Question: summary for this article :key theme, major findings, and key implications NEW STORE DEPARTMENT LE CLO FEATURE C NEW STORE STORE CTION TO GROWTH NEW

summary for this article :key theme, major findings, and key implications

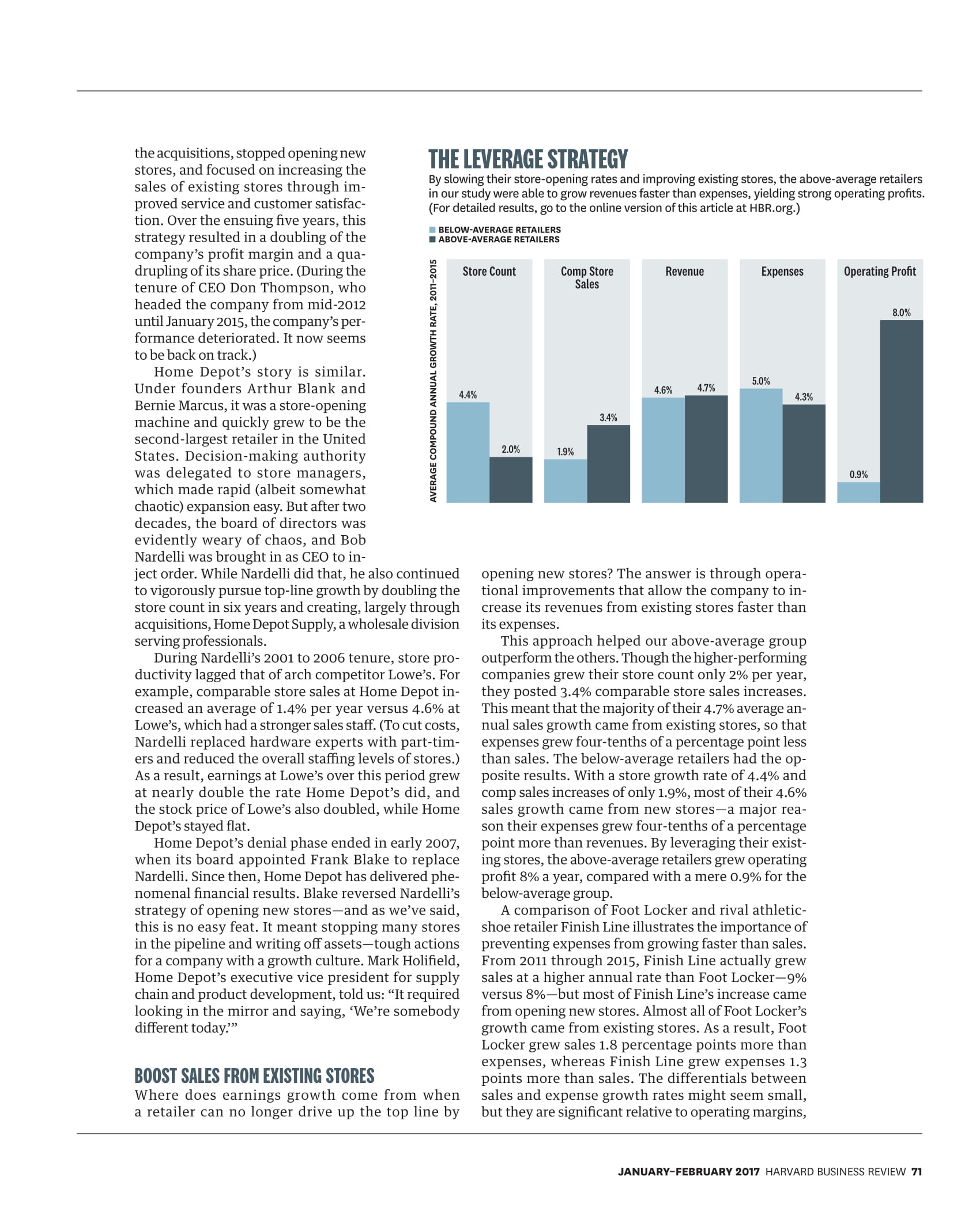

NEW STORE DEPARTMENT LE CLO FEATURE C NEW STORE STORE CTION TO GROWTH NEW STORE FOOD PHARM NEW STORE NEW STORE STORE CLOSING FOOD & PHARMACY HOME & DIY GRAND OPENING CURING THE ADDICTION DD & D MACY DEPARTRE NET TO GROWTH House sne B BURGER W HOME & DIY aker House MARVA P BUSINESS Sneaker HourLUSTRATION BY ROD HUNT 99 FEBRUARY 2017Sneaker E CLOS 50% nouse STRAL CORE ONLINE COOLS STORE CLOSING STORE CLOSING STORE CLOSED STORE CLOSED STORE CLOSED STORE CLOSED EFOOD PHARIS STORE CLOSED STORE CLOST HOME & DIY STORE CLOSING STORE CLOSING STORE CLOSING ARE CLO ING STORE CLOSING STORE CLOSING STARE CLOSING 50 D DEPARTMENT STORE CLOSING STORE STORE CLOSED STORE CLOSED Sneaker House Sneaker House Sneaker House B B NEW STORE NEW STORE URGER OPENING SOON! OPENING SOON! NEW STORE NEW STORE A D DEPARTMENT D STORE DEPARTMENT STORE LESSONS FROM THE RETAIL INDUSTRY BY MARSHALL FISHER, VISHAL GAUR, AND HERB KLEINBERGER STORE JANUARY FEBRUARY 2017 HARVARD BUSINESS REVIEW 67FEATURE CURING THE ADDICTION TO GROWTH SHARE THIS \"TIM. HBR Lllill HAHES IT EAST. see PAGE 16 FOR INSTRUCTIONS. ompanies in all industries eventu- ally see their revenue growth slow. Retailers are no exception. Fickle consumers, intense competition, changing markets, and the rapid encroachment of online retailing all combine to exert pressure on the top line. The retail graveyard islled with chains such as Circuit City, Austin Reed, Linens 'n Things, Loehmann's, British Home Stores, Radioshack, and the Sports Authoritythat expanded rapidly and then, faced with declining growth, couldn't nd ways to change course. What should a retailer do when growth slows? Is it doomed, or is there a way to prosper when its business matures? To answer these questions, we examined the nancial data of 37 us. retailers with recent sales of at least $1 billion whose top-line an- nual growth rate had slowed to single digits. Some of these retailers had seen their bottom lines fall even faster than their top lines; others had achieved dou- ble-digit earnings growth and above-average stock market returns. Our analysis showed that the less successful retailers had continued to chase growth by IN BRIEF THE PHDBLEH In pursuit of double-digit revenue growth, many retailers relentlessly open new stores, even when doing so destroys the protability oftheir businesses. THE CAUSE This addiction is fueled by Wall Street and a capitalist culture that's obsessed with growth. It's hard to kick, primarily because companies don't know when or how to switch to a slow-growth strategy. THE SOLUTION Mature companies should rely on a strategy that focuses on growing revenues of existing stores faster than expenses. opening new stores far past the point of diminishing returns. By contrast, the successful retailers had drasti- cally curtailed expansion and instead relied on operational improvements at their existing stores to drive addi- tional sales. This allowed them to in- crease revenues faster than expenses, which had a powerful positive impact on earnings. That may seem like a simple strat egy, but it's one that most retailers do not follow, for three reasons. First, Wall Street and the capitalist culture celebrateand demandgrowth. Indeed, slow growth is regarded as something between a disease and a moral failing. When faced with de- clining growth, companies are urged to go back to the drawing board, re- think the business, and come up with a new strategy to pump up the top line. Second, leaders of many retail chains don't know when to make the transition. Consequently, they keep expanding until their chains begin to 65 HARVARD BUSINESS REVIEW JANUARY-FEBRUARY 2011 collapse under their own weight. And third, growth companies and mature businesses require very differ- ent operating strategies. Many companies that excel at growth lack the capabilities to make the switch. In this article, we explain when living with slow growth makes sense, providing metrics that can help retailers determine when and how to move from a high-growth to a low-growth strategy. We also of- fer a framework for creating a low-growth strategy that allows retailers