Answered step by step

Verified Expert Solution

Question

1 Approved Answer

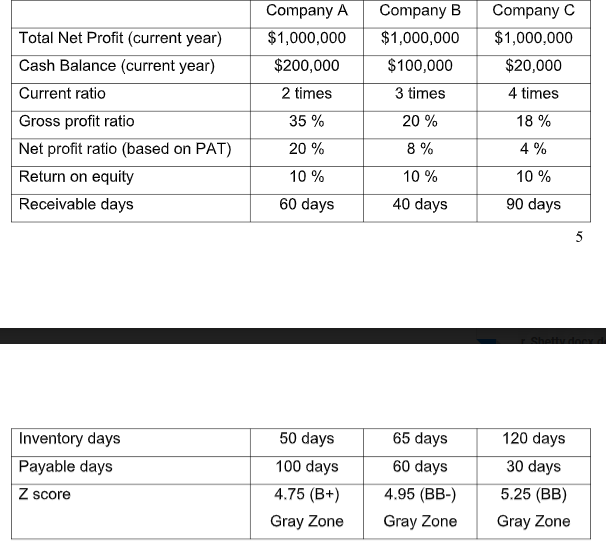

Summarized are the key ratios and financial snapshots of three different companies: NOTE: All the three companies are in same industry and have same set

Summarized are the key ratios and financial snapshots of three different companies:

NOTE: All the three companies are in same industry and have same set of variables exposed to them.

i. From the above information, comment on the financial health of the stated companies. (10 marks) ii. Highlight the positive factors and red flags for each of the stated companies. (5 marks) iii. As an investor in the equity market, choose one company for your investment plans. Give proper justification. (5 marks)

Company C $1,000,000 $20,000 4 times Total Net Profit (current year) Cash Balance (current year) Current ratio Gross profit ratio Net profit ratio (based on PAT) Return on equity Receivable days Company A $1,000,000 $200,000 2 times 35 % 20% 10 % 60 days Company B $1,000,000 $100,000 3 times 20 % 18 % 4 % 8 % 10 % 10 % 40 days 90 days Inventory days Payable days Z score 50 days 100 days 4.75 (B+) Gray Zone 65 days 60 days 4.95 (BB) Gray Zone 120 days 30 days 5.25 (BB) Gray ZoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started