Summarize the two pages

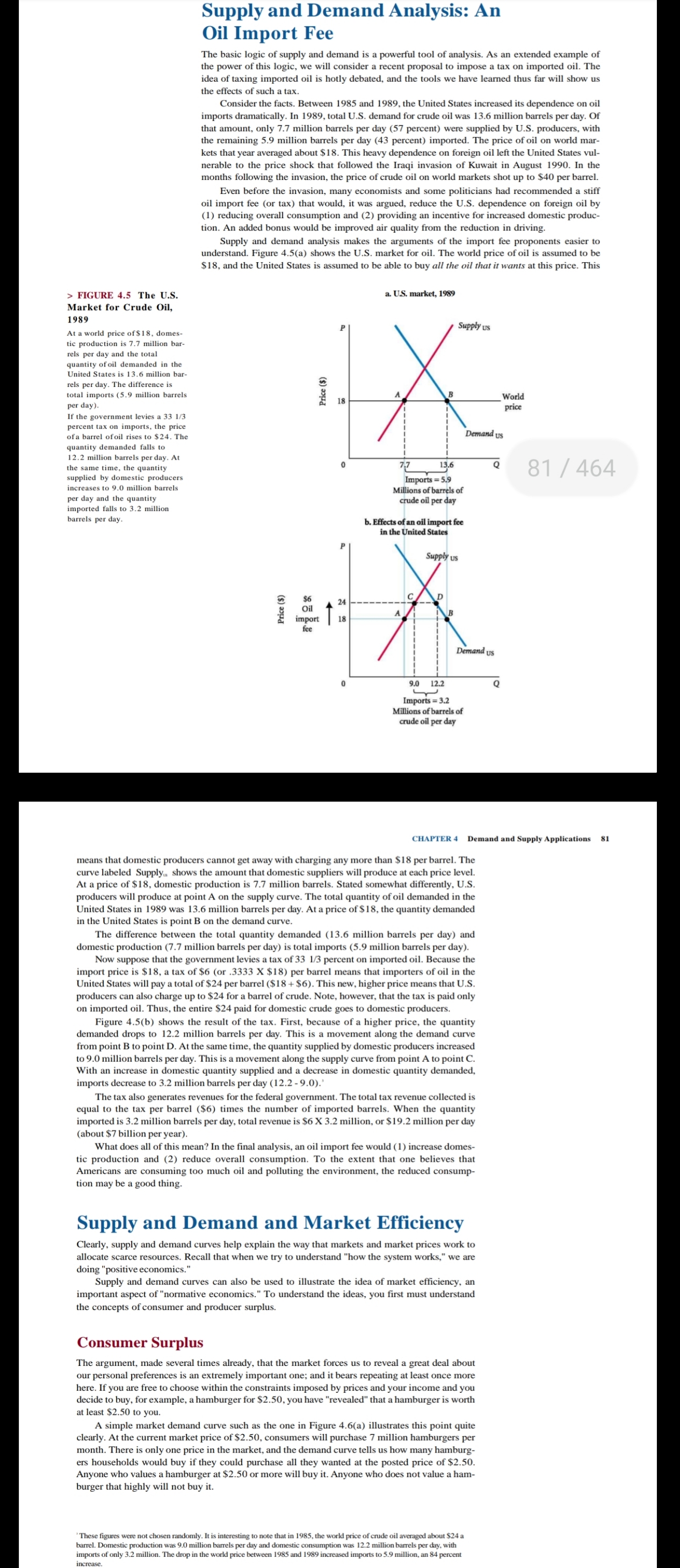

Supply and Demand Analysis: An Oil Import Fee The basic logic of supply and demand is a powerful tool of analysis. As an extended example of the power of this logic, we will consider a recent proposal to impose a tax on imported oil. The idea of taxing imported oil is hotly debated, and the tools we have learned thus far will show us the effects of such a tax. Consider the facts. Between 1985 and 1989, the United States increased its dependence on oil imports dramatically. In 1989, total U.S. demand for crude oil was 13.6 million barrels per day. Of that amount, only 7.7 million barrels per day (57 percent) were supplied by U.S. producers, with the remaining 5.9 million barrels per day (43 percent) imported. The price of oil on world mar- kets that year averaged about $18. This heavy dependence on foreign oil left the United States vul- nerable to the price shock that followed the Iraqi invasion of Kuwait in August 1990. In the months following the invasion, the price of crude oil on world markets shot up to $40 per barrel. Even before the invasion, many economists and some politicians had recommended a stiff oil import fee (or tax) that would, it was argued, reduce the U.S. dependence on foreign oil by (1) reducing overall consumption and (2) providing an incentive for increased domestic produc- tion. An added bonus would be improved air quality from the reduction in driving. Supply and demand analysis makes the arguments of the import fee proponents easier to understand. Figure 4.5(a) shows the U.S. market for oil. The world price of oil is assumed to be $ 18, and the United States is assumed to be able to buy all the oil that it wants at this price. This > FIGURE 4.5 The U.S. a. US. market, 1989 Market for Crude Oil, 1989 At a world price of$18, domes- Supply us tic production is 7.7 million bar- rels per day and the total quantity of oil demanded in the United States is 13.6 million bar rels per day. The difference is total imports (5.9 million barrels per day). Price ($) 18 World If the government levies a 33 1/3 price percent tax on imports, the price of a barrel of oil rises to $24. The Demand us quantity demanded falls to 12.2 million barrels per day. At the same time, the quantity 7-7 13.6 supplied by domestic producers 81 / 464 increases to 9.0 million barrels Imports = 5.9 per day and the quantity Millions of barrels of imported falls to 3.2 million crude oil per day barrels per day. b. Effects of an oil import fee in the United States Supply us Price ( $) 24 18 Demand us 9.0 12.2 Imports = 3.2 Millions of barrels of crude oil per day CHAPTER 4 Demand and Supply Applications 81 means that domestic producers cannot get away with charging any more than $18 per barrel. The curve labeled Supply. shows the amount that domestic suppliers will produce at each price level. At a price of $18, domestic production is 7.7 million barrels. Stated somewhat differently, U.S. producers will produce at point A on the supply curve. The total quantity of oil demanded in the United States in 1989 was 13.6 million barrels per day. At a price of $18, the quantity demanded in the United States is point B on the demand curve. The difference between the total quantity demanded (13.6 million barrels per day) and domestic production (7.7 million barrels per day) is total imports (5.9 million barrels per day). Now