to increase revenues faster than expenses by leveraging their existing resources. If retailers do this, they can stay in the maturity stage of the life cycle for a very long time, forestalling de cline. Though our focus here is on the retail industry in the United States, we hope that companies in other industries will take the broad lessons to heart. WHEN GROWTH STALLS The retail life cycle follows a classic S-curve. Success- ful companies grow quickly in their early years by opening stores and penetrating new markets. Once the most attractive sites have been exploited, they add stores in increasingly less attractive locations. As their store networks become ever more dense, new stores begin to cannibalize the sales of existing ones, reducing the net sales gain for the entire chain. Walmart followed just this pattern. In the scal year ending January 31, 1968, its 24 stores generated $12.6 million in sales and $482,000 in net prot. By fiscal 1988, it had 1,198 stores, sales of $15 billion, and net income of $627.6 million. The compound an- nual growth rate (CAGR) of its revenues and earnings for the 20-year period was exactly the same: 43%. This illustrates that value creation in the growth phase comes from scaling the business, not neces- sarily from increasing protability. But growth can not continue forever. (Had Walmart continued to grow at that rate, its 2015 revenues would have been $246 trillion, more than three times the world GDP!) Data shows that by 2006 new stores had begun to cannibalize the sales of existing stores, and Walmart was entering the maturity stage. So it's not surprising that its top-line growth slowed, falling to an average CAGR of 2.7% in the 20112015 period. Walmart op- erates in more than 30 countries, and clearly growth rates differ by country, but this doesn't counteract the fact that its overall recent growth rate has been in the low single digits. Our study focused on what happens to retailers when growth stalls. We examined the sales growth, stock market returns, and other publicly reported - nancial data of the 37 U.S. retailers whose recent sales were at least $1 billion and whose sales growth from 2011 through 2015 had dipped to single digits. (We ex cluded companies that, growing at greater than 10% per year, hadn't yet reached maturity, and those with negative sales growth that were clearly in decline.) We then split the retailers into two groups based on their performance from 2011 through 2015: those with aver- age annual total shareholder returns (TSR), including stock returns, dividends, and stock splits, at or above 12.4% the average annual TSR of the S&P 500 index over this periodand those with below-average re- turns. (For a detailed look at the nancial results of the 37 retailers, go to the online version of this article at HBR.org.) The data vividly shows that slowing growth can engender stagnation: The operating prot of the 20 underperforming companies grew only 0.9% per year, on average, and their average annual TSR was a mere 2.8%. But the 17 successful retailers demonstrate just as persuasively that it's possible to prosper with modest top-line growth. These companies grew their operat- ing prot 8% a year, on averagemore than eight times the rate of the unsuccessful onesand their average annual TSR was a whopping 21.9' over the veyear period. That is nearly double the S&P 500 growth rate. To understand what differentiated the more suc- cessful companies from the underperformers, we examined their public information and interviewed current and former executives of Dillard's, Foot Locker, Home Depot, Kroger, Macy's, and McDonald's. Despite very different businessessome retailers are diversied (for example, L Brands), and several have operations in many different countries (for example, McDonald's)we found remarkable similarities in their approaches. \"Will THE RIGHT HEIRICS When you're a retailer, nobody tells you that your chain's high-growth days are over and it's time to switch to a maturity strategy. To detect when you should begin transitioning from high growth to slow growth, you need to track the right metrics. At first glance, it seems obvious that the time to make the move is when new-store productivity has declined to the point that the invest- ments made in opening new stores hurts, rather than helps, the bottom line. But knowing exactly when new stores have