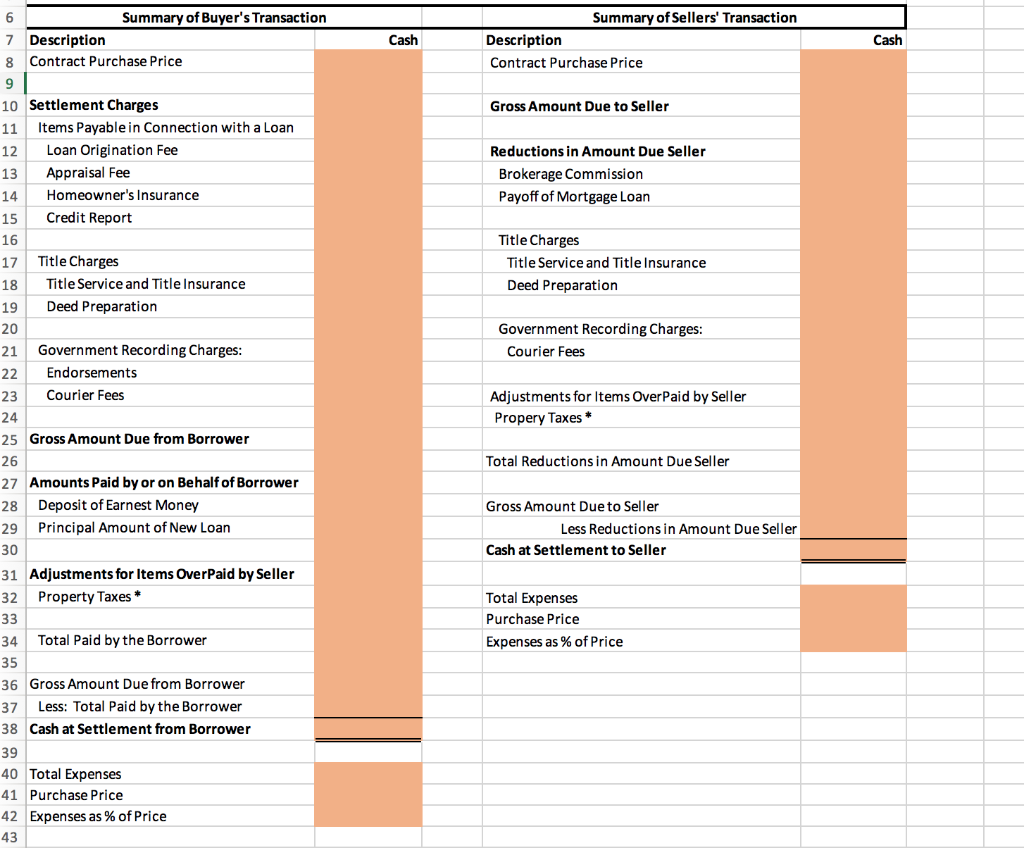

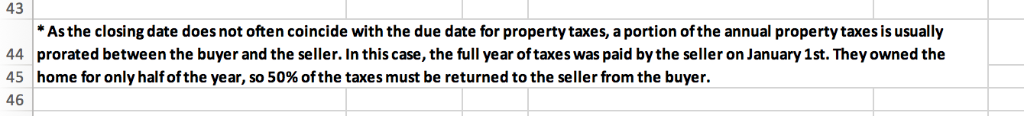

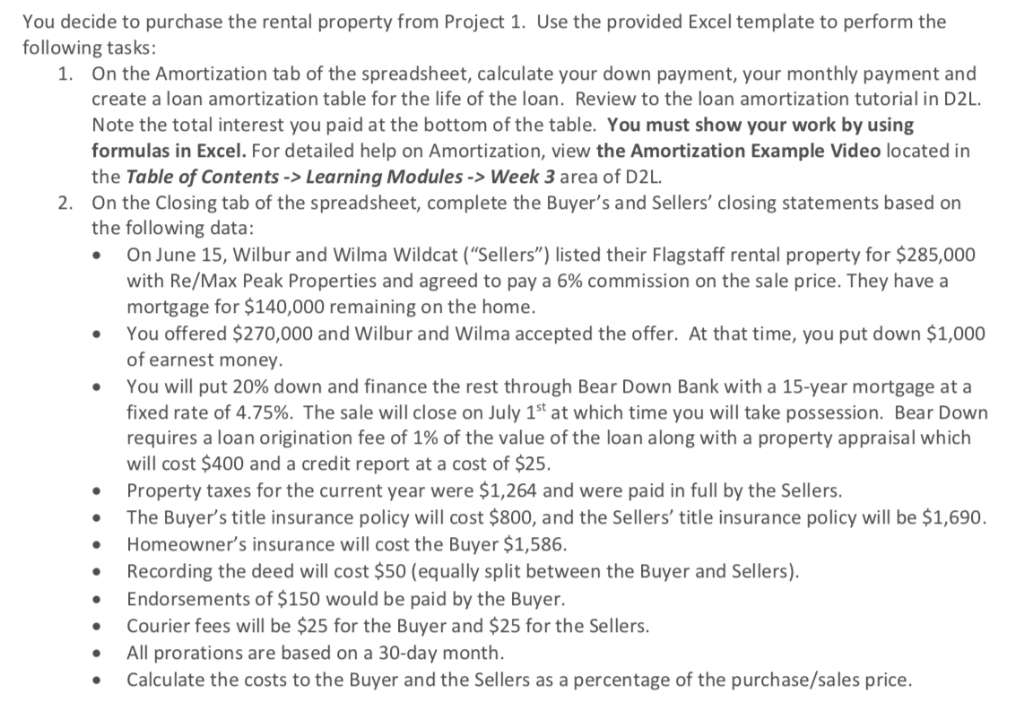

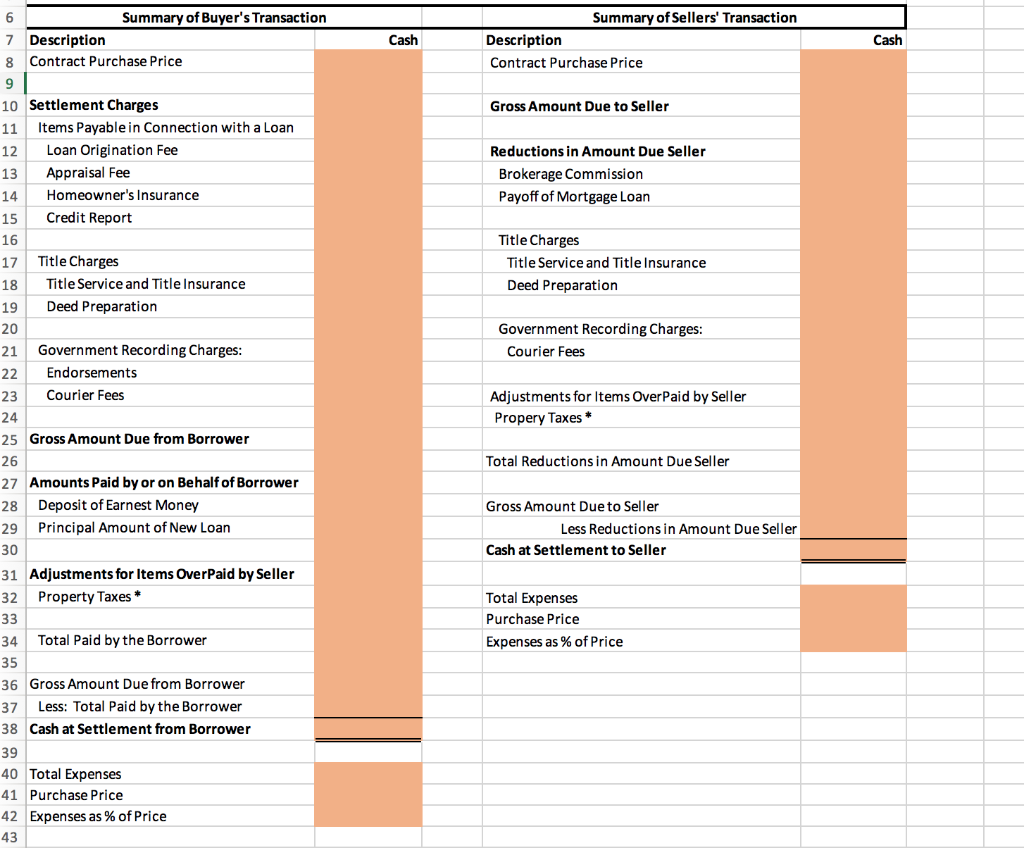

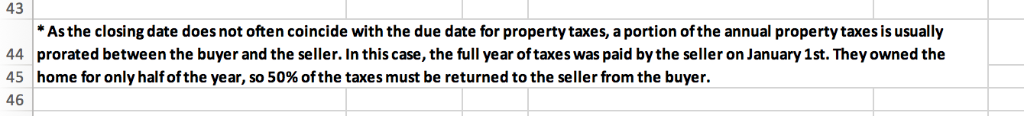

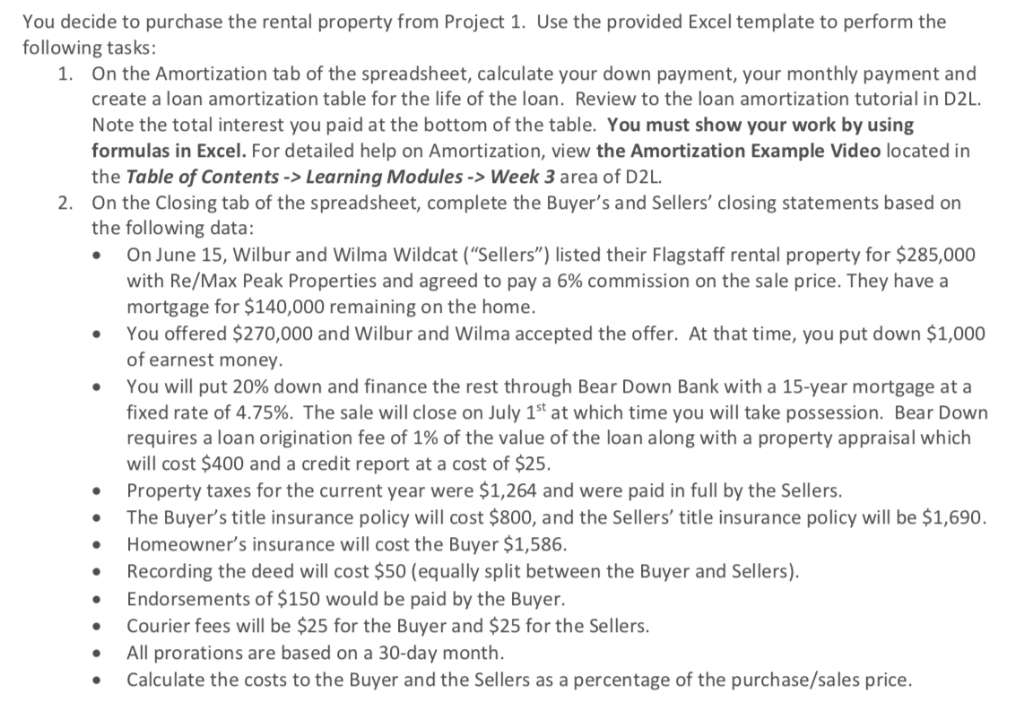

Summary of Buyer's Transaction Summary of Sellers' Transaction 6 7 Description Cash Description Cash 8 Contract Purchase Price Contract Purchase Price 9 10 Settlement Charges Gross Amount Due to Seller Items Payable in Connection with a Loan 11 Loan Origination Fee 12 Reductions in Amount Due Seller Appraisal Fee Brokerage Commission 13 Homeowner's Insurance 14 Payoff of Mortgage Loan Credit Report 15 16 Title Charges Title Charges 17 Title Service and Title Insurance Title Service and Title Insurance 18 Deed Preparation Deed Preparation 19 20 Government Recording Charges: Government Recording Charges: Courier Fees 21 Endorsements 22 Adjustments for Items OverPaid by Seller Courier Fees 23 24 Propery Taxes Gross Amount Due from Borrower 25 Total Reductions in Amount Due Sel l er 26 Amounts Paid by or on Behalf of Borrowe r 27 Deposit of Earnest Money 28 Gross Amount Due to Seller Principal Amount of New Loan 29 Less Reductions in Amount Due Seller Cash at Settlement to Seller 30 Adjustments for Items OverPaid by Seller 31 32 Property Taxes Total Expenses Purchase Price 33 Total Paid by the Borrower 34 Expenses as % of Price 35 36 Gross Amount Due from Borrower Less: Total Paid by the Borrower 37 38 Cash at Settlement from Borrower 39 40 Total Expenses 41 Purchase Price Expenses as % of Price 42 43 43 As the closing date does not often coincide with the due date for property taxes, a portion ofthe annual property taxes is usually 44 prorated between the buyer and the seller. In this case, the full year of taxes was paid by the seller on January 1st. They owned the home for only half of the year, so 50% of the taxes must be returned to the seller from the buyer. 