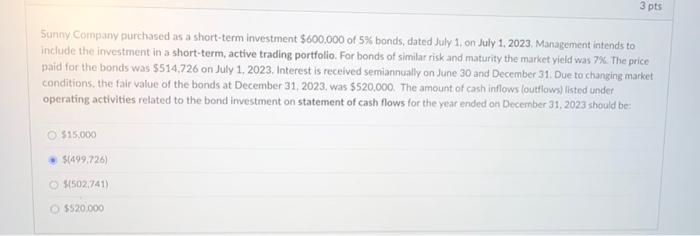

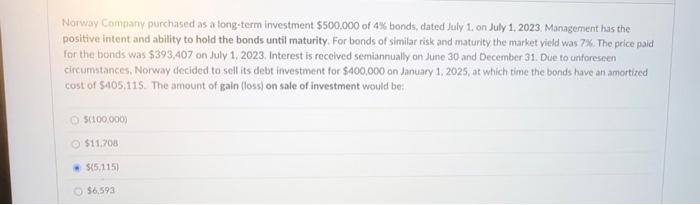

Sunny Company purchased as a short-term investment $600,000 of 5% bonds, dated July 1, on July 1, 2023, Management intends to include the investment in a short-term, active trading portfolio. For bonds of similar risk and maturity the market yield was 7%. The price paid for the bonds was $514,726 on July 1,2023 . Interest is recelved semiannually on June 30 and December 31 . Due to changing market conditions, the fair value of the bonds at December 31, 2023, was $520,000. The amount of cash inflows (outflows) listed under operating activities related to the bond investment on statement of cash flows for the year ended on December 31,2023 should be: $15,000 $(499.726) M(502.741) $520000 Norway Company purchased as a long-term investment $500,000 of 4% bonds, dated July 1, on July 1,2023. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 7%. The price paid for the bonds was $393,407 on July 1, 2023, Interest is feceived semiannually on June 30 and December 31 . Due to unforeseen circumstances, Norway decided to self its debt investment for $400,000 on January 1.2025, at which time the bonds have an amortized cost of $405,115. The amount of gain (loss) on sale of investment would be: s(100,000) $11,708 $(5,115) $6,593 Sunny Company purchased as a short-term investment $600,000 of 5% bonds, dated July 1, on July 1, 2023, Management intends to include the investment in a short-term, active trading portfolio. For bonds of similar risk and maturity the market yield was 7%. The price paid for the bonds was $514,726 on July 1,2023 . Interest is recelved semiannually on June 30 and December 31 . Due to changing market conditions, the fair value of the bonds at December 31, 2023, was $520,000. The amount of cash inflows (outflows) listed under operating activities related to the bond investment on statement of cash flows for the year ended on December 31,2023 should be: $15,000 $(499.726) M(502.741) $520000 Norway Company purchased as a long-term investment $500,000 of 4% bonds, dated July 1, on July 1,2023. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 7%. The price paid for the bonds was $393,407 on July 1, 2023, Interest is feceived semiannually on June 30 and December 31 . Due to unforeseen circumstances, Norway decided to self its debt investment for $400,000 on January 1.2025, at which time the bonds have an amortized cost of $405,115. The amount of gain (loss) on sale of investment would be: s(100,000) $11,708 $(5,115) $6,593