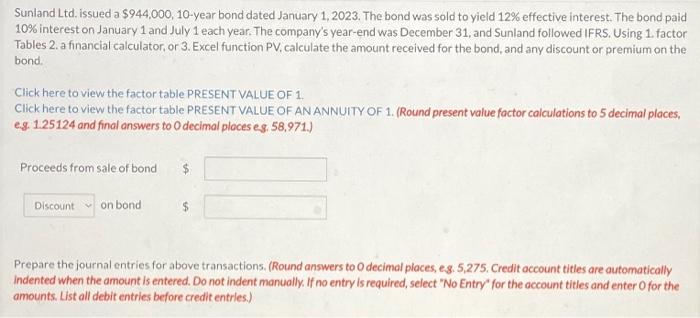

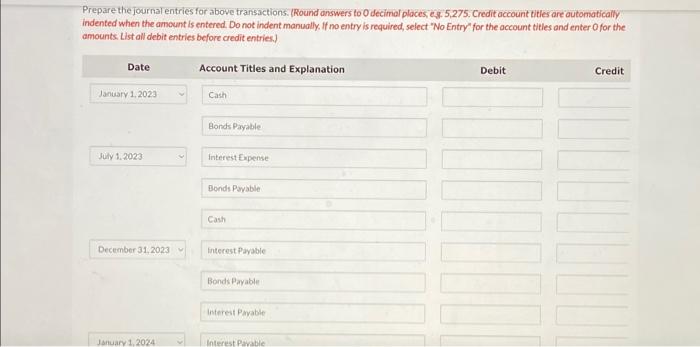

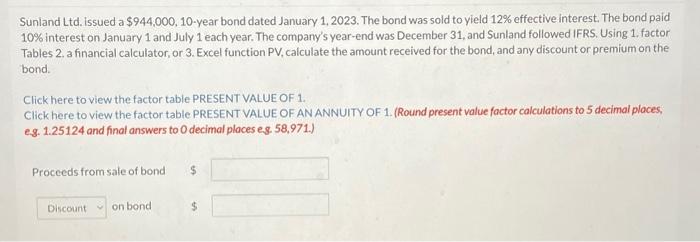

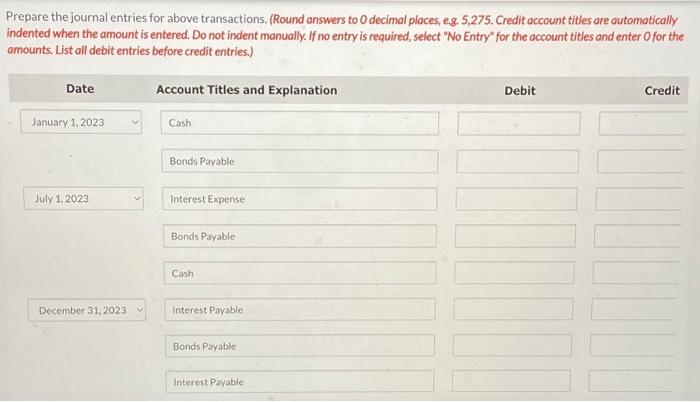

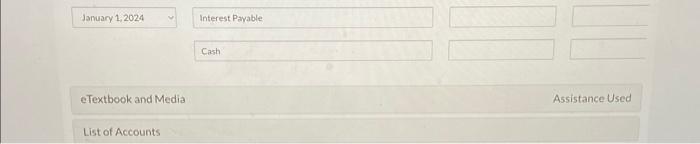

Sunland Ltd. issued a $944,000,10-year bond dated January 1,2023 . The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31 , and Sunland followed IFRS. Using 1 . factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and final answers to O decimal ploces eg. 58.971.) Proceeds from sale of bond on bond Prepare the journal entries for above transactions. (Round answers to 0 decimal places, eg. 5,275. Credit account titles are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entrles.) repare the journalentries for above transactions. (Round onswers to O decimel places, es, 5,275. Credit account titles are outomatically ndented when the amount is entered. Do not indent manudlly. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) January 1.2024 interest Payable cash Sunland Ltd. issued a $944,000,10-year bond dated January 1,2023 . The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31 , and Sunland followed IFRS. Using 1 . factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and final answers to 0 decimal places es. 58,971.) Proceeds from sale of bond $ on bond 5 Prepare the journal entries for above transactions. (Round answers to 0 decimal places, eg. 5,275. Credit account titles are automotically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) January 1, 2024 Interest Pavable Cash eTextbook and Media Assistance Used List of Accounts