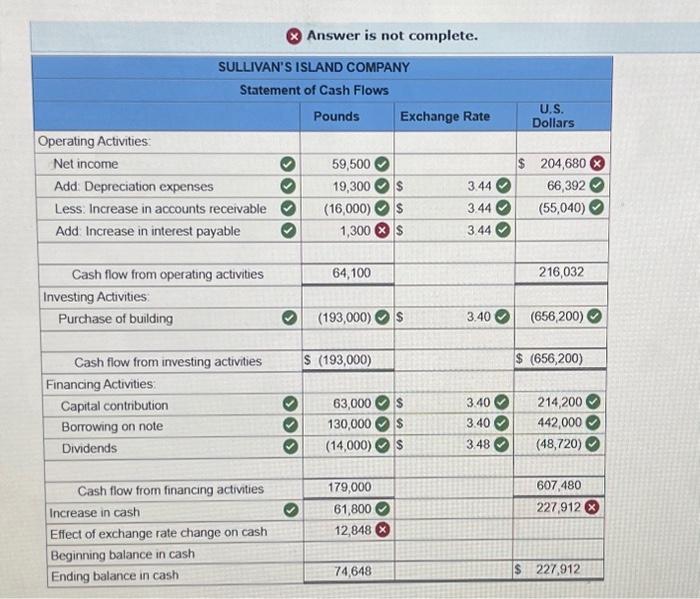

Sullivan's Island Company began operating a subsidiary in a foreign country on January 1,2020, by investing capital in the amount of 63,000 pounds. The subsidiary immediately borrowed 130,000 pounds on a five-year note with 10 percent interest payable annually beginning on January 1,2021. The subsidlary then purchased for 193,000 pounds a building that had a 10 -year expected life and no salvage value and is to be depreciated using the straight-ine method. Also on January 1,2020, the subsidiary rented the building for three years to a group of local attomeys for 8,000 pounds per month. By year-end, rent payments totaling 80,000 pounds had been received, and 16,000 pounds was in accounts recelvable. On October 1,2020, 4,200 pounds was paid for a repair made to the butiding The subsidiary transterred a cash dividend of 14,000 pounds back to Sullivan's Island Company on December 31, 2020 The functional currency for the subsidiary is the pound. Currency exchange rates for 1 pound follow. Prepare a statement of cash flows in pounds for Sullivan's Island Company's foreign subsidiary, and then translate this statement into US doliars. (Round your exchange rate answers to 2 decimal ploces. Amounts to be deducted and cash outflows should be indicated with minus sign.) (x) Answer is not complete. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ SULLIVAN'S ISLAND COMPANY } \\ \hline \multicolumn{4}{|c|}{ Statement of Cash Flows } \\ \hline & Pounds & Exchange Rate & \begin{tabular}{l} U.S. \\ Dollars \end{tabular} \\ \hline \multicolumn{4}{|l|}{ Operating Activities: } \\ \hline Net income & 59,500 & & $204,680 \\ \hline Add: Depreciation expenses & 19,300 & 3.44 & 66,392 \\ \hline Less: Increase in accounts receivable & (16,000) & 344 & (55,040) \\ \hline Add: Increase in interest payable & 1,300 & 344 & \\ \hline Cash flow from operating activities & 64,100 & & 216,032 \\ \hline \multicolumn{4}{|l|}{ Investing Activities: } \\ \hline Purchase of building & (193,000) & 3.40 & (656,200) \\ \hline Cash flow from investing activities & $(193,000) & & $(656,200) \\ \hline \multicolumn{4}{|l|}{ Financing Activities: } \\ \hline Capital contribution & 63,0000 & 3.40 & 214,200 \\ \hline Borrowing on note & 130,000 & 3.40 & 442,000 \\ \hline Dividends & (14,000) & 3.48 & (48,720) \\ \hline Cash flow from financing activities & 179,000 & & 607,480 \\ \hline Increase in cash & 61,8000 & & 227,912 \\ \hline Effect of exchange rate change on cash & 12,848 & & \\ \hline \multicolumn{4}{|l|}{ Beginning balance in cash } \\ \hline Ending balance in cash & 74,648 & & $227,912 \\ \hline \end{tabular}