Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sunland's tire division typically sold all of its output to the assembly division for use in its tricycle products. The market for tires was

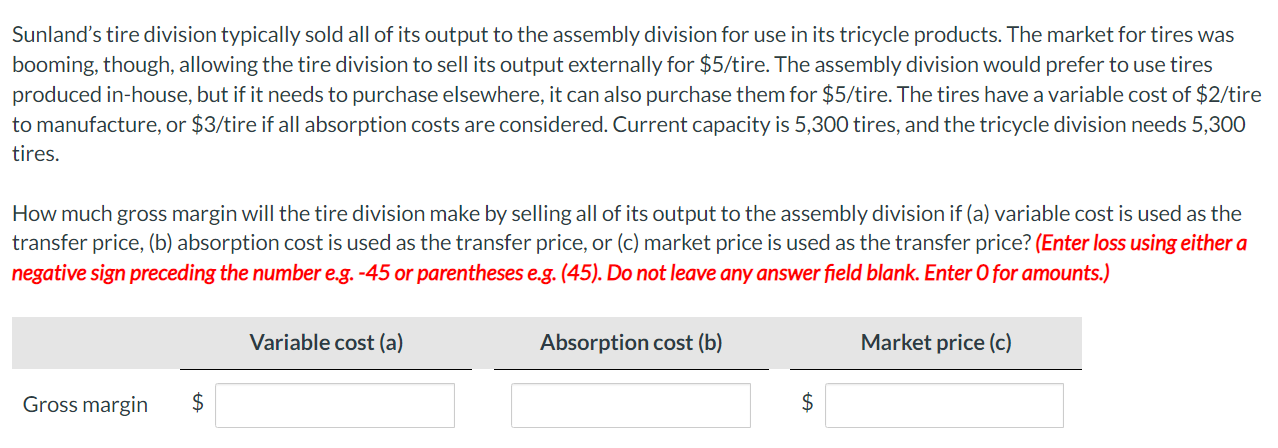

Sunland's tire division typically sold all of its output to the assembly division for use in its tricycle products. The market for tires was booming, though, allowing the tire division to sell its output externally for $5/tire. The assembly division would prefer to use tires produced in-house, but if it needs to purchase elsewhere, it can also purchase them for $5/tire. The tires have a variable cost of $2/tire to manufacture, or $3/tire if all absorption costs are considered. Current capacity is 5,300 tires, and the tricycle division needs 5,300 tires. How much gross margin will the tire division make by selling all of its output to the assembly division if (a) variable cost is used as the transfer price, (b) absorption cost is used as the transfer price, or (c) market price is used as the transfer price? (Enter loss using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Do not leave any answer field blank. Enter O for amounts.) Variable cost (a) Gross margin $ Absorption cost (b) Market price (c) $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

lets analyze each scenario and calculate the gross margin for Sunlands tire division under different ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started