Question

Summer Peebles Income Statement Problem Must show EVERY step, I must know exactly how you got every number. Everything in the solution and work should

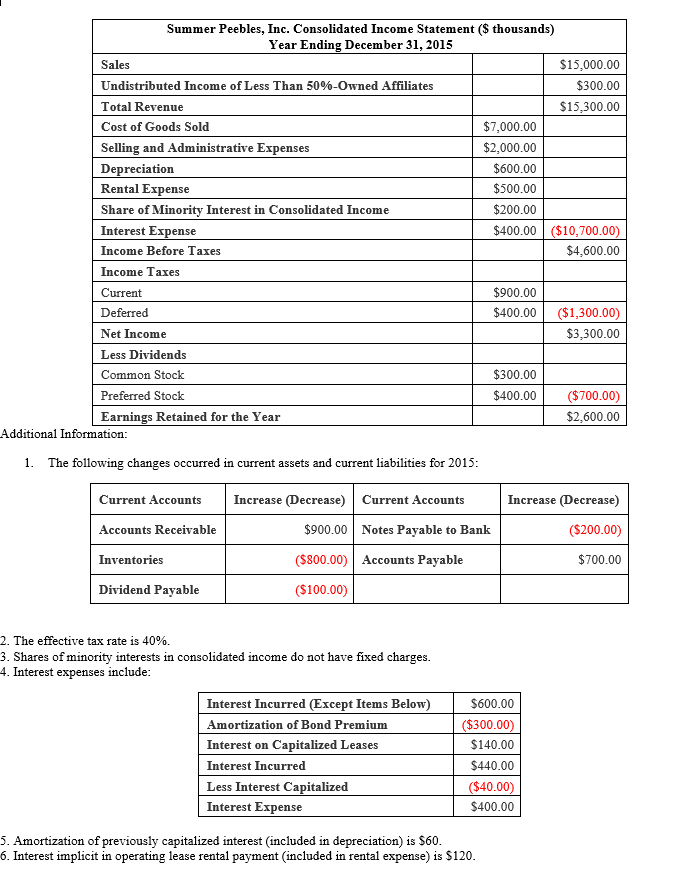

Summer Peebles Income Statement Problem Must show EVERY step, I must know exactly how you got every number. Everything in the solution and work should be clear and easy to understand on how you got each and every number. Any formulas used should be included, Excel spread sheet would be preferred (I have this table in an excel spread sheet that you can work from ,and I would just have to email it to you since I can't seem to add the file on this question) make sure I can see every formula, and know where you got every number from). If you have any question please let me know, and please pay attention to each number (there's a lot of 0s). -This assignment has different numbers from other questions like it listed elsewhere, so please pay attention to only the numbers provided below. Thank you.

Problem:

A. Compute the following earnings coverage ratios: 1. Earnings to fixed charges. 2. Cash flow to fixed charges. 3. Earnings coverage of preferred dividends.

B. Analyze and interpret the earnings coverage ratios in (A).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started