Answered step by step

Verified Expert Solution

Question

1 Approved Answer

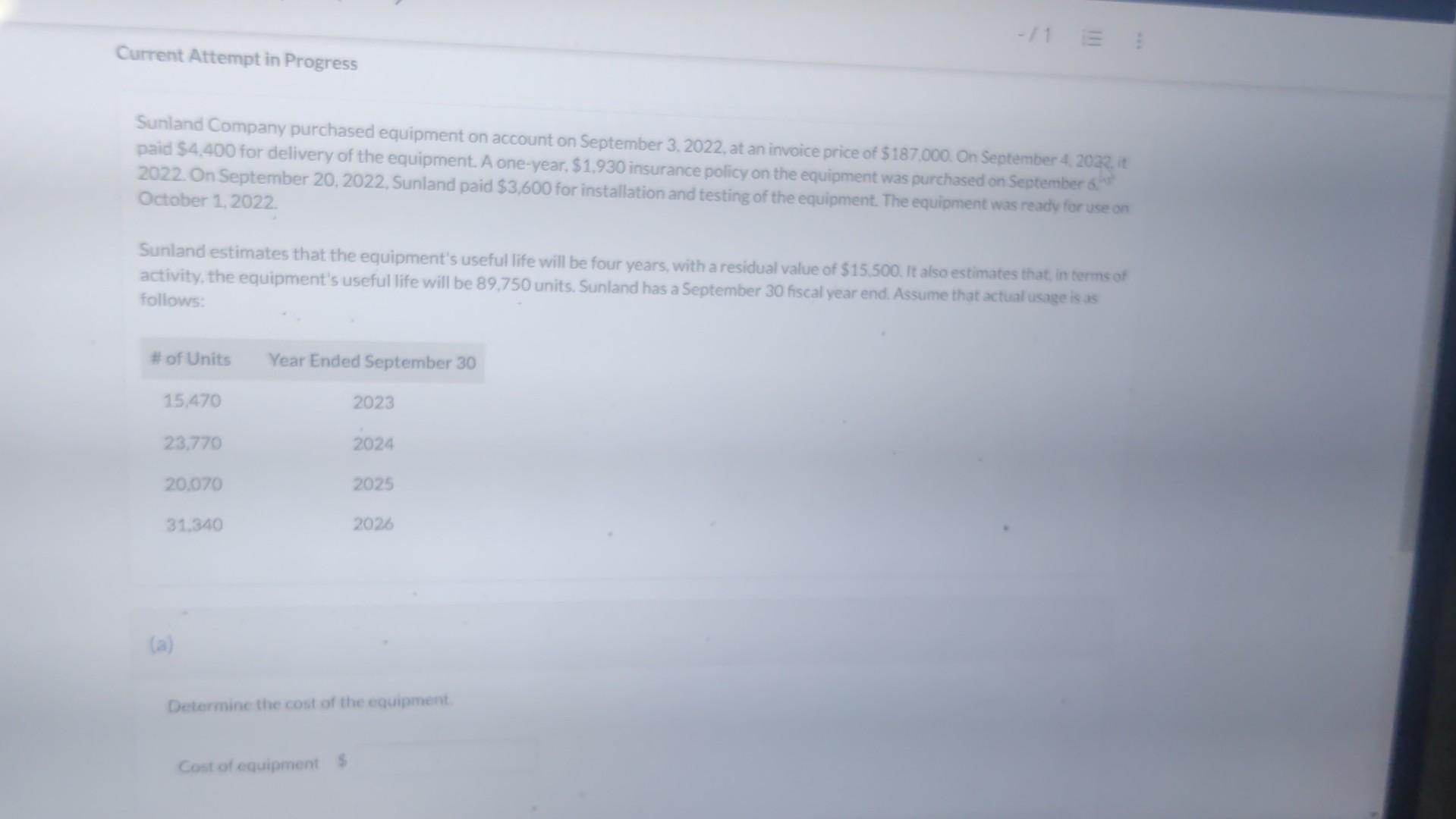

Sunland Company purchased equipment on account on September 3, 2022, at an invoice price of $187,000. On September 4, 2022, it paid $4,400 for delivery