suppose that the government levies a tax of 33 1/3 percent on imported oil. Because the import price is $18, a tax of $6 (or .3333 X $18) per barrel means that importers of oil in the United States will pay a total of $24 per barrel ($18 + $6). This new, higher price means that U.S. producers can also charge up to $24 for a barrel of crude. Note, however, that the tax is paid only on imported oil. Thus, the entire $24 paid for domestic crude goes to domestic producers Figure 4.5(b) shows the result of the tax. First, because of a higher price, the quantity demanded drops to 12.2 million barrels per day. This is a movement along the demand curve from point B to point D. At the same time, the quantity supplied by domestic producers increased to 9.0 million barrels per day. This is a movement along the supply curve from point A to point C. With an increase in domestic quantity supplied and a decrease in domestic quantity demanded, imports decrease to 3.2 million barrels per day (12.2 -9.0).' The tax also generates revenues for the federal government. The total tax revenue collected is equal to the tax per barrel ($6) times the number of imported barrels. When the quantity imported is 3.2 million barrels per day, total revenue is $6 X 3.2 million, or $19.2 million per day (about $7 billion per year). What does all of this mean? In the final analysis, an oil import fee would (1) increase domes- tic production and (2) reduce overall consumption. To the extent that one believes that Americans are consuming too much oil and polluting the environment, the reduced consump- tion may be a good thing. Supply and Demand and Market Efficiency Clearly, supply and demand curves help explain the way that markets and market prices work to allocate scarce resources. Recall that when we try to understand "how the system works," we are doing "positive economics." Supply and demand curves can also be used to illustrate the idea of market efficiency, an important aspect of "normative economics." To understand the ideas, you first must understand the concepts of consumer and producer surplus. Consumer Surplus The argument, made several times already, that the market forces us to reveal a great deal about our personal preferences is an extremely important one; and it bears repeating at least once more here. If you are free to choose within the constraints imposed by prices and your income and you decide to buy, for example, a hamburger for $2.50, you have "revealed" that a hamburger is worth at least $2.50 to you. A simple market demand curve such as the one in Figure 4.6(a) illustrates this point quite clearly. At the current market price of $2.50, consumers will purchase 7 million hamburgers per month. There is only one price in the market, and the demand curve tells us how many hamburg- ers households would buy if they could purchase all they wanted at the posted price of $2.50 Anyone who values a hamburger at $2.50 or more will buy it. Anyone who does not value a ham- burger that highly will not buy it. "These figures were not chosen randomly. It is interesting to note that in 1985, the world price of crude oil averaged about $24 a barrel. Domestic production was 9.0 million barrels per day and domestic consumption was 12.2 million barrels per day, with imports of only 3.2 million. The drop in the world price between 1985 and 1989 increased imports to 5.9 million, an 84 percent