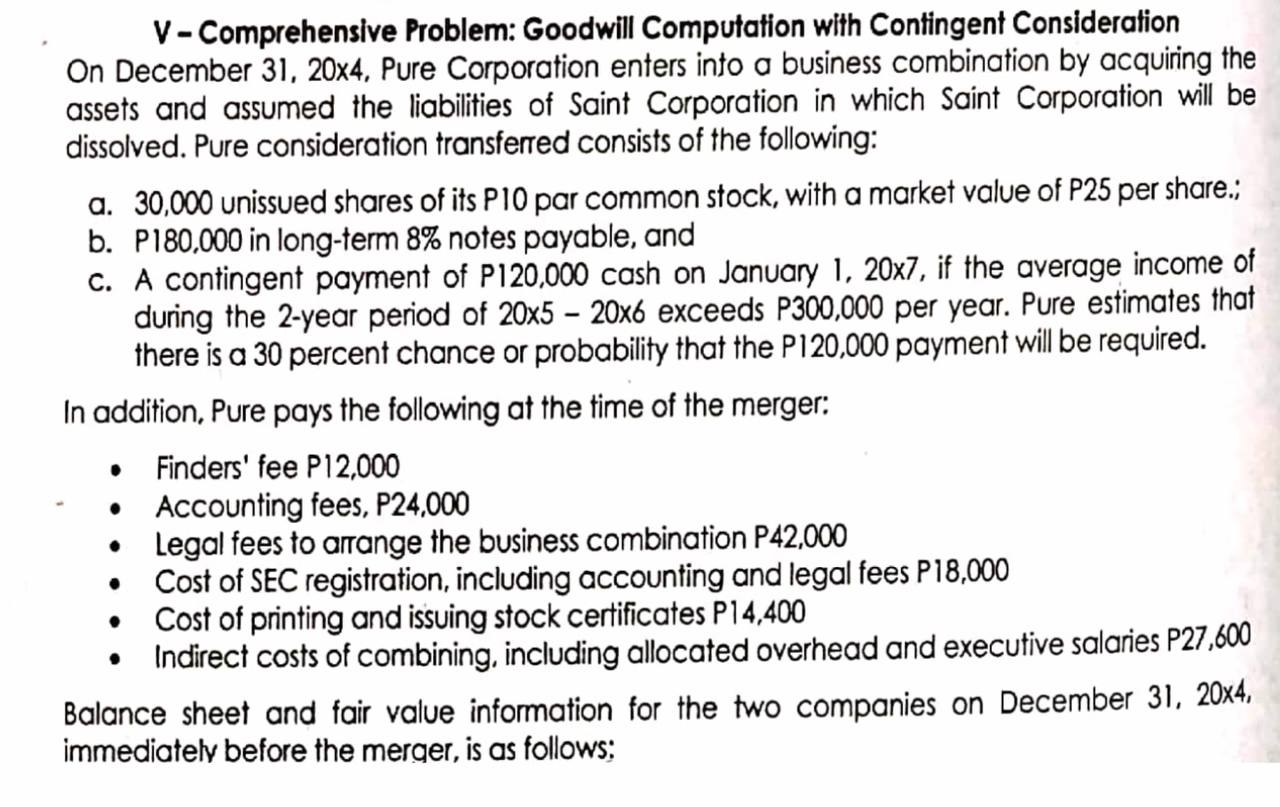

V-Comprehensive Problem: Goodwill Computation with Contingent Consideration On December 31, 20x4, Pure Corporation enters into a business combination by acquiring the assets and assumed

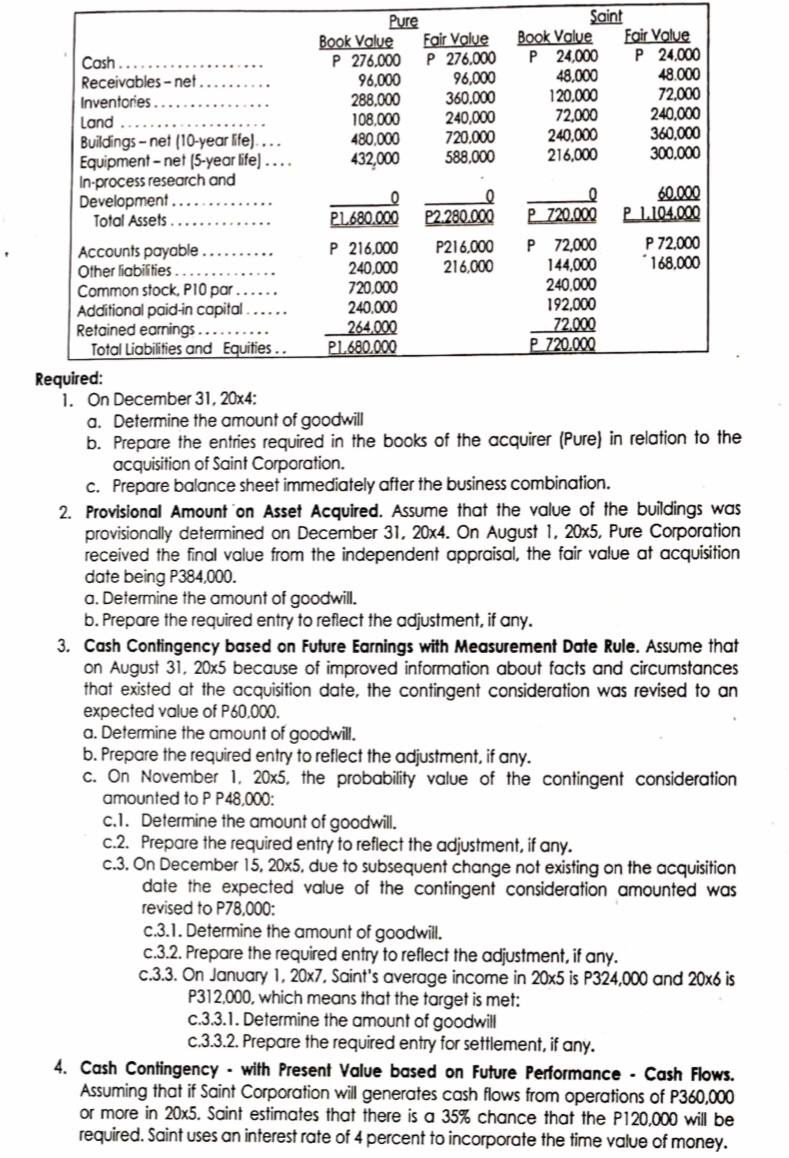

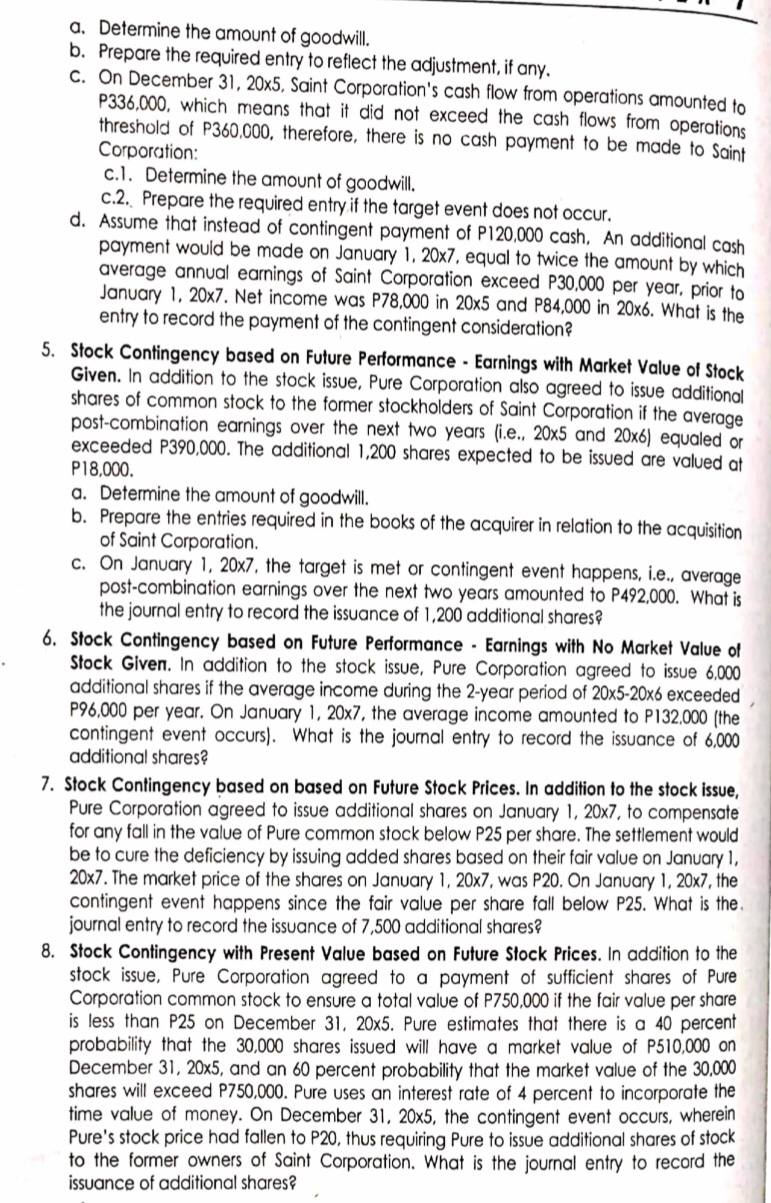

V-Comprehensive Problem: Goodwill Computation with Contingent Consideration On December 31, 20x4, Pure Corporation enters into a business combination by acquiring the assets and assumed the liabilities of Saint Corporation in which Saint Corporation will be dissolved. Pure consideration transferred consists of the following: a. 30,000 unissued shares of its P10 par common stock, with a market value of P25 per share.; b. P180,000 in long-term 8% notes payable, and c. A contingent payment of P120,000 cash on January 1, 20x7, if the average income of during the 2-year period of 20x5 - 20x6 exceeds P300,000 per year. Pure estimates that there is a 30 percent chance or probability that the P120,000 payment will be required. In addition, Pure pays the following at the time of the merger: Finders' fee P12,000 Accounting fees, P24,000 Legal fees to arrange the business combination P42,000 Cost of SEC registration, including accounting and legal fees P18,000 Cost of printing and issuing stock certificates P14,400 Indirect costs of combining, including allocated overhead and executive salaries P27,600 Balance sheet and fair value information for the two companies on December 31, 20x4, immediately before the merger, is as follows; Pure Saint Book Value Fair Value Book Value Fair Value Cash....... Receivables-net. P 276.000 P 276,000 P 24,000 P 24,000 96,000 96,000 48,000 48.000 Inventories..... 288,000 360.000 120,000 72,000 Land 108,000 240,000 72,000 240,000 Buildings-net (10-year life].... 480,000 720,000 240,000 360,000 Equipment-net (5-year life)... 432,000 588,000 216,000 300,000 In-process research and Development.... 