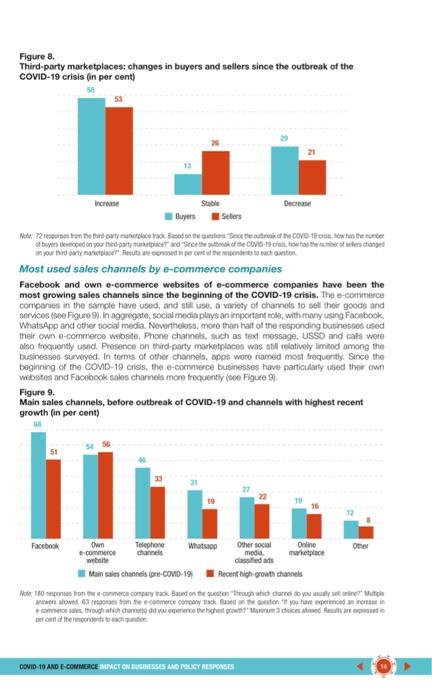

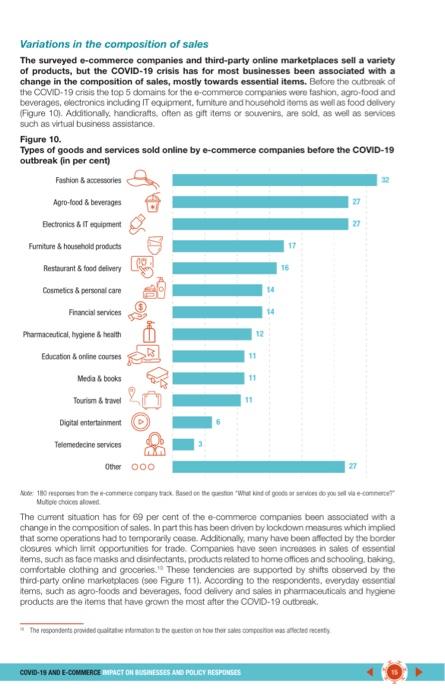

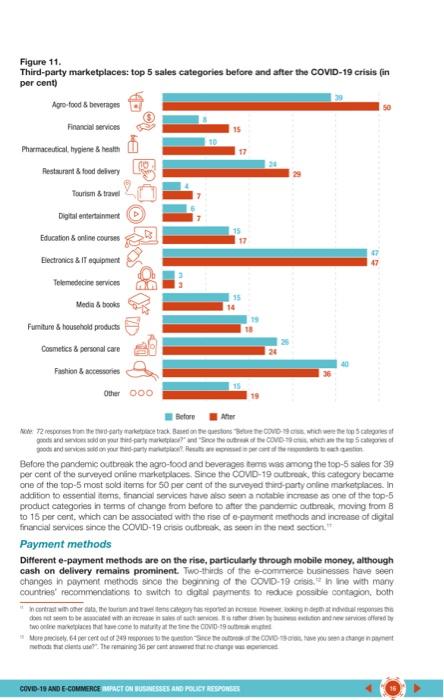

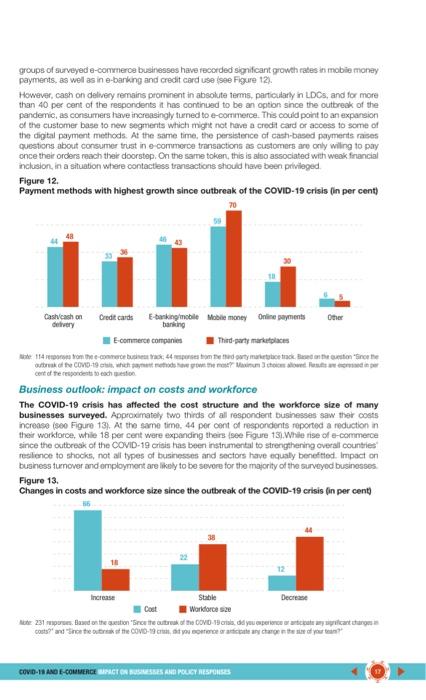

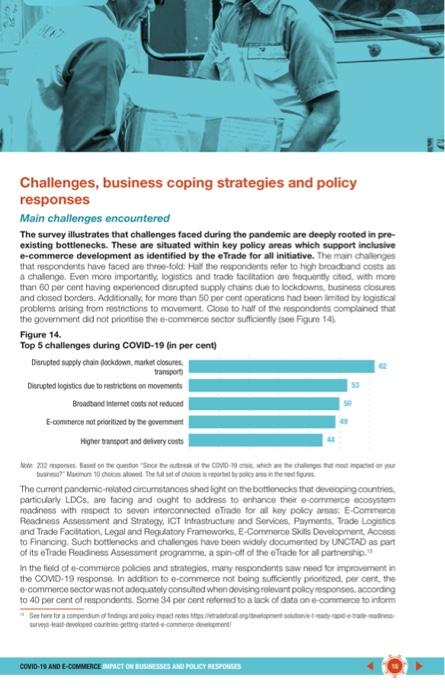

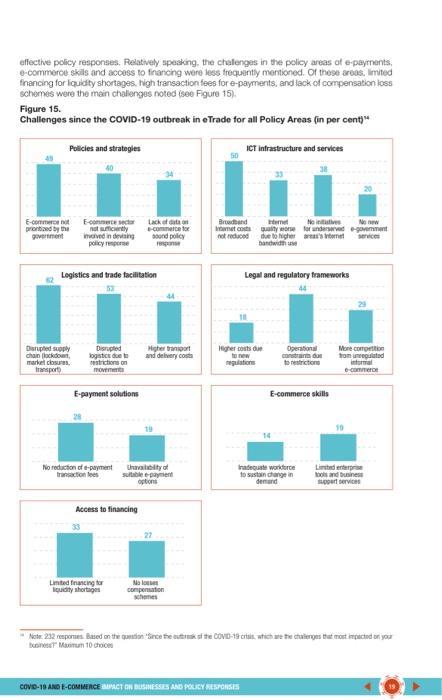

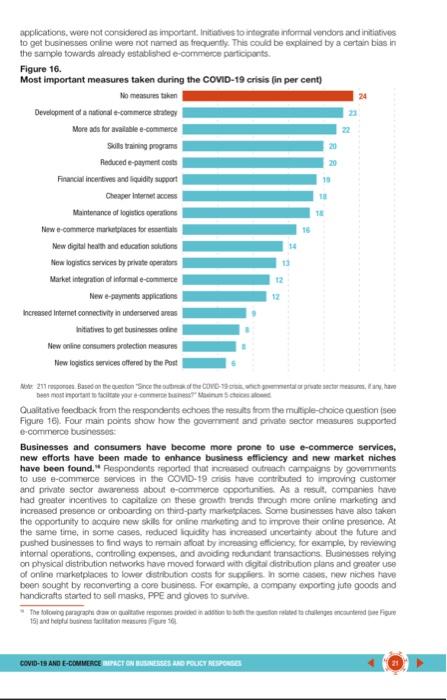

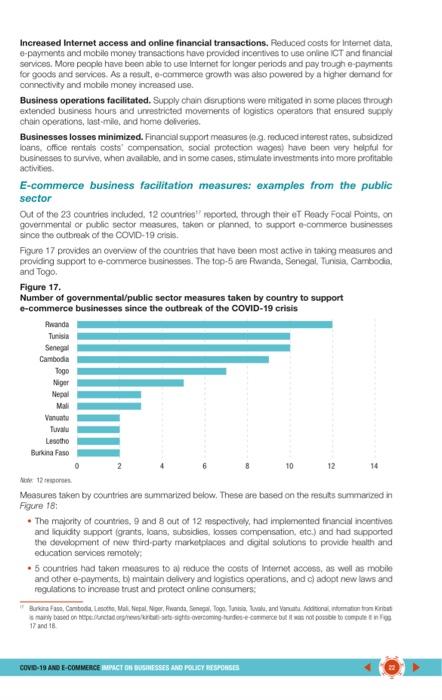

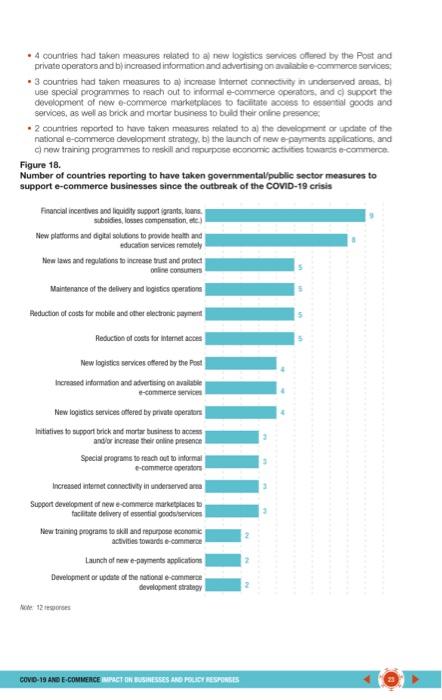

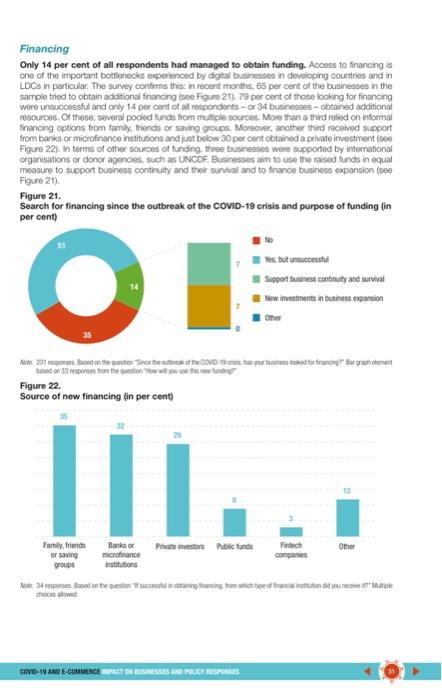

19:02 11 4G moodle.balamand.edu.lb 2 sur 20 Impact on e-commerce businesses Overall sales trends E-commerce companies have predominantly been declines in sales, while narty to per cent of third party online marketplaces have seen increase new selers and attracted more customers. For te trusse survete COVD 18 defecte About 5 por oling goods and independ on the diety w 30 percent which do or other remer of people and total em Set below. www, wound 30 percent of them had been in a n.com for the red party and For worted by the rod by party must comedy unters of buyers sont de of the markets sowe toner conviny and a halos Pre Whooverado da made thrine are verere Figure Impact of COVID-19 crisis on monthly e-commerce in percent ... Figure Third party marketplace changes in buyers and COVID-19 crisis in percent Figure 8. Third-party marketplaces: changes in buyers and sellers since the outbreak of the COVID-19 crisis in percent) 13 Dec Buyers Meter 72 poromethylococcution Sorte trek of the COVE-15 the number of boysed on your drotheke DOVO-18 totales conged on your tid party nie meer of the respondente con Most used sales channels by e-commerce companies Facebook and own e-commerce websites of e-commerce companies have been the most growing sales channels since the beginning of the COVID-19 crisis. The e-commerce companies in the sample have used, and still use a variety of channels to sell their goods and services (see Figure 9). In aggregate social media plays an important role with many using Facebook WhatsApp and other social media. Nevertheless, more than half of the responding businesses used their own e-commerce website, Phone channels, such as text message. USSD and cals were ono frequently used. Presence on third-party marketplaces was still relatively limited among the businesses surveyed. In torms of other channels, apps wore named most frequently. Since the beginning of the COMID-19 crisis, the e-commerce businesses have particularly used their own websites and Facebook sales channels more frequently thee Figure Figure 9. Main sales channels, before outbreak of COVID-19 and channels with highest recent growth (in per cent) 31 Facebook Own Telephone Whatsapp Other social Online Other -commerce channels meda website Main sales channels pre-COVID-19) Recent high growth channels Mode 180 response to the e-commerce company track Based on the through which are do you wadly truth we wet 63 tome commerce company Based on the stone period Through there you were the most fear De of the content touch COVID-10 AND E-COMMERCE PACIONESSES AND POLICY RESPONSES Variations in the composition of sales The surveyed e-commerce companies and third-party online marketplaces sell a variety of products, but the COVID-19 crisis has for most businesses been associated with a change in the composition of sales, mostly towards essential items. Before the outbreak of the COMID-19 crisis the top 5 domains for the e-commerce companies were fashion, agro-food and beverages, electronics including IT equipment, furniture and household items as well as food delivery Figure 101. Additionally, handicrafts often as gift items or souvenirs, are sold as well as services such as virtual business assistance Figure 10. Types of goods and services sold online by e-commerce companies before the COVID-19 outbreak fin per cent) Fashion accessories Agro-food & beverages Blectronics & IT equipment Furniture & household products Restaurant & food delivery Cosmetics & personal care Financial services Pharmaceutical, hygiene & health Education online courses Media & books Tourion & travel 27 17 TE 14 14 de 11 11 Digital entertainment Telemedecine services Other 000 Note 10 persone contengantar Based on the store ind et goed you selecom" Multiple choicon el The current situation has for 69 per cent of the e-commerce companies been associated with a change in the composition of sales. In part this has been driven by lockdown measures which implied that some operations had to temporarily cease. Additionaly, many have been affected by the border closures which limit opportunities for trade. Companies have seen increases in sales of essential Items, such as face masks and disinfectants, products related to home offices and schooling, baking. comfortable clothing and groceries. These tendencies are supported by shifts observed by the third-party online marketplaces (900 Figure 11). According to the respondents, everyday essential Items, such as agro-foods and beverages, food delivery and sales in pharmaceuticals and hygiene products are the items that have grown the most after the COMID-19 outbreak. The respondents provided with more the resten on how there comes as a lectus et COVE-19 AND E-COMMERCE IMPACTOR SINESSES AND POLICY RESPONSES 50 Figure 11. Third-party marketplaces: top 5 sales categories before and after the COVID-19 crisis (in per cent) Agro food beverages Financial services Pharmaceutical hygiene heath DO Restaurant & food delivery Tourism & travel Digital entertainment Education online courses Electronics & IT equipment CA Telemedicine service Media & books Furniture & household products Cosmetics & personal care Fashion accessories Other 000 Before her 2 responses to the party track Based on the store the white categones gard to add on your payment SohCOMO Stowo and your thirty Before the pandemic outbreak the agro-food and beverages tems was among the top-5 sales for 39 per cent of the surveyed online marketplaces. Since the COVD-19 outbreak, this category became one of the top-5 most sold items for 50 per cent of the surveyed third-party online marketplaces. In addition to essential toms, financial services have also seen a notable increase as one of the top-5 product categories in terms of change from before to after the pandemic outbreak, moving from B to 15 per cent, which can be associated with the rise of e-payment methods and increase of digital francial services since the COVID-19 ores outbreek as seen in the net section Payment methods Different e-payment methods are on the rise, particularly through mobile money, although cash on delivery remains prominent. Two-thirds of the e-commerce businesses have seen changes in payment methods since the beginning of the COVD-19 Crisis in line with many countries' recommendations to switch to digital payments to reduce possibile contagion, both In contrast with her at the fourton and receported that a pestis detsember when in de to create come to my at the fine the GOVID-19 More proper cert out of 29 porosten Schuhe Cove you a target to the case. The rang 36 percent to changed COVD 19 AND E COMMERCE MPACT ON BUSINESSES AND POLICY RESPONSES groups of surveyed e-commerce businesses have recorded significant growth rates in mobile money payments as well as in e-banking and credit card use see Figure 12). However, cash on delivery remains prominent in absolute terms, particularly in LDCs, and for more than 40 per cent of the respondents it has continued to be an option Snce the outbreak of the pandemic, as consumers have increasingly turned to e-commerce. This could point to an expansion of the customer base to new segments which might not have a credit card or access to some of the digital payment methods. At the same time, the persistence of cash-based payments raises questions about consumer trust in e-commerce transactions as customers are only willing to pay