Answered step by step

Verified Expert Solution

Question

1 Approved Answer

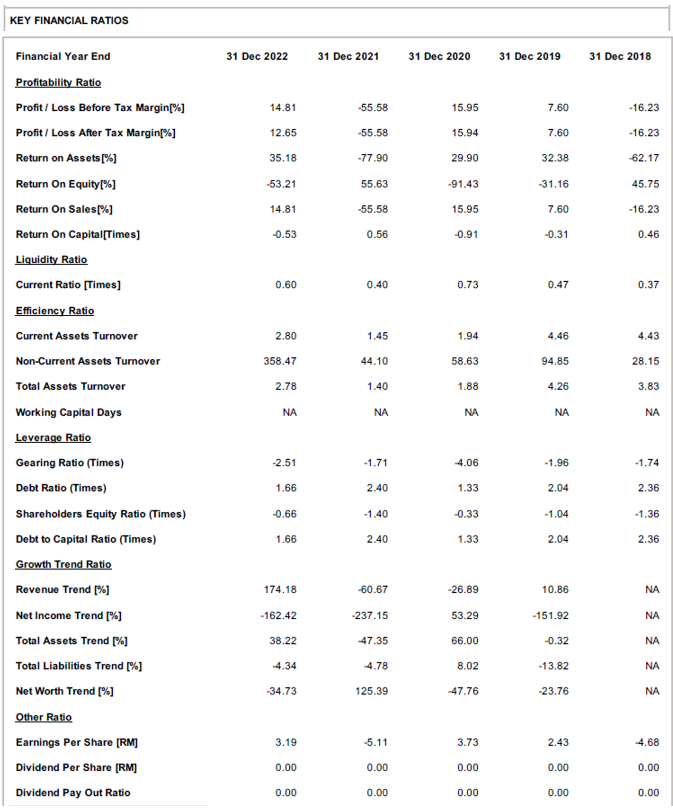

Summarize the key financial ratio for the latest 5 ?year data as mentioned in the image. If possible come out with a graph to clearly

Summarize the key financial ratio for the latest ?year data as mentioned in the image. If possible come out with a graph to clearly show and explain the details easily? Also explain each ratio and its ?clearly to show where the company are now.

KEY FINANCIAL RATIOS Financial Year End Profitability Ratio Profit/Loss Before Tax Margin[%] 31 Dec 2022 31 Dec 2021 31 Dec 2020 31 Dec 2019 31 Dec 2018 14.81 -55.58 15.95 7.60 -16.23 Profit/Loss After Tax Margin[%] 12.65 -55.58 15.94 7.60 -16.23 Return on Assets [%] 35.18 -77.90 29.90 32.38 -62.17 Return On Equity [%] -53.21 55.63 -91.43 -31.16 45.75 Return On Sales[%] 14.81 -55.58 15.95 7.60 -16.23 Return On Capital[Times] -0.53 0.56 -0.91 -0.31 0.46 Liquidity Ratio Current Ratio [Times] 0.60 0.40 0.73 0.47 0.37 Efficiency Ratio Current Assets Turnover 2.80 1.45 1.94 4.46 4.43 Non-Current Assets Turnover 358.47 44.10 58.63 94.85 28.15 Total Assets Turnover 2.78 1.40 1.88 Working Capital Days NA 880 4.26 3.83 NA NA NA Leverage Ratio Gearing Ratio (Times) -2.51 -1.71 -4.06 -1.96 -1.74 Debt Ratio (Times) 1.66 2.40 1.33 2.04 2.36 Shareholders Equity Ratio (Times) -0.66 -1.40 -0.33 -1.04 -1.36 Debt to Capital Ratio (Times) 1.66 2.40 1.33 2.04 2.36 Growth Trend Ratio Revenue Trend [%] 174.18 -60.67 -26.89 10.86 Net Income Trend [%] -162.42 -237.15 53.29 -151.92 Total Assets Trend [%] 38.22 -47.35 66.00 -0.32 Total Liabilities Trend [%] -4.34 -4.78 8.02 -13.82 Net Worth Trend [%] -34.73 125.39 -47.76 -23.76 3 3 3 3 3 NA NA NA NA NA Other Ratio Earnings Per Share [RM] 3.19 -5.11 3.73 2.43 -4.68 Dividend Per Share [RM] 0.00 0.00 0.00 0.00 0.00 Dividend Pay Out Ratio 0.00 0.00 0.00 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started