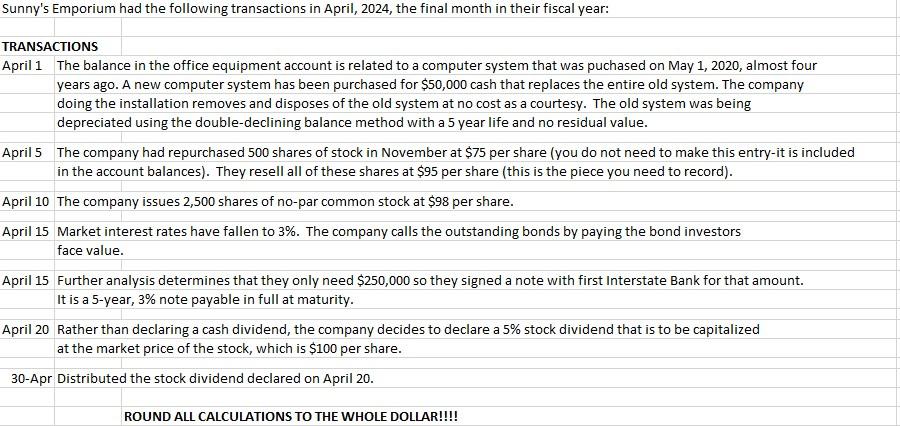

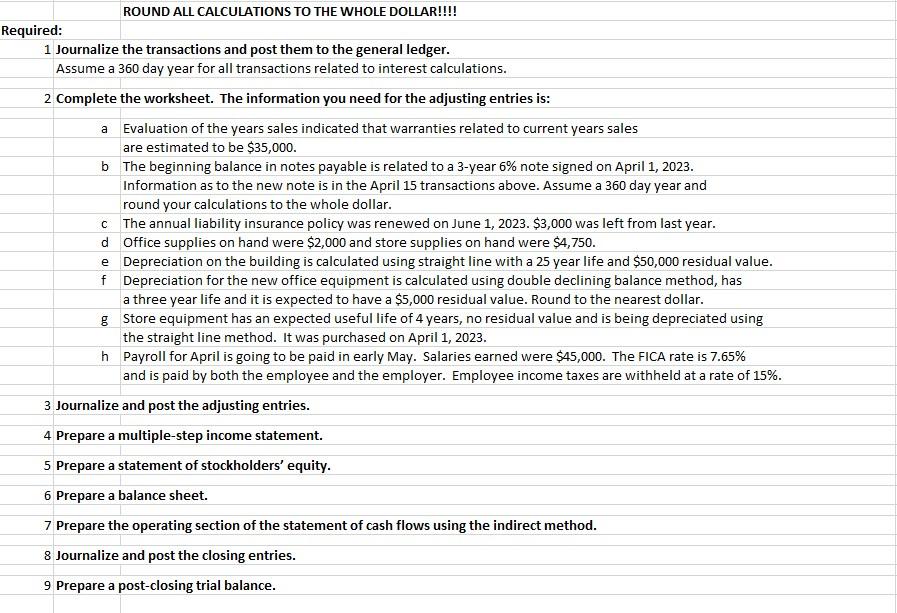

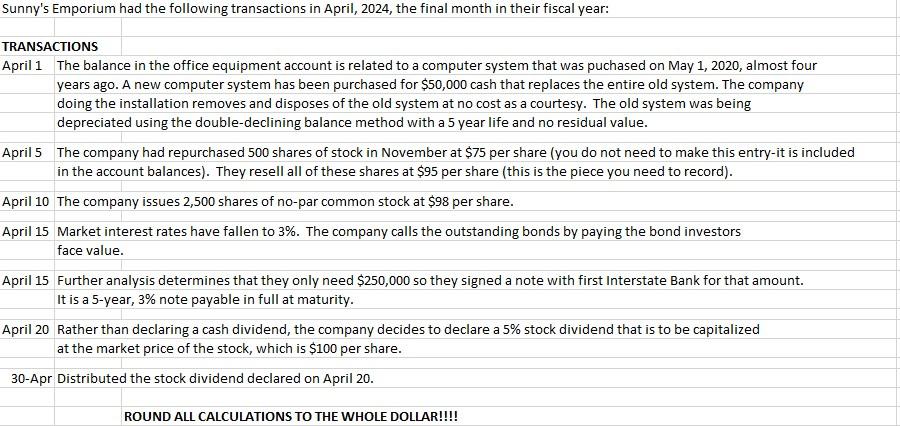

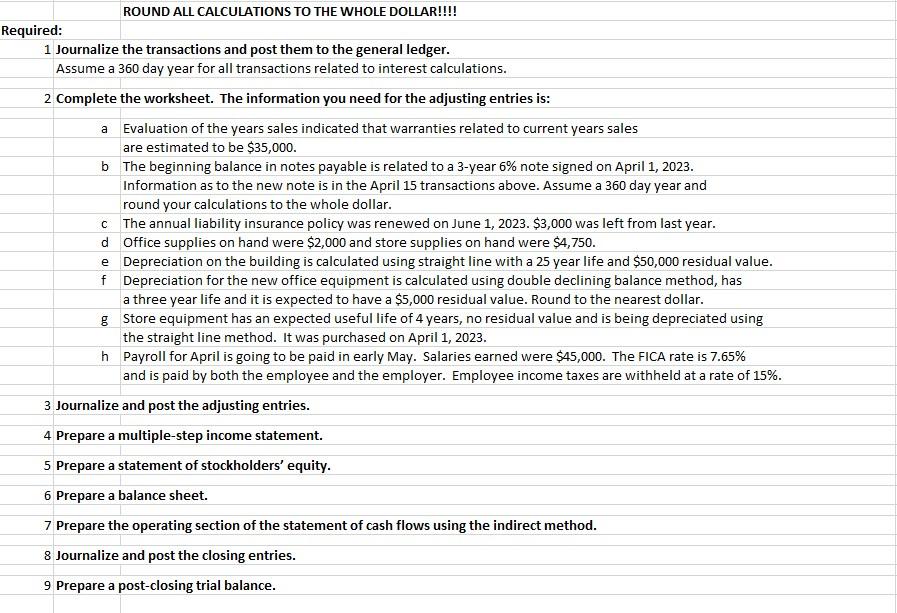

Sunny's Emporium had the following transactions in April, 2024, the final month in their fiscal year: TRANSACTIONS April 1 The balance in the office equipment account is related to a computer system that was puchased on May 1, 2020, almost four years ago. A new computer system has been purchased for $50,000 cash that replaces the entire old system. The company doing the installation removes and disposes of the old system at no cost as a courtesy. The old system was being depreciated using the double-declining balance method with a 5 year life and no residual value. April 5 The company had repurchased 500 shares of stock in November at $75 per share (you do not need to make this entry-it is included in the account balances). They resell all of these shares at $95 per share (this is the piece you need to record). April 10 The company issues 2,500 shares of no-par common stock at $98 per share. April 15 Market interest rates have fallen to 3%. The company calls the outstanding bonds by paying the bond investors face value. April 15 Further analysis determines that they only need $250,000 so they signed a note with first Interstate Bank for that amount. It is a 5 -year, 3% note payable in full at maturity. April 20 Rather than declaring a cash dividend, the company decides to declare a 5% stock dividend that is to be capitalized at the market price of the stock, which is $100 per share. 30-Apr Distributed the stock dividend declared on April 20. ROUND ALL CALCULATIONS TO THE WHOLE DOLLAR!!!! ROUND ALL CALCULATIONS TO THE WHOLE DOLLAR!!!! Required: 1 Journalize the transactions and post them to the general ledger. Assume a 360 day year for all transactions related to interest calculations. 2 Complete the worksheet. The information you need for the adjusting entries is: a Evaluation of the years sales indicated that warranties related to current years sales are estimated to be $35,000. b The beginning balance in notes payable is related to a 3-year 6% note signed on April 1, 2023. Information as to the new note is in the April 15 transactions above. Assume a 360 day year and round your calculations