become unprofitable is far from easy. It takes time for a new store to mature; consequently, early sales may not be indicative of eventual sales. Also, extenuating factors, such as economic downturns or natural disasters, can have a huge temporary impact on sales. Our study revealed one measure that can reliably tell retailers when to slow the pace of expansion: return on invested capi tal. Not coincidentally, it's a metric that research has shown is strongly correlated to the long-term appre- ciation of stock price. For retailers, ROIC is the ratio of adjusted operating income (operating income plus rental expense for the new store) to average invested capital (the sum of investments in property and equipment, capitalized leases, and inventory net of payables). To compute ROIC for a new store, a retailer needs four things: a sales forecast for the new store over time, operating expenses, the required capital investments, and how much the new store will carmi balize the sales of nearby stores. Many of our exemplar companiesincluding Foot Locker, Home Depot, Kroger, Macy's, and McDonald'strack ROIC and adhere religiously to rel- atively high hurdle rates for new stores (the minimum rate of return that a proposed investment would be expected to generate). Some retailers, however, ignore the capital re- quirements of new stores and focus solely on growth in earnings. This can lead to bad decisions. Karen Hoguet, Macy's chief nancial ofcer, told us that she was surprised when a competitor began to open new stores in locations that Macy's had rejected. Later she learned that the competitor had based its decisions on projections of growth in earnings per share rather than return on invested capital. The new stores turned out to be poor performers. \"We were right,\" she observed. \"They weren't great stores.\" In addition to ROIC, we recommend that retailers track two others metrics. The rst is revenue per store, THE RETAIL llFE CYCLE Retailers grow quickly in their early years by opening new stores. As attractive sites become scarce and new stores begin to cannibalize existing ones, growth falters. Maturity Decline JANUARY-FEBRUARY 2011 HARVARD BUSINESS REVIEW 53 FEATURE CURING THE ADDICTION TO GROWTH CAN ACQUISITIONS REIGNITE GROWTH? Retailers chasing top-line growth often resort to acquisitions to pump up revenues, despite overwhelming research showing that in all industries the majority of acquisitions do not create value. So it's no surprise that the retailers with abOve-average stock- market performance in our study of 37 U.S. companies were much more conservative with their acquisitions than those with below~average performance. Our research did show, however, that some types of acquisitions deliver more value than others. Fill-ins. We found that acquisitions that strengthened the core business by lling in underserved areas with new stores or by adding new capabilities were the most successful. Nine of the 17 above-average performers used this type of acquisition to enhance their existing markets. Dillard's, for example, executed this strategy successfully in Texas, the Southwest, and the Midwest. Diversication. Only four of the better performers made acquisitions to diversify into new businessesiand most of them were eventually Spun off or shut down. L Brands is one of the few companies to have diversied successfully. Its acquisitions included Abercrombie & Fitch, Henri Bendel. Lane Bryant, Lerner Stores, and victOria's Secret. Many of the 20 underperforming companies, including Nordstrom, the Gap, Finish Line, Bed Bath & Beyond, and most recently Walmart, have pursued diversication with generally poor results. Although the reasons for their lackluster performance are difcult to ascertain using public data, their acquisitions, even if protable, seem to have diverted capital and management attention from their mature businesses. Geographic expansion. Target and Walmart attempted to expand into Canada and Germany, respectively, through acquisitions. Both efforts were colossal failures. The main reasons were signicant differences between customers, competitors. and government regulations in those countries and the United States. STOP OPENING NEW STORES As a retailer tracks the three metrics we've just described, its managers will see when new stores in a particular chain and in a given country are having a diminishing impact