Question

Sumsong is a company specializing in the manufacture and sale of laptop batteries and laptop computers over the past 15 years. It has two divisions:

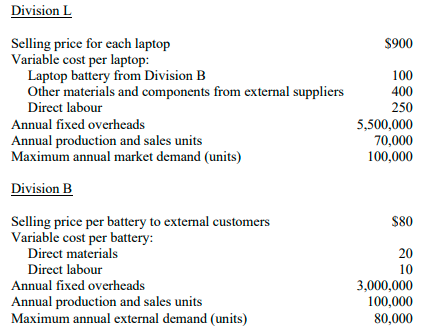

Sumsong is a company specializing in the manufacture and sale of laptop batteries and laptop computers over the past 15 years. It has two divisions: the battery division (Division B) and the laptop division (Division L). Division L manufactures and sells laptop computers to local distributors. Division L purchases most of its materials and components from an external supplier, X Company, except laptop batteries. Division L uses laptop batteries internally supplied by Division B. Each laptop computer manufactured by Division L requires one laptop battery. Division B is given free autonomy to set the transfer price, but is required to meet Division Ls demand for batteries before selling externally. The following data is available for both divisions:

In addition to the materials and labour costs above, Division B incurs a variable cost of $5 for packaging each battery for all external sales. Currently, the Head Offices purchasing policy allows Division L to purchase the batteries only from Division B. The manager of Division L is unhappy as X Company, a long-time supplier, has offered to supply laptop batteries at a special rate of $40 per battery to Division L. The cost of placing an order for batteries from Company X is estimated to be $50, and the annual holding cost of a battery is estimated to be 1% of the purchase price (a) Under the current transfer pricing system, prepare a variable costing income statement showing the profit/loss for each of the division and for Sumsong as a whole. Your sales and costs figures should, where appropriate, be split into external sales and internal transfers. (9 marks) After numerous discussions with both divisional managers, to ensure that the divisional managers stay motivated, Head Office has agreed to changes in corporate policies. Specifically, Head Office has agreed to allow (i) Division L to buy externally; and (ii) Division B to sell externally at any quantity; provided that the divisions work together to optimize the profits of Sumsong as a whole. (b) Recommend an arrangement that would optimise Sumsongs profits. Include in your proposal an appropriate transfer pricing arrangement that could be acceptable to both divisions. Support your proposal with computations. (8 marks) (c) Assume that Division L is located in a region with higher corporate tax rate than Division B. Based on your recommendation in part (b), and ignoring the constraints of tax laws, compute a transfer price that would benefit Sumsong Group and be acceptable by divisional managers. Clearly explain your proposal. (5 marks) (d) Assume that Division L will purchase its annual requirement of laptop batteries from X Company. Calculate the Economic Order Quantity (EOQ) for the batteries based on given information. Explain to Division Ls manager the implications of the computed EOQ for managing the level of battery inventory held by Division L. (6 marks) Please answer (a), (b), (c) and (d) separately.

DivisionL \begin{tabular}{lr} Selling price for each laptop & $900 \\ Variable cost per laptop: & \\ Laptop battery from Division B & 400 \\ Other materials and components from external suppliers & 250 \\ Direct labour & 5,500,000 \\ Annual fixed overheads & 70,000 \\ Annual production and sales units & 100,000 \\ Maximum annual market demand (units) & \end{tabular} DivisionB \begin{tabular}{lr} Selling price per battery to external customers & $80 \\ Variable cost per battery: & \\ Direct materials & 20 \\ Direct labour & 10 \\ Annual fixed overheads & 3,000,000 \\ Annual production and sales units & 100,000 \\ Maximum annual external demand (units) & 80,000 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started