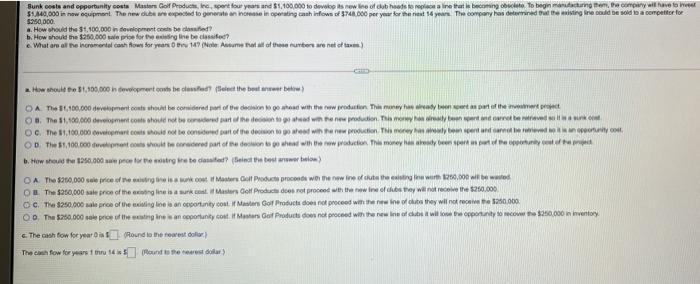

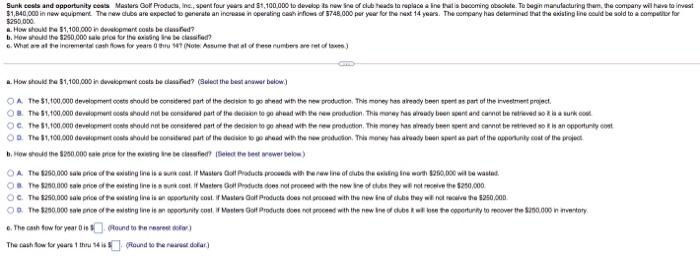

Sunk costs and opportunity costs Masters Golf Produch, Inc. sport four years and 51.100.000 to develop is now in of cheats to replain that is becoming to bondage, the company w 51/220,000 in now ocupant. The new de respected to generate annossa in operating cash infown of $742.000 per year for the net 54 year. The company has determined out the writing in could be sold to a completo $250,000 *. How should the $1.500,000 in downlopment is best? b. How should the $250,000 ale preferine besser? What are at the incremental cash flows for years on 147 (Neumaat of these numbers are not ofta) 2. How about to 31,400,000 womert cente beled (eet the best aneb OA The16.100.000 development on the considered art of the decision to go head with the reduction. This has part of the On The 31.100.000 manns should not be comparte de toda new production. The models OC. The 1.100.000 euros should not be consid part of the decision to head with new in the more you wanted no OD The 1.100.000 Gent could be ordered part of a down to head with row production. The money may b. How how the 1990.000 por lo mentre retea? Select the best www OA The $20.000 sole rice of the control Product code we the wine out the worn 1200.00 wie w O The 100.000 price of the line is Masters Golf Productos proced with the wine of wine recethe $250.000 OC. The $250.000 ale pro of the wing to anotty cout if Mastan Goll Production proceed with the wine they will not receive the $250.000 OD The $200.000 price of the engine ancoponunty cost i Masters Golf Produits de no proceed with the wine will recow $350.000 in mentory The cash fow for year Round to the rest dallar The cash fow for your intend to the restor) Sunkcesis and opportunity cos Masters Gol Products, inc., spent four years and St,100.000 to develop is now of club reads to replace a ine that is becoming toolute. To begin manufacturing them, the company will have to invest $1,840,000 in new equipment. The new duce are expected to generate an increase in operating cash flows 74.000 per year for the next 14 years. The company has determined that the existing line could be sold to computer for 3250.000 A. How shoulde 51,100,000 part cous bed? 6. How would the $250.000 sale price for the engine de classe 6. What we all the incremental cash flows for years 7 (Note Assume that at ofrece unterto) 2. How shoulde $1,100,000 in development costs be danified? (Sdlect the best answer below) OA The $1.500.000 developments should be considered part of the desire to go with the new production. This money has areas been spent as part of the rivement protect o the 51,100.000 dolarent would not be considered part of the documente go head was the new production. This may has ready been spent and carviot be reved to be sure OC. The $1.100.000 development cone would not be catered part of the decision to go head with the edition. This money has may be and cannot be retrieved both an opportunayot OD The 51.100.000 deviliment would be considered part of the decisiete pe raut with the new production. This money has been apart as part of the opportunity cou of the h. How would the $250.000 ale prostor the ware tested in bewer below) CA The $250.000 sa price of existing the is a un cost. If stere Cut Products prooed wherewine of cute the existing to worth $280,000 will be waste OB The $360,000 aprice of the existing line is a sunt cont. Matter Golf Product does not proceed with the newine of the they will not receive the $200.000 OC. The 320,000 ale price of a singine is an opportunity cost. Musters Golf Product does not proces with the new inel dubstyl not rece he $250.000 On The $280.000 price of the sitngine is a community Com Morten GotPouch does not proceed with the new route to the conturn to rower the $200.000 to . The can tow for year in Rand to the cases of) The cash fow for years thus Pound to her ear)