60.000 P1.680.000 P2.280.000 P 720.000 P1.104.000 P 216,000 240,000 P216,000 216,000 P 72,000 P 72,000 144,000 168,000 720,000 240,000 240,000 192,000 Retained earnings..... 264,000 72,000 P1.680.000 P 720.000 Total Assets.... Accounts payable....... Other liabilities...... Common stock, P10 par. Additional paid-in capital..... Total Liabilities and Equities.. Required: 1. On December 31, 20x4: a. Determine the amount of goodwill b. Prepare the entries required in the books of the acquirer (Pure) in relation to the acquisition of Saint Corporation. c. Prepare balance sheet immediately after the business combination. 2. Provisional Amount on Asset Acquired. Assume that the value of the buildings was provisionally determined on December 31, 20x4. On August 1, 20x5, Pure Corporation received the final value from the independent appraisal, the fair value at acquisition date being P384,000. a. Determine the amount of goodwill. b. Prepare the required entry to reflect the adjustment, if any. 3. Cash Contingency based on Future Earnings with Measurement Date Rule. Assume that on August 31, 20x5 because of improved information about facts and circumstances that existed at the acquisition date, the contingent consideration was revised to an expected value of P60,000. a. Determine the amount of goodwill. b. Prepare the required entry to reflect the adjustment, if any. c. On November 1, 20x5, the probability value of the contingent consideration amounted to P P48,000: c.1. Determine the amount of goodwill. c.2. Prepare the required entry to reflect the adjustment, if any. c.3. On December 15, 20x5, due to subsequent change not existing on the acquisition date the expected value of the contingent consideration amounted was revised to P78,000: c.3.1. Determine the amount of goodwill. c.3.2. Prepare the required entry to reflect the adjustment, if any. c.3.3. On January 1, 20x7, Saint's average income in 20x5 is P324,000 and 20x6 is P312,000, which means that the target is met: c.3.3.1. Determine the amount of goodwill c.3.3.2. Prepare the required entry for settlement, if any. . 