once their orders reach their doorstep. On the same token, this is also associated with weak financial inclusion, in a situation were contactless transactions should have been privileged Figure 12. Payment methods with highest growth since outbreak of the COVID-19 crisis in per cent) 70 Cashcash on Credit cards E-banking mobile Mobile money Online payments Other banking E-commerce companies Third-party marks 114 From the comprometed out the track the store the trak of the COVO-19. hehe. Mostowed wome cent of the rest Business outlook: impact on costs and workforce The COVID-19 crisis has affected the cost structure and the workforce size of many businesses surveyed. Approximately two thirds of all respondent businesses saw the costs increase (se Figure 13). At the same time. 44 per cent of respondents reported a reduction in their workforce, while 18 per cent were expanding theirs (see Figure 131. While rise of e-commerce since the outbreak of the COVID-19 crisis has been instrumental to strengthening overall countries resilience to shocks, not all types of businesses and sectors have equally benefitted. Impact on business turnover and employment are likely to be severe for the majority of the surveyed businesses Figure 13. Changes in costs and workforce size since the outbreak of the COVID-19 crisis in per cent) Stable Decrease Cost Workforce se ute 231. Based on the store the autre OVD13, did you pernyattaro couts?and "Sreteras The COVO-19cm, cercay change the site of your tant COVD 18 AD E-COMMERCE ACTOR BUSINESSES AND POLICY RESPONSES effective policy responses. Relatively speaking the chalenges in the policy areas of e-payments. e-commerce Skals and access to financing were less frequently mentioned. Of these areas, limited financing for liquidity shortages, high transaction fees for e-payments, and lack of compensation loss schemes were the main challenges noted (see Figure 15). Figure 15. Challenges since the COVID-19 outbreak in e Trade for all Policy Areas (in per cent Policies and strategies ICT infrastructure and services E-COMTE-Commerce sector Lack of duto pronted by the noticiently e-commerce for government med indeving and policy Brand News New e costs or for andre government not reduced due to higher or bandwide Logistics and trade facilitation Legal and regulatory frameworks Disrupted supply chain flockdow market closure Transport Disrupled Higher raport gati due te and delivery cost restrictions on movement Higher costs to new Operational Mine competition constante con from regulated to restriction e-comme E-payment solutions E-commerce skills 19 10 No reduction of payment transaction les thayo solibee payment options traust workforce to sustain angin demand and business support services Access to financing 22 Limited racing to louidity shortages Noo compensation Not: 232 epornes. Based on the condonance the box of the Cove 18 crisis, which the challenges that most inached on you Maimun 10 Choi COVO-19 AND E-COMMERCE ACT ON BUSINESSES AND POLICY RESPONSES Further feedback received confirmed how supply chain disruptions (eg, closed airports, freight disruption especially in remote locations, dis-functional storage facilities, etc.) have deeply impacted turnover of e-commerce sector relying on trade in goods and value chains. Reduced or no demand for services has also had an impact on turnover for businesses operating in hard-hit sectors, such hospitality, transport and tourism, education and training, entertainment and leisure, relying on trade in services, both local and cross-border. Moreover, price hikes for certain goods and services, lower consumer spending and reduced orders have negatively impacted on business profitability. In addition to the impact on business operations and turnover, they have also highlighted several other aspects related to the impact and challenges they faced Impact on capacity to invest. Even when demand grew, businesses found it very challenging to adapt and expand to meet the additional demand. Insufficient funds to scale-up operations, uncertainty about the future to undertake new investments, availability of the required workforce on short notice were vital challenges, further complicated by health-related precaution measures. The same constraints impacted the availability of resources dedicated to communication and visibility, necessary to expose products and services to potential buyers in the market ICT gaps further exacerbated. Respondents further reaffirmed the importance of having an accessible, affordable and well-performing ICT infrastructure, especially in rural areas where access to online markets is very limited and low digitaliteracy is a major hindrance. Bottlenecks persist also in better connected areas. Some respondents reported that working from home has been hampered by power cuts, insufficient bandwidth and no reliable infrastructure to sustain demand for automation of business processes Consumer protection and competition. Supply chain disruptions have severely impacted on e-commerce for import-dependent countries facing already high transport and logistics costs. Price hikes for goods in high demand during the crisis have stressed the importance of sound consumer protection regulations and institutions according to respondents from Small Island Developing States, who feet particularly disadvantaged by limited competition in aviation and expensive freight market Persistent cash on delivery culture. Many businesses have adapted business practices to the COVO-19 new normal by introducing contactless delivery options and e-payments solutions. However, respondents reported that cash on delivery payments oftenpose the biggest challenge as they put workers at increased risk of contracting COVID-19. Efforts to minimize physical transactions have been hindered by strong cultural inclinations related to the use of cash and payment on delivery Additionay, imited availability of e-payment Gateways and solutions has been ched as a bottleneck to increasing online sales. Business facilitation measures: an overview Governments and the private sector have taken a range of measures relevant for the e-commerce sector to mitigate the economic and social impact of the COVID-19 crisis, but many respondents also pointed towards a lack of support for the sector. One quarter of respondents perceived that no measures had been taken to support e-commerce see Figure 16). Furthermore, the COVID-19 crisis pushed the importance of having a national e-commerce strategy to the forefront On the other hand, many measures were very hands-on in nofth of the responses, increased publicity efforts for e-commerce, e-commerce skills trainings to bring more people up to date with the opportunities offered by the digital economy as well as reduced transaction costs for e-payment were considered major measures token Additionally. more than 15 per cent of the respondents considered financial and liquidity support in addition to maintaining logistics operations vital for their business continuity, as well as cheaper Internet access and new e-commerce opportunities for essential goods and services. New services, such as additional logistics Services from the private sector and the post of new e-payment * Set for comple:ww..comprese crows-220003 wew.hr ass.com/202004/22/cere.COND-cand personal-chat COVID-19 AND E-COMMERCE BPACT ONSSES AND POLICY RESPONSES 20 20 applications were not considered as important. Initiatives to integrate informal vendors and initiatives to get businesses online were not named as frequently. This could be explained by a certain bias in the sample towards already established e-commerce participants Figure 16. Most important measures taken during the COVID-19 crisis fin per cent) No measures taken Development of a national e-commerce strategy