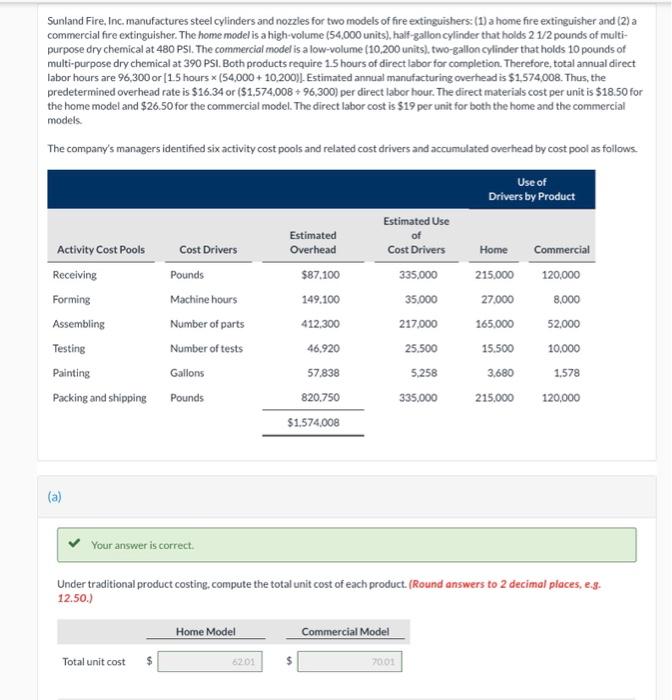

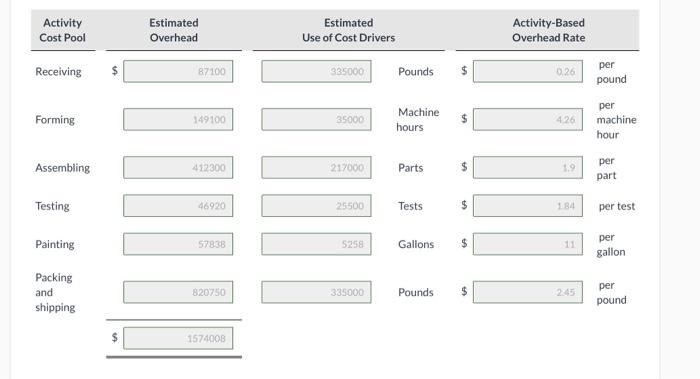

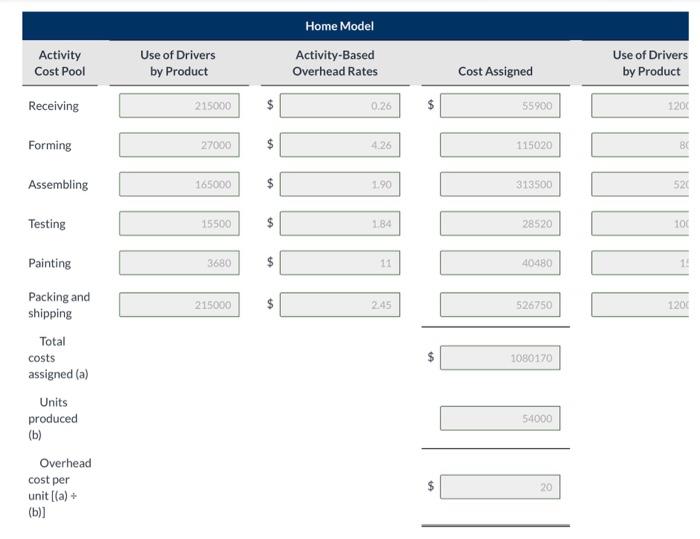

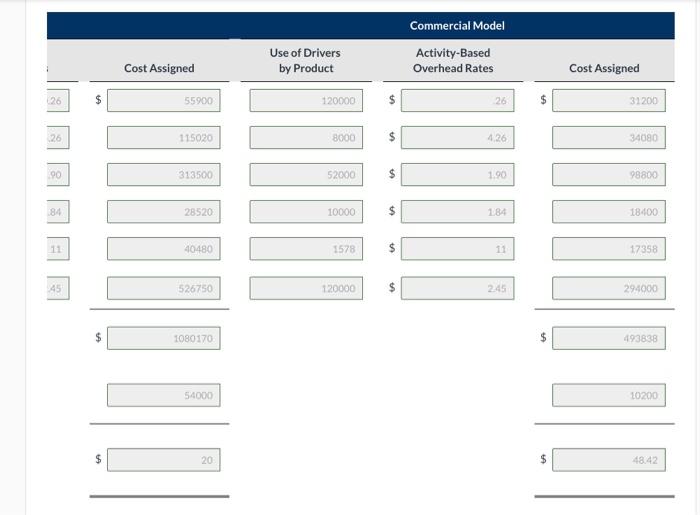

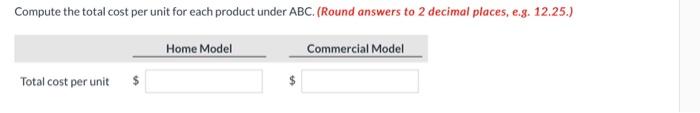

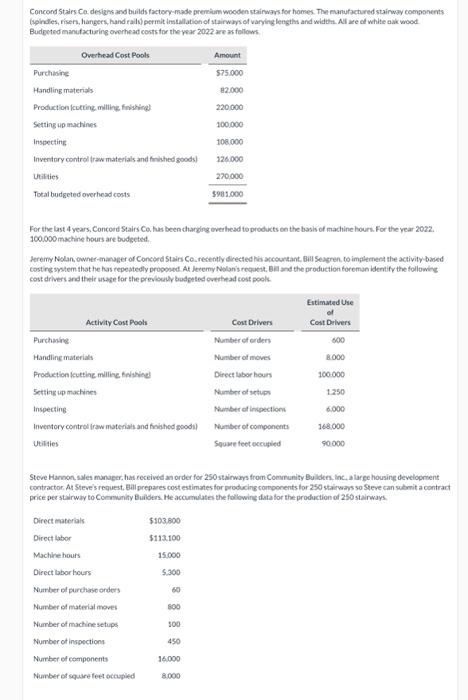

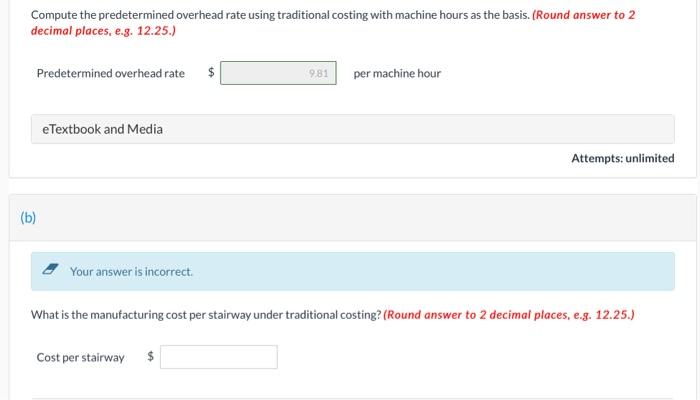

Sunland Fire, Inc, manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 21/2 pounds of multipurpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI, Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours (54,000+10,200)]. Estimated annual manufacturing overhead is $1,574,008. Thus, the predetermined overhead rate is $16.34 or ($1.574,00896.300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as follows. (a) Your answer is correct. Under traditional product costing. compute the total unit cost of each product. (Round answers to 2 decimal places, e.g. 12.50.) ActivityCostPoolReceivingEstimatedOverhead$100 Forming 217000 Parts $ 25500 Tests $184 per test Packing and shipping Forming Assembling Testing Painting Packing and shipping Total costs assigned (a) Units produced (b) Overhead cost per unit [(a)+ (b)] =$5900CostAssigned Commercial Model 800052000 \begin{tabular}{l} Activity-Based Overhead Rates \\ \hline \\ \hline 26 \\ \hline \end{tabular} $31200CostAssigned 98800 18400 17358 54000 10200 $ 20 $ Compute the total cost per unit for each product under ABC. (Round answers to 2 decimal places, e.g. 12.25.) Concord Stairs Co desizns and builds factory-made premium wooden