on total revenues and ROIC. When it reaches the point at which most or all options for expansion have an unacceptable ROIC, it's time to slow the rate of store openingsor stop opening them altogether. Both groups of retailers in our study slowed their storeopening rate from 2000 to the 2011 to 2015 period. But the retailers with above-average stock-market performance slowed their rate more: They added just 2% more stores per year while the below- average retailers added 4.4% more. We cannot emphasize strongly enough how hard it is for a retailer that has spent decades in high-growth mode to turn off the store-opening machine. It has a large team in place dedicated to planning and managing the opening of stores. Employees throughout the com- pany feel the excitement of producing double-digit growth year aer year and worry that if growth slows, opportuni- ties for advancement will dry up too. A host of consultants constantly urge se nior managers not to shift strategy but rather to redouble their efforts to reig- which is simply total revenue in a year divided by the total store count. The second is estimated revenue added per new store, which is the difference between total actual revenues and the estimated revenues from existing stores that would have been achieved if no new stores had been opened, divided by the num ber of new stores. To calculate the estimated revenue from existing stores, take the prior year's revenue and add the increase in comparable store sales (the revenue increase at stores that were open for at least 12 months prior to the current scal year, which are known in the industry as \"comps\" and reported on re- tail nancial statements) and add an es'dmate of the cannibalization of existing stores that is due to new storesa loss in revenue that would be avoided if no new stores were opened. Walmart is one retailer that tracks and reports a cannibalization eect. Savvy retailers can use all three metrics to detect signs that they should be slowing the growth of new stores. If a retailer has signicant international oper- ations, it should use as the revenue number what the revenues for a year would have been absent currency uctuations. Alternatively, a retailer can compute this metric for each country in which it operates, using the revenues in the local currency of the country. 70 HARVARD BUSINESS REVIEW JANUARY-FEBRUARY 2011 nite growth. That includes making acquisitionswhich all too often don't work out. (See the sidebar \"Can Acquisitions Reignite Growth?\") And the CEO, who has been selling a growth story to investors for years, worries about coming up with a new tune to sing, For all these reasons, retailers often go through a long, painful period of denial before they acknowl- edge that growth has ended and it's time to switch strategies. It's likely that many of the underperforrn- ing retailers in our study are in this denial stage now. Indeed, in Walmart's 2016 annual report, CEO Doug McMillon asserts: \"We are a growth company; we just happen to be a large one\"-a remarkable statement given that the scal year ending January 31, 2016, was the rst in its history that Walmart's sales declined. Many of the highperforming retailers also went through a rocky denial period. Let's look at two exam- ples: McDonald's and Home Depot. McDonald's grew rapidly and successfully through 1998 by opening new stores. In 1999, growth began to slow, but McDonald's continued down the growth path, also acquiring other restaurant chains, de spite the fact that this strategy was eroding its earn- ings and depressing its stock price. A new CEO (Jim Cantalupo) reversed that course in 2003. He divested the acquisitions, stopped opening new stores, and focused on increasing the sales of existing stores through im proved service and customer satisfac- tion. Over the ensuing ve years, this strategy resulted in a doubling of the company's profit margin and a qua drupling of its share price. (During the tenure of CEO Don Thompson, who headed the company from mid-2012 until January 2015, the company's per- formance deteriorated. It now seems to be back on track.) Home Depot's story is similar. Under founders Arthur Blank and Bernie Marcus, it was a store-opening machine and quickly grew to be the second-largest retailer in the United States. Decisionmaking authority was delegated to store managers, which made rapid (albeit