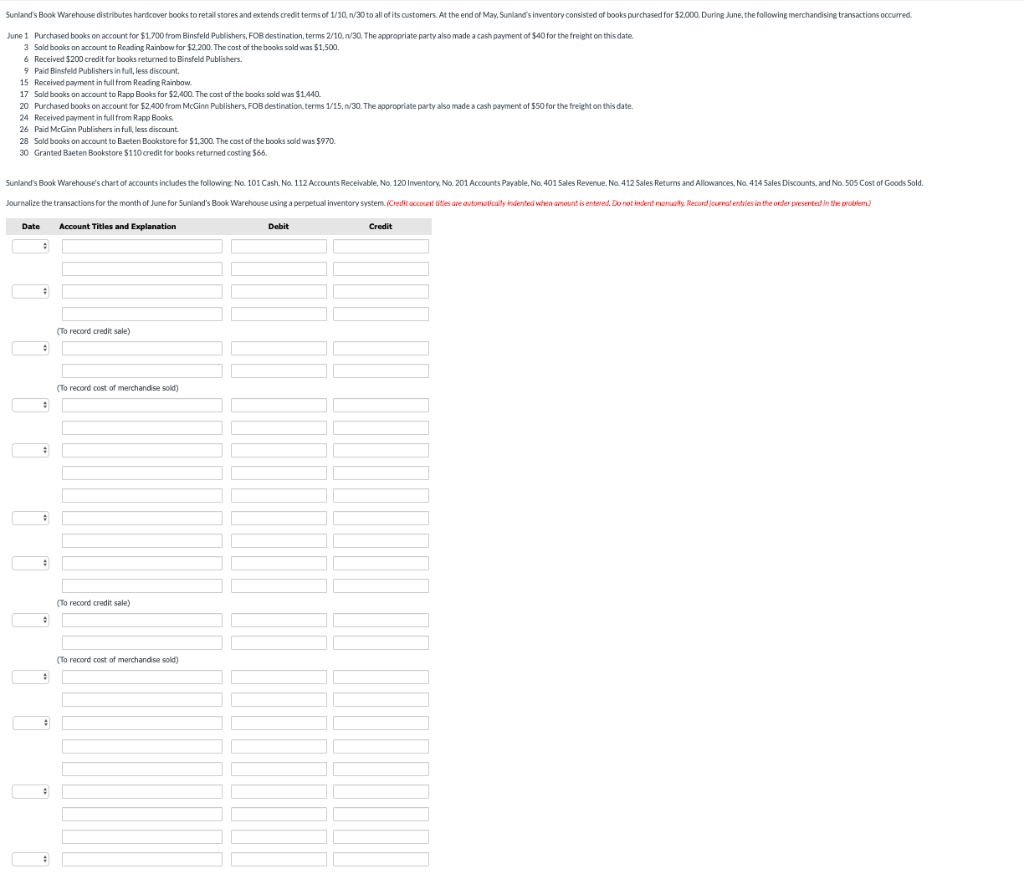

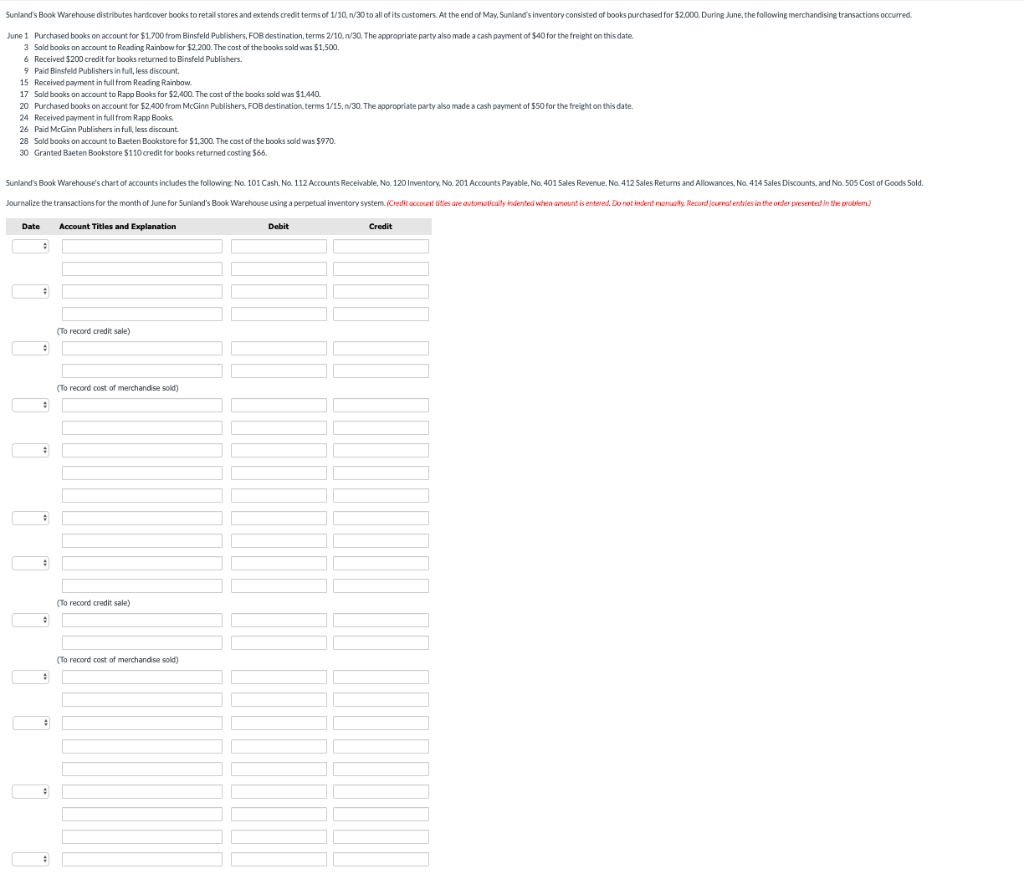

Sunland's Book Warehouse distributes hardcover books to retail stores and extends credit terms of 1/10, n/30 to all of its customers. At the end of May, Sunland's inventory consisted of books purchased for $2000 During June, the following merchandising transactions occurred. June 1 0, n/30, The appropriate party also made a cash payment of $40 for the freight on this date Purchased books on accour kodwas $1.500 6 Received $200 credit for books returned to Binsfeld Publishers. Paid Binsfeld Publishers in full, less discount 9 7 Eald ooks o crount to Raon Books for $2400. The cost of the books sold was $1440 Purchased books on account for $2.400 from McGinn Publishers, FOB destination, terms 1/15, n/30. The agpropriate party also made a cash payment of $50 for the freight on this date. 20 24 Received payment in full from Rapp Books. Soldbooks on account to Raeten Bookstore for $1.300 The cost of the books sold was $970. 28 30 Granted Baeten Bookstore $110 credit for books returned costing $66. Sunland's Book Warehouse's chart of accounts includes the following No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 201 Accounts Pavable, No, 401 Sales Revenue, No. 412 Sales Retuns and Allowances, No. 414 Sales Discounts, and No. 505 Cost of Goods Sold. Journalize the transactions for the month of June for Sunland 's Book Warehouse using a perpetual inventory system.(Credit account idles are automatically indented when amount is entered. Do not indent manualy Record jounal entries in the order presented In the problem) Account Titles and Explanation Date Debit Credit (To record credit sale) (To record cost of merchandise sold) (To record credit