Answered step by step

Verified Expert Solution

Question

1 Approved Answer

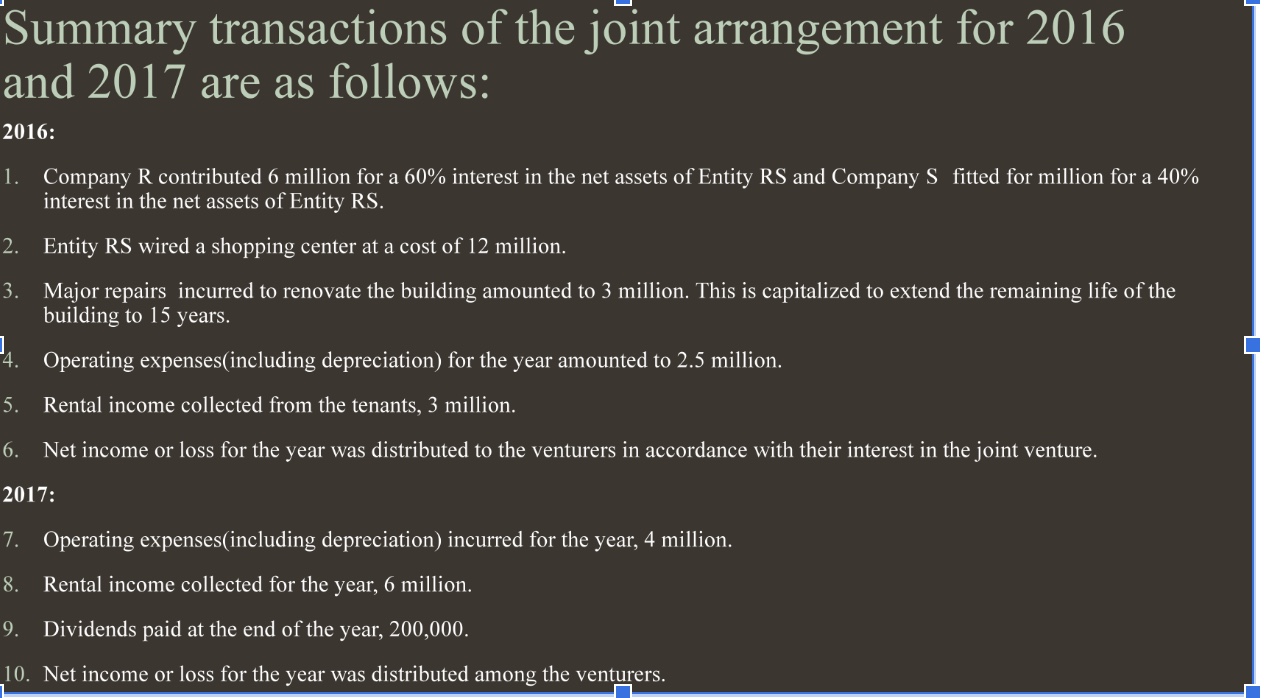

Summary transactions of the joint arrangement for 2 0 1 6 and 2 0 1 7 are as follows: 2 0 1 6 : Company

Summary transactions of the joint arrangement for

and are as follows:

:

Company R contributed million for a interest in the net assets of Entity RS and Company S fitted for million for a

interest in the net assets of Entity RS

Entity RS wired a shopping center at a cost of million.

Major repairs incurred to renovate the building amounted to million. This is capitalized to extend the remaining life of the

building to years.

Operating expensesincluding depreciation for the year amounted to million.

Rental income collected from the tenants, million.

Net income or loss for the year was distributed to the venturers in accordance with their interest in the joint venture.

:

Operating expensesincluding depreciation incurred for the year, million.

Rental income collected for the year, million.

Dividends paid at the end of the year,

Net income or loss for the year was distributed among the venturers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started