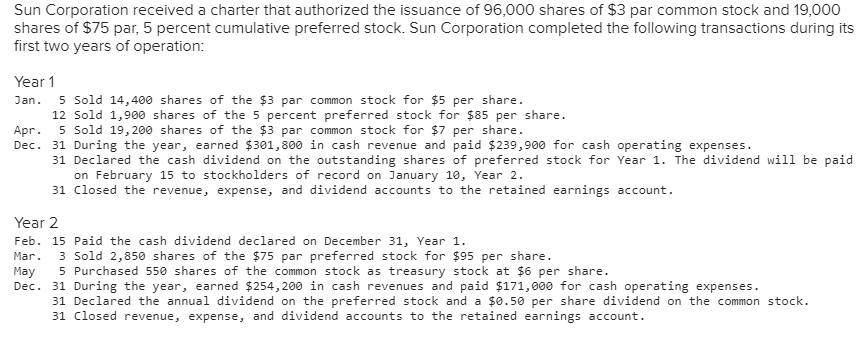

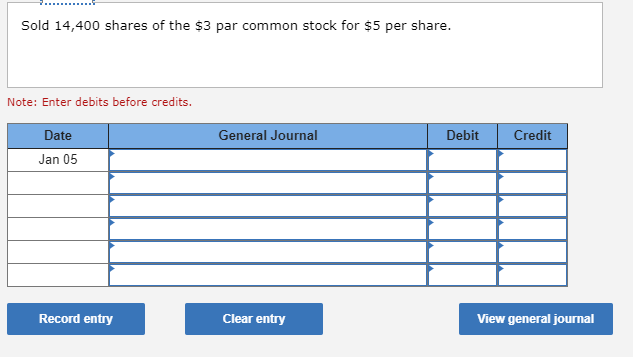

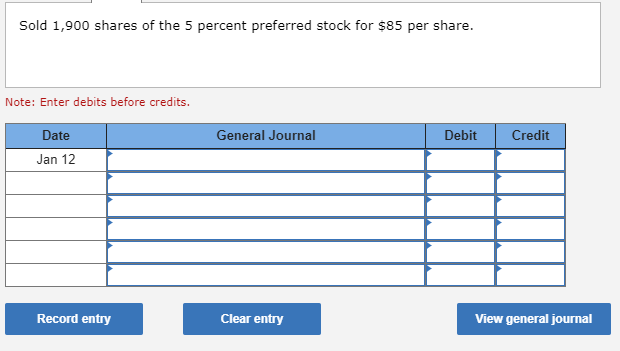

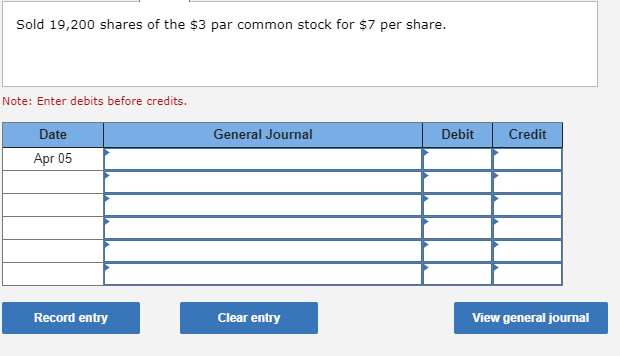

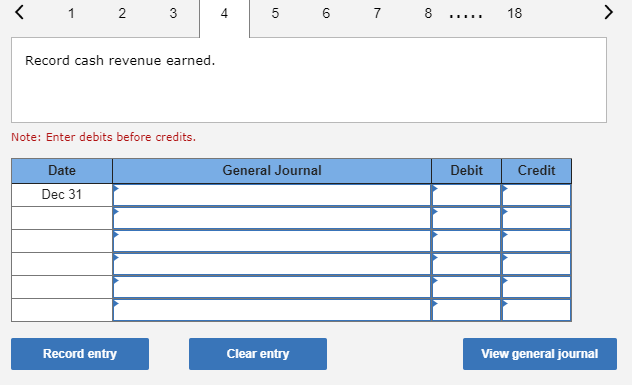

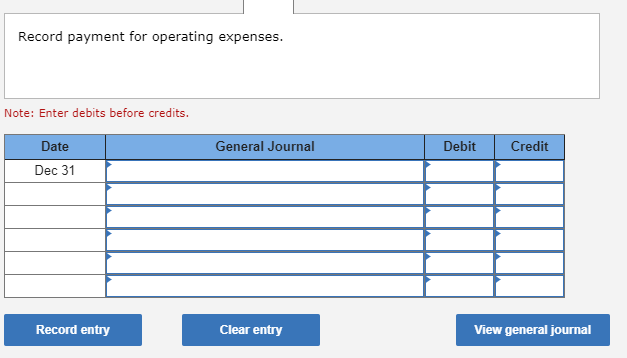

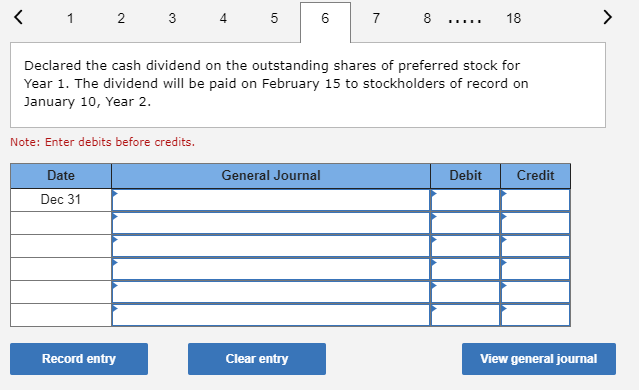

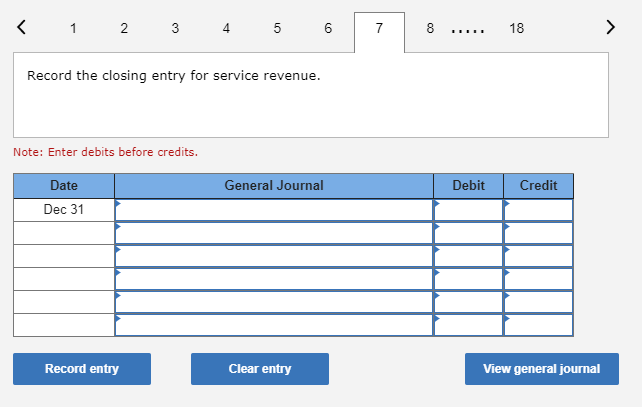

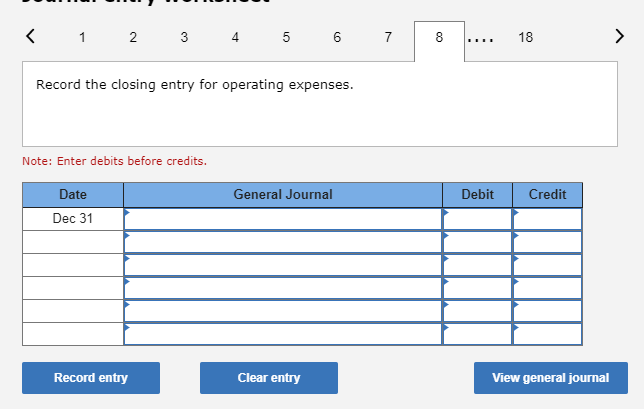

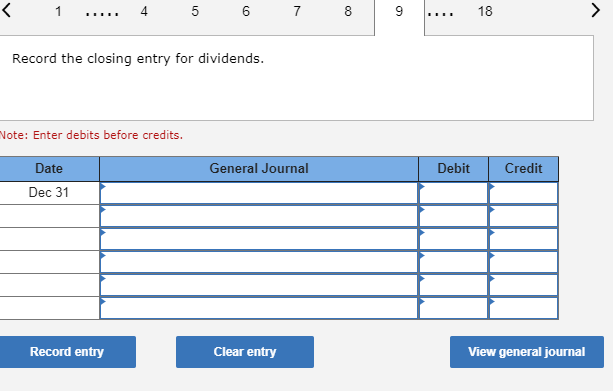

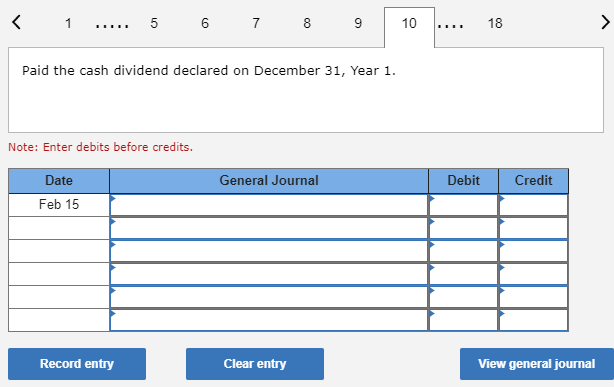

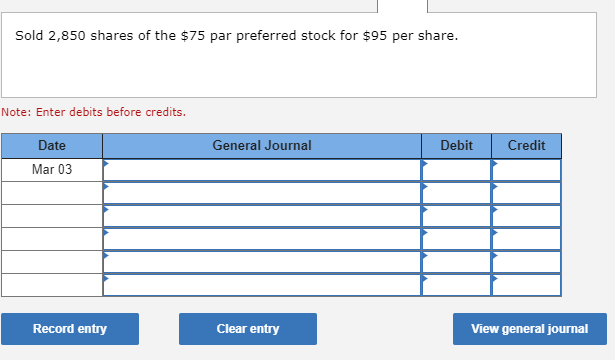

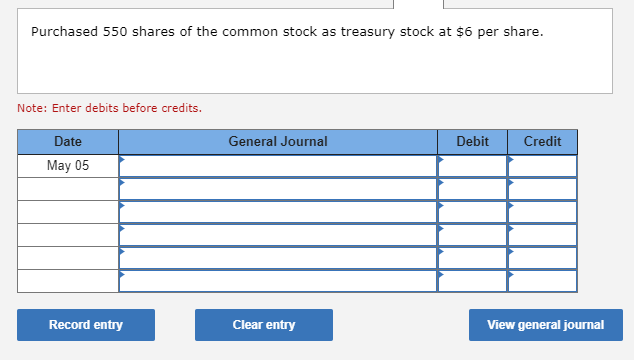

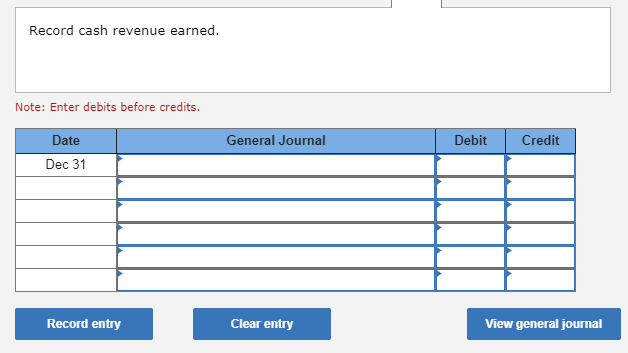

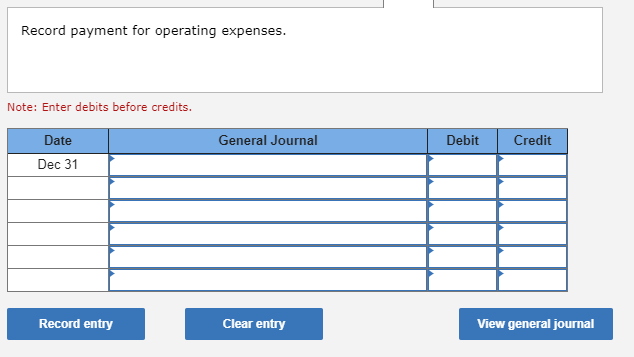

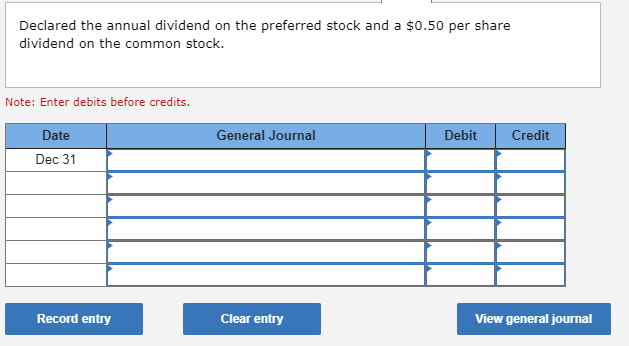

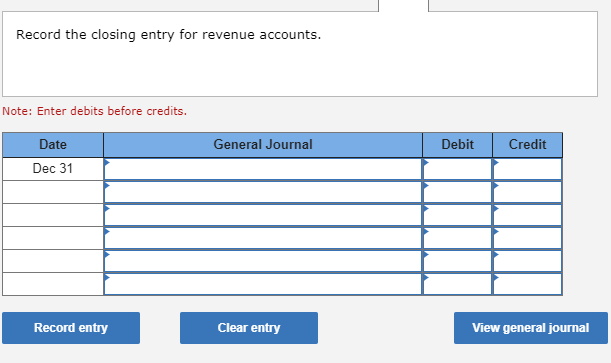

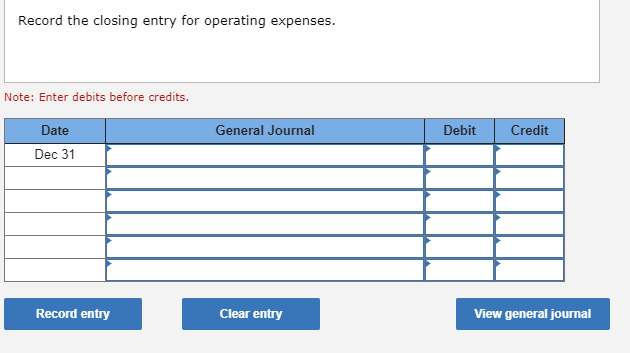