sale) t of marchandise sold) (To racord e # Sunland's Book Warehouse distributes hardcover books to retail stores and extends credit terms of 1/10, n/30 to all of its customers. At the end of May, Sunland's inventory consisted of books purchased for $2000 During June, the following merchandising transactions occurred. June 1 0, n/30, The appropriate party also made a cash payment of $40 for the freight on this date Purchased books on accour kodwas $1.500 6 Received $200 credit for books returned to Binsfeld Publishers. Paid Binsfeld Publishers in full, less discount 9 7 Eald ooks o crount to Raon Books for $2400. The cost of the books sold was $1440 Purchased books on account for $2.400 from McGinn Publishers, FOB destination, terms 1/15, n/30. The agpropriate party also made a cash payment of $50 for the freight on this date. 20 24 Received payment in full from Rapp Books. Soldbooks on account to Raeten Bookstore for $1.300 The cost of the books sold was $970. 28 30 Granted Baeten Bookstore $110 credit for books returned costing $66. Sunland's Book Warehouse's chart of accounts includes the following No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 201 Accounts Pavable, No, 401 Sales Revenue, No. 412 Sales Retuns and Allowances, No. 414 Sales Discounts, and No. 505 Cost of Goods Sold. Journalize the transactions for the month of June for Sunland 's Book Warehouse using a perpetual inventory system.(Credit account idles are automatically indented when amount is entered. Do not indent manualy Record jounal entries in the order presented In the problem) Account Titles and Explanation Date Debit Credit (To record credit sale) (To record cost of merchandise sold) (To record credit sale) t of marchandise sold) (To racord e #