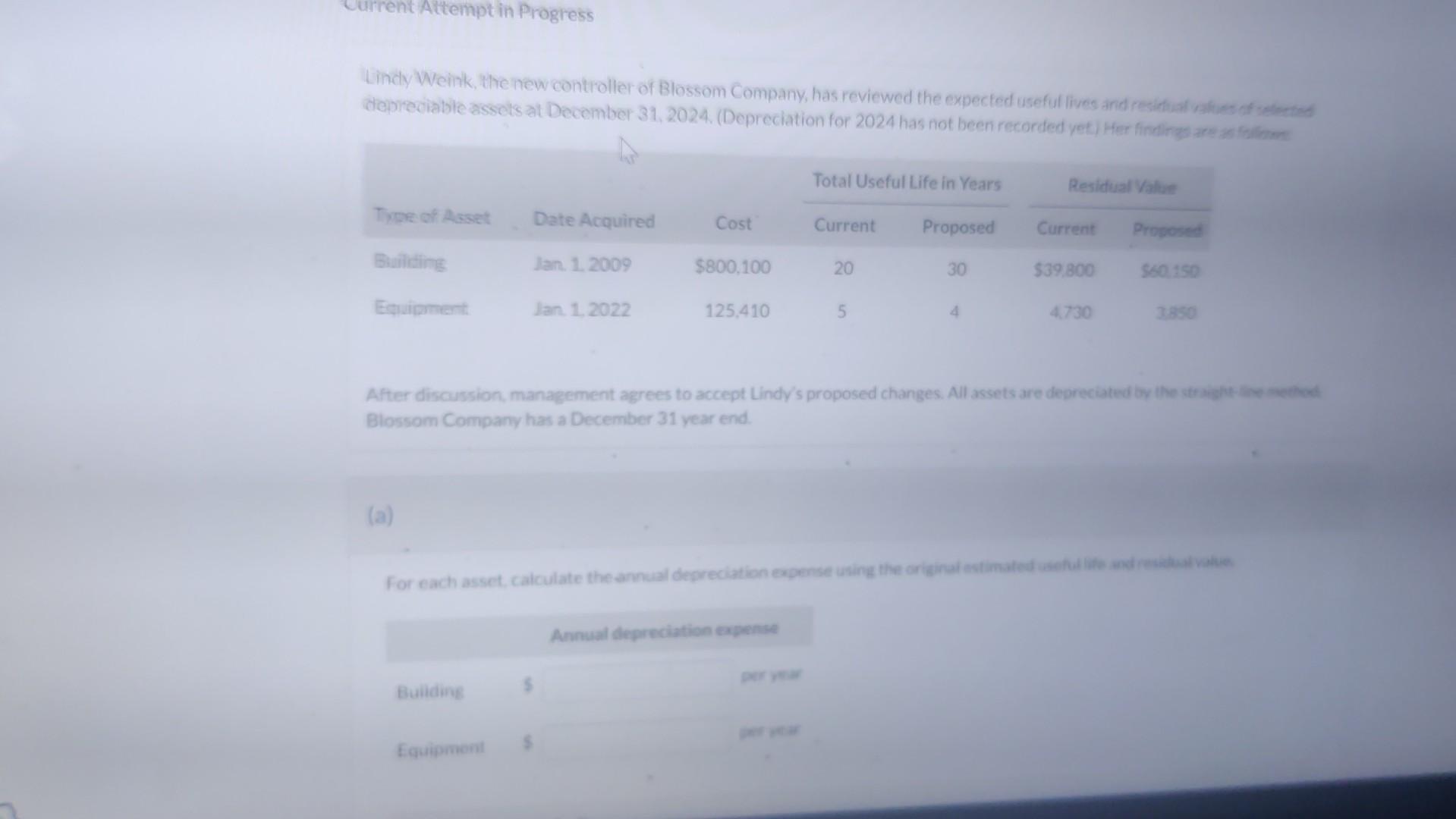

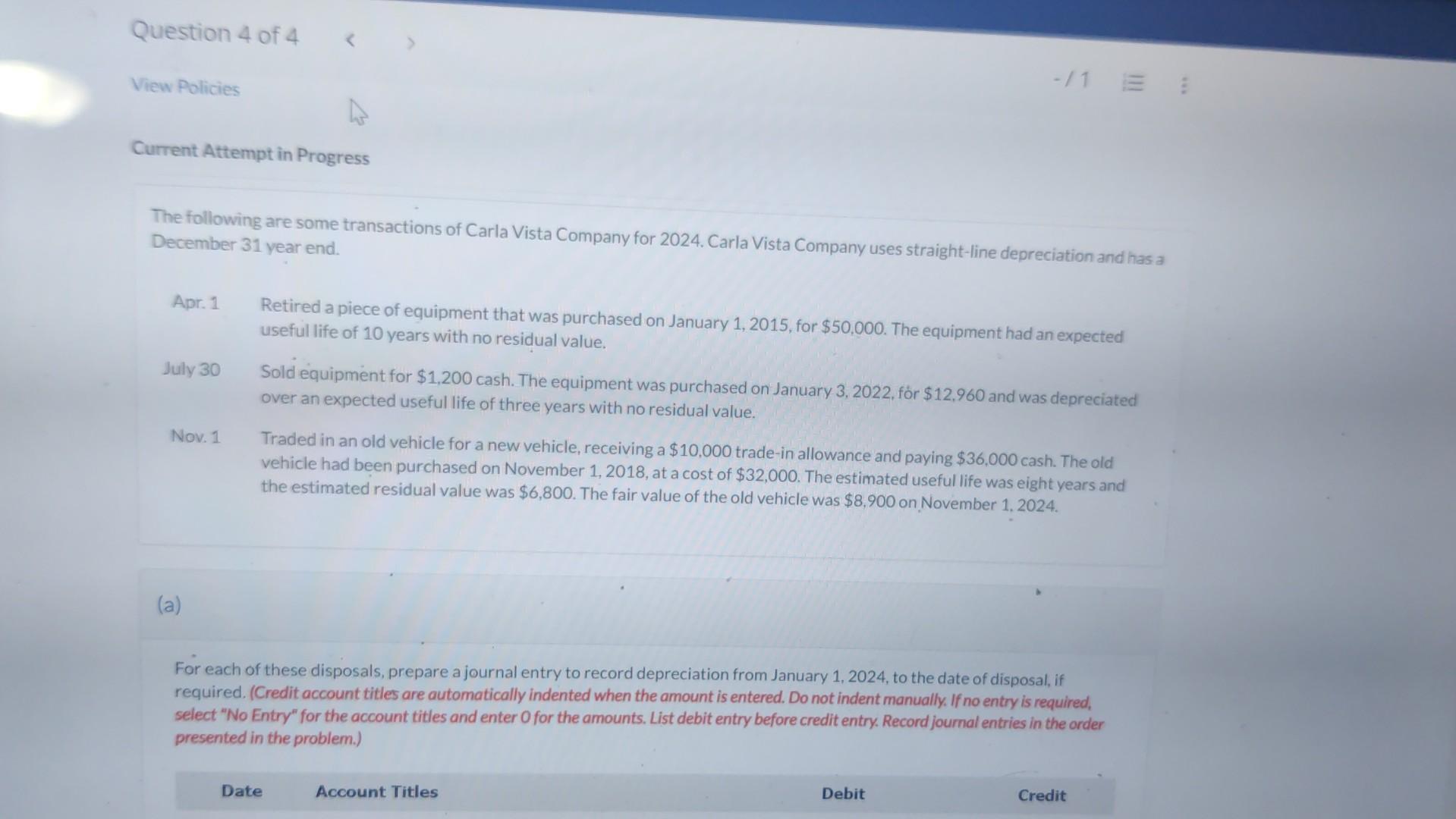

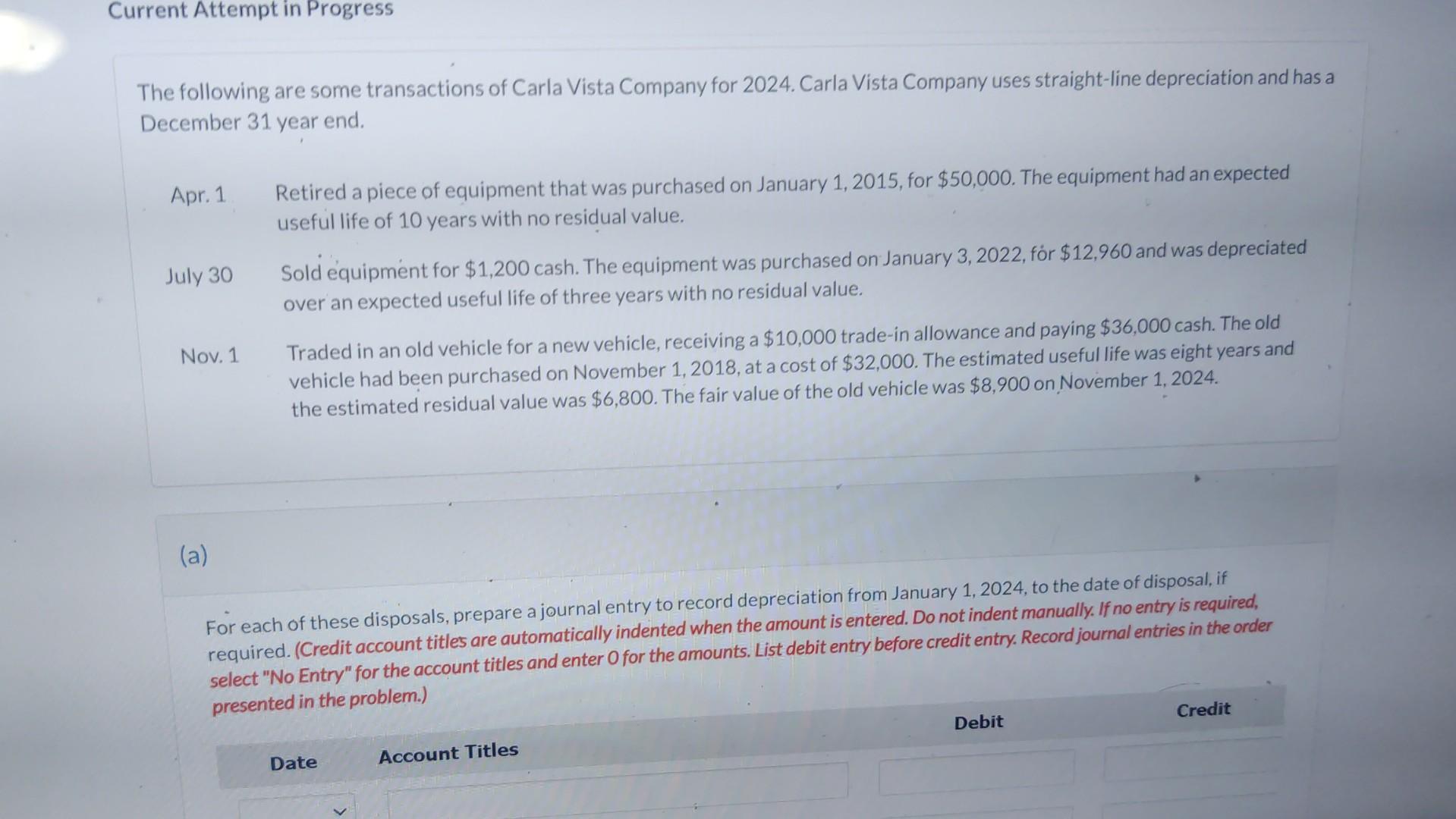

Sunland Company purchased equipment on account on September 3, 2022, at an invoice price of $187,000. On September 4, 2022, it paid $4,400 for delivery of the equipment. A one-year, $1,930 insurance policy on the equipment was purchased on September 6 . 2022. On September 20,2022, Sunland paid $3,600 for installation and testing of the equipment. The equipment was ready for use on October 1, 2022. Sunland estimates that the equipment's useful life will be four years, with a residual value of $15,500. It also estimates that, in terms of activity, the equipment's useful life will be 89,750 units. Sunland has a September 30 fiscal year end. Assume that actual usige is as follows: (a) Determine the cost of the equipment. Lindy Weink, the new controller of Blossom Company, has reviewed the expected useful lives and resithat satues af velentad After discussion, management agrees to accept Lindy's proposed changes. All assets are depreciated by the straisht-ive acethots Blossom Company has a December 31 year end. (a) For each asset, caiculate