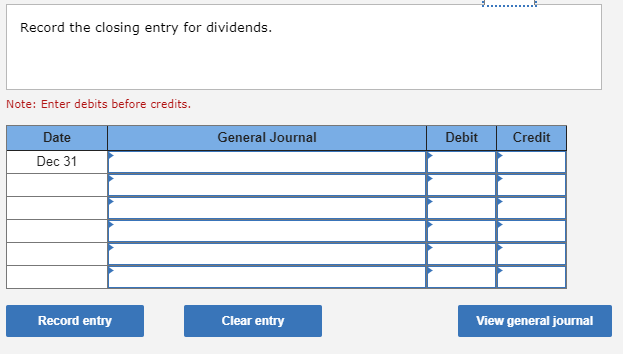

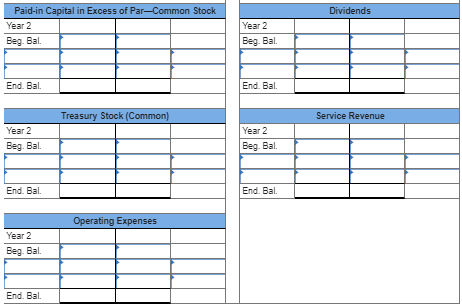

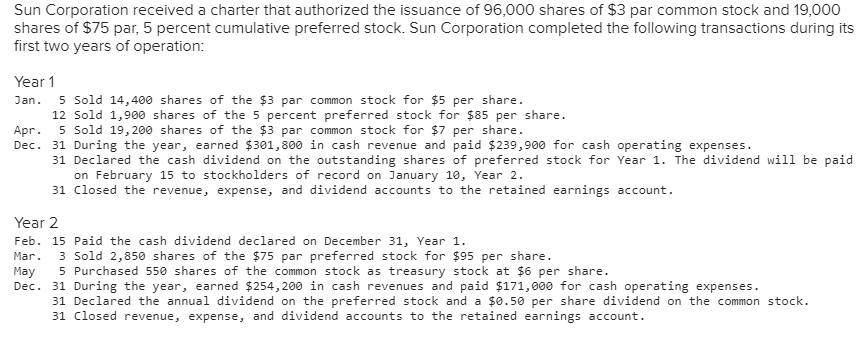

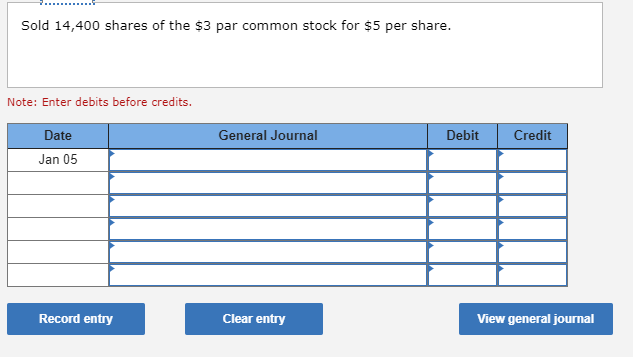

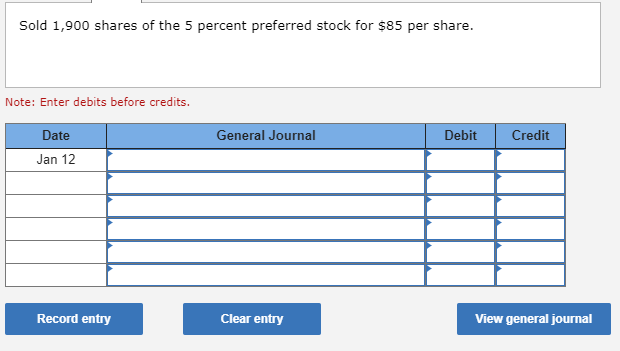

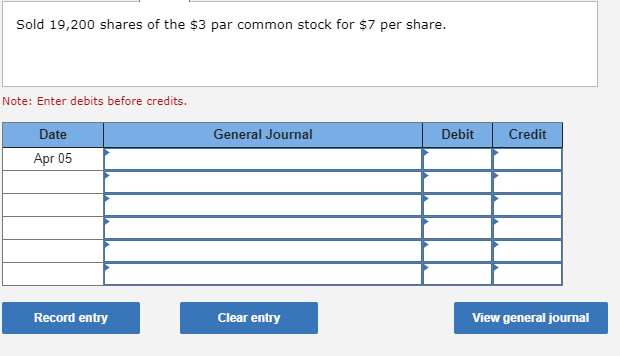

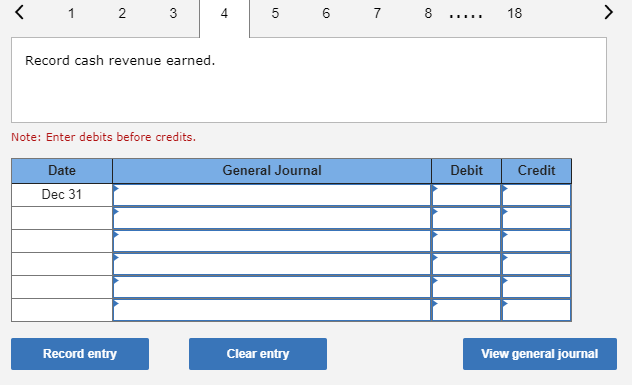

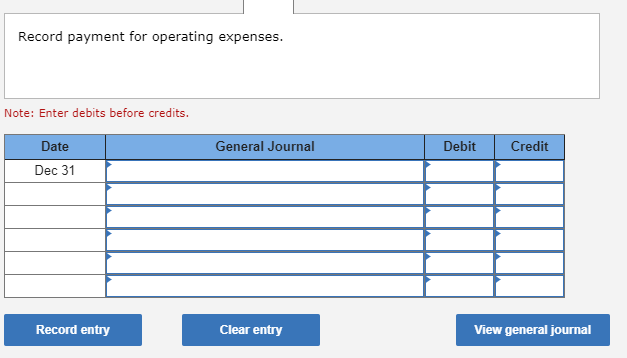

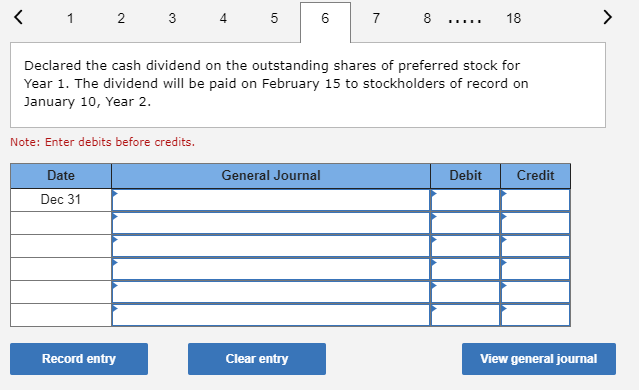

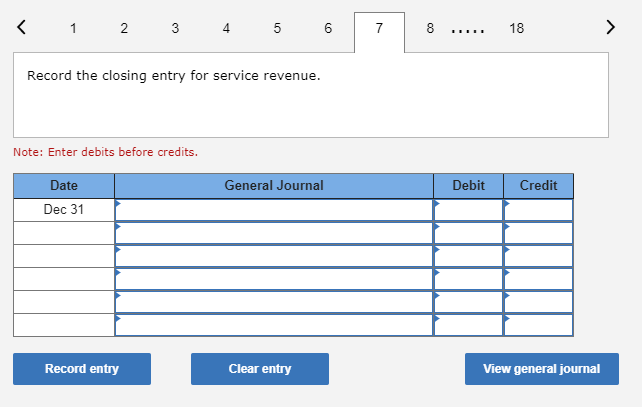

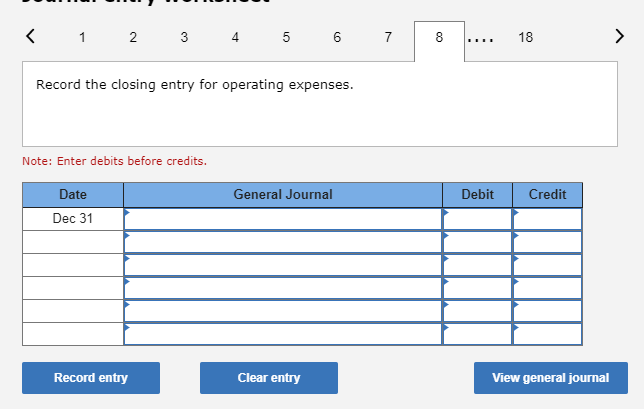

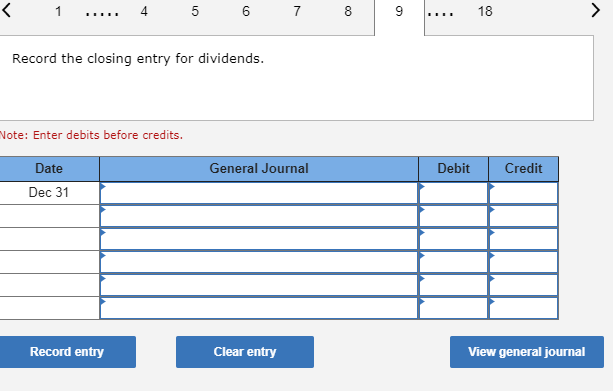

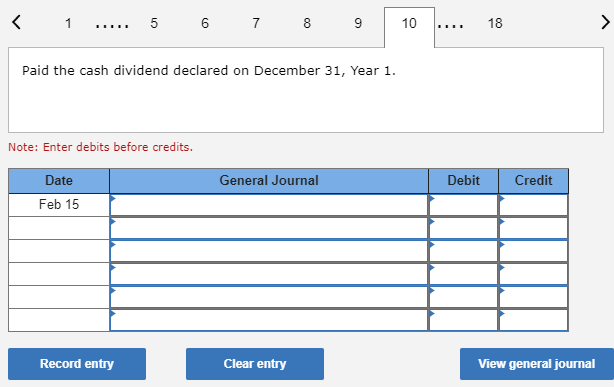

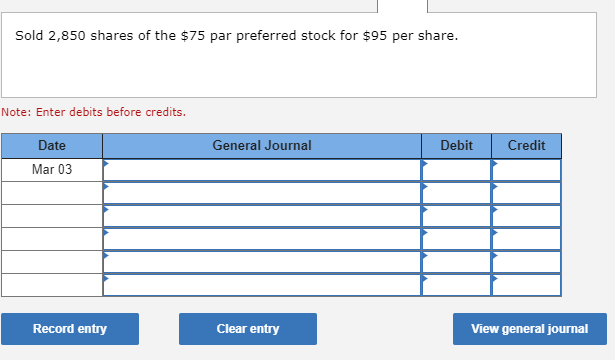

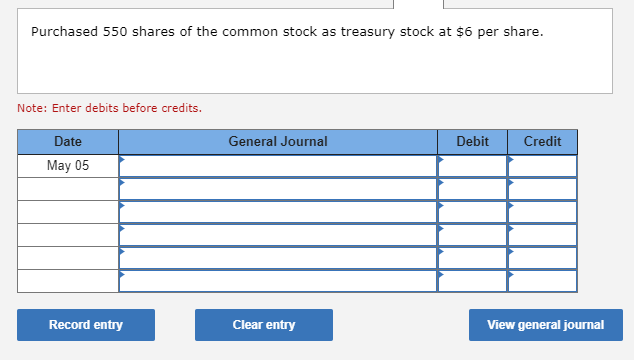

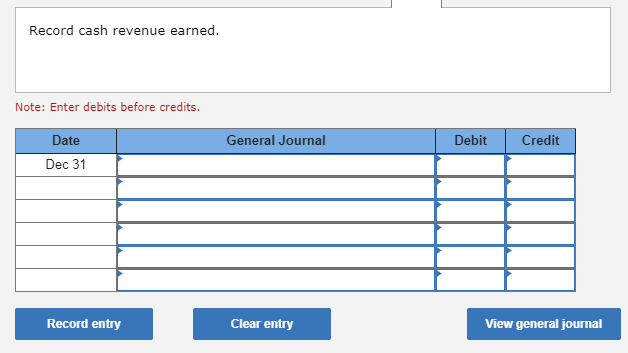

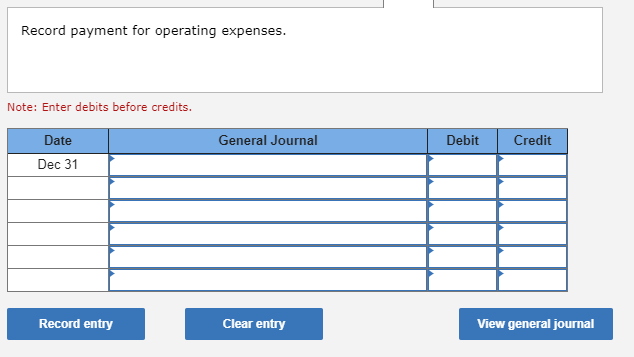

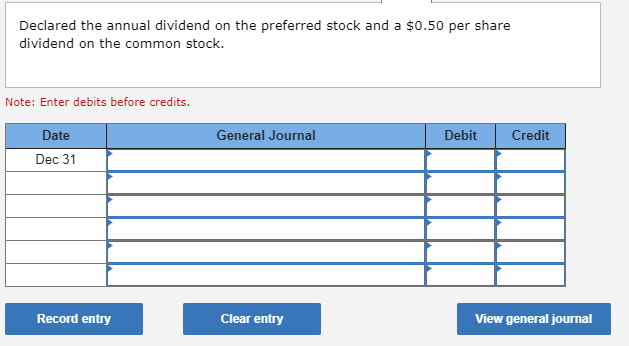