45 46 You decide to purchase the rental property from Project 1. Use the provided Excel template to perform the following tasks 1. On the Amortization tab of the spreadsheet, calculate your down payment, your monthly payment and create a loan amortization table for the life of the loan. Review to the loan amortization tutorial in D2L. Note the total interest you paid at the bottom of the table. You must show your work by using formulas in Excel. For detailed help on Amortization, view the Amortization Example Video located in the Table of Contents -> Learning Modules -> Week 3 area of D2L. 2. On the Closing tab of the spreadsheet, complete the Buyer's and Sellers' closing statements based on the following data: On June 15, Wil bur and Wilma Wildcat ("Sellers") listed their Flagstaff rental property for $285,000 with Re/Max Peak Properties and agreed to pay a 6% commission on the sale price. They have a mortgage for $140,000 remaining on the home. You offered $270,000 and Wilbur and Wilma accepted the offer. At that time, you put down $1,000 of earnest money You will put 20% down and finance the rest through Bear Down Bank with a 15-year mortgage at a fixed rate of 4.75%. The sale will close on July 1st at which time you will take possession. Bear Down requires a loan origination fee of 1% of the value of the loan along with a property appraisal which cost $400 and a credit report at a cost of $25. Property taxes for the current year were $1,264 and were paid in full by the Sellers The Buyer's title insurance policy will cost $800, and the Sellers' title insurance policy will be $1,690. Homeowner's insurance will cost the Buyer $1,586. Recording the deed will cost $50 (equally split between the Buyer and Sellers) Endorsements of $150 would be paid by the Buyer. Courier fees will be $25 for the Buyer and $25 for the Sellers. All