Question

Summer Sunglasses has debt in the form of zero-coupon bonds with a face value of $10,000 which is due in one year. Today's value of

| "Summer Sunglasses" has debt in the form of zero-coupon bonds with a face value of $10,000 which is due in one year. Today's value of "Summer Sunglasses" ' assets is $11,900. "Summer Sunglasses" ' assets return standard deviation is 28 percent per year. The annual Treasury-bill, or risk-free, rate is 4 percent, compounded continuously. |

| "Winter Boots" has debt in the form of zero-coupon bonds with a face value of $44,000 which is due in one year. Today's value of "Winter Boots" ' assets is $47,600. "Winter Boots" ' assets return standard deviation is 34 percent per year. |

| Now, let's say, these two companies, Summer Sunglasses and Winter Boots have decided to merge. The seasonality of the two companies' sales revenues creates the diversification effect. As a result, the newly created firms (Winter Sunglasses & Summer Boots) assets return standard deviation is only 18 percent per year. |

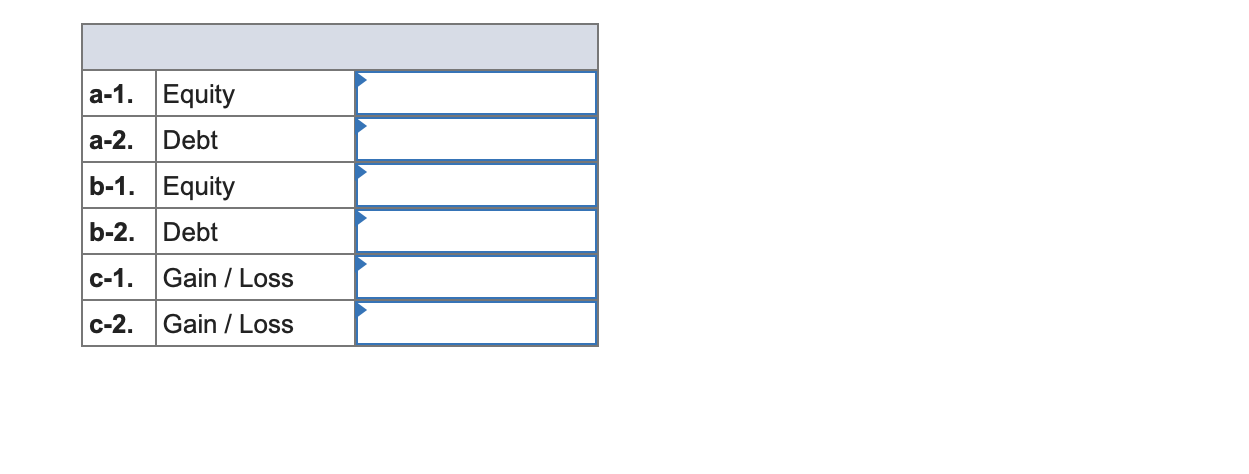

| a-1. | Calculate the sum of market values of equity of "Summer Sunglasses" and "Winter Boots". (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

| a-2. | Calculate the sum of market values of debt of "Summer Sunglasses" and "Winter Boots". (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

| b-1. | Calculate the market value of equity of the newly created "Winter Sunglasses & Summer Boots". (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

| b-2. | Calculate the market value of debt of the newly created "Winter Sunglasses & Summer Boots". (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

| c-1. | Calculate the gain or loss for stockholders as a result of this merger. (A loss should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

| c-2. | Calculate the gain or loss for bondholders as a result of this merger. (A loss should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started