4. Cash Contingency with Present Value based on Future Performance Cash Flows. Assuming that if Saint Corporation will generates cash flows from operations of P360,000 or more in 20x5. Saint estimates that there is a 35% chance that the P120,000 will be required. Saint uses an interest rate of 4 percent to incorporate the time value of money. a. Determine the amount of goodwill. b. Prepare the required entry to reflect the adjustment, if any. c. On December 31, 20x5. Saint Corporation's cash flow from operations amounted to P336,000, which means that it did not exceed the cash flows from operations threshold of P360,000, therefore, there is no cash payment to be made to Saint Corporation: c.1. Determine the amount of goodwill. c.2. Prepare the required entry if the target event does not occur. d. Assume that instead of contingent payment of P120.000 cash. An additional cash payment would be made on January 1, 20x7, equal to twice the amount by which average annual earnings of Saint Corporation exceed P30,000 per year, prior to January 1, 20x7. Net income was P78,000 in 20x5 and P84,000 in 20x6. What is the entry to record the payment of the contingent consideration? 5. Stock Contingency based on Future Performance Earnings with Market Value of Stock Given. In addition to the stock issue, Pure Corporation also agreed to issue additional shares of common stock to the former stockholders of Saint Corporation if the average post-combination earnings over the next two years (i.e.. 20x5 and 20x6) equaled or exceeded P390,000. The additional 1,200 shares expected to be issued are valued at P18,000. a. Determine the amount of goodwill. b. Prepare the entries required in the books of the acquirer in relation to the acquisition of Saint Corporation. c. On January 1, 20x7. the target is met or contingent event happens, ie.. average post-combination earnings over the next two years amounted to P492.000. What is the journal entry to record the