Answered step by step

Verified Expert Solution

Question

1 Approved Answer

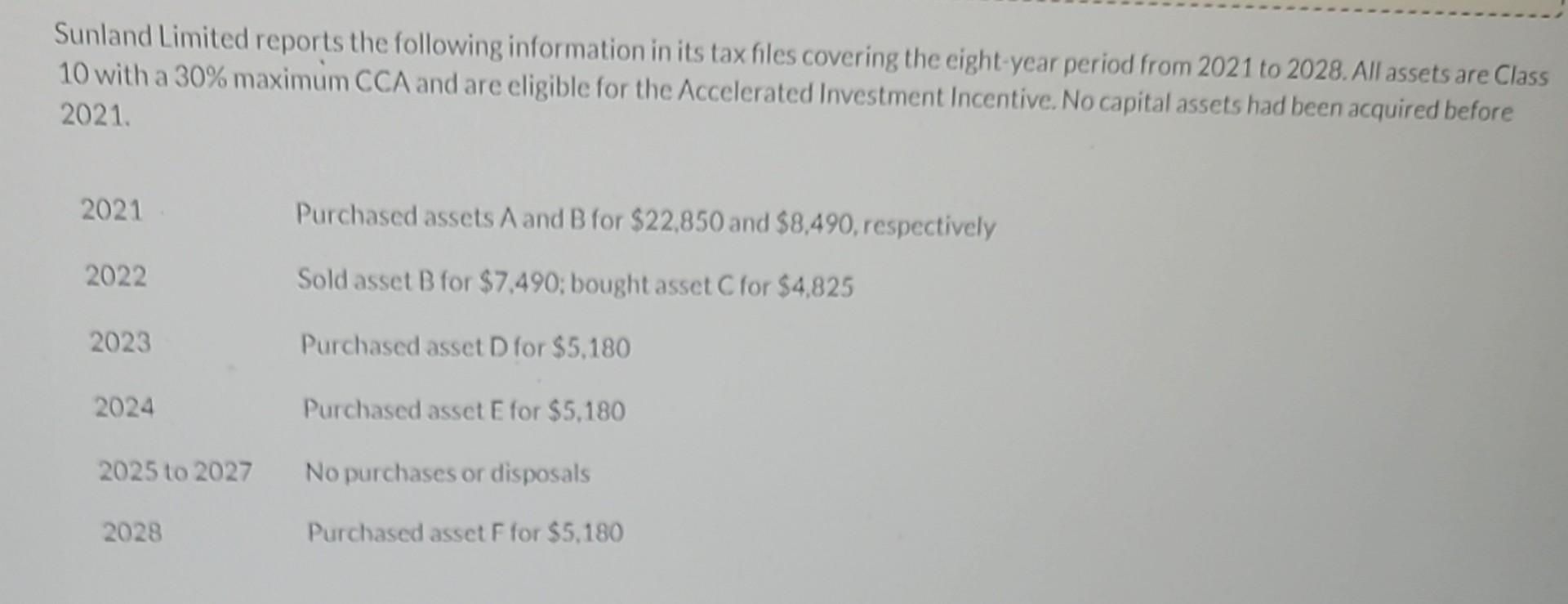

Sunland Limited reports the following information in its tax files covering the eight-year period from 2021 to 2028 . All assets are Class 10 with