the annual depreciation expense using the originaf estimated useful ife ma resalual valie: The following are some transactions of Carla Vista Company for 2024. Carla Vista Company uses straight-line depreciation and has a December 31 year end. Apr. 1 Retired a piece of equipment that was purchased on January 1, 2015, for $50,000. The equipment had an expected useful life of 10 years with no residual value. July 30 Sold equipment for $1,200 cash. The equipment was purchased on January 3, 2022, for $12,960 and was depreciated over an expected useful life of three years with no residual value. Nov. 1 Traded in an old vehicle for a new vehicle, receiving a $10,000 trade-in allowance and paying $36,000 cash. The old vehicle had been purchased on November 1,2018 , at a cost of $32,000. The estimated useful life was eight years and the estimated residual value was $6,800. The fair value of the old vehicle was $8,900 on November 1,2024. (a) For each of these disposals, prepare a journal entry to record depreciation from January 1,2024 , to the date of disposal, if required. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry. Record journal entries in the order presented in the problem.) The following are some transactions of Carla Vista Company for 2024. Carla Vista Company uses straight-line depreciation and has a December 31 year end. Apr. 1 Retired a piece of equipment that was purchased on January 1,2015 , for $50,000. The equipment had an expected useful life of 10 years with no residual value. July 30 Sold equipment for $1,200 cash. The equipment was purchased on January 3, 2022, fr $12,960 and was depreciated over an expected useful life of three years with no residual value. Nov. 1 Traded in an old vehicle for a new vehicle, receiving a $10,000 trade-in allowance and paying $36,000 cash. The old vehicle had been purchased on November 1,2018 , at a cost of $32,000. The estimated useful life was eight years and the estimated residual value was $6,800. The fair value of the old vehicle was $8,900 on N ovember 1,2024 . (a) For each of these disposals, prepare a journal entry to record depreciation from January 1,2024 , to the date of disposal, if required. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry. Record journal entries in the order

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started