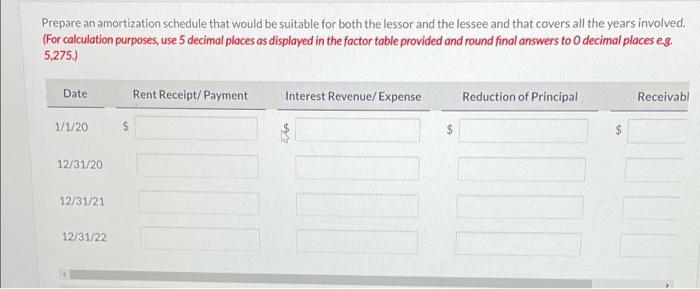

Sunland Leasing Company leases a new machine to Sharrer Corporation. The machine has a cost of $ 65,000 and fair value of $ 94,000. Under the 3-year, non-cancelable contract, Sharrer will receive title to the machine at the end of the lease. The machine has a 3-year useful life and no residual value. The lease ws signed on January 1, 2020. Sunland expects to earn an 8% return on its investment, and this implicitrate is known by Sharrer. The annual rentals are payable on each December 31, beginning December 31, 2020 Click here to view factor tables (b) Prepare an amortization schedule that would be suitable for both the lessor and the lessee and that covers all the years involved (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to decimal places es. 5,275) Date Rent Receipt/ Payment Interest Revenue/Expense Reduction of Prinrinal Darni Prepare an amortization schedule that would be suitable for both the lessor and the lessee and that covers all the years involved. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to decimal places eg. 5,275) Date Rent Receipt/ Payment Interest Revenue/Expense Reduction of Principal Receivabl 1/1/20 $ $ $ $ 12/31/20 12/31/21 12/31/22 Sunland Leasing Company leases a new machine to Sharrer Corporation. The machine has a cost of $ 65,000 and fair value of $ 94,000. Under the 3-year, non-cancelable contract, Sharrer will receive title to the machine at the end of the lease. The machine has a 3-year useful life and no residual value. The lease ws signed on January 1, 2020. Sunland expects to earn an 8% return on its investment, and this implicitrate is known by Sharrer. The annual rentals are payable on each December 31, beginning December 31, 2020 Click here to view factor tables (b) Prepare an amortization schedule that would be suitable for both the lessor and the lessee and that covers all the years involved (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to decimal places es. 5,275) Date Rent Receipt/ Payment Interest Revenue/Expense Reduction of Prinrinal Darni Prepare an amortization schedule that would be suitable for both the lessor and the lessee and that covers all the years involved. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to decimal places eg. 5,275) Date Rent Receipt/ Payment Interest Revenue/Expense Reduction of Principal Receivabl 1/1/20 $ $ $ $ 12/31/20 12/31/21 12/31/22