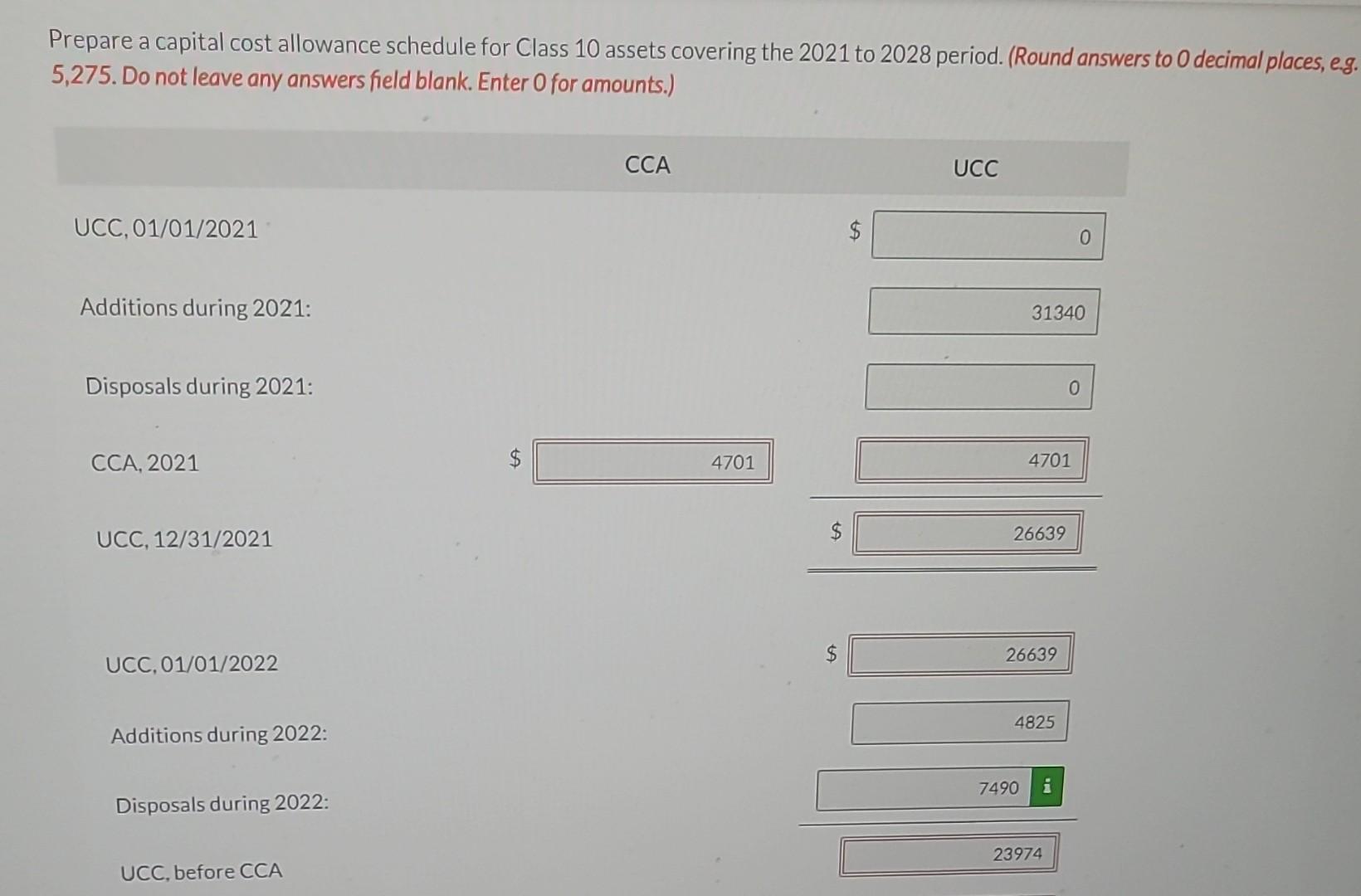

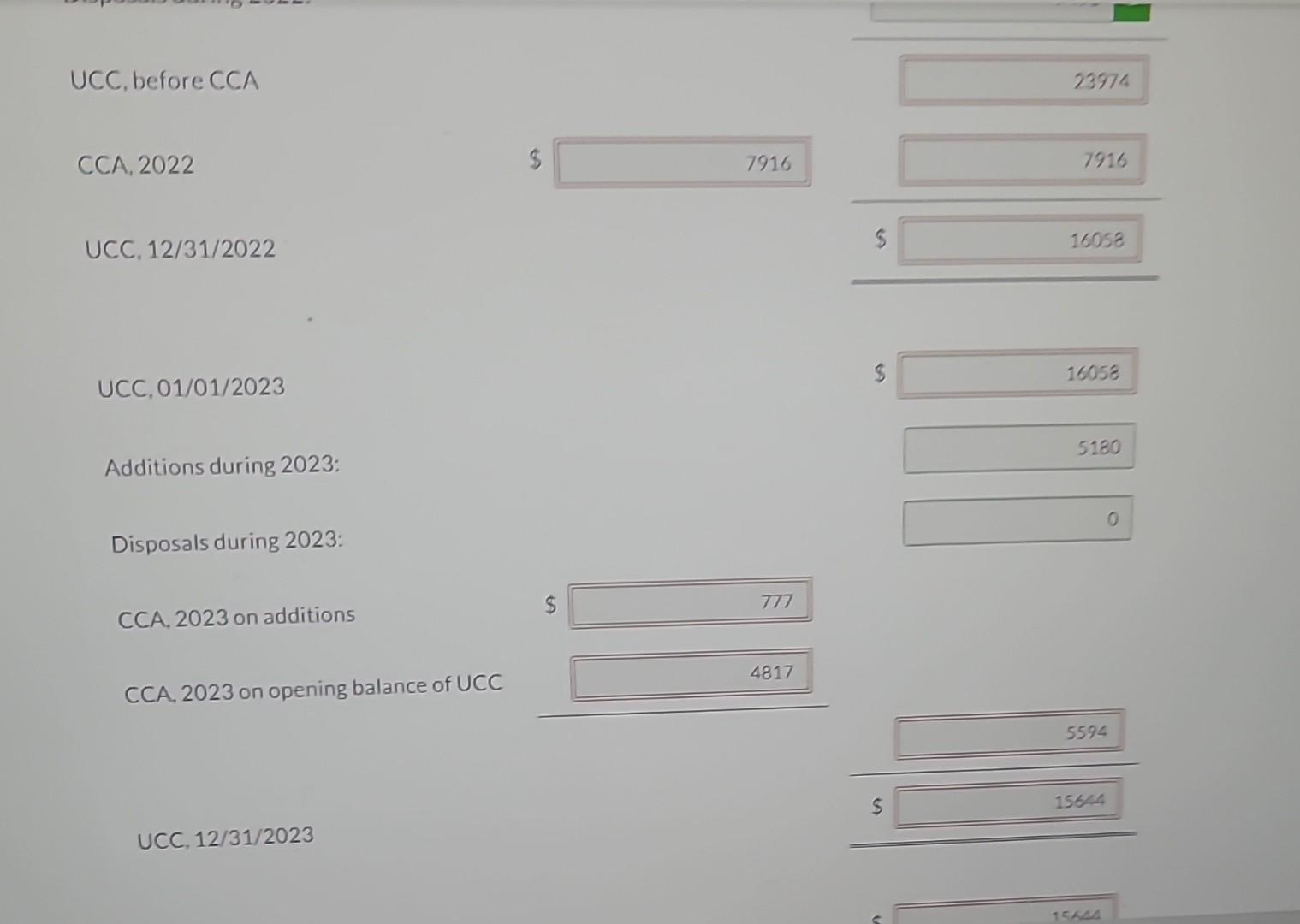

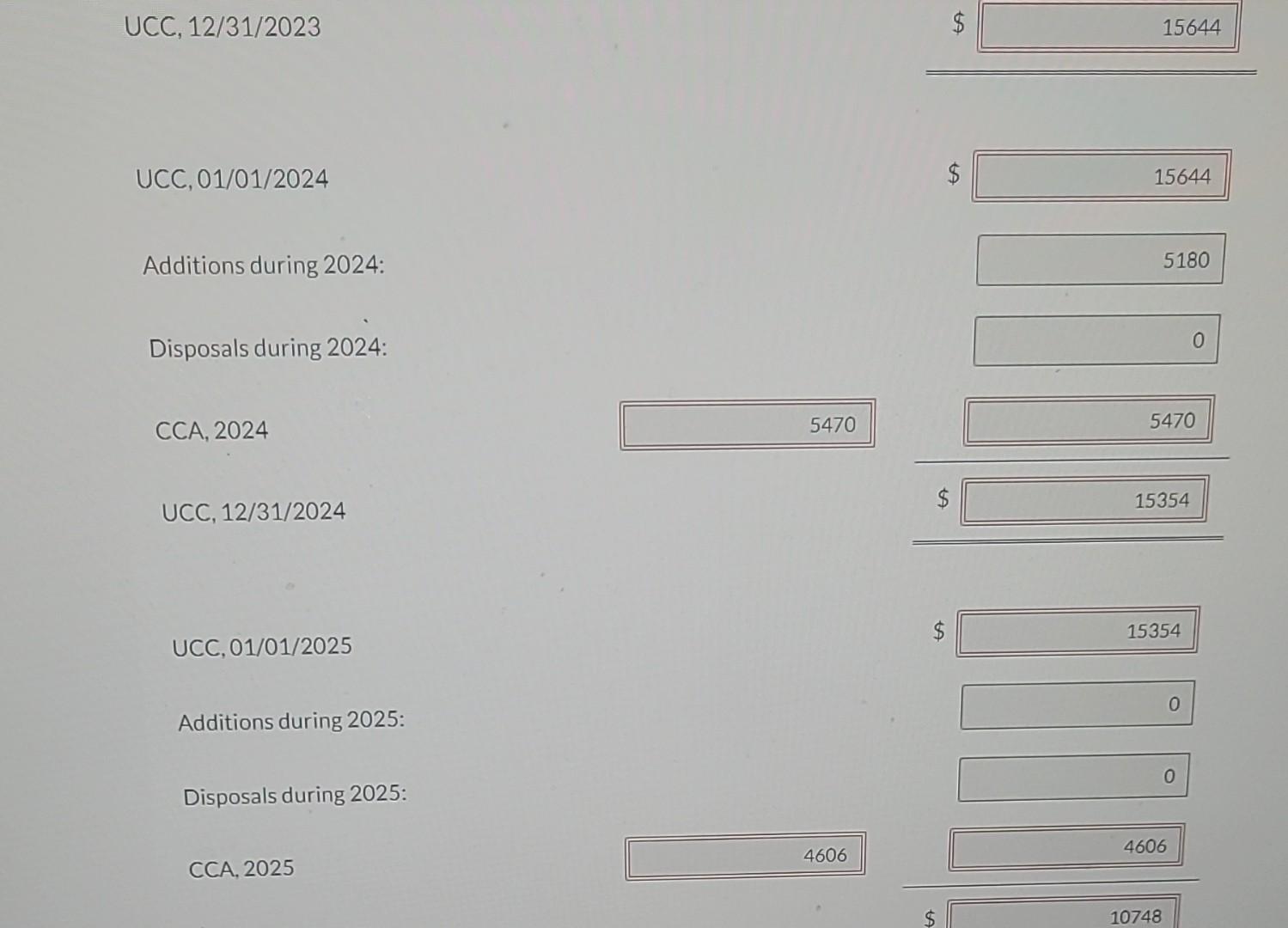

Sunland Limited reports the following information in its tax files covering the eight-year period from 2021 to 2028 . All assets are Class 10 with a 30% maximum CCA and are eligible for the Accelerated Investment Incentive. No capital assets had been acquired before 2021. 20212022202320242025to20272028PurchasedassetsAandBfor$22,850and$8,490,respectivelySoldassetBfor$7,490;boughtassetCfor$4,825PurchasedassetDfor$5,180PurchasedassetEfor$5,180NopurchasesordisposalsPurchasedassetFfor$5,180 Prepare a capital cost allowance schedule for Class 10 assets covering the 2021 to 2028 period. (Round answers to 0 decimal places, e g. 5,275. Do not leave any answers field blank. Enter 0 for amounts.) UCC, before