More ads for available e-commerce Sisting programs Reduced e-payment.com Financial incentives and liquidity support 10 Cheaper internet access Mantenance of logistics operations New e-commerce marketplaces for essentials New digital health and education solutions New logistics Services by private cortos Market integration of informal e-commerce New e-payments applications Increased Internet connectivity in underserved areas Initiatiwes to get businesses online New online consumers protection measures New logistics Services offered by the Post 16 217 Based on the gestion Seche Cove Stor protecteur, he most important face your e- comiche Qualitative feedback from the respondents echoes the results from the multiple-choice question see Figure 16). Four main points show how the government and private sector measures supported e-commerce businesses: Businesses and consumers have become more prone to use e-commerce services, new efforts have been made to enhance business efficiency and new market niches have been found. Respondents reported that increased Outreach campaigns by governments to use e-commerce services in the COMID-19. crisis have contributed to improving customer and private sector awareness about e-commerce opportunities. As a result, companies have had greater incentives to capitale on these growth trends through more online marketing and increased presence or onboarding on third-party marketplaces. Some businesses have also taken the opportunity to acquire new skills for online marketing and to improve their online presence. At the same time, in some cases, reduced liquidity has increased uncertainty about the future and pushed businesses to find ways to remain afloat by increasing efficiency for example, by reviewing internal operations, controlling expenses, and avoiding redundant transactions Businesses relying on physical distribution networks have moved forward with digital distribution plans and greater use of online marketplaces to lower distribution costs for suppliers. In some cases, new niches have been sought by reconverting a core business. For example, a company exporting jute goods and handicrafts started to sell masks, PPE and gloves to survive The following paraan product ratione et changes encountered 15 and infotainmeur 16 COVID-19 AND E-COMMERCE PACIONALINESSES AND POLICY RESPONSES Increased Internet access and online financial transactions, Reduced costs for internet data, e-payments and mobile money transactions have provided incentives to use online ICT and financial services. More people have been able to use Internet for longer periods and pay trough e-payments for goods and services. As a result, e-commerce growth was also powered by a higher demand for connectivity and mobile money increased use. Business operations facilitated. Supply chain disruptions were mitigated in some places through extended business hours and restricted movements of logistics operators that ensured supply chain operations, last-mile, and home deliveries. Businesses losses minimized. Financial support measures leg. reduced interest rates, subsidized loans, office rentals costs' compensation social protection wagos) have been very helpful for businesses to survive, when available, and in some cases, stimulate investments into more profitable activities E-commerce business facilitation measures: examples from the public sector Out of the 23 countries included, 12 countries reported through their et Ready Focal Points on governmental or public sector measures taken or planned to support e-commerce businesses since the outbreak of the COVID-19 crisis. Figure 17 provides an overview of the countries that have been most active in taking measures and providing support to e-commerce businesses. The top-5 are Rwanda, Senegal, Tunisia Cambodia, and Togo Figure 17. Number of governmental/public sector measures taken by country to support e-commerce businesses since the outbreak of the COVID-19 crisis Rwanda Tunisia Senegal Cambodia Togo Niger Nepal Mali Vanuatu Tuvalu Lesotho Burkina Faso 10 12 12 Measures taken by countries are summarized below. These are based on the results summarized in Figure 18: The majority of countries, 9 and 8 out of 12 respectively, had implemented financial incentives and liquidity support (grants, loans, subsidies, losses compensation, etc.) and had supported the development of new third-party marketplaces and digital solutions to provide health and education services remotely . 5 countries had taken measures to a reduce the costs of Internet access, as well as mobile and other e-payments, by maintain delivery and logistics operations, and c) adopt new laws and regulations to increase trust and protect online consumers: "Burton Fe, Cambodia. Ma epal Niger, Hwanda Senegal Togo Tonal, and Vanatoaromation om Kru many based on the partie de contingudes commerce but it was not possible to completo 17 and 18 COVO-19 AND E-COMMERCE IMPACT ON BUSINESSES AND POLICY RESPONSE 4 countries had taken measures related to a new logistics Services offered by the Post and private operators and b) increased information and advertising on available e-commerce services, - 3 countries had taken measures to all increase Internet connectivity in underserved areas, b use special programmes to reach out to informal e-commerce operators and support the development of new e-commerce marketplaces to facilitate acousto essential goods and services, as well as brick and mortar business to build their online presence: 2 countries reported to have taken measures related to all the development or update of the national e-commerce development strategy. b) the launch of new e-payments applications, and new training programmes to reskill and repurpose economic activities towards e-commerce Figure 18. Number of countries reporting to have taken governmental public sector measures to support e-commerce businesses since the outbreak of the COVID-19 crisis Financial incentives and liquidity support igrants, loans. subsidies losses compensation, etc.) New platforms and digital solutions to provide health and education services remotely New laws and regulations to increase trust and protect online consumers Maintenance of the delivery and logistics operation Reduction of costs for mobile and other electronic payment Reduction of costs for internet acces New logistics services offered by the Post Increased information and advertising on available -commerce Service New logistics services offered by private operators Initiatives to support brick and mortar business to access and/or increase their online presente Special programs to reach out to informal e-commerce operators Increased internet connectivity in underserved are Support development of new e-commerce marketplaces to facilitate delivery of essential good services New training programs so skill and repurpose economic activities towards e-commerce Launch of new e-payments applications Development or update of the national commerce development strategy COVO-19 AND E-COMMERCE IMPACT ON BUSINESSES AND LITRESS Country highlights by policy area The sixteen measures reported by countries can be grouped along the 7 eTrade for at policy areas Boosting e-commerce readiness and market development Development or update of the national e-commerce development strategy o in Cambodia, the development of Cambodia E-commerce Strategy under the Ministry of Commerce was pursued even after the outbreak of the COVID-19 pandemic and has been successfully completed and launched in July 2020 on Senegal. COMID-19 has accelerated the process of implementing the Senegal National E-commerce Development Strategy (SNDCES). The implementation of the SNDCES IS ongoing, particularly for certain activities of axes 1, 2 and 5, which include the creation of a national third-party