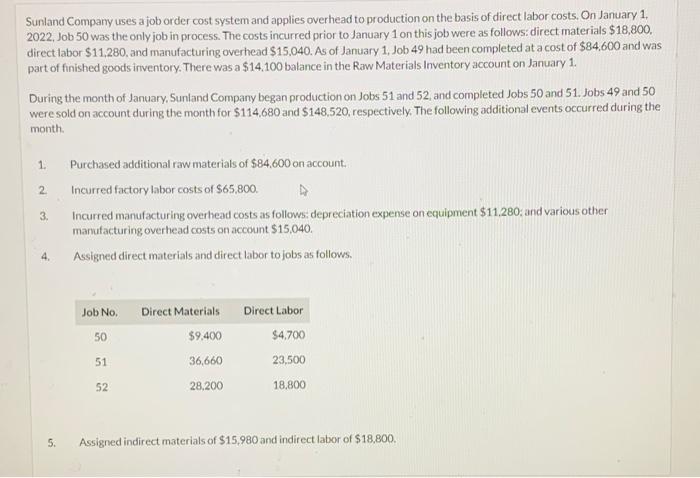

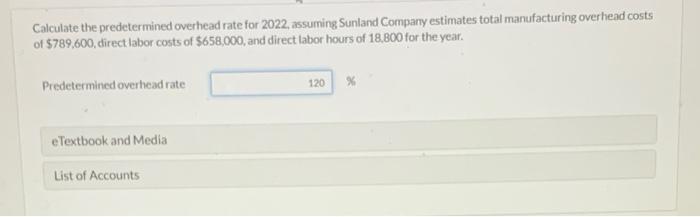

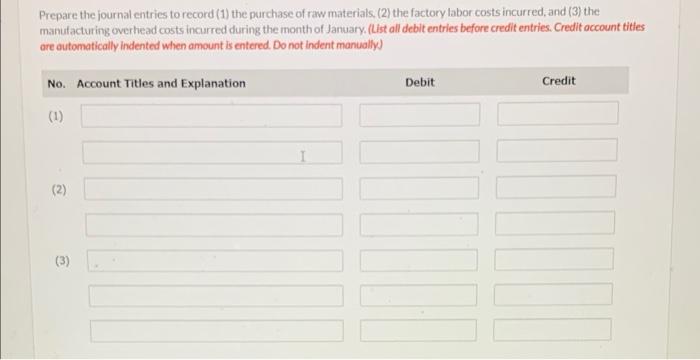

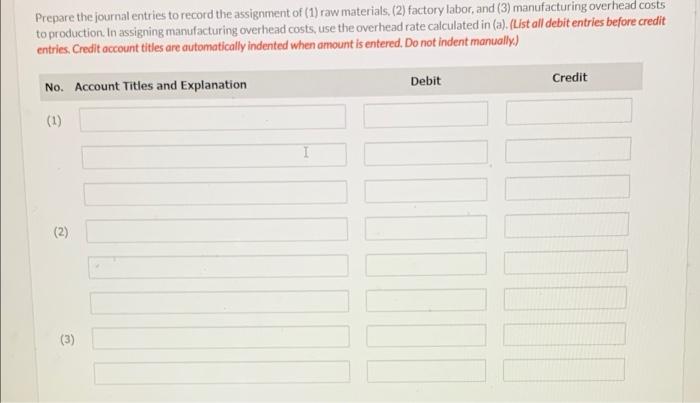

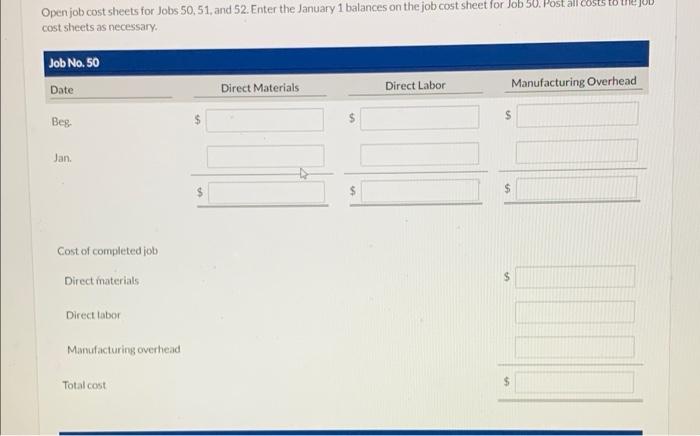

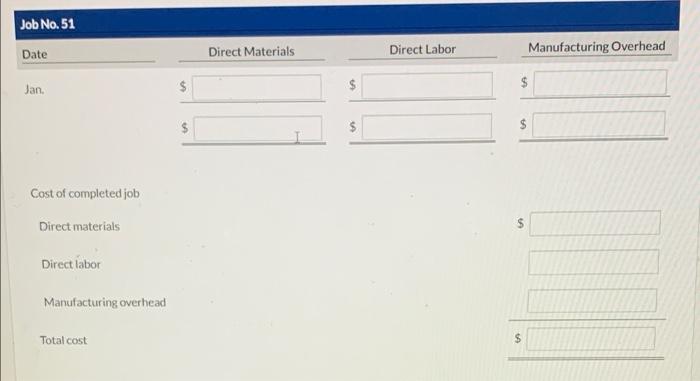

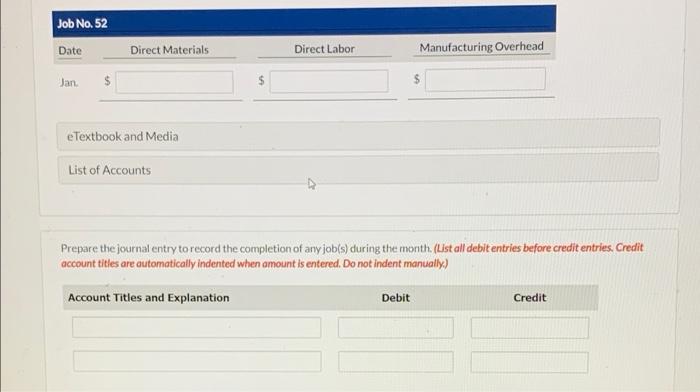

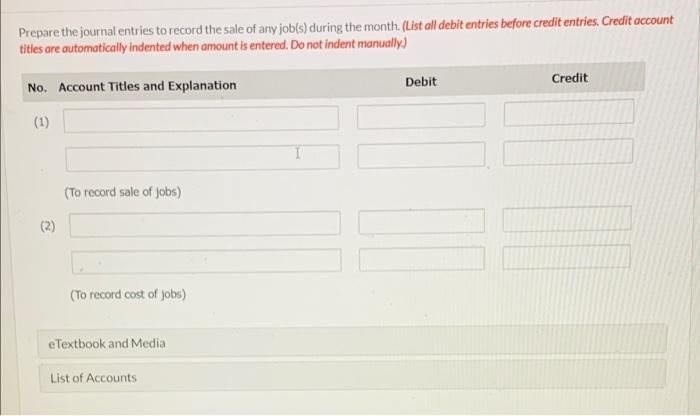

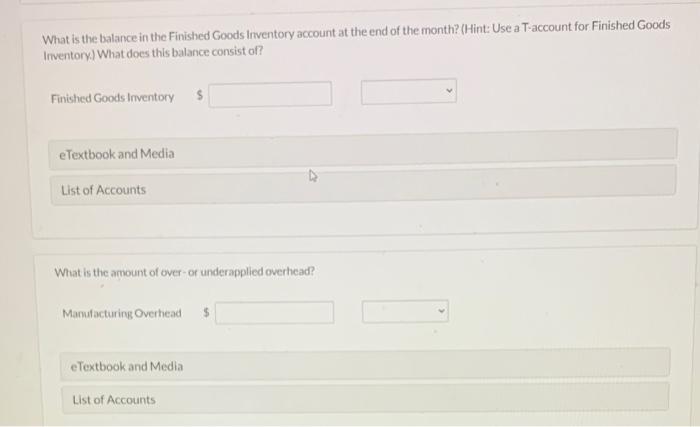

Sunland Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2022, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $18,800, direct labor $11,280, and manufacturing overhead $15,040. As of January 1, Job 49 had been completed at a cost of $84,600 and was part of finished goods inventory. There was a $14.100 balance in the Raw Materials Inventory account on January 1. During the month of January, Sunland Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $114,680 and $148,520, respectively. The following additional events occurred during the month 1. 2 3. Purchased additional raw materials of $84,600 on account Incurred factory labor costs of $65,800. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $11.280: and various other manufacturing overhead costs on account $15,040. Assigned direct materials and direct labor to jobs as follows. 4. Job No. 50 Direct Materials $9,400 36,660 28,200 Direct Labor $4.700 23,500 18,800 51 52 5. Assigned indirect materials of $15,980 and indirect labor of $18,800, Calculate the predetermined overhead rate for 2022, assuming Sunland Company estimates total manufacturing overhead costs of $789,600, direct labor costs of $658,000, and direct tabor hours of 18,800 for the year. Predetermined overhead rate 120 x eTextbook and Media List of Accounts Prepare the journal entries to record (1) the purchase of raw materials. (2) the factory labor costs incurred, and (3) the manufacturing overhead costs incurred during the month of January. