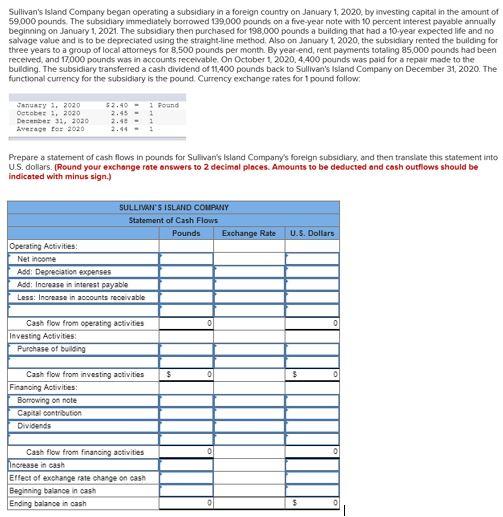

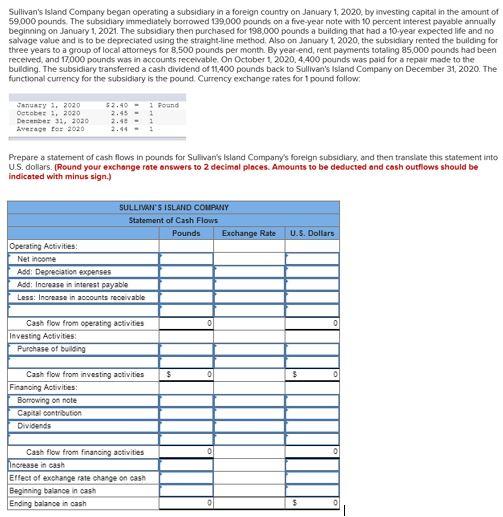

Sullivan's Island Company began operating a subsidiary in a foreign country on January 1, 2020, by investing capital in the amount of 59.000 pounds. The subsidiary immediately borrowed 139,000 pounds on a five-year note with 10 percent interest payable annually beginning on January 1, 2021. The subsidiary then purchased for 198,000 pounds a building that had a 10-year expected life and no salvage value and is to be depreciated using the straight-line method Also on January 1, 2020, the subsidiary rented the building for three years to a group of local attorneys for 8.500 pounds per month. By year end, rent payments totaling 85,000 pounds had been received, and 17000 pounds was in accounts receivable On October 1 2020.4.400 pounds was paid for a repair made to the building. The subsidiary transferred a cash dividend of 11.400 pounds back to Sullivan's Island Company on December 31, 2020. The functional currency for the subsidiary is the pound Currency exchange rates for 1 pound follow January 1, 2020 October, 2020 December 31, 2020 Average tor 2020 $2.40 - 1 Pound 2.45 - 2.45 - 1 Prepare a statement of cash flows in pounds for Sullivan's Island Company's foreign subsidiary, and then translate this statement into U.S. dollars. (Round your exchange rate answers to 2 decimal places. Amounts to be deducted and cash outflows should be indicated with minus sign.) U.S. Dollars SULLIVANS ISLAND COMPANY Statement of Cash Flows Pounds Exchange Rate Operating Activities: Net inconte Add: Depreciation expenses Add: Increase in interest payable Less: Increase in accounts receivable Cash flow from operating activities Investing Activities: Purchase of building Cash flow from investing activities Financing Activities: Borrowing on note Capital contribution Dividends Cash flow from financing activities Increase in cash Effect of exchange rate change on cash Beginning balance in cash Ending balance in cash Sullivan's Island Company began operating a subsidiary in a foreign country on January 1, 2020, by investing capital in the amount of 59.000 pounds. The subsidiary immediately borrowed 139,000 pounds on a five-year note with 10 percent interest payable annually beginning on January 1, 2021. The subsidiary then purchased for 198,000 pounds a building that had a 10-year expected life and no salvage value and is to be depreciated using the straight-line method Also on January 1, 2020, the subsidiary rented the building for three years to a group of local attorneys for 8.500 pounds per month. By year end, rent payments totaling 85,000 pounds had been received, and 17000 pounds was in accounts receivable On October 1 2020.4.400 pounds was paid for a repair made to the building. The subsidiary transferred a cash dividend of 11.400 pounds back to Sullivan's Island Company on December 31, 2020. The functional currency for the subsidiary is the pound Currency exchange rates for 1 pound follow January 1, 2020 October, 2020 December 31, 2020 Average tor 2020 $2.40 - 1 Pound 2.45 - 2.45 - 1 Prepare a statement of cash flows in pounds for Sullivan's Island Company's foreign subsidiary, and then translate this statement into U.S. dollars. (Round your exchange rate answers to 2 decimal places. Amounts to be deducted and cash outflows should be indicated with minus sign.) U.S. Dollars SULLIVANS ISLAND COMPANY Statement of Cash Flows Pounds Exchange Rate Operating Activities: Net inconte Add: Depreciation expenses Add: Increase in interest payable Less: Increase in accounts receivable Cash flow from operating activities Investing Activities: Purchase of building Cash flow from investing activities Financing Activities: Borrowing on note Capital contribution Dividends Cash flow from financing activities Increase in cash Effect of exchange rate change on cash Beginning balance in cash Ending balance in cash