prorations are based on a 30-day month Calculate the costs to the Buyer and the Sellers as a percentage of the purchase/sales price Summary of Buyer's Transaction Summary of Sellers' Transaction 6 7 Description Cash Description Cash 8 Contract Purchase Price Contract Purchase Price 9 10 Settlement Charges Gross Amount Due to Seller Items Payable in Connection with a Loan 11 Loan Origination Fee 12 Reductions in Amount Due Seller Appraisal Fee Brokerage Commission 13 Homeowner's Insurance 14 Payoff of Mortgage Loan Credit Report 15 16 Title Charges Title Charges 17 Title Service and Title Insurance Title Service and Title Insurance 18 Deed Preparation Deed Preparation 19 20 Government Recording Charges: Government Recording Charges: Courier Fees 21 Endorsements 22 Adjustments for Items OverPaid by Seller Courier Fees 23 24 Propery Taxes Gross Amount Due from Borrower 25 Total Reductions in Amount Due Sel l er 26 Amounts Paid by or on Behalf of Borrowe r 27 Deposit of Earnest Money 28 Gross Amount Due to Seller Principal Amount of New Loan 29 Less Reductions in Amount Due Seller Cash at Settlement to Seller 30 Adjustments for Items OverPaid by Seller 31 32 Property Taxes Total Expenses Purchase Price 33 Total Paid by the Borrower 34 Expenses as % of Price 35 36 Gross Amount Due from Borrower Less: Total Paid by the Borrower 37 38 Cash at Settlement from Borrower 39 40 Total Expenses 41 Purchase Price Expenses as % of Price 42 43 43 As the closing date does not often coincide with the due date for property taxes, a portion ofthe annual property taxes is usually 44 prorated between the buyer and the seller. In this case, the full year of taxes was paid by the seller on January 1st. They owned the home for only half of the year, so 50% of the taxes must be returned to the seller from the buyer. 