to the whole dollar. c The annual liability insurance policy was renewed on June 1,2023 . $3,000 was left from last year. d Office supplies on hand were $2,000 and store supplies on hand were $4,750. e Depreciation on the building is calculated using straight line with a 25 year life and $50,000 residual value. f Depreciation for the new office equipment is calculated using double declining balance method, has a three year life and it is expected to have a $5,000 residual value. Round to the nearest dollar. g Store equipment has an expected useful life of 4 years, no residual value and is being depreciated using the straight line method. It was purchased on April 1, 2023. h Payroll for April is going to be paid in early May. Salaries earned were $45,000. The FICA rate is 7.65% and is paid by both the employee and the employer. Employee income taxes are withheld at a rate of 15%. 3 Journalize and post the adjusting entries. 4 Prepare a multiple-step income statement. 5 Prepare a statement of stockholders' equity. 6 Prepare a balance sheet. 7 Prepare the operating section of the statement of cash flows using the indirect method. 8 Journalize and post the closing entries. 9 Prepare a post-closing trial balance. Sunny's Emporium had the following transactions in April, 2024, the final month in their fiscal year: TRANSACTIONS April 1 The balance in the office equipment account is related to a computer system that was puchased on May 1, 2020, almost four years ago. A new computer system has been purchased for $50,000 cash that replaces the entire old system. The company doing the installation removes and disposes of the old system at no cost as a courtesy. The old system was being depreciated using the double-declining balance method with a 5 year life and no residual value. April 5 The company had repurchased 500 shares of stock in November at $75 per share (you do not need to make this entry-it is included in the account balances). They resell all of these shares at $95 per share (this is the piece you need to record). April 10 The company issues 2,500 shares of no-par common stock at $98 per share. April 15 Market interest rates have fallen to 3%. The company calls the outstanding bonds by paying the bond investors face value. April 15 Further analysis determines that they only need $250,000 so they signed a note with first Interstate Bank for that amount. It is a 5 -year, 3% note payable in full at maturity. April 20 Rather than declaring a cash dividend, the company decides to declare a 5% stock dividend that is to be capitalized at the market price of the stock, which is $100 per share. 