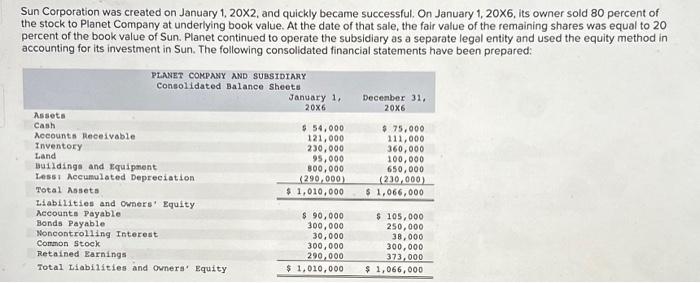

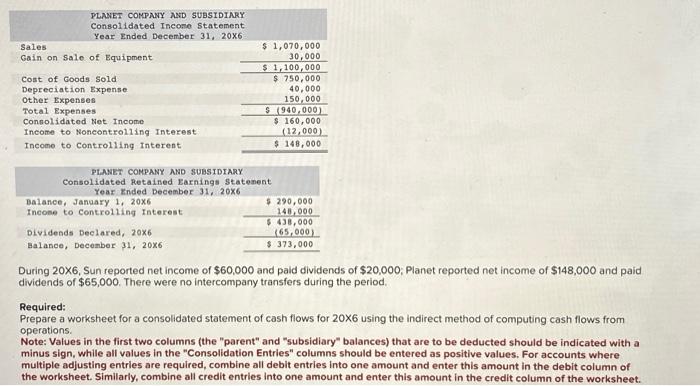

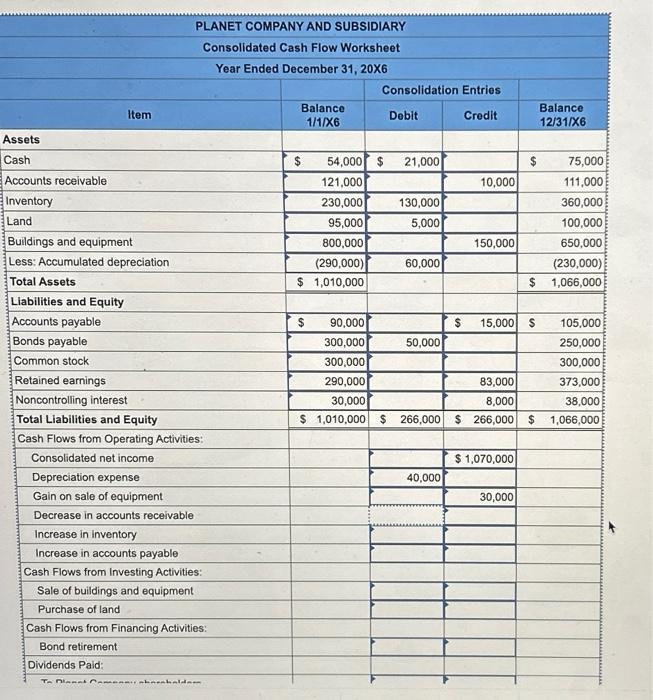

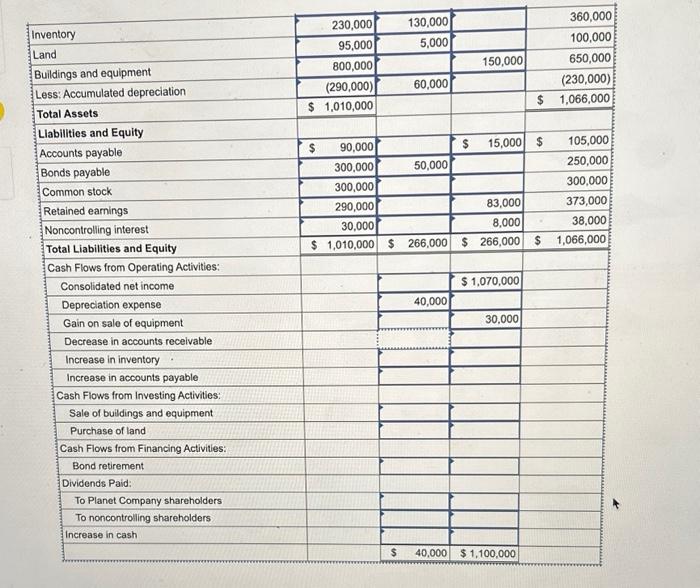

Sun Corporation was created on January 1, 20X2, and quickly became successful. On January 1,20X6, its owner sold 80 percent of the stock to Planet Company at underlying book value. At the date of that sale, the fair value of the remaining shares was equal to 20 percent of the book value of Sun. Planet continued to operate the subsidiary as a separate legal entity and used the equity method in accounting for its investment in Sun. The following consolidated financial statements have been prepared: During 20X6, Sun reported net income of $60,000 and paid dividends of $20,000; Planet reported net income of $148,000 and paid dividends of $65,000. There were no intercompany transfers during the period. Required: Prepare a worksheet for a consolidated statement of cash flows for 206 using the indirect method of computing cash flows from operations. Note: Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. PLANET COMPANY AND SUBSIDIARY Consolidated Cash Flow Worksheet Year Ended December 31, 20 X6 Sun Corporation was created on January 1, 20X2, and quickly became successful. On January 1,20X6, its owner sold 80 percent of the stock to Planet Company at underlying book value. At the date of that sale, the fair value of the remaining shares was equal to 20 percent of the book value of Sun. Planet continued to operate the subsidiary as a separate legal entity and used the equity method in accounting for its investment in Sun. The following consolidated financial statements have been prepared: During 20X6, Sun reported net income of $60,000 and paid dividends of $20,000; Planet reported net income of $148,000 and paid dividends of $65,000. There were no intercompany transfers during the period. Required: Prepare a worksheet for a consolidated statement of cash flows for 206 using the indirect method of computing cash flows from operations. Note: Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. PLANET COMPANY AND SUBSIDIARY Consolidated Cash Flow Worksheet Year Ended December 31, 20 X6