marketplace, the establishment of relay delivery points, the establishment of an e-commerce observatory, and a review of the legal texts governing e-commerce. The Ministry of Trade and Small and Medium Enterprises manages the implementation of the SNDCES. In addition, two bodies will be created to ensure good governance of e-commerce in Senegal, amely an observatory housed within the Ministry of Commerce and small and medium enterprises (SMEs) and a framework for consultation between e-commerce players to defend their common interests. In this regard, the consortium of e-commerce players was officially launched on 16 June 2020 by the Minister of Commerce Increased information and advertising on available e-commerce services on Cambodia, public and private sectors have increasingly reached out to their target audience via digital marketing and online tools, such as social media Facebook, YouTube, etc.) and online conference applications (Zoom, Microsoft Team, etc.). on Rwanda, the government has put in place measures to increase the awareness and trust of citizens on online business in collaboration with stakeholders and the private sector, a continuous assessment of third-party marketplaces is done and those that quality according to predefined criteria are regularly published. As of July 2020, 35 third-party marketplaces have been published. In addition, public-private dialogues are regularly held to understand challenges and opportunities of e-commerce in different sectors (third-party marketplaces, logistics warehouse, payments etc). in Senegal, awareness campaigns have been camed out to communicate on initiatives put in place, through media coverage and advertising sport (TV, radio, press, online portals O in Tunisia, sensitization campaigns have been held, mainly through the national radio, focused on advising consumers on safe online shopping and warning them of the guarantees necessary to ensure consumers' protection Support development of new e-commerce marketplaces to facilitate delivery of essential goods/services, as well as brick and mortar business to build their online presence. In Cambodia, the Ministry of Commerce is working on the GodeCart project, funded by the Enhanced Integrated Framework (Elf). The project aims at providing opportunities for Cambodian SMEs to grow and diversity their domestic and cross-border e-commerce sales based on a robust, supportive, and conducive e-commerce ecosystem and a Cambodian-owned and managed marketplace krown in French as Steches Cotongue ao Senegal SNDESI The Strategy fotowed suit the UNCTADTrade Readiness to which was daten 2016. The SNDCES sched in December 2013 and male possible with the Sport of the Enforced to work) The protesthe followiges Tributes and employment Opportunities that visbie282C-place for Cambodian ton and provincial starting both domestic and recorder e-commerce 2 Strengthen come value chure to customed access to the skills and France Ingrove access to Barong Trondenetic and foreign source for e-commerce firms to contration of new quited cbs in Cambodian SMEs and are in format comercia prochas reached of its objectives, which has been modified and covered in media channel COVID-19 AND E-COMMERCE IMPACT ON BUSINESSES AND POLICY RESPONSES in Senegal, in partnership with the Trade Point Senegal Foundation, the Ministry of Commerce has deployed a website for the sale of local products to encourage the population to consume local products to help producers cope with the pandemnic. The third-party marketplace is called ekomkom (www.consommonsiocatnet. This is the second third-party marketplace recently established. A first one was put in place with the support of the Ministry of Trade to facilitate supply of essential goods in the aftermath of the COVID-19 crisis, lo. www.ccommercecovi sn, which was then renamed into www.ecommercesunegal.sn. These initiatives respond to the government strategy aimed at, pooling efforts of the private sector through the creation of a national e-commerce consortium, while also giving the higher visibility through this enhanced public-private cooperation projects. Special programmes to reach out to informal e-commerce operators In Togo, handicraft workers and entrepreneurs have been invited to expand their business through www.assiyeyemeg, a marketplace managed by the Socit des postes du Togo dedicated to promoting Made in Togo handicrafts. The latter initiative was launched in 2020 and accelerated In response to the COMID-19 crisis in Tunisia, a sensitization campaign was run through the radio to raise awareness of traders on e-commerce regulation and on respect for the rules governing online sales, especially on social networks. In Senegal, a process of formalization and registration of e-commerce businesses has started The creation of a national. e-commerce consortium to boost the promotion and sale of a categories of Senegalese products, in particular local products, in place. This process is also supported by other initiatives that enabled onboarding of e-commerce businesses for instance, third-party marketplaces established to address needs emerged during the pandemic, such as the e-Komkom and commercesenegal.sn New third-party marketplaces and digital solutions to provide health and education services remotely in Cambodia, the Ministry of Health has developed digital third-party marketplaces, such as a website www.cdcmon gov.khi a Facebook page and various digital communication tools. The Ministry of Education, Youth and Sport also encouraged education institutions to deploy online looming tools In Mal, the Ministry of National Education has adopted and implemented a training programme using media (radio and TV for students in final exams classes In Niger an online third-party marketplace www.mobileclassroom.com.ng was created by the Ministry of Education to give students access to a pool of video content in Senegal, the Ministry of National Education has set up a digital tool called Appendre a la maison to help students access lessons and exercises in certain disciplines particularly to prepare chidren in final exams classes. Thus, a set of third-party marketplaces specially dedicated to learners and others intended for teachers has been put online on education an in Tunisia, several initiatives have been developed by public institutions, NGOs, universities start-up and SMEs. The Ministry of Higher Educations and Scientific Research oops track of these initiatives through a dedicated portal. One of the most popular applications is: www.Sawen.com/ allowing users to find many applications related to neighbourhood support services, health and medical tacities, food, transport and logistics, e-learning and telewing In Vanuatu, the Ministry of Education has put in place online learning third-party marketplaces for schools See porno 5807955-40-23 COVIO-19 AMD E-COMMERCE ACT ON BLESSES AND POLICY RESPONSES Increasing Internet access Reduction of costs for Internet access. in Lesotho mobile and telecommunication companies have reduced the costs for Internet access to educational websites and content to assist students to study online during the COVID-19 lockdown in Tunisia, three telecommunications operators provided free internet access for distance education third-party mariontplaces during the lockdown. To avoid network saturation, rationing of Internet use in Tunisia was recommended with reduced mobile data access costs granted during night hours o in Nepal, telecommunication companies other different kinds of cheaper data packages and recharge bonuses Increased internet connectivity in underserved areas in Niger, internet coverage in underserved areas has significantly increased with several dozen Vilages connected and more than 200 other villages in prospect. COMID-19 gave further