30-Apr Distributed the stock dividend declared on April 20. ROUND ALL CALCULATIONS TO THE WHOLE DOLLAR!!!! ROUND ALL CALCULATIONS TO THE WHOLE DOLLAR!!!! Required: 1 Journalize the transactions and post them to the general ledger. Assume a 360 day year for all transactions related to interest calculations. 2 Complete the worksheet. The information you need for the adjusting entries is: a Evaluation of the years sales indicated that warranties related to current years sales are estimated to be $35,000. b The beginning balance in notes payable is related to a 3-year 6% note signed on April 1, 2023. Information as to the new note is in the April 15 transactions above. Assume a 360 day year and round your calculations to the whole dollar. c The annual liability insurance policy was renewed on June 1,2023 . $3,000 was left from last year. d Office supplies on hand were $2,000 and store supplies on hand were $4,750. e Depreciation on the building is calculated using straight line with a 25 year life and $50,000 residual value. f Depreciation for the new office equipment is calculated using double declining balance method, has a three year life and it is expected to have a $5,000 residual value. Round to the nearest dollar. g Store equipment has an expected useful life of 4 years, no residual value and is being depreciated using the straight line method. It was purchased on April 1, 2023. h Payroll for April is going to be paid in early May. Salaries earned were $45,000. The FICA rate is 7.65% and is paid by both the employee and the employer. Employee income taxes are withheld at a rate of 15%. 3 Journalize and post the adjusting entries. 4 Prepare a multiple-step income statement. 5 Prepare a statement of stockholders' equity. 6 Prepare a balance sheet. 7 Prepare the operating section of the statement of cash flows using the indirect method. 8 Journalize and post the closing entries. 9 Prepare a post-closing trial balance