Answered step by step

Verified Expert Solution

Question

1 Approved Answer

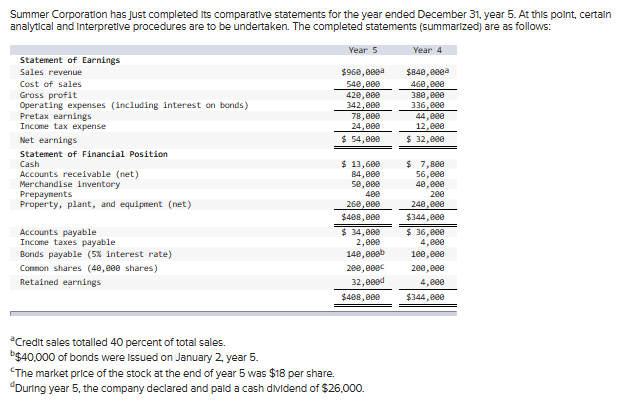

Summer Corporation has just completed its comparative statements for the year ended December 31, year 5. At this point, certain analytical and Interpretive procedures

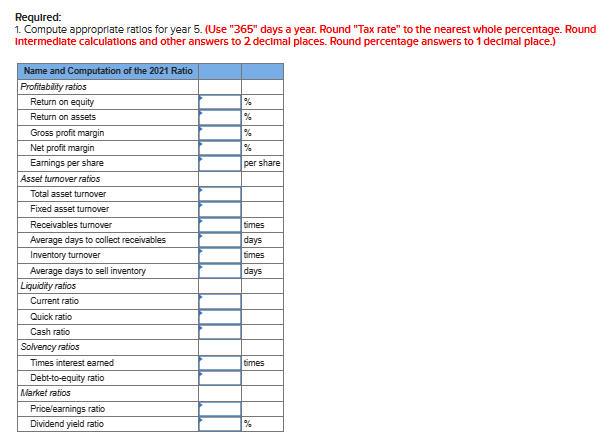

Summer Corporation has just completed its comparative statements for the year ended December 31, year 5. At this point, certain analytical and Interpretive procedures are to be undertaken. The completed statements (summarized) are as follows: Statement of Earnings Sales revenue Cost of sales Gross profit Operating expenses (including interest on bonds) Pretax earnings Income tax expense Net earnings Statement of Financial Position Cash Accounts receivable (net) Merchandise inventory Prepayments Property, plant, and equipment (net) Accounts payable Income taxes payable Bonds payable (5% interest rate) Common shares (40,000 shares) Retained earnings *Credit sales totalled 40 percent of total sales. b$40,000 of bonds were issued on January 2, year 5. Year 5 Year 4 $960,000* $840,0002 540,000 460,000 420,000 380,000 342,000 336,000 78,000 44,000 24,000 12,000 $ 54,000 $ 13,600 84,000 50,000 $ 32,000 $ 7,800 56,000 40,000 400 200 260,000 $408,000 $ 34,000 2,000 140,000b 240,000 $344,000 $ 36,000 4,000 100,000 200,000 200,000 32,000d 4,000 $408,000 $344,000 "The market price of the stock at the end of year 5 was $18 per share. "During year 5, the company declared and paid a cash dividend of $26,000. Required: 1. Compute appropriate ratios for year 5. (Use "365" days a year. Round "Tax rate" to the nearest whole percentage. Round Intermediate calculations and other answers to 2 decimal places. Round percentage answers to 1 decimal place.) Name and Computation of the 2021 Ratio Profitability ratios Return on equity Return on assets Gross profit margin Net profit margin Earnings per share Asset turnover ratios Total asset turnover Fixed asset turnover % % % % per share Receivables turnover Average days to collect receivables Inventory turnover Average days to sell inventory times days times days Liquidity ratios Current ratio Quick ratio Cash ratio Solvency ratios Times interest earned Debt-to-equity ratio Market ratios Price/earnings ratio Dividend yield ratio times %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure lets compute the requested ratios for Year 5 1 Profitability Ratios Return on Equity ROE Net EarningsAverage Shareholders Equity x 100 ROE 540002...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started