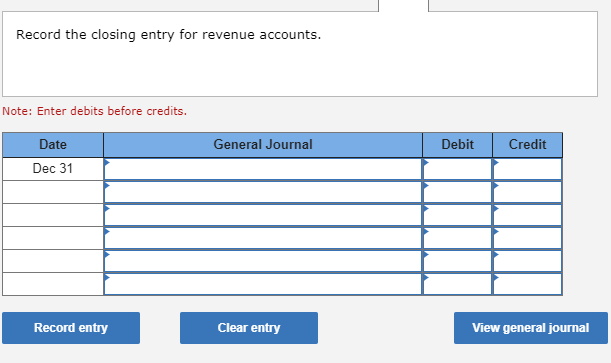

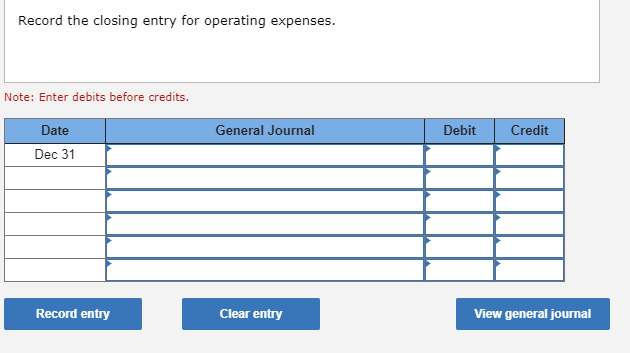

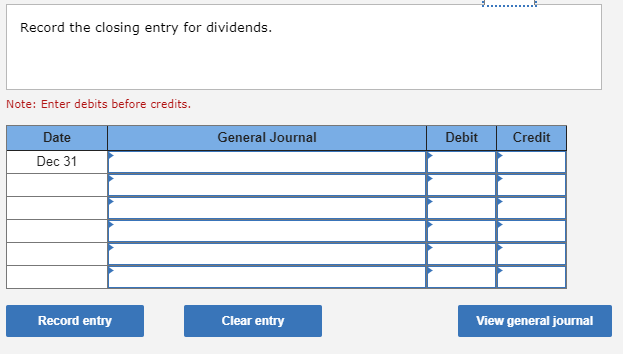

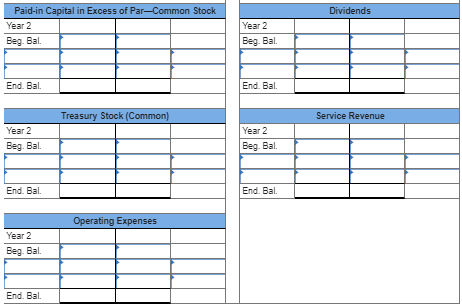

Sun Corporation received a charter that authorized the issuance of 96,000 shares of $3 par common stock and 19,000 shares of $75 par, 5 percent cumulative preferred stock. Sun Corporation completed the following transactions during its first two years of operation: Year 1 Jan. 5 Sold 14,400 shares of the $3 par common stock for $5 per share 12 Sold 1,900 shares of the 5 percent preferred stock for $85 per share. Apr. 5 Sold 19,200 shares of the $3 par common stock for $7 per share. Dec. 31 During the year, earned $301,800 in cash revenue and paid $239,900 for cash operating expenses 31 