impotus to ongoing projects aimed at tast-tracking last-mile connectivity in rural areas, such as the Niger 2.0 Smart Villages project, supported by the International Telecommunication Union (TU). o in Tuvalu, the Government through the Ministry of Justice Communication and Foreign Affairs has installed satelite dishes in all its outer and to enhance connectivity, especially with regards to education amidst the COVD-19 crisis Fostering use of e-payments Launch of new e-payment applications, reduction of costs for mobile and electronic payments o in Cambodia, the National Bank of Cambodia is tat-tracking its plans to launch the Bakong App, an nl-in-one mobile payment and banking app using blockchain technology in Kiribati, mary government employees who did not have bank accounts before the panderrig were obliged to open them. The Government enforced a mandatory salary payment direct to bank accounts effective from 10 Apr 2020 to reduce cash payment that may contribute to the risk of spreading COVID-19. o in Nepal, the Government encouraged use of dectronic payments, and urged its citizen to use online banking and related apps on Rwanda, the Central Bank suspended mobile money foes for three months and waived charges on push and pul services between bark accounts and mobile wallets. in Senegal, some mobie payment fees and costs were removed during the peak of the pandemic Outbreak to encourage people to use digital payment systems. These include utilities payments, for water and electricity bills. In Togo, the Socit des postes du Togo has actively promoted e-payments by raising awareness on the use of its ECO CCP solution, an account opened based on a telephone number, no need for identity documents which poses a chalenge for many. Fees were scrapped for money transactions from the ECO CCP account to e-wallet accounts of mobile operators, TMoney and Floor, and vice versa. In addition, the Post lunched the e-Poste mobile app, and widely communicated via social networks and direct marketing to promote its use. The application is available on Google Play and allows users to pay their clectricity and water bills free of charge. in Tunisia, measures taken by the Central Bank focused on reducing walk-in sarvices in banks by cancelling fees for operations through automated to machines and encouraging banks to issue mor payment cards. See http:/www.thier 20-igledno Easing e-commerce logistics Maintenance of the delivery and logistics operations in Kiribati, new measures were placed including orine clearance of documentation of all incoming vessels and fights, bringing in essential goods or repatriating foreign citizens. to minimize contacts In Mali, to ensure the country's product supply the Government, despite the decision to close the borders, authorized the entry of vehicles and aircrafts transporting essential goods. on Niger, all delivery and logistics operations were maintained outside of the curfew hours for the Niamey region for 45 days throughout the country New logistics services offered by the Post in Senegal, in response to the COMID-19 outbreak La Poste readjusted its offer through its delivery service called "Jotnac", in particular by deploying a digital third-party marketplace tevising prices and diversifying partners. on Tunisia, domestic and international postal activities were fully maintained. Arrangements for delivery of retirement pensions for the elderly at their homes were made using itinerant post offices reassigned to this task in response to the COVD-19 outbreak New logistics services offered by private operators In Cambodia, there has been a nise in the use of private logistes companies that recently entered the Cambodian market, especially food and grocery delivery companies, such as Food Panda, Nham24, and E-gots in Senegal, some logistics companies have developed new products during the COVID-19 Outbreak period to facilitate e-commerce transactions, for example by offering online third-party merketplaces integrating mobile payment and delivery systems (ie the company Global through its platform called www.rapidos.snl. on Tunisia, there have been new express doivery and logistes services companies appearing in the market, especially during the lockdown period Strengthening the e-commerce business environment in Cambodia, as the law on e-commerce and low on consumer protection were passed in November 2019, the government, through the Ministry of Commerce has been working on drafting legal documents, ie. Prakas, to enforce effective implementation and the urgency for moving forward was stressed following the COVD-19 outbreak o Nepal, the Ministry of Industry. Commerce and Supplies continues to draft new e-commerce laws during the COVID-19 outbreak, with plans to submit the draft low to the parliament. This is part of the implementation of the national e-commerce strategy adopted in 2019, In Niger, a law on the interception of electronic communications was passed in June 2020, deemed to contribute to safer online transactions. However, criticism has been raised by civil society groups about its insufficient oversight mechanisms and human rights safeguards on Tunisia, a decree-law was ssued in April 2020 laying down specific provisions for the repression of violations of the competition and fair pricing rules during the lockdown period. See www.lindas com 29-11-04-2020-2020-20_2120013000100 COMID-19 AND E-COMMERCE PACT ON BUSINESSES AND POLIET SPONSES Enhancing skills No significant country initiatives were signalled, beside Cambodia, though that refers to activities targeting the private sector and is not necessarily COVID-19 related o In Cambodia, the Ministry of Commerce has been colaborating with the Economic Research Institute for ASEAN and East Asia on e-capacity building through enhancing e-commerce knowledge and skills among government officials. The E-capacity Buiding on E-commerce's Overall goal is to provide support for key government officials, to improve negotiators' skills and knowledge around e-commerce, with a particular focus on domestic and cross border regulations in the context of free trade agreements Ensuring business continuity through funding and financing opportunities o In Cambodia, the Mnistry of Economy and France has established the SME Bark and officially launched it in Apr 2020. It foresees co-financing from financial institutions in Cambodia to provide fnancial incentives and liquidity support to SMEs in al sectors, especially priority sectors, including: 1) food production and processing:2production for domestic consumption waste processing, and products for tourism sector; 3) industry producing financial products or parts and components to support other industries: 41 ICT research and development, including innovation ICT management services; and 5) Industry located in SME clusters. In Lesotho, the Government has established a COVID-19 Private Sector Relief Fund to financially assist businesses which closed their operations during the lockdown. This fund is mainly for payment ofront and any costs or liabilities related to outstanding loans in Mali, the Government granted subsidies to economic operators to facilitate the supply of basic products (rice, milk, and oIt also lowered electricity bills for three months and distributed free food to disadvantaged households In Niger, a vast fiscal reduction package was approved, containing facilitation of import of all products related to the fight against COMID-19. Additionally, the Government implemented tax and duty exemptions postponement of payment dates, suspension of on-site tax inspections and tax collection proceedings across most affected sectors, for instance, travel and transport services, hospitality, sport, and leisure. In addition, consultations with economic operators were envisaged