Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Sun Finance Ltd, a subsidiary of Sun Resorts Group incorporated in Mauritius with reporting currency Mauritian Rupees (MUR) is contracting two foreign currency loans

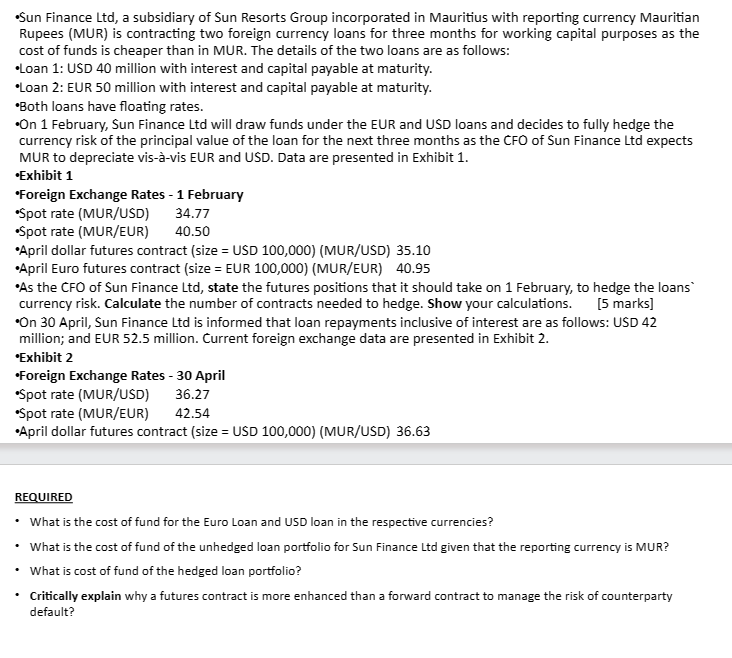

- Sun Finance Ltd, a subsidiary of Sun Resorts Group incorporated in Mauritius with reporting currency Mauritian Rupees (MUR) is contracting two foreign currency loans for three months for working capital purposes as the cost of funds is cheaper than in MUR. The details of the two loans are as follows: -Loan 1: USD 40 million with interest and capital payable at maturity. -Loan 2: EUR 50 million with interest and capital payable at maturity. -Both loans have floating rates. -On 1 February, Sun Finance Ltd will draw funds under the EUR and USD loans and decides to fully hedge the currency risk of the principal value of the loan for the next three months as the CFO of Sun Finance Ltd expects MUR to depreciate vis--vis EUR and USD. Data are presented in Exhibit 1. -Exhibit 1 Foreign Exchange Rates - 1 February -Spot rate (MUR/USD) 34.77 -Spot rate (MUR/EUR) 40.50 -April dollar futures contract (size = USD 100,000) (MUR/USD) 35.10 -April Euro futures contract (size = EUR 100,000) (MUR/EUR) 40.95 -As the CFO of Sun Finance Ltd, state the futures positions that it should take on 1 February, to hedge the loans' currency risk. Calculate the number of contracts needed to hedge. Show your calculations. [5 marks] -On 30 April, Sun Finance Ltd is informed that loan repayments inclusive of interest are as follows: USD 42 million; and EUR 52.5 million. Current foreign exchange data are presented in Exhibit 2. 'Exhibit 2 -Foreign Exchange Rates - 30 April -Spot rate (MUR/USD) 36.27 -Spot rate (MUR/EUR) 42.54 -April dollar futures contract (size = USD 100,000) (MUR/USD) 36.63 REQUIRED - What is the cost of fund for the Euro Loan and USD loan in the respective currencies? - What is the cost of fund of the unhedged loan portfolio for Sun Finance Ltd given that the reporting currency is MUR? - What is cost of fund of the hedged loan portfolio? - Critically explain why a futures contract is more enhanced than a forward contract to manage the risk of counterparty default

- Sun Finance Ltd, a subsidiary of Sun Resorts Group incorporated in Mauritius with reporting currency Mauritian Rupees (MUR) is contracting two foreign currency loans for three months for working capital purposes as the cost of funds is cheaper than in MUR. The details of the two loans are as follows: -Loan 1: USD 40 million with interest and capital payable at maturity. -Loan 2: EUR 50 million with interest and capital payable at maturity. -Both loans have floating rates. -On 1 February, Sun Finance Ltd will draw funds under the EUR and USD loans and decides to fully hedge the currency risk of the principal value of the loan for the next three months as the CFO of Sun Finance Ltd expects MUR to depreciate vis--vis EUR and USD. Data are presented in Exhibit 1. -Exhibit 1 Foreign Exchange Rates - 1 February -Spot rate (MUR/USD) 34.77 -Spot rate (MUR/EUR) 40.50 -April dollar futures contract (size = USD 100,000) (MUR/USD) 35.10 -April Euro futures contract (size = EUR 100,000) (MUR/EUR) 40.95 -As the CFO of Sun Finance Ltd, state the futures positions that it should take on 1 February, to hedge the loans' currency risk. Calculate the number of contracts needed to hedge. Show your calculations. [5 marks] -On 30 April, Sun Finance Ltd is informed that loan repayments inclusive of interest are as follows: USD 42 million; and EUR 52.5 million. Current foreign exchange data are presented in Exhibit 2. 'Exhibit 2 -Foreign Exchange Rates - 30 April -Spot rate (MUR/USD) 36.27 -Spot rate (MUR/EUR) 42.54 -April dollar futures contract (size = USD 100,000) (MUR/USD) 36.63 REQUIRED - What is the cost of fund for the Euro Loan and USD loan in the respective currencies? - What is the cost of fund of the unhedged loan portfolio for Sun Finance Ltd given that the reporting currency is MUR? - What is cost of fund of the hedged loan portfolio? - Critically explain why a futures contract is more enhanced than a forward contract to manage the risk of counterparty default Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started