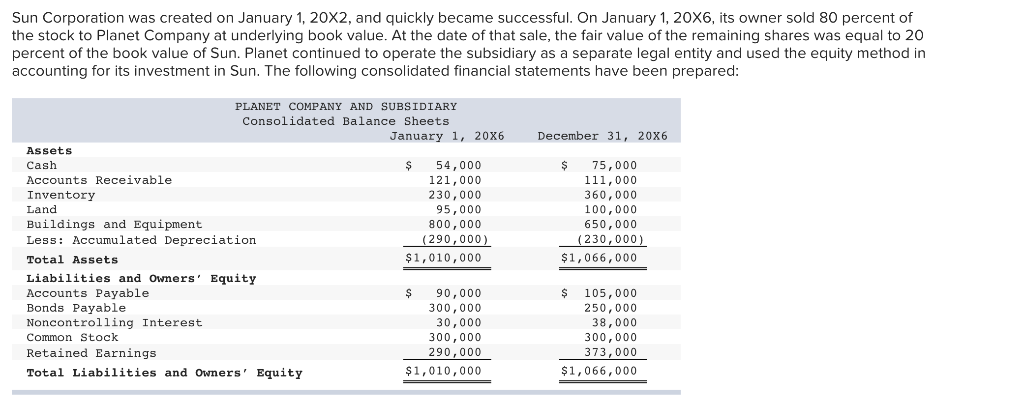

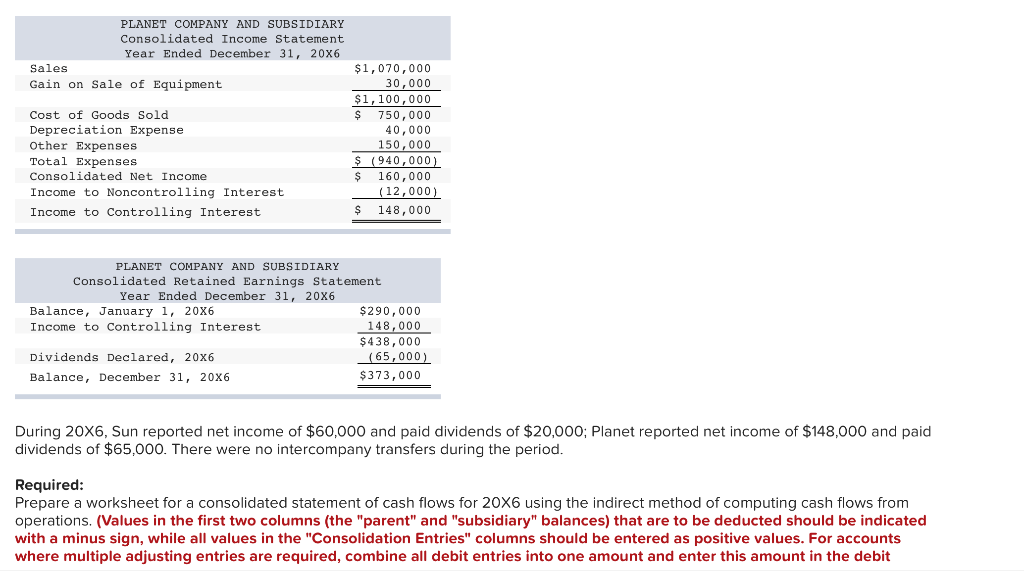

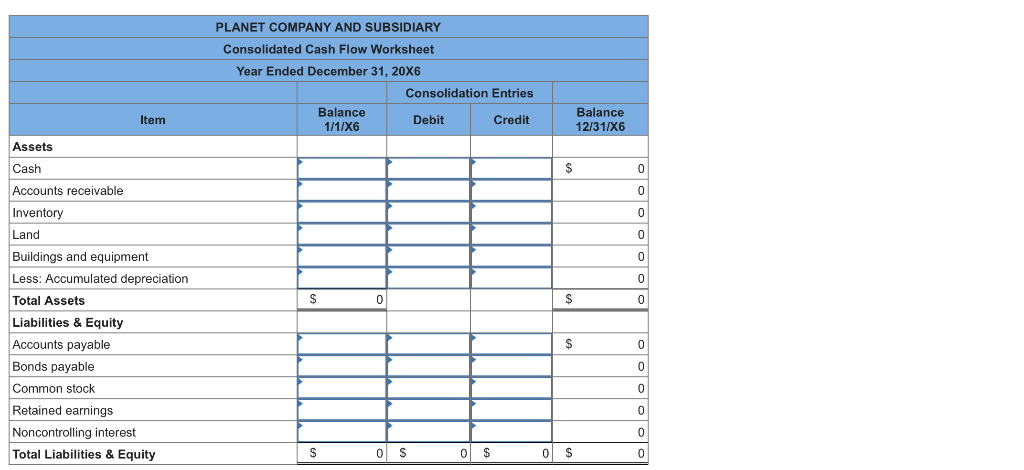

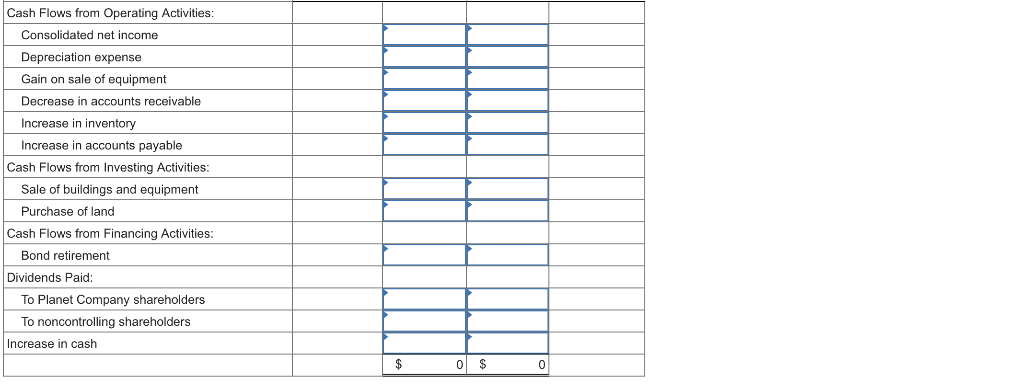

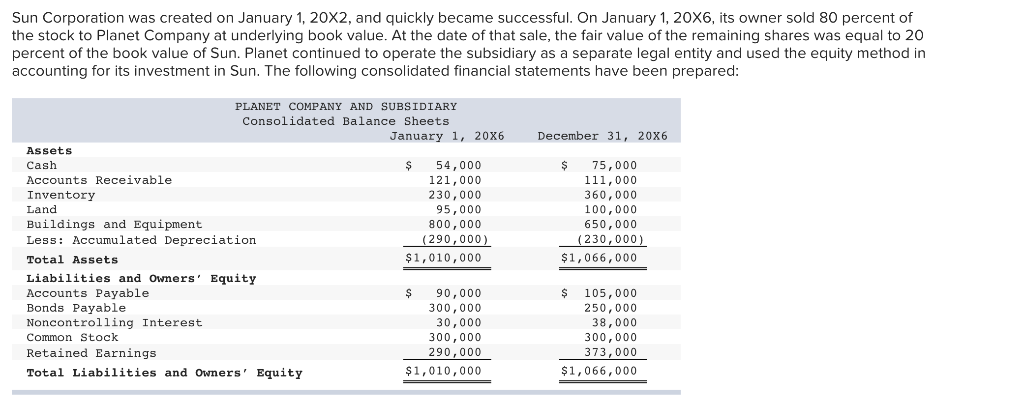

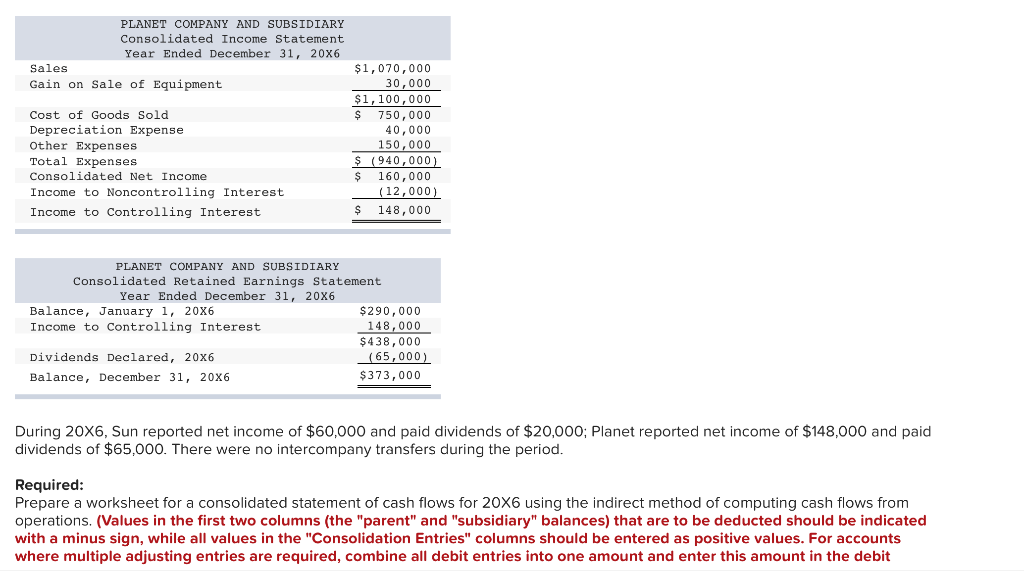

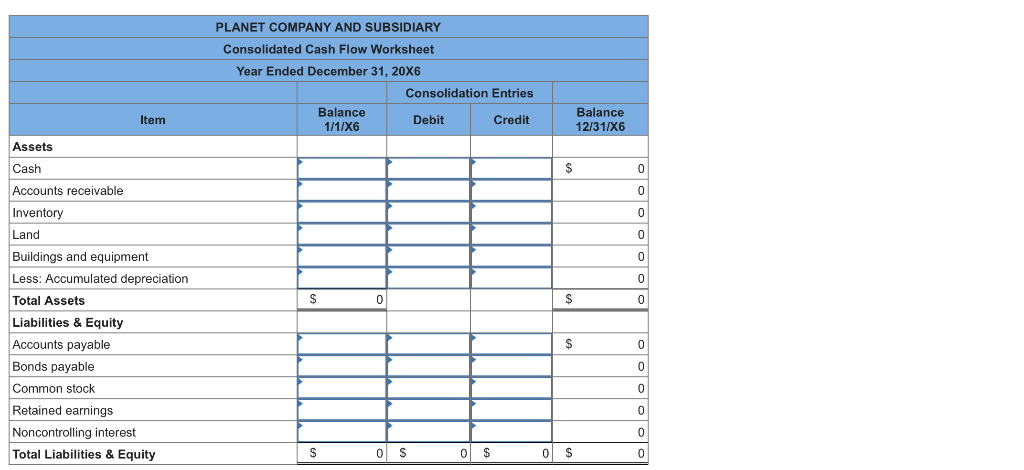

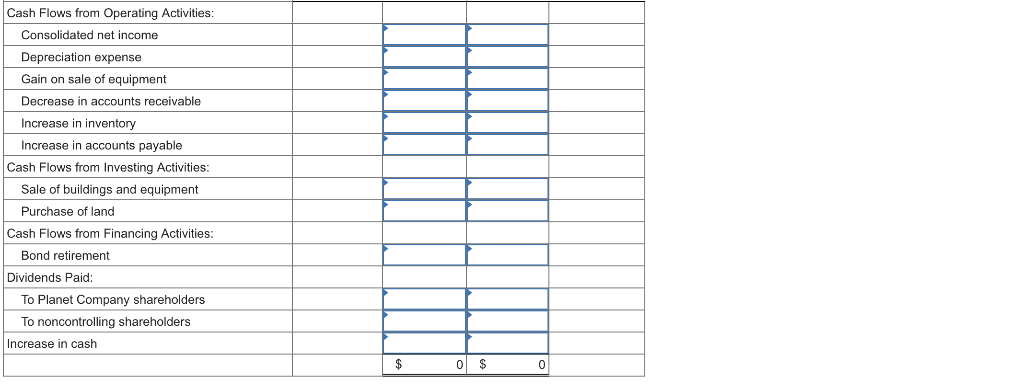

Sun Corporation was created on January 1, 20X2, and quickly became successful. On January 1, 20X6, its owner sold 80 percent of the stock to Planet Company at underlying book value. At the date of that sale, the fair value of the remaining shares was equal to 20 percent of the book value of Sun. Planet continued to operate the subsidiary as a separate legal entity and used the equity method in accounting for its investment in Sun. The following consolidated financial statements have