Summarize each department budget in a paragraph and note any large variances, explain two variances that might cause concern and prompt further analysis

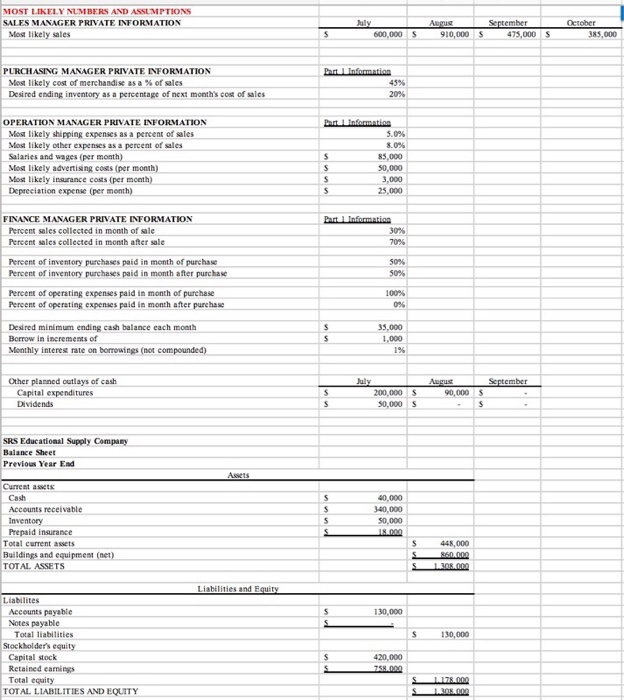

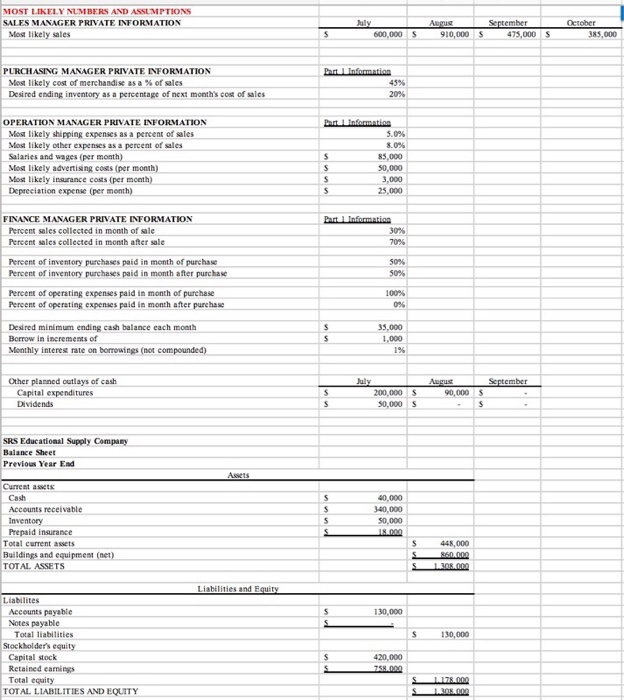

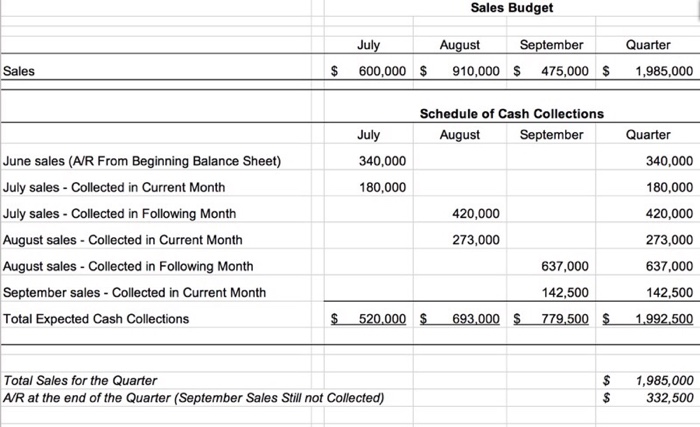

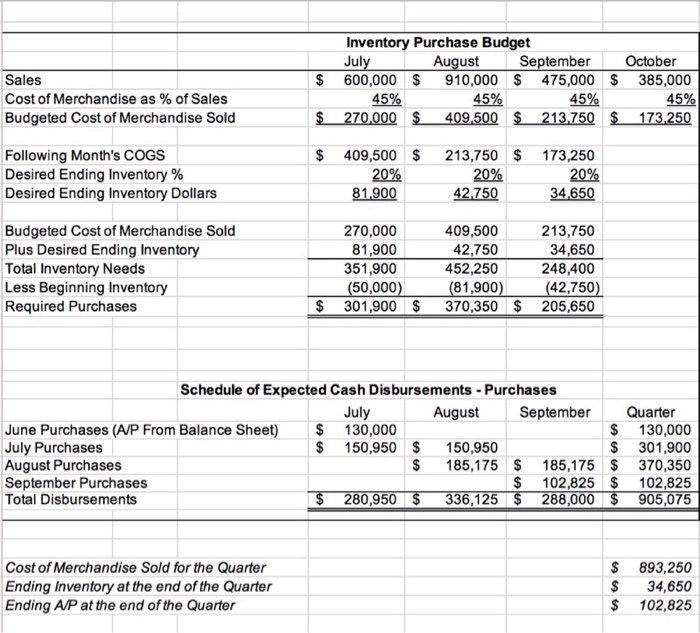

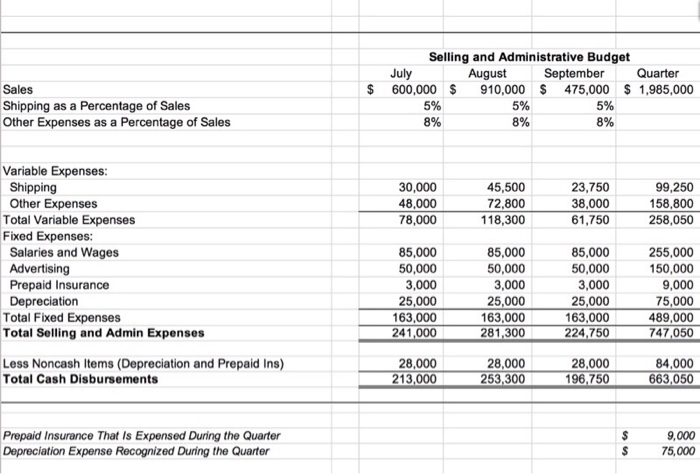

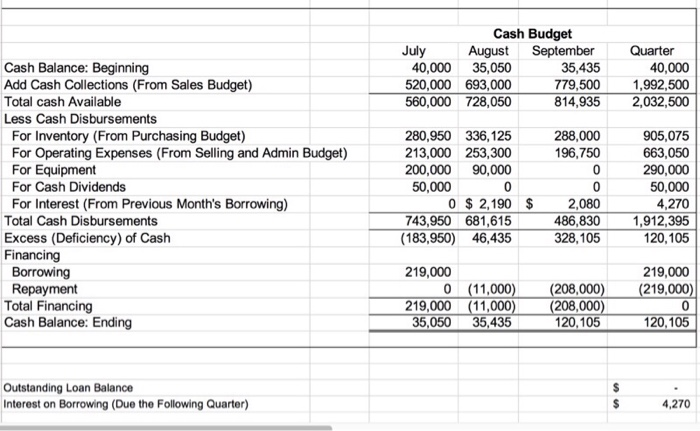

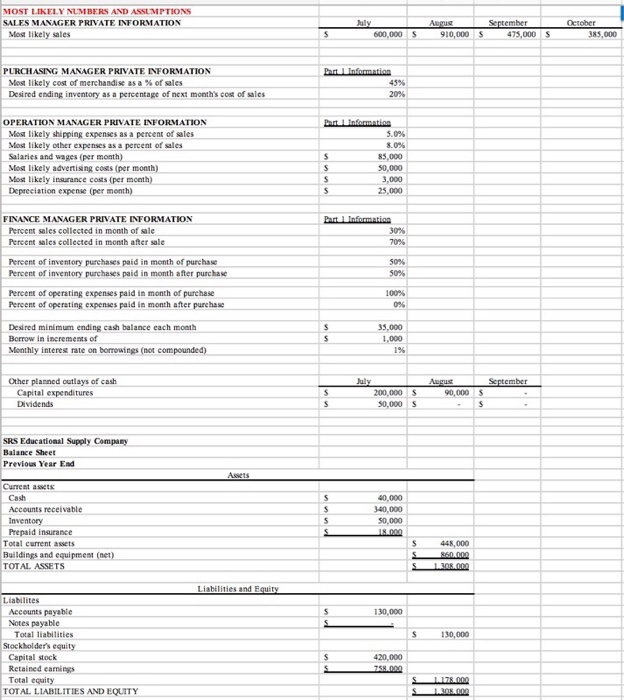

MOST LIKELY NUMBERS AND ASSUMPTIONS SALES MANAGER PRIVATE INFORMATION ember Most likely sales 600,000 10,000 475,000 385,000 PURCHASING MANAGER PRIVATE INFORMATION Most likely cost of merchandise as % of sales Desired coding inventory as a percentage of next month's co of sales 20% OPERATION MANAGER PRIVATE INFORMATION likely shipping expenses as a percent of sales Most likely other expenses as a percent of sales Salaries and wages (per month) Most likely advetisng costs (per month) Most likely insurance coss (per Depreeiation expense (per 8.0% 85,000 50,000 3,000 25,000 FINANCE MANAGER PRIVATE INFORMATION Percent ales collected in month of sale Percent sales collected in month after sale 30% Pereent of inventory purchases paid in month of purehase Percent of inventory purchases paid in month after purchase 50% Percent of operating expenses paid in month of purchase Percent of operating expenses paid in month after purchase 100% Desired minimum ending cash balance each moath Borrow in increments of Monthly interes rate on borrowings (not 35,000 1% Other planned outlays of cash Capital expenditures Dividends 200,000 S 50,000 S 90,000 SRS Educational Supply Company Balance Sheet Previous Year End Currest assets Cash Accounts receivable 40,000 40,000 50,000 Prepaid insurance Total current assets Buildings and equipment TOTAL ASSETS 448,000 Liabilities and