issuance of 1,200 additional shares 6. Stock Contingency based on Future Performance Earnings with No Market Value of Stock Given. In addition to the stock issue, Pure Corporation agreed to issue 6,000 additional shares if the average income during the 2-year period of 20x5-20x6 exceeded P96,000 per year. On January 1, 20x7, the average income amounted to P132,000 (the contingent event occurs). What is the journal entry to record the issuance of 6.000 additional shares? 7. Stock Contingency based on based on Future Stock Prices. In addition to the stock issue, Pure Corporation agreed to issue additional shares on January 1, 20x7, to compensate for any fall in the value of Pure common stock below P25 per share. The settlement would be to cure the deficiency by issuing added shares based on their fair value on January 1, 20x7. The market price of the shares on January 1, 20x7, was P20. On January 1, 20x7, the contingent event happens since the fair value per share fall below P25. What is the. journal entry to record the issuance of 7,500 additional shares? 8. Stock Contingency with Present Value based on Future Stock Prices. In addition to the stock issue. Pure Corporation agreed to a payment of sufficient shares of Pure Corporation common stock to ensure a total value of P750,000 if the fair value per share is less than P25 on December 31, 20x5. Pure estimates that there is a 40 percent probability that the 30,000 shares issued will have a market value of P510,000 on December 31, 20x5, and an 60 percent probability that the market value of the 30,000 shares will exceed P750,000. Pure uses an interest rate of 4 percent to incorporate the time value of money. On December 31, 20x5, the contingent event occurs, wherein Pure's stock price had fallen to P20, thus requiring Pure to issue additional shares of stock to the former owners of Saint Corporation. What is the journal entry to record the issuance of additional shares?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started