somewhat chaotic) expansion easy. But after two decades, the board of directors was evidently weary of chaos, and Bob Nardelli was brought in as CEO to in j ect order. While Nardelli did that, he also continued to vigorously pursue top-line growth by doubling the store count in six years and creating, largely through acquisitions, Home Depot Supply, awholesale division serving professionals. During Nardelli's 2001 to 2006 tenure, store pro ductivity lagged that of arch competitor Lowe's. For example, comparable store sales at Home Depot in- creased an average of 1.4% per year versus 4.6% at Lowe's, which had a stronger sales stai (To cut costs, Nardelli replaced hardware experts with part-tim- ers and reduced the overall stafng levels of stores.) As a result, earnings at Lowe's over this period grew at nearly double the rate Home Depot's did, and the stock price of Lowe's also doubled, while Home Depot's stayed at. Home Depot's denial phase ended in early 2007, when its board appointed Frank Blake to replace Nardelli. Since then, Home Depot has delivered phe- nomenal nancial results. Blake reversed Nardelli's strategy of opening new storesand as we've said, this is no easy feat. It meant stopping many stores in the pipeline and writing off assetstough actions for a company with a growth culture. Mark Holjfreld, Home Depot's executive vice president for supply chain and product development, told us: \"It required looking in the mirror and saying, 'We're somebody different today?\" AVERAGE COMPOUN D All N HAL GROWTH RATE, 2011-201 5 MOST SAIES FROM EXISTING STORES Where does earnings growth come from when a retailer can no longer drive up the top line by Store Count MR 3.4% 10% \" THE lEIIERIIGE STRATEGY By slowing their store-opening rates and improving existing stores, the above-average retailers in our study were able to grow revenues faster than expenses, yielding strong operating prots. (For detailed results, go to the online version of this article at HBR.org.) I lELOIN-AVERAGE RETAILERS I ABOVE-AVERAGE RETAILERS CnmpStore Revenua Sales Expenses opening new stores? The answer is through opera- tional improvements that allow the company to in crease its revenues from existing stores faster than its expenses. This approach helped our above-average group outperform the others. Though the higherperforming companies grew their store count only 2% per year, they posted 3.4% comparable store sales increases. This meant that the majority of their 4.7% average an- nual sales growth came from existing stores, so that expenses grew four-tenths of a percentage point less than sales. The belowaverage retailers had the op posite results. With a store growth rate of 4.4% and comp sales increases of only 1.9%, most of their 4.6% sales growth came from new storesa major rea- son their expenses grew four-tenths of a percentage point more than revenues. By leveraging their exist- ing stores, the aboveaverage retailers grew operating prot 8% a year, compared with a mere 0.9% for the below-average group. A comparison of Foot Locker and rival athletic- shoe retailer Finish Line illustrates the importance of preventing expenses from growing faster than sales. From 2011 through 2015, Finish Line actually grew sales at a higher annual rate than Foot Locker9% versus 8%but most of Finish Line's increase came from opening new stores. Almost all of Foot Locker's growth came from existing stores. As a result, Foot Locker grew sales 1.8 percentage points more than expenses, whereas Finish Line grew expenses 1.3 points more than sales. The differentials between sales and expense growth rates might seem small, but they are signicant relative to operating margins, Operating Prot 3.0% 5.0% 4.1% 4.6% "3% I as\" JANUARV-FEBRUAIIY 2017 HARVARD BUSINESS REVIEW 71 FEATURE CURING THE ADDICTION TO GROWTH which were in the range of 10% for both companies, and completely explain why Foot Locker's operating prot grew at a 23.6% rate while Finish Line's declined at a 4.6% rate. Ken Hicks, who served as the CEO of Foot Locker from 2009 until late 2014 and then as executive chair- man until May 2015, told us that his strategy to im prove operational performance relied on leveraging real estate, inventory, and store associates. His rules of thumb were that inventory should grow half as fast as sales and controllable expenses 70% as fast as sales. He remarked that it's