45 46 You decide to purchase the rental property from Project 1. Use the provided Excel template to perform the following tasks 1. On the Amortization tab of the spreadsheet, calculate your down payment, your monthly payment and create a loan amortization table for the life of the loan. Review to the loan amortization tutorial in D2L. Note the total interest you paid at the bottom of the table. You must show your work by using formulas in Excel. For detailed help on Amortization, view the Amortization Example Video located in the Table of Contents -> Learning Modules -> Week 3 area of D2L. 2. On the Closing tab of the spreadsheet, complete the Buyer's and Sellers' closing statements based on the following data: On June 15, Wil bur and Wilma Wildcat ("Sellers") listed their Flagstaff rental property for $285,000 with Re/Max Peak Properties and agreed to pay a 6% commission on the sale price. They have a mortgage for $140,000 remaining on the home. You offered $270,000 and Wilbur and Wilma accepted the offer. At that time, you put down $1,000 of earnest money You will put 20% down and finance the rest through Bear Down Bank with a 15-year mortgage at a fixed rate of 4.75%. The sale will close on July 1st at which time you will take possession. Bear Down requires a loan origination fee of 1% of the value of the loan along with a property appraisal which cost $400 and a credit report at a cost of $25. Property taxes for the current year were $1,264 and were paid in full by the Sellers The Buyer's title insurance policy will cost $800, and the Sellers' title insurance policy will be $1,690. Homeowner's insurance will cost the Buyer $1,586. Recording the deed will cost $50 (equally split between the Buyer and Sellers) Endorsements of $150 would be paid by the Buyer. Courier fees will be $25 for the Buyer and $25 for the Sellers. All prorations are based on a 30-day month Calculate the costs to the Buyer and the Sellers as a percentage of the purchase/sales price