Declared the cash dividend on the outstanding shares of preferred stock for Year 1. The dividend will be paid on February 15 to stockholders of record on January 10, Year 2. 31 Closed the revenue, expense, and dividend accounts to the retained earnings account. Year 2 Feb. 15 Paid the cash dividend declared on December 31, Year 1. Mar. 3 Sold 2,850 shares of the $75 par preferred stock for $95 per share May 5 Purchased 550 shares of the common stock as treasury stock at $6 per share Dec. 31 During the year, earned $254,200 in cash revenues and paid $171,000 for cash operating expenses. 31 Declared the annual dividend on the preferred stock and a 0.50 per share dividend on the common stock. 31 Closed revenue, expense, and dividend accounts to the retained earnings account. Sold 1,900 shares of the 5 percent preferred stock for $85 per share Note: Enter debits before credits. Date General Journal Debit Credit Jan 12 Record entry Clear entry View general journal 123|4|5678 18 Record cash revenue earned. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Record payment for operating expenses Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal 12345|6178 18 Declared the cash dividend on the outstanding shares of preferred stock for Year 1. The dividend will be paid on February 15 to stockholders of record on January 10, Year 2. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal 2 3 4 6 7 Record the closing entry for service revenue. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal K123 4 5 678.... 18 Record the closing entry for operating expenses. Note: Enter debits before credits Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Paid the cash dividend declared on December 31, Year 1 Note: Enter debits before credits. Date General Journal Debit Credit Feb 15 Record entry Clear entry View general journal Sold 2,850 shares of the $75 par preferred stock for $95 per share. Note: Enter debits before credits. Date General Journal Debit Credit Mar 03 Record entry Clear entry View general journal Purchased 550 shares of the common stock as treasury stock at $6 per share. Note: Enter debits before credits. Date General Journal Debit Credit May 05 Record entry Clear entry View general journal Record cash revenue