Answered step by step

Verified Expert Solution

Question

1 Approved Answer

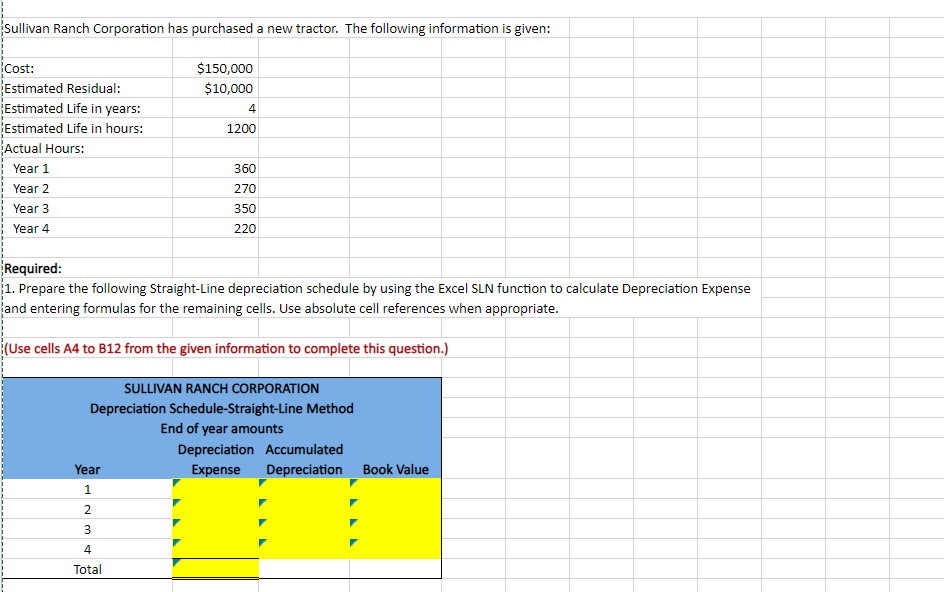

Sullivan Ranch Corporation has purchased a new tractor. The following information is given: 1. Prepare the following Straight-Line depreciation schedule by using the Excel SLN

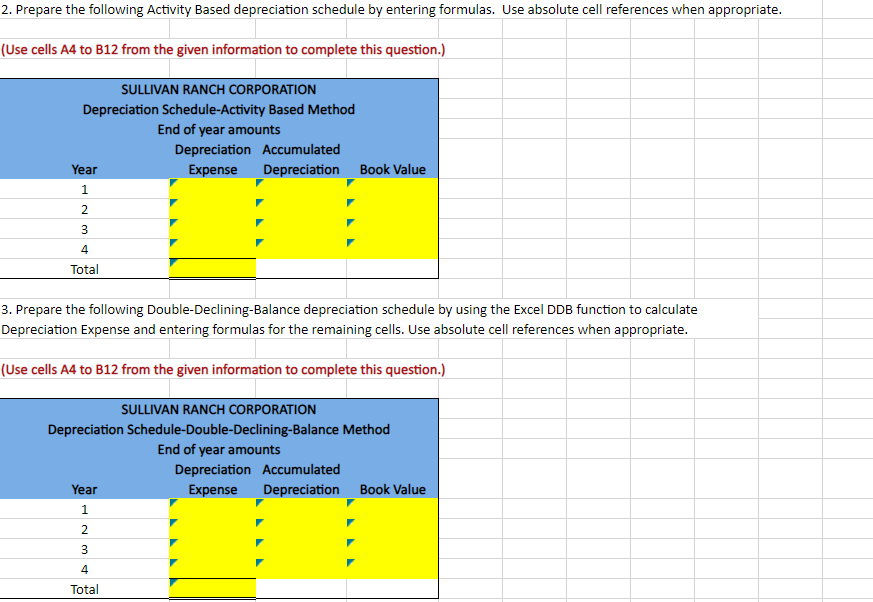

Sullivan Ranch Corporation has purchased a new tractor. The following information is given: 1. Prepare the following Straight-Line depreciation schedule by using the Excel SLN function to calculate Depreciation Expense and entering formulas for the remaining cells. Use absolute cell references when appropriate. (Use cells A4 to B12 from the given information to complete this question.) SULLIVAN RANCH CORPORATION Depreciation Schedule-Straight-Line Method End of year amounts Depreciation Accumulated Year 1 2 3 4 Total Expense Depreciation Book Value Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB function to calculate Depreciation Expense and entering formulas for the remaining cells. Use absolute cell references when appropriate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started