leading to if necessary prior controls to contain inflation. These measures taken at the national level are complemented by those taken at the West African Economic and Monetary Union level, such as: 1) increase of FCFA 340 billion in the volume of liquidity injected by the Central Bank of West African States (BCEAO) each week into the money market in favor of banks to bring liquidity to FCFA 4750 billion, 2) establishment of a guarantee tund of FCFA 50 bition with the BCEAO by the State of Niger to allow focal banks to mobile FCFA 150 billion for the benefit of economic operators, of which FCFA 50 billion are for SMEs regularly registered and compliant with rules of hiring, remuneration, and accounting obligations. The 2020 finance law has been amended to take into account al the measures having an impact on law originally passed In Rwanda, the Government has launched a comprehensive RF 100 billion Economic Recovery Fund, a two-year facility established to cushion businesses in most affected sectors by the COVID-19 crisis, as well as facilitate domestic production of essential health products and protective equipment. The government, through the Ministry of ICT and Innovation, launched a grant competition for innovative solutions, called Corona Action Rwanda, to encourage young entrepreneurs develop scalable and sustainable solutions to mitigate the socio-economic impact of the pandemic. Four projects have won grants, while other 13 Rwandan organizations have offered to support 30 projects that did not win the grants but proved their potential to weather the unprecedented disruptions caused by COVID-19. Pastoretto nepou preactorenployees and built tore.com.co actor development are been under en by the United Nations Dent Program but corded to the public sector Senes.com/ot.com action and COVE-14 AND E-COMMERCE MPACT ON BUSESSES AND POLICY RESPONSES in Senegal, as part of the Government's economic and social recovery plan several business support measures are planned, ncluding for those in e-commerce. Also, within the contact of certain Ministry of Commerce projects (such as the creation of the bread marketing platform jaymamburu.nl. some actors have received funding to facilitate implementation in Tunisia, the Government set up a digital platform to apply for grant support for businesses atlected by the lockdown. Government support covers tres and duties postponement or suspension, as well as the creation of different funds to cushion the impact on most affected sectors, In Tuvalu, the Government through the National Bank of Tuvalu, Development Bank of Tal and the Tuvalu National Provident Fund provided grants and loans to members and non-embers affected both directly and indirectly by the COVD-19 crisis Public-private cooperation and private sector initiatives Collaboration among market participants and the public sector play an important role in the COVID-19 crisis to limit its adverse impact of the respondents 40 per cent were of are involved in public private sector collaboration and close to half in public sector initiates see Figure 19). The complementary qualitative responses emphasise very much collaboration instead of competition to serve population's needs and ensure business Survival. This is with the station of Immediate rebel of basic needs. Long-term benefits of the current collaboration, namely increased trust in e-commerce, have been reported as well. Lack of trust remains a hude to e-commerce Consequently, a response saw increasing importance for a public-private partnership for a quality label for e-commerce participants to protect consumer interests and enhance confidence. One such Initiative is Tunisia's "Label de Confidence E-commerce businesses that receive this be comply with certain standards which secure transactions and, where this promise is not upheld gues consumers simple access to legal course. Furthermore, some governments launched awareness campaigns for e-commerce as well as Outreach campaigns to instrust in potential customers Several collaborations in onboarding new businesses are listed as well as sporting local produce providers and more broadly sourcing locally. For instance, a respondented collaborating with the United States Agency for International Development to onboard women lod buses Additionally, in several countries, Initiatives established new third-party marketplaces to unite various e-commerce participants to provide goods and services more easily to the population To support the sector several initiatives centred around payments and fancing. For instance making utilities payable using mobile money, establishing a local payment way in the Pacific for reduced cost and improving cross-border payments. One initiative, in collaboration with the United Nations Capital Development Fund (UNCDF), aims to provide credit scores for loans and grants to Ugandan farmers Furthermore, several initiatives were directed towards training new market participants as well as providing tech support to them. Furthermore, Burkina Faso established a mentoring programme for SMEs in accounting, legal and fiscal concerns. In Tunisia, a start-up launched a platform to collect technological devices to recycle and repair them and distribute to students need to moduce the wealth gap in the current education situation Finally, some of the initiatives are specifically targeted towards supporting vulnerable parts of the population, such as distributing relief packages to low income mothers or producing face masks locally in marginalised communities, which are the sold gibaly as well as distributed badly to those in need In the sub-set of respondents (5) whose business was not involved in any initiative and that stated that they would not like to participate in a public-private sector colaborations For 20 several Seter See promovid-19 Se pongo.com COVIS-10 AND E-COMMERCE PACTORS AND POLICY RESPONSES intuencing factors were identified such as the lack of awareness of resources and ot professional network to do so. For private sector initiatives, a limited professional network is indeed a decisie factor Although the other factors of limited awareness, resources, time, and value also impact the decision Figure 19. Company involvement in new public-private sector initiatives to support e-commerce in per cent) Public-private sector colaboration Private sector initiatives Mer 211 responses for private sector collaboration 2016 for one sectors Bandera Il public placer laboratoire porte commend them the OVD work with other private sectores de pantacontos de contacte de todo Figure 20. Reasons for not participating in new public-private initiatives or in joint private sector collaboration in per cent) lack of awareness Lack of resources Lack of time Latest professor Public-private sector collaboration Private sector initiatives such per colaboration to potente Tyour business is at work with the sectores produto.com As we eppe paid the spde ashi paakiddoke #napet COVID-19 AND E-COMMERCE NICION DESSES AND POLICY RESPONSE Financing Only 14 per cent of all respondents had managed to obtain funding. Access to financing is one of the important bottlenecks experienced by diga businesses in developing countries and in LDCs in particular. The survey confirms this in recent months. 