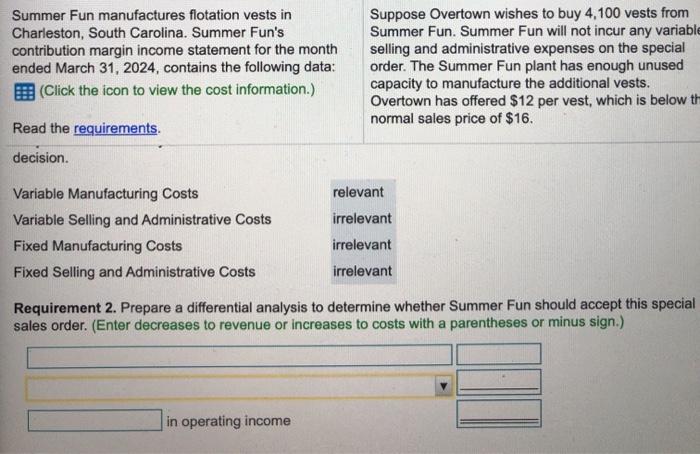

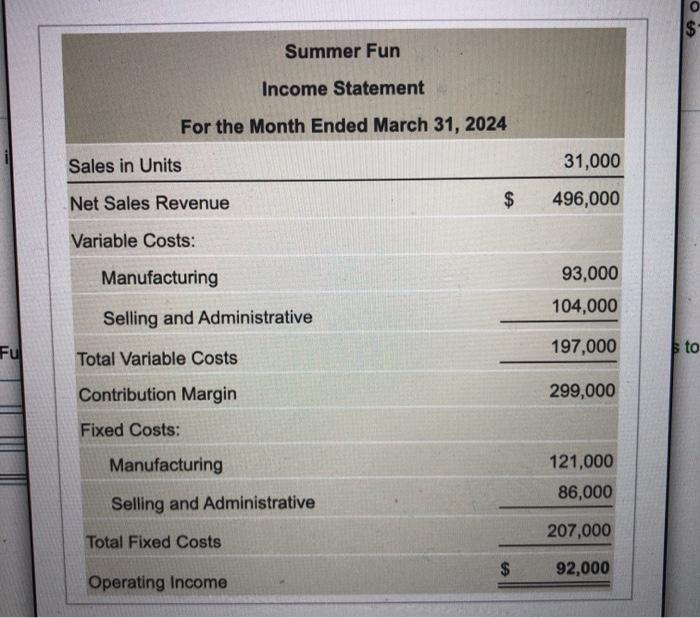

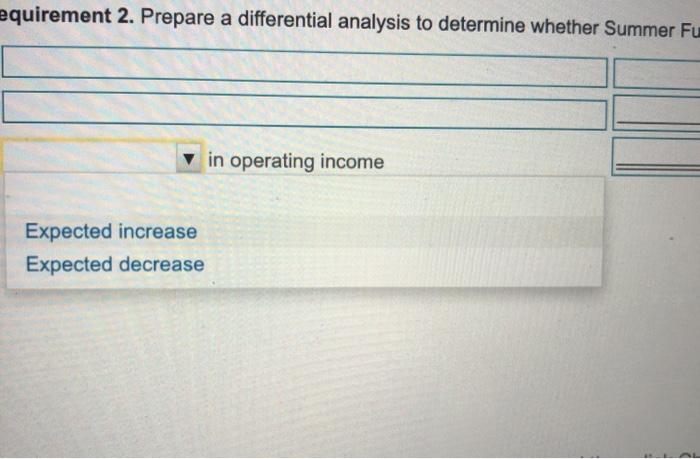

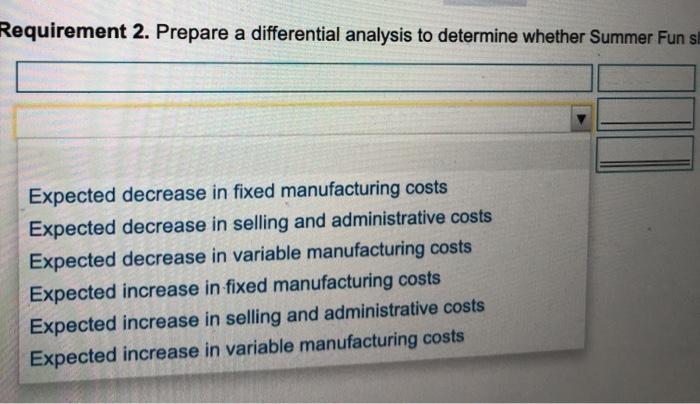

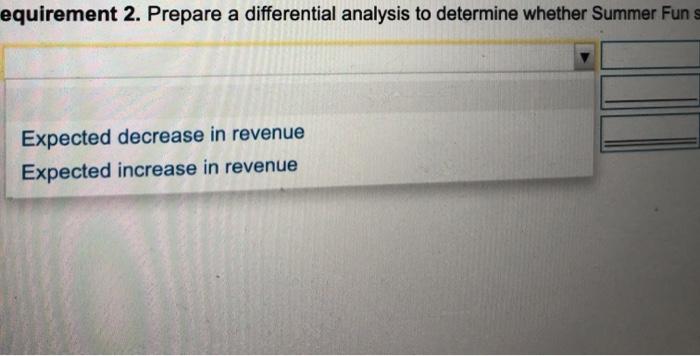

Summer Fun manufactures flotation vests in Charleston, South Carolina. Summer Fun's contribution margin income statement for the month ended March 31, 2024, contains the following data: (Click the icon to view the cost information.) Suppose Overtown wishes to buy 4,100 vests from Summer Fun. Summer Fun will not incur any variable selling and administrative expenses on the special order. The Summer Fun plant has enough unused capacity to manufacture the additional vests. Overtown has offered $12 per vest, which is below th normal sales price of $16. Read the requirements. decision. Variable Manufacturing Costs Variable Selling and Administrative Costs Fixed Manufacturing Costs Fixed Selling and Administrative Costs relevant irrelevant irrelevant irrelevant Requirement 2. Prepare a differential analysis to determine whether Summer Fun should accept this special sales order. (Enter decreases to revenue or increases to costs with a parentheses or minus sign.) in operating income o $ Summer Fun Income Statement For the Month Ended March 31, 2024 Sales in Units 31,000 Net Sales Revenue $ 496,000 Variable Costs: Manufacturing 93,000 104,000 Selling and Administrative Fu 197,000 to Total Variable Costs Contribution Margin 299,000 Fixed Costs: Manufacturing 121,000 86,000 Selling and Administrative 207,000 Total Fixed Costs $ 92,000 Operating Income Requirements 1. Identify each cost in the income statement as either relevant or irrelevant to Summer Fun's decision. 2. Prepare a differential analysis to determine whether Summer Fun should accept this special sales order. 3. Identify long-term factors Summer Fun should consider in deciding whether to accept the special sales order. equirement 2. Prepare a differential analysis to determine whether Summer Fu v in operating income Expected increase Expected decrease Requirement 2. Prepare a differential analysis to determine whether Summer Fun sh Expected decrease in fixed manufacturing costs Expected decrease in selling and administrative costs Expected decrease in variable manufacturing costs Expected increase in fixed manufacturing costs Expected increase in selling and administrative costs Expected increase in variable manufacturing costs equirement 2. Prepare a differential analysis to determine whether Summer Fun Expected decrease in revenue Expected increase in revenue