earned Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Record payment for operating expenses Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Declared the annual dividend on the preferred stock and a $0.50 per share dividend on the common stock. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Record the closing entry for revenue accounts Note: Enter debits before credits Debit Credit Date General Journal Dec 31 Clear entry View general journal Record entry Record the closing entry for operating expenses. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Record the closing entry for dividends. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Year 1 Cash Dividends Payable Year 1 Year 1 End. Bal. End. Bal. Retained Earnings Preferred Stock Year 1 Year 1 End. Bal. End. Bal. Common Stock Paid-in Capital in Excess of Par-Preferred Stock Year 1 Year 1 End. Bal. End. Bal. Paid-in Capital in Excess of Par-Common Stock Year 1 Dividends Year 1 End. Bal. End. Bal. ting Expenses Year 1 Year 1 End. Bal End. Bal Year 2 s Payable Year 2 Year 2 Beg. Bal Beg. Bal End. Bal. End. Bal. Retained Earnings Preferred Stock Year 2 Year 2 Beg. Bal. Beg. Bal. End. Bal. End. Bal. Stock Paid-in C Year 2 Beg. Bal. l in Excess of Par-Preferred Stock Year 2 Beg. Bal. End. Bal End. Bal Paid-in Capital in Excess of Par-Common Stock Year 2 Beg. Bal. Dividends Year 2 Beg. Bal. End. Bal. End. Bal. Treasury Stock (Common Service Revenue Year 2 Year 2 Beg. Bal. Beg. Bal. End. Bal End. Bal. Operating Expenses Year 2 Beg. Bal. End. Bal