Answered step by step

Verified Expert Solution

Question

1 Approved Answer

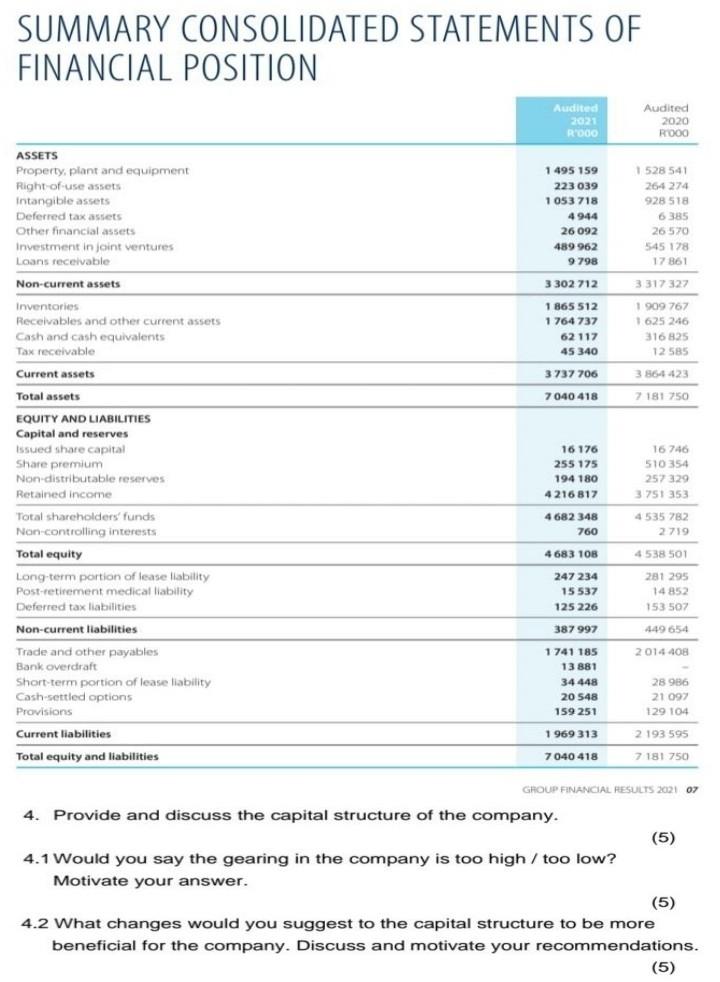

SUMMARY CONSOLIDATED STATEMENTS OF FINANCIAL POSITION Audited 2021 R'000 Audited 2020 ROO0 1495 159 223039 1 053 718 1 4944 26 092 489 962 9798

SUMMARY CONSOLIDATED STATEMENTS OF FINANCIAL POSITION Audited 2021 R'000 Audited 2020 ROO0 1495 159 223039 1 053 718 1 4944 26 092 489 962 9798 3302 712 1 865 512 1764 737 62 117 45 340 1528 541 264 274 928 518 6385 26 570 545 178 17861 3.317327 1909 767 1625 246 316 825 12585 3737 706 3864 423 7040 418 7 181 750 ASSETS Property, plant and equipment Right-of-use assets Intangible assets Deferred tax assets Other financial assets Investment in joint ventures Loans receivable Non-current assets Inventories Receivables and other current assets Cash and cash equivalents Tax receivable Current assets Total assets EQUITY AND LIABILITIES Capital and reserves Issued share capital Share premium Non-distributable reserves Retained income Total shareholders' funds Non-controlling interests Total equity Long-term portion of lease liability Post-retirement medical liability Deferred tax liabilities Non-current liabilities Trade and other payables Bank overdraft Short-term portion of lease liability Cash-settled options - Provisions Current liabilities Total equity and liabilities 16 176 255 175 194 180 4 216 817 16 746 510 354 257 329 3751 353 4535 782 4682 348 760 2719 4 683 108 4538 501 247 234 15 537 125 226 281 295 14 852 153 507 387 997 449 654 2014 408 1741 185 13 881 34 448 20 548 159 251 28 986 21 097 129 104 1 969 313 2 193 595 7 181750 7040 418 GROUP FINANCIAL RESULTS 2021 07 4. Provide and discuss the capital structure of the company. (5) 4.1 Would you say the gearing in the company is too high /too low? Motivate your answer. (5) 4.2 What changes would you suggest to the capital structure to be more beneficial for the company. Discuss and motivate your recommendations. (5) SUMMARY CONSOLIDATED STATEMENTS OF FINANCIAL POSITION Audited 2021 R'000 Audited 2020 ROO0 1495 159 223039 1 053 718 1 4944 26 092 489 962 9798 3302 712 1 865 512 1764 737 62 117 45 340 1528 541 264 274 928 518 6385 26 570 545 178 17861 3.317327 1909 767 1625 246 316 825 12585 3737 706 3864 423 7040 418 7 181 750 ASSETS Property, plant and equipment Right-of-use assets Intangible assets Deferred tax assets Other financial assets Investment in joint ventures Loans receivable Non-current assets Inventories Receivables and other current assets Cash and cash equivalents Tax receivable Current assets Total assets EQUITY AND LIABILITIES Capital and reserves Issued share capital Share premium Non-distributable reserves Retained income Total shareholders' funds Non-controlling interests Total equity Long-term portion of lease liability Post-retirement medical liability Deferred tax liabilities Non-current liabilities Trade and other payables Bank overdraft Short-term portion of lease liability Cash-settled options - Provisions Current liabilities Total equity and liabilities 16 176 255 175 194 180 4 216 817 16 746 510 354 257 329 3751 353 4535 782 4682 348 760 2719 4 683 108 4538 501 247 234 15 537 125 226 281 295 14 852 153 507 387 997 449 654 2014 408 1741 185 13 881 34 448 20 548 159 251 28 986 21 097 129 104 1 969 313 2 193 595 7 181750 7040 418 GROUP FINANCIAL RESULTS 2021 07 4. Provide and discuss the capital structure of the company. (5) 4.1 Would you say the gearing in the company is too high /too low? Motivate your answer. (5) 4.2 What changes would you suggest to the capital structure to be more beneficial for the company. Discuss and motivate your recommendations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started