summarise the questions please

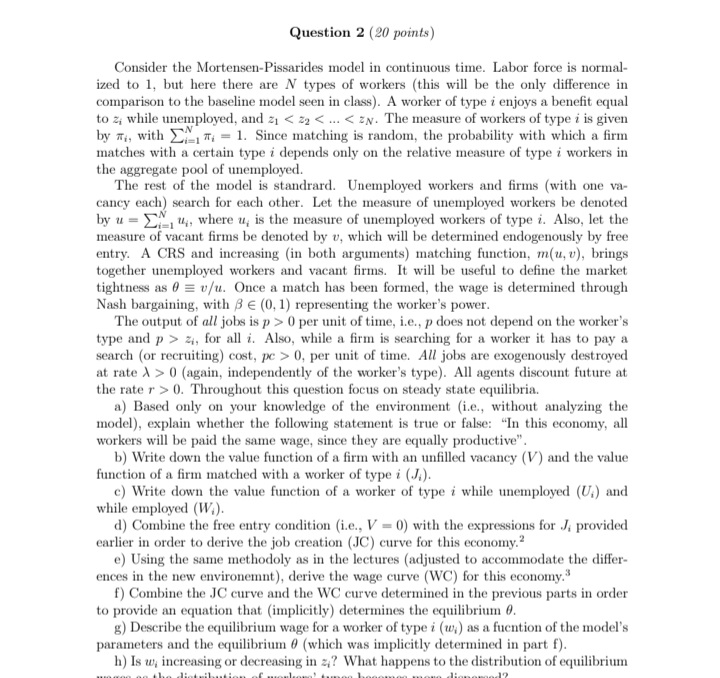

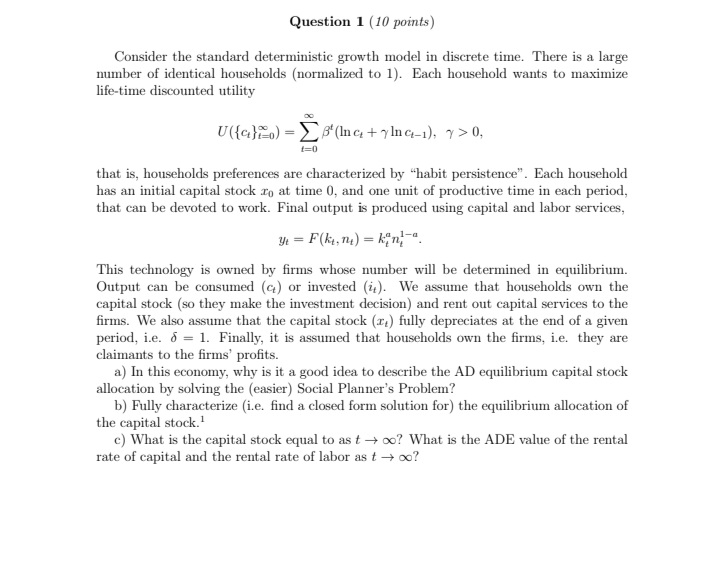

Question 4 [Eff points] Consider the planner's problem for a real business cycle model with inelastic labor supply [essentially the stochastic growth model} and no trend growth. Preferences are given by: no. {11 Output is produced using capital K Yr = AIR: {'1} where K. is the capital stock at the start of period t. and A! is a TFP shock and is governed by a discrete state Markov chain. There are adjustment costs to capital, which evolves according to the following production function: Kt+1= Kill'7 [3] When 6 = . this becomes the simple model we saw in clam with full depreciation [i.e. where Ki\" 2 L}. The resource constraint is K=Cr+fr a} Write down the recursive formulation of planner's problem. Use two constraints: the typical resource constraint and the capital production function. Denote the Lagrange multiplier on the resource constraint as 1,. and the one on the capital production constraint EB ARI!- h] Derive the rst order conditions. Provide an intuitive explanation of qi. c] Using gums and verify1 solve the model and End the policy functions for HI\our assumptions, sellers will not carry any money as they enter the KW market).* c) Describe the objective function of the typical buyer, J(m), where the hat denotes next period's choice." d) Describe the equilibrium variables go, q1 as functions of the model's parameters, including the nominal interest rate, i. How is q1 related to the real balances z = om?" To simplify the analysis hereafter, assume that u is quadratic: u(q) = -$ + (1+7)q, y >0. Notice that this specification implies q* = y, u'(q) -1 = y-q, and u(q") -q" = 2. e) Given this utility specification find closed-form solutions for go, 91. f) For any y, i, with i > 0).? Finally, define the welfare function of this economy as the measure of the various KW market meetings times the net surplus generated in each meeting, i.e., W = olu(go) - qo] + (1 - o)[u(qi) - qi]- g) Since o is the fraction of type-0 sellers, who accept credit, and since in type-0 meetings the buyer is never liquidity constrained, intuition suggests that welfare should increase in o. It turns out that this intuition is wrong! Show that, for o e [0, a], we have OW/do 0 per unit of time, i.e., p does not depend on the worker's type and p > 2, for all i. Also, while a firm is searching for a worker it has to pay a search (or recruiting) cost, pc > 0, per unit of time. All jobs are exogenously destroyed at rate A > 0 (again, independently of the worker's type). All agents discount future at the rate r > 0. Throughout this question focus on steady state equilibria. a) Based only on your knowledge of the environment (i.e., without analyzing the model), explain whether the following statement is true or false: "In this economy, all workers will be paid the same wage, since they are equally productive" b) Write down the value function of a firm with an unfilled vacancy (V) and the value function of a firm matched with a worker of type i (J;). e) Write down the value function of a worker of type i while unemployed (U,) and while employed (W.). d) Combine the free entry condition (i.e., V = 0) with the expressions for J, provided earlier in order to derive the job creation (JC) curve for this economy. e) Using the same methodoly as in the lectures (adjusted to accommodate the differ- ences in the new environemnt), derive the wage curve (WC) for this economy. f) Combine the JC curve and the WC curve determined in the previous parts in order to provide an equation that (implicitly) determines the equilibrium 0. g) Describe the equilibrium wage for a worker of type i (wy) as a fuention of the model's parameters and the equilibrium o (which was implicitly determined in part f). h) Is w increasing or decreasing in z,? What happens to the distribution of equilibriumQuestion 1 {re points] Consider the standard deterministic growth model in discrete time. There is a large number of identical households [normalized to 1}. Each household wants to maximize life-time discounted utility Unease = Scene. + Thus1}: 'r e n. that is, households preferences are characterized by \"habit persistence\". Each household has an initial capital stock an at time I], and one unit of productive time in each period, that can be devoted to work. Final output is produced using capital and labor services, 3;! = F[h,m} = FarrelE. This technology is owned by rms whose number will be determined in equilibrium. Ontput can be consumed [q] or invested {ii}. We amume that households own the capital stock [so they make the investment decision] and rent out capital services to the Blue. We also assume that the capital stock {of} fully depreciates at the end of a given period, i.e. E = 1. Finally, it he assumed that households own the rms, i.e. they are claimants to the rms* prots. a} In this economy, why is it a good idea to describe the AD equilibrium capital stock allocation by solving the {easier} Social Plan ner's Problem? b] Fully characterize {i.e. nd a closed form solution for] the equilibrium allocation of the capital stools:l c] \"That is the capital stock equal to as t > on? 1What is the ADE value of the rental rate of capital and the rental rate of labor as t r on