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually) Debit Credit No. Account Titles and Explanation (1) (2) (3) Prepare the journal entries to record the assignment of (1) raw materials (2) factory labor, and (3) manufacturing overhead costs to production. In assigning manufacturing overhead costs, use the overhead rate calculated in (a). (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually) No. Account Titles and Explanation Debit Credit (1 ) (2) (3) Openjob cost sheets for Jobs 50, 51, and 52. Enter the January 1 balances on the job cost sheet for Job 50. Post all costs cost sheets as necessary. Job No. 50 Date Direct Materials Direct Labor Manufacturing Overhead $ Beg $ S Jan. $ $ Cost of completed job Direct materials $ Direct labor Manufacturing overhead Total cost $ Job No.51 Date Direct Materials Direct Labor Manufacturing Overhead Jan. $ $ $ $ $ $ $ Cost of completed job Direct materials $ Direct labor Manufacturing overhead Total cost $ Job No. 52 Date Direct Materials Direct Labor Manufacturing Overhead Jan $ $ e Textbook and Media List of Accounts Prepare the journal entry to record the completion of any job(s) during the month. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually) Account Titles and Explanation Debit Credit Prepare the journal entries to record the sale of any job(s) during the month. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit No. Account Titles and Explanation (1) (To record sale of jobs) (2) (To record cost of jobs) eTextbook and Media List of Accounts What is the balance in the Finished Goods Inventory account at the end of the month? (Hint: Use a T-account for Finished Goods Inventory) What does this balance consist of? Finished Goods Inventory s e Textbook and Media List of Accounts What is the amount of over or underapplied overhead? Manufacturing Overhead $ eTextbook and Media List of Accounts