66 per cent of the businesses in the sample tried to obtain additional financing Figure 21.79 per cent of those looking for financing were unsuccessful and only 14 per cent of all respondents - 34 businesses-obtained additional resources. Of these several pooled funds from multiple sources. More than a third roled on informal financing options from family, friends or saving groups. Moreover, another third received support from banks or microfinance institutions and just below 30 percent obtained a private investment (see Figure 22). In terms of other sources of funding three businesses were supported by International organisations or donor agencies, such as UNCDF. Businesses aim to use the raised funds in equal measure to support business continuity and their sual and to finance business expansion (see Figure 21). Figure 21. Search for financing since the outbreak of the COVID-19 crisis and purpose of funding lin per cent) On Yes, but success Support business continuity and survival New investments in business expansion Other No. 21 apres Bated on the nearest Cortested to financing Bergronden Figure 22. Source of new financing in per cent) lii 12 Family, friends or saving groups Banka e Private investors Public funds microfinance One companies Note toponom. Based on the question constante de tractament you recente arte choices COVO-19 AND E-COMMERCEIPACT ON BUSES ALTRES 19:02 11 4G moodle.balamand.edu.lb 2 sur 20 Impact on e-commerce businesses Overall sales trends E-commerce companies have predominantly been declines in sales, while narty to per cent of third party online marketplaces have seen increase new selers and attracted more customers. For te trusse survete COVD 18 defecte About 5 por oling goods and independ on the diety w 30 percent which do or other remer of people and total em Set below. www, wound 30 percent of them had been in a n.com for the red party and For worted by the rod by party must comedy unters of buyers sont de of the markets sowe toner conviny and a halos Pre Whooverado da made thrine are verere Figure Impact of COVID-19 crisis on monthly e-commerce in percent ... Figure Third party marketplace changes in buyers and COVID-19 crisis in percent Figure 8. Third-party marketplaces: changes in buyers and sellers since the outbreak of the COVID-19 crisis in percent) 13 Dec Buyers Meter 72 poromethylococcution Sorte trek of the COVE-15 the number of boysed on your drotheke DOVO-18 totales conged on your tid party nie meer of the respondente con Most used sales channels by e-commerce companies Facebook and own e-commerce websites of e-commerce companies have been the most growing sales channels since the beginning of the COVID-19 crisis. The e-commerce companies in the sample have used, and still use a variety of channels to sell their goods and services (see Figure 9). In aggregate social media plays an important role with many using Facebook WhatsApp and other social media. Nevertheless, more than half of the responding businesses used their own e-commerce website, Phone channels, such as text message. USSD and cals were ono frequently used. Presence on third-party marketplaces was still relatively limited among the businesses surveyed. In torms of other channels, apps wore named most frequently. Since the beginning of the COMID-19 crisis, the e-commerce businesses have particularly used their own websites and Facebook sales channels more frequently thee Figure Figure 9. Main sales channels, before outbreak of COVID-19 and channels with highest recent growth (in per cent) 31 Facebook Own Telephone Whatsapp Other social Online Other -commerce channels meda website Main sales channels pre-COVID-19) Recent high growth channels Mode 180 response to the e-commerce company track Based on the through which are do you wadly truth we wet 63 tome commerce company Based on the stone period Through there you were the most fear De of the content touch COVID-10 AND E-COMMERCE PACIONESSES AND POLICY RESPONSES Variations in the composition of sales The surveyed e-commerce companies and third-party online marketplaces sell a variety of products, but the COVID-19 crisis has for most businesses been associated with a change in the composition of sales, mostly towards essential items. Before the outbreak of the COMID-19 crisis the top 5 domains for the e-commerce companies were fashion, agro-food and beverages, electronics including IT equipment, furniture and household items as well as food delivery Figure 101. Additionally, handicrafts often as gift items or souvenirs, are sold as well as services such as virtual business assistance Figure 10. Types of goods and services sold online by e-commerce companies before the COVID-19 outbreak fin per cent) Fashion accessories Agro-food & beverages Blectronics & IT equipment Furniture & household products Restaurant & food delivery Cosmetics & personal care Financial services Pharmaceutical, hygiene & health Education online courses Media & books Tourion & travel 27 17 TE 14 14 de 11 11 Digital entertainment Telemedecine services Other 000 Note 10 persone contengantar Based on the store ind et goed you selecom" Multiple choicon el The current situation has for 69 per cent of the e-commerce companies been associated with a change in the composition of sales. In part this has been driven by lockdown measures which implied that some operations had to temporarily cease. Additionaly, many have been affected by the border closures which limit opportunities for trade. Companies have seen increases in sales of essential Items, such as face masks and disinfectants, products related to home offices and schooling, baking. comfortable clothing and groceries. These tendencies are supported by shifts observed by the third-party online marketplaces (900 Figure 11). According to the respondents, everyday essential Items, such as agro-foods and beverages, food delivery and sales in pharmaceuticals and hygiene products are the items that have grown the most after the COMID-19 outbreak. The respondents provided with more the resten on how there comes as a lectus et COVE-19 AND E-COMMERCE IMPACTOR SINESSES AND POLICY RESPONSES 50 Figure 11. Third-party marketplaces: top 5 sales categories before and after the COVID-19 crisis (in per cent) Agro food beverages Financial services Pharmaceutical hygiene heath DO Restaurant & food delivery Tourism & travel Digital entertainment Education online courses Electronics & IT equipment CA Telemedicine service Media & books Furniture & household products Cosmetics & personal care Fashion accessories Other 000 Before her 2 responses to the party track Based on the store the white categones gard to add on your payment SohCOMO Stowo and your thirty Before the pandemic outbreak the agro-food and beverages tems was among the top-5 sales for 39 per cent of the surveyed online marketplaces. Since the COVD-19 outbreak, this category became one of the top-5 most sold items for 50 per cent of the surveyed third-party online marketplaces. In addition to essential toms, financial services have also seen a notable increase as one of the top-5 product categories in terms of change from before to after the pandemic outbreak, moving from B to 15 per cent, which can be associated with the rise of e-payment methods and increase of digital francial services since the COVID-19 ores outbreek as seen in the net section Payment methods Different e-payment methods are on the rise, particularly through mobile money, although cash on delivery remains prominent. Two-thirds of the e-commerce businesses have seen changes in payment methods since the beginning of the COVD-19 Crisis in line with many countries' recommendations to switch to digital payments to reduce possibile contagion, both In contrast with her at the fourton and receported that a pestis detsember when in de to create come to my at the fine the GOVID-19 More proper cert out of 29 porosten Schuhe Cove you a target to the case. The rang 36 percent to changed COVD 19 AND E COMMERCE MPACT ON BUSINESSES AND POLICY RESPONSES groups of surveyed e-commerce businesses have recorded significant growth rates in mobile money payments as well as in e-banking and credit card use see Figure 12). However, cash on delivery remains prominent in absolute terms, particularly in LDCs, and for more than 40 per cent of