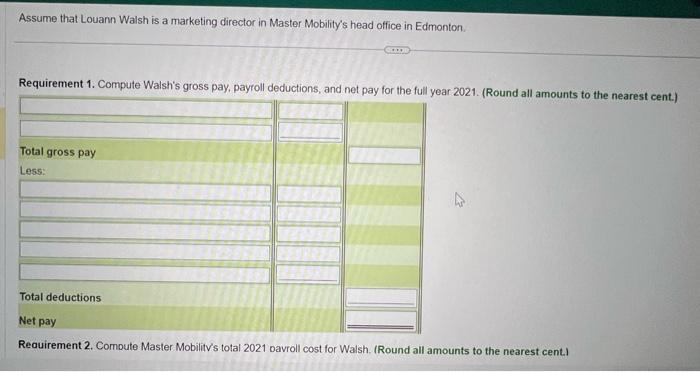

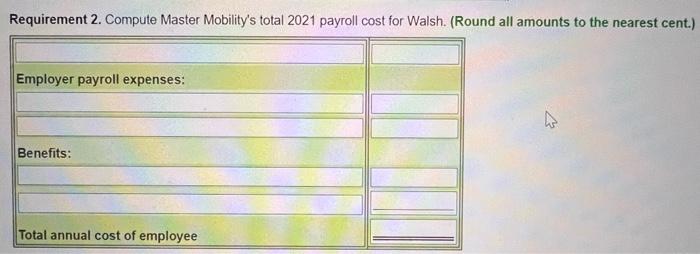

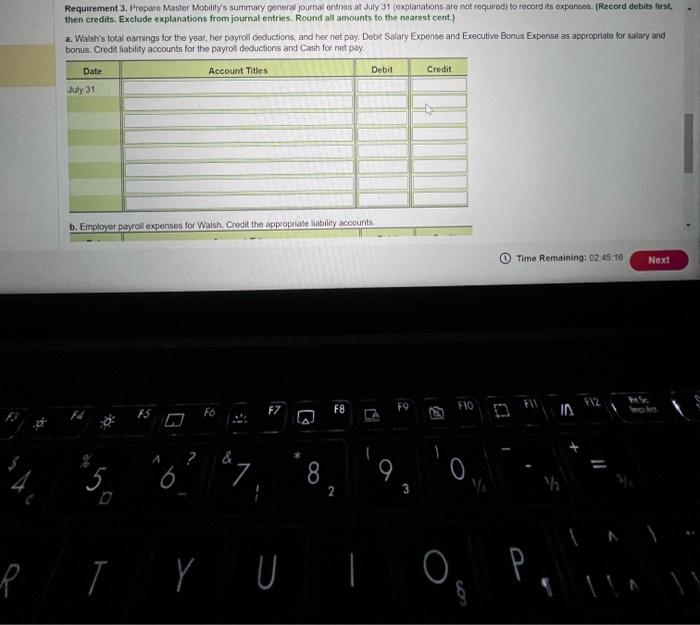

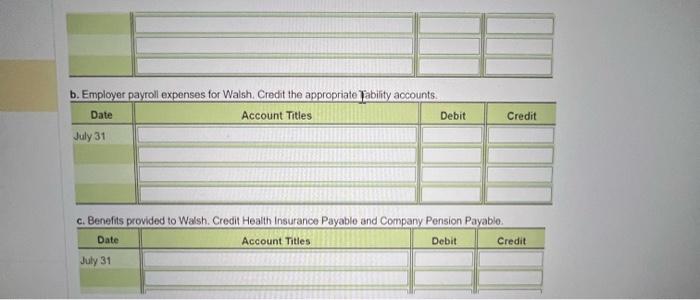

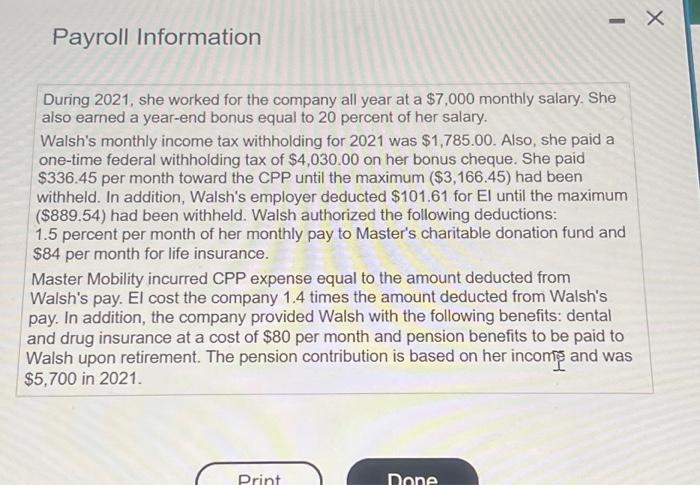

sume that Louann Walsh is a marketing director in Masler Mobility's head office in Edmonton. (Click the icon to view the payroll information.) Compute Walsh's gross pay, payroil deductions, and net pay for the full year 2021. Compute Master Mobilitys total 2021 payroll cost for Walsh. Prepare Master Mobility's summary general joumal entries at July 31 (explanations are not required) to record its expense for the following. a. Walsh's tolal earnings for the year, her payroll deductions, and her net pay. Debit Salary Expense and Executive Bonus Compensation as appropriate. Credil flability acoounts for payroll deductions and Cash for net pay b. Employer payroll exponses for Walsh, Credit the approptiato liabinity aocounts. c. Benefits provided to Walsh. Credit Heath Insurance Payable and Company Pension Payable. Assume that Louann Walsh is a marketing director in Master Mobility's head office in Edmonton. Requirement 1. Compute Walsh's gross pay, payroll deductions, and net pay for the full vear 2021. (Round all amounts to the nearest cent.) Reauirement 2. Compute Master Mobilitv's total 2021 oavroll cost for Walsh. (Round all amounts to the nearest cent.) Requirement 2. Compute Master Mobility's total 2021 payroll cost for Walsh. (Round all amounts to the nearest cent.) Requirement 3. Prepare Master Mobility's summary generad journal entros at July 31 (explanations are not requrod) to record iss exponsos. (Record debits farst, then credits, Exclude explanations from journal entries, Round all amounts to the nearest cent.) a. Walsh's total