been prepared PLANET COMPANY AND SUBSIDIARY Consolidated Balance Sheets January 1, 20x6 December 31, 20x6 Assets Cash Accounts Receivable Inventory Land Buildings and Equipment Less: Accumulated Depreciation Total Assets $ 54,000 121,000 230,000 95,000 800,000 $75, 000 111,000 360,000 100,000 650,000 (230,000 $1,066, 000 (290,000) $1,010,000 Liabilities and owners' Equity Accounts Payable Bonds Payable Noncontrolling Interest Common Stock Retained Earnings $ 90,000 300,000 30,000 300,000 290,000 $1,010,000 105, 000 250,000 38,000 300,000 373,000 $1,066,000 Total Liabilities and Owners' Equity PLANET COMPANY AND SUBSIDIARY Consolidated Income Statement Year Ended December 31, 20x6 $1,070,000 30,000 $1,100,000 $ 750, 000 40,000 150,000 940,000 $ 160,000 (12,000) 148,000 Sales Gain on Sale of Equipment Cost of Goods Sold Depreciation Expense Other Expenses Total Expenses Consolidated Net Incomee Income to Noncontrolling Interest Income to Controlling Interest PLANET COMPANY AND SUBSIDIARY Consolidated Retained Earnings Statement Year Ended December 31, 20X6 Balance, January 1, 20X6 Income to Controlling Interest $290,000 148.000 $438,000 65,000) Dividends Declared, 20x6 Balance, December 31, 20x6 $373,000 During 20X6, Sun reported net income of $60,000 and paid dividends of $20,000; Planet reported net income of $148,000 and paid dividends of $65,000. There were no intercompany transfers during the period Required: Prepare a worksheet for a consolidated statement of cash flows for 20X6 using the indirect method of computing cash flows from operations. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit PLANET COMPANY AND SUBSIDIARY Consolidated Cash Flow Worksheet Year Ended December 31, 20X6 Consolidation Entries Balance 1/1/X6 Balance 12/31/X6 Item Debit Credit Assets Cash Accounts receivable Inventory Land Buildings and equipment Less: Accumulated depreciation Total Assets Liabilities & Equity Accounts payable Bonds payable Common stock Retained earnings Noncontrolling interest Total Liabilities & Equity 0 Cash Flows from Operating Activities: Consolidated net income Depreciation expense Gain on sale of equipment Decrease in accounts receivable Increase in inventory Increase in accounts payable Cash Flows from Investing Activities: Sale of buildings and equipment Purchase of land Cash Flows from Financing Activities Bond retirement Dividends Paid To Planet Company shareholders To noncontrolling shareholders Increase in cash 0