stairwas for homes. The manufschured stainway components (ipindes, risers, hangers, hand railvi permit installation of stairwars of varying lengths and widtht. All are of white aak wood. Budgeted manufzcturing overhead costs toc the wear 2022 are as follows. For the last 4 years, Concerd Stairs Ca has been charging everthesd to products on the basis of machine hourh. For the year 2022. 100.000 machine hours are budgeted. Heremy Nolan, owner-mansger of Concord Stairs Co, resently directed his accourtant, Bill Seseren, to implemees the activity based costing system that he has repestedly proposed At Jeremy Nolan's request, Bia and the production toreman identify the following cost driveri and theit whate for the previsenly budgeted overtead cost pook. Steve Harnon, sales manager, has received an order for 250 stairwars from Community Buliders, inc, a large housing development contractor. As Steve's request, Bil prepares cost estimates for producing components for 250 stairwass so Steve can whorit a contract price per starway to Comwnity Buibers. He accumulates the following data for the production of 250 stairways. Compute the predetermined overhead rate using traditional costing with machine hours as the basis. (Round answer to 2 decimal places, e.g. 12.25.) Predetermined overhead rate eTextbook and Media Attempts: unlimi (b) Your answer is incorrect. What is the manufacturing cost per stairway under traditional costing? (Round answer to 2 decimal places, e.g. 12.25.) $