earnings for the year, her payrol deductions, and her net pay. Debit Salary Expense and Erecutive Bonus Expense as appropriate for satary and bonus, Credit liability accounts for the payroll geducticns and Cash for net pay. b. Employer payroll expenses for Walsh. Credit the appropriate Jability accounts. \begin{tabular}{c||c||c||c|} \hline \multicolumn{1}{|c|}{ Date } & Account Titles & Debit & Credit \\ \hline July31 & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} c. Benefits provided to Walsh. Credit Health Insurance Payable and Company Pension Payablo. \begin{tabular}{|c||c||c||c||} \hline Date & Account Tites & Debit & Credit \\ \hline July 31 & & & \\ \hline & & & \\ \hline \end{tabular} Payroll Information During 2021, she worked for the company all year at a $7,000 monthly salary. She also earned a year-end bonus equal to 20 percent of her salary. Walsh's monthly income tax withholding for 2021 was $1,785.00. Also, she paid a one-time federal withholding tax of $4,030.00 on her bonus cheque. She paid $336.45 per month toward the CPP until the maximum ($3,166.45) had been withheld. In addition, Walsh's employer deducted $101.61 for El until the maximum (\$889.54) had been withheld. Walsh authorized the following deductions: 1.5 percent per month of her monthly pay to Master's charitable donation fund and \$84 per month for life insurance. Master Mobility incurred CPP expense equal to the amount deducted from Walsh's pay. El cost the company 1.4 times the amount deducted from Walsh's pay. In addition, the company provided Walsh with the following benefits: dental and drug insurance at a cost of $80 per month and pension benefits to be paid to Walsh upon retirement. The pension contribution is based on her income and was 55,700 in 2021