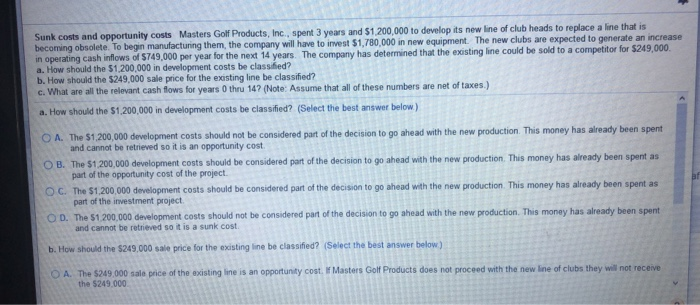

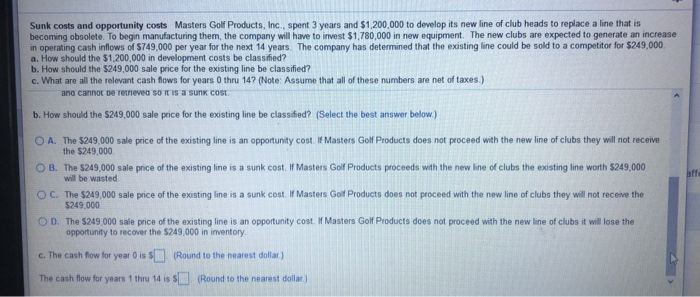

Sunk costs and opportunity costs Masters Golf Products, Inc., spent 3 years and $1,200,000 to develop its new line of club heads to replace a line that is becoming obsolete. To begin manufacturing them, the company will have to invest $1,780,000 in new equipment. The new clubs are expected to generate an increase in operating cash inflows of $749,000 per year for the next 14 years. The company has determined that the existing line could be sold to a competitor for $249,000 a. How should the $1,200,000 in development costs be classified? b. How should the $249,000 sale price for the existing line be classified? c. What are all the relevant cash flows for years thru 147 (Note: Assume that all of these numbers are not of taxes.) a. How should the $1,200,000 in development costs be classified? (Select the best answer below) O A. The $1,200,000 development costs should not be considered part of the decision to go ahead with the new production. This money has already been spent and cannot be retrieved so it is an opportunity cost OB. The $1,200,000 development costs should be considered part of the decision to go ahead with the new production. This money has already been spent as part of the opportunity cost of the project OC. The $1.200.000 development costs should be considered part of the decision to go ahead with the new production. This money has already been spent as part of the investment project OD. The $1.200.000 development costs should not be considered part of the decision to go ahead with the new production. This money has already been spent and cannot be retrieved so it is a sunk cost b. How should the $249.000 sale price for the existing line be classified? (Select the best answer below) O A. The $249.000 sale price of the existing line is an opportunity cost, Masters Golf Products does not proceed with the new line of clubs they will not receive the $249.000 Sunk costs and opportunity costs Masters Golf Products, Inc., spent 3 years and $1,200,000 to develop its new line of club heads to replace a line that is becoming obsolete. To begin manufacturing them, the company will have to invest $1,780,000 in new equipment. The new clubs are expected to generate an increase in operating cash inflows of $749,000 per year for the next 14 years. The company has determined that the existing line could be sold to a competitor for $249,000 a. How should the $1,200,000 in development costs be classified? b. How should the $249,000 sale price for the existing line be classified? c. What are all the relevant cash flows for years thru 147 (Note: Assume that all of these numbers are net of taxes.) and cannot be reneved so is a Sun COSE b. How should the $249,000 sale price for the existing line be classified? (Select the best answer below.) O A. The $249,000 sale price of the existing line is an opportunity cost. If Masters Golf Products does not proceed with the new line of clubs they will not receive the $249,000 OB. The $249,000 sale price of the existing line is a sunk cost. If Masters Golf Products proceeds with the new line of clubs the existing line worth $249,000 will be wasted OC. The $249,000 sale price of the existing line is a sunk cost. If Masters Golf Products does not proceed with the new line of clubs they will not receive the $249.000 OD. The $249.000 sale price of the existing line is an opportunity cost. I Masters Golf Products does not proceed with the new line of clubs it will lose the opportunity to recover the $249,000 in inventory c. The cash flow for year is (Round to the nearest dollar) The cash flow for years thru 14 is $ (Round to the nearest dollar)