possible to leverage low- to mid- singledigit increase in sales growth to produce strong prots and stock returns. An implication of this is the need for at least some sales increase. In other words, this is a low-growth, not a no-growth, strategy. There are many ways a retailer can boost sales from existing stores. Let's look in detail at the most important. Real estate. Even if a retailer is not increasing its store count, its real estate group should not be idle. It should be closing unproductive stores, expand ing and remodeling stores in the best locations, and carefully vetting locations for the few new ones. Under Frank Blake and his successor, Craig Menear, root iocxrn's smarter ro IMPROVE Home Depot has concentrated on refreshing existing stores and catching up on deferred maintenance. Foot Locker has focused on rationalizing the location of its stores, closing some and adding space where it would do the most good. Analytics. The extent to which customers can nd the products they want at a reasonable price and get help from sales associates as needed is a crucial de- terminant of whether they buy something or leave a store empty-handed. Many analytics tools are avail- able today that help retailers decide what assortment of products to carry in what quantities, how to price those items, and how many sales associates should work in each store, at what hours. Kroger's use of analytics is noteworthy. In 2010 it began deploying infrared technology that tracks when customers enter the store and then uses pre- dictive analytics to estimate when they are likely to reach the checkout lanes. This allows Kroger to de termine how many lanes need to be operating at any given time in order to meet its exacting wait-time standards. A large dynamic display informs custom- ers and associates of the current wait time. Since the technology was implemented, average wait time has dropped from four minutes to 26 seconds, and cus tomer satisfaction with checkout has improved significantly. Initiatives such as this one have helped Kroger achieve more than 50 straight quarters of positive increases in comparable store sales. New-product development. OPERATIONAL PERFRMANCE RELIED 0N lEVERAGING REAL ESTATE, INVENTORY, AND STAFFING. Retailers seeking improved sales at existing stores often develop new products to boost revenues. To do so effectively, they need highly disci- plined methods for identifying and testing potential offerings. Consider Home Depot's process for adding private-label products. The retailer first identifies market-brand items that are performing poorly and exam- ines customer complaint data to see how the products could be improved. It then develops private-label prod- uctsfor example, Hampton Bay ceil- ing fans, Husky tools, and Glacier Bay toiletsand continually renes them to improve quality and lower costs. Instead of using the cost savings to boost gross margin on the products, it often passes the savings on to cus- tomers in the form oflower prices. That drives more sales at existing stores and takes share from compet itors. If a new private-label product consistently gets a 3 out of 5 or lower in customer ratings or fails to take 72 HARVARD BUSINESS REVIEW JANUARY-FEBRUARY 2017 significant share from the branded item, Home Depot kills it. Staffing. The effectiveness of your sales force depends on whom you hire, how you train them, what technology you deploy to make them more effective, and how you staff each department in each store during each hour of the day. It all starts with hiring the right people. Ken Hicks told us that all Foot Locker applicants take an on- line test that measures their dispo sition toward selling and their fit with the Foot Locker culture. The company refined the test over time by giving it to current associates and correlating the results with their actual productivity. Company data shows that people hired after the program was put in place in 2013 had higher sales per hour and stayed with the company longer than people who had not been hired through the program. Foot Locker also optimizes productivity by assigning the associates with the highest sales per hour to work the most important shifts. L Brands, which takes a similar approach, calls this practice \"putting the aces in their places .