CCA CCA, 2022 UCC. 12/31/2022 UCC. 01/01/2023 Additions during 2023: Disposals during 2023: CCA, 2023 on additions CCA, 2023 on opening balance of UCC ucc, 12/31/2023 UCC, 12/31/2023 UCC, 01/01/2024 $ 15644 Additions during 2024: $15644 Disposals during 2024: CCA, 2024 \begin{tabular}{|} \hline 5470 \\ \hline \end{tabular} UCC, 01/01/2025 Additions during 2025: Disposals during 2025: CCA, 2025 \begin{tabular}{|} \hline 606 \\ \hline \end{tabular} Sunland Limited reports the following information in its tax files covering the eight-year period from 2021 to 2028 . All assets are Class 10 with a 30% maximum CCA and are eligible for the Accelerated Investment Incentive. No capital assets had been acquired before 2021. 20212022202320242025to20272028PurchasedassetsAandBfor$22,850and$8,490,respectivelySoldassetBfor$7,490;boughtassetCfor$4,825PurchasedassetDfor$5,180PurchasedassetEfor$5,180NopurchasesordisposalsPurchasedassetFfor$5,180 Prepare a capital cost allowance schedule for Class 10 assets covering the 2021 to 2028 period. (Round answers to 0 decimal places, e g. 5,275. Do not leave any answers field blank. Enter 0 for amounts.) UCC, before CCA CCA, 2022 UCC. 12/31/2022 UCC. 01/01/2023 Additions during 2023: Disposals during 2023: CCA, 2023 on additions CCA, 2023 on opening balance of UCC ucc, 12/31/2023 UCC, 12/31/2023 UCC, 01/01/2024 $ 15644 Additions during 2024: $15644 Disposals during 2024: CCA, 2024 \begin{tabular}{|} \hline 5470 \\ \hline \end{tabular} UCC, 01/01/2025 Additions during 2025: Disposals during 2025: CCA, 2025 \begin{tabular}{|} \hline 606 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started