E Liabilites Accounts payable Notes payable 130,000 Total liabilities 130,000 Stockholders e Capital stock Retained earnings Total equity TOTAL LIABILITIES AND EQUITY Sales Budget Jul September Quarter Sales $ 600,000 910,000 S 475,000 1,985,000 Schedule of Cash Collections July 340,000 180,000 August September Quarter June sales (A/R From Beginning Balance Sheet) July sales - Collected in Current Month July sales-Collected in Following Month August sales-Collected in Current Month August sales-Collected in Following Month September sales-Collected in Current Month Total Expected Cash Collections 340,000 180,000 420,000 273,000 637,000 142,500 420,000 273,000 637,000 142,500 Total Sales for the Quarter AR at the end of the Quarter (September Sales Still not Collected) $1,985,000 332,500 Inventory Purchase Budget Jul August September October Sales Cost of Merchandise as % of Sales Budgeted Cost of Merchandise Sold $ 600,000 $ 910,000 $ 475,000 $ 385,000 45% $ 270000409.500 $ 213750173 250 45% 45% 45% $409,500 213,750$173,250 Following Month's COGS Desired Ending Inventory % Desired Ending Inventory Dollars 20% 81,900 20% 20% 34650 Budgeted Cost of Merchandise Sold Plus Desired Ending Inventory Total Inventory Needs Less Beginning Inventory Required Purchases 409,500 42,750 452,250 81,900 $ 301,900$370,350205,650 270,000 81,900 351,900 50,000 213,750 34,650 248,400 42,750 Schedule of Expected Cash Disbursements -Purchases July August September Quarter June Purchases (A/P From Balance Sheet) 130,000 July Purchases August Purchases September Purchases Total Disbursements $130,000 $ 301,900 $185,175 185,175 $ 370,350 $ 102,825 $ 102,825 905,075 $150,950 150,950 950 288,000 Cost of Merchandise Sold for the Quarter Ending Inventory at the end of the Quarter Ending AP at the end of the Quarter $ 