\" Training is also a critical piece of the puzzle. Well- trained sales associates who have deep product knowledge can signicantly increase the percent age of customers entering the store who actually buy somethingwhat retailers call the \"close rate." Dillard' , which offers online product training to its sales associates, has found that each hour associ- ates spend on training increases their sales rate by a remarkable 5%. Another common way to improve the performance of salespeople is to remove non-valueadded work from their responsibilities so that they can devote more time to helping customers. An exemplar here is Foot Locker. In most shoe stores, sales associates make many trips to the back room to check on product avail ability and retrieve items that customers want to try on. Those trips consume precious time, and many im- patient customers leave without making a purchase. To reduce the time associates spend off the floor, Foot Locker introduced scan guns that allow them to check what's available in the back room, online, and in other stores without leaving the customer's side. The guns are estimated to have added 2% to sales. Macy's also uses technology to facilitate the sales process. Its \"smart tting rooms\" are equipped with iPads that allow customers to request additional items or different sizes, which sales associates then deliver to them in the tting room. channel strategy. Most brick-and-mortar retaers would be happier if the internet, which made online shopping possible, had never been invented. But smart retailers understand that a strong omnichan nel strategy can increase overall sales by giving cus- tomers additional ways to gather information, make purchases, and receive products. For example, allowing customers to buy products online and pick them up in a store not only enhances online sales but also boosts store sales. That's because customers tend to make additional purchases when they come to the store to pick up their items. Retailers also benet from the opportunity to fulll online or ders with inventory in stores. This can help them avoid markdowns on overstocked items and mini- mize the need to expand distribution center capacity during seasonal buying surges. Omnichannel retailers can also increase sales by optimizing their distribution networks to speed up order fulllment. A study of one retailer showed that opening a new distribution center that cut average de- livery times of online sales for some customers from seven days to three produced an additional 4% in sales from the customers in that segment. The gross margin on the additional sales was more than enough to cover the cost of adding a distribution center. One retailer that understands this is Home Depot. It recently replaced two older direct-fulfillment centers with three new ones. The location of these centers and the stocking strategies and operational processes they use have been optimized for faster delivery to customers. Home Depot has also im- proved the accuracy of lead-time information pro- vided to customers. Previously, it would tell all cus- tomers in all zip codes that delivery for a given item would be in the range of seven to nine days. Now it provides customized delivery times that can be as short as two days. \"There is no doubt from our data that reducing delivery time is driving higher sales,\" Holield told us. JANUARY-FEBRUARY 2011 HARVARD BUSINESS REVIEW 73 FEATURE CURING THE ADDICTION TO GROWTH For an extended reading list, go to the online version ofthis article at HBR.org. Customer-facing policies. Things like your re- turn policy, acceptance of credit cards, and store hours need to be continually monitored and revised to enhance sales. McDonald's, for instance, made numerous improvements during the 20062011 pe- riod, including switching from a cash-only payment policy to accepting credit cards, expanding some stores' period of operation to 24 hours, and doubling lanes for drive-through business at busy stores to relieve congestion. Bob Marshall, the former vice president of McDonald's U.S. restaurant operations, estimates that these changes yielded a double-digit sales increase. technology was thoroughly rened was it rolled out companywide. McDonald's, by contrast, seems to have forgot- ten the need for a disciplined process during Don Thompson's tenure. \"Management fell in love with their own ideas and lacked the discipline to kill products like Mighty Wings whose test results were questionable,\" Marshall