the respondents it has continued to be an option Snce the outbreak of the pandemic, as consumers have increasingly turned to e-commerce. This could point to an expansion of the customer base to new segments which might not have a credit card or access to some of the digital payment methods. At the same time, the persistence of cash-based payments raises questions about consumer trust in e-commerce transactions as customers are only willing to pay once their orders reach their doorstep. On the same token, this is also associated with weak financial inclusion, in a situation were contactless transactions should have been privileged Figure 12. Payment methods with highest growth since outbreak of the COVID-19 crisis in per cent) 70 Cashcash on Credit cards E-banking mobile Mobile money Online payments Other banking E-commerce companies Third-party marks 114 From the comprometed out the track the store the trak of the COVO-19. hehe. Mostowed wome cent of the rest Business outlook: impact on costs and workforce The COVID-19 crisis has affected the cost structure and the workforce size of many businesses surveyed. Approximately two thirds of all respondent businesses saw the costs increase (se Figure 13). At the same time. 44 per cent of respondents reported a reduction in their workforce, while 18 per cent were expanding theirs (see Figure 131. While rise of e-commerce since the outbreak of the COVID-19 crisis has been instrumental to strengthening overall countries resilience to shocks, not all types of businesses and sectors have equally benefitted. Impact on business turnover and employment are likely to be severe for the majority of the surveyed businesses Figure 13. Changes in costs and workforce size since the outbreak of the COVID-19 crisis in per cent) Stable Decrease Cost Workforce se ute 231. Based on the store the autre OVD13, did you pernyattaro couts?and "Sreteras The COVO-19cm, cercay change the site of your tant COVD 18 AD E-COMMERCE ACTOR BUSINESSES AND POLICY RESPONSES effective policy responses. Relatively speaking the chalenges in the policy areas of e-payments. e-commerce Skals and access to financing were less frequently mentioned. Of these areas, limited financing for liquidity shortages, high transaction fees for e-payments, and lack of compensation loss schemes were the main challenges noted (see Figure 15). Figure 15. Challenges since the COVID-19 outbreak in e Trade for all Policy Areas (in per cent Policies and strategies ICT infrastructure and services E-COMTE-Commerce sector Lack of duto pronted by the noticiently e-commerce for government med indeving and policy Brand News New e costs or for andre government not reduced due to higher or bandwide Logistics and trade facilitation Legal and regulatory frameworks Disrupted supply chain flockdow market closure Transport Disrupled Higher raport gati due te and delivery cost restrictions on movement Higher costs to new Operational Mine competition constante con from regulated to restriction e-comme E-payment solutions E-commerce skills 19 10 No reduction of payment transaction les thayo solibee payment options traust workforce to sustain angin demand and business support services Access to financing 22 Limited racing to louidity shortages Noo compensation Not: 232 epornes. Based on the condonance the box of the Cove 18 crisis, which the challenges that most inached on you Maimun 10 Choi COVO-19 AND E-COMMERCE ACT ON BUSINESSES AND POLICY RESPONSES Further feedback received confirmed how supply chain disruptions (eg, closed airports, freight disruption especially in remote locations, dis-functional storage facilities, etc.) have deeply impacted turnover of e-commerce sector relying on trade in goods and value chains. Reduced or no demand for services has also had an impact on turnover for businesses operating in hard-hit sectors, such hospitality, transport and tourism, education and training, entertainment and leisure, relying on trade in services, both local and cross-border. Moreover, price hikes for certain goods and services, lower consumer spending and reduced orders have negatively impacted on business profitability. In addition to the impact on business operations and turnover, they have also highlighted several other aspects related to the impact and challenges they faced Impact on capacity to invest. Even when demand grew, businesses found it very challenging to adapt and expand to meet the additional demand. Insufficient funds to scale-up operations, uncertainty about the future to undertake new investments, availability of the required workforce on short notice were vital challenges, further complicated by health-related precaution measures. The same constraints impacted the availability of resources dedicated to communication and visibility, necessary to expose products and services to potential buyers in the market ICT gaps further exacerbated. Respondents further reaffirmed the importance of having an accessible, affordable and well-performing ICT infrastructure, especially in rural areas where access to online markets is very limited and low digitaliteracy is a major hindrance. Bottlenecks persist also in better connected areas. Some respondents reported that working from home has been hampered by power cuts, insufficient bandwidth and no reliable infrastructure to sustain demand for automation of business processes Consumer protection and competition. Supply chain disruptions have severely impacted on e-commerce for import-dependent countries facing already high transport and logistics costs. Price hikes for goods in high demand during the crisis have stressed the importance of sound consumer protection regulations and institutions according to respondents from Small Island Developing States, who feet particularly disadvantaged by limited competition in aviation and expensive freight market Persistent cash on delivery culture. Many businesses have adapted business practices to the COVO-19 new normal by introducing contactless delivery options and e-payments solutions. However, respondents reported that cash on delivery payments oftenpose the biggest challenge as they put workers at increased risk of contracting COVID-19. Efforts to minimize physical transactions have been hindered by strong cultural inclinations related to the use of cash and payment on delivery Additionay, imited availability of e-payment Gateways and solutions has been ched as a bottleneck to increasing online sales. Business facilitation measures: an overview Governments and the private sector have taken a range of measures relevant for the e-commerce sector to mitigate the economic and social impact of the COVID-19 crisis, but many respondents also pointed towards a lack of support for the sector. One quarter of respondents perceived that no measures had been taken to support e-commerce see Figure 16). Furthermore, the COVID-19 crisis pushed the importance of having a national e-commerce strategy to the forefront On the other hand, many measures were very hands-on in nofth of the responses, increased publicity efforts for e-commerce, e-commerce skills trainings to bring more people up to date with the opportunities offered by the digital economy as well as reduced transaction costs for e-payment were considered major measures token Additionally. more than 15 per cent of the respondents considered financial and liquidity support in addition to maintaining logistics operations vital for their business continuity, as well as cheaper Internet access and new e-commerce opportunities for essential goods and services. New services, such as additional logistics Services from the private sector and the post of new e-payment * Set for comple:ww..comprese crows-220003 wew.hr ass.com/202004/22/cere.COND-cand personal-chat COVID-19 AND E-COMMERCE