893,250 $ 34,650 $ 102,825 Selling and Administrative Budget July Augs September Qter Sales Shipping as a Percentage of Sales Other Expenses as a Percentage of Sales $ 600,000 910,000 475,000 1,985,000 5% 8% 5% 8% 5% 8% Variable Expenses Shipping Other Expenses 30,000 48,000 78,000 45,500 72,800 118,300 23,750 38,000 61,750 99,250 158,800 258,050 Total Variable Expenses Fixed Expenses: Salaries and Wages Advertising Prepaid Insurance Depreciation 85,000 50,000 3,000 25,000 163,000 41000 255,000 150,000 9,000 75,000 489,000 281,300224,750 747,050 85,000 50,000 3,000 25,000 163,000 85,000 50,000 3,000 25,000 163,000 Total Fixed Expenses Total Selling and Admin Expenses Less Noncash Items (Depreciation and Prepaid Ins) Total Cash Disbursements 28,000 213,000 28,000 253,300 28,000 196,750 84,000 663,050 Prepaid Insurance That Is Expensed During the Quarter Depreciation Expense Recognized During the Quarter 9,000 75,000 Cash Budget July August September Quarter Cash Balance: Beginning Add Cash Collections (From Sales Budget) Total cash Available Less Cash Disbursements 40,000 35,050 520,000 693,000 560,000 728,050 40,000 779,500 1,992,500 814,935 2,032,500 35,435 288,000 196,750 For Inventory (From Purchasing Budget) For Operating Expenses (From Selling and Admin Budget) For Equipment For Cash Dividends For Interest (From Previous Month's Borrowing) 905,075 663,050 290,000 50,000 4,270 1,912,395 120,105 280,950336,125 213,000 253,300 200,000 90,000 50,000 Total Cash Disbursements Excess (Deficiency) of Cash Financing 0 $ 2,190 $2,080 486,830 328,105 743,950 681,615 (183,950) 46,435 Borrowing 219,000 219,000 219,000 Total Financing Cash Balance: Ending 0 (11,000) 219,000 11,000 35,050 35,435 208,000 208,000 120,105 120,105 Outstanding Loan Balance Interest on Borrowing (Due the Following Quarter) 4,270