told us. As internal improvement projects with acceptable ROIC begin to outnumber attractive new-store op- tions, capital allocation will evolve smoothly from a scaling strategy to a leverage strategy. To successfully make this shift, however, retailers must clearly com municate their strategy to Wall Street. Investors like companies that beat expectations and hate those that fall short. Mature retailers should set conservative an- MATURE RETAILERS GENERATE A [01 0F CASH, WHICH CAN BE USED TO FUND DPERATIONAL IMPROVEMENIS. nual sales targets and explain their logic for focusing on ROIC. During Blake's tenure, Home Depot began an- nouncing increasingly high targets for ROIC, starting with 15%, then 24%, and now 35%. It has been meeting those targets ahead of its announced schedule. What happens when a retailer has more capital ALLOCATE BAPITAE WISE\" The good news about mature retailers is that they gen- erate a lot of cash, which can be used to fund the types of operations-improvement projects described above. The challenge is making sure that the available capital is allocated to the most promising initiatives. Companies should formulate and follow a disci- plined capital allocation process that starts with idea generation. Retailers should begin by mining all ar- eas of the business for process-improvement ideas, as well as take inspiration from other retailers. Some companies, such as Macy's and McDonald's, have in novation groups to find and evaluate improvement ideas. McDonald's also has an innovation center, where it replicates store equipment and processes to test the effect of new products on service times in a given type of restaurant. According to Bob Marshall, the innovation center was instrumental to the success ful introduction of the McCaf line of drinks in us. restaurants in 2007 and 2008. He estimates that they generated a mid-single-digit annual sales increase in the United States. Once ideas have been generated, the next step is to evaluate the ROIC of each initiative and fund only those that exceed the desired hurdle rate. \"The things you don't do are often more important than the things you do,\" Hicks says. Pilot projects should be conducted for each initiative, and the results should determine whether the initiative is rolled out to all stores. Foot Locker rst put its scan gun technology only in pilot stores. At the same time, it worked with Motorola to reduce the cost of the scanner, from $1,200 to $300. Only after the 74 HARVARD BUSINESS REVIEW JANUARY-FEBRUARY 2011 than attractive internal or external investment op- portunities? After putting aside cash for a rainy day (retailing is cyclical, and it's easy to burn cash during downturns), the retailer should distribute the remain- der to shareholders via dividends or stock buybacks, which the above-average performers generally did, undoubtedly helping their stock prices. Home Depot, for example, announced a policy to return at least half of available cash each year to shareholders. THE oesrrrucravs oesessron with high growth per- vades virtually all capitalist economies. Although this article focuses on the retail industry, we hope it will spark managers and investors in all sectors to pause and reconsider when high growth is good and when it's bad. Our analysis offers just a snapshot in time. It cer- tainly does not mean that the poorer perfon'ners can't join the ranks of the better performers or vice versa. (Even the more successful retailers have experienced periods of lackluster performance.) That said, making the switch from an expansion to a leverage strategy is a huge challenge for retailers. It often requires a new CEOone who delights in the nittygritty work of improving operations. Sadly, all too many leaders of mature retailers just can't seem to come to grips with the reality that their companies' gogo days are behind them and that it's time to kick the growth addiction. 6 Han Reprint R170'IC E HIRSIIIll FISHER is the UPS Professor at the University of Pennsylvania's Wharton School. the coauthor (with Ananth Raman) of The New Science of Retailing, and the cofounder and chairman of 4R Systems, a retail analytics rm. VISIIAL Mill is a professor at Cornell's Johnson School of Business. Illill KLEIIIIEREER is an adjunct professor at New York University's Stern School of Business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts