Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sunrise, Inc, has no debt outstanding and a total market value of $262,500. Earnings before interest and taxes, EBIT, are projected to be $42,000 If

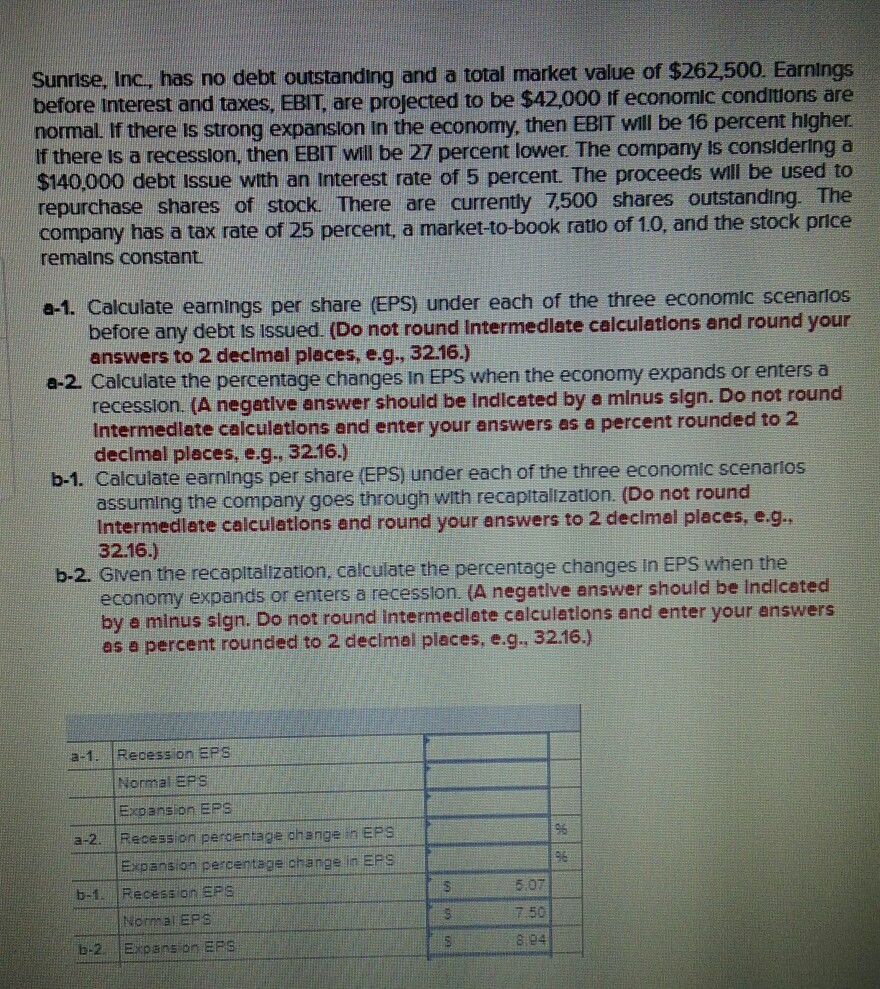

Sunrise, Inc, has no debt outstanding and a total market value of $262,500. Earnings before interest and taxes, EBIT, are projected to be $42,000 If economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 16 percent higher If there is a recession, then EBIT will be 27 percent lower. The company is considering a $140,000 debt Issue with an Interest rate of 5 percent. The proceeds will be used to repurchase shares of stock. There are currently 7.500 shares outstanding. The company has a tax rate of 25 percent, a market-to-book ratio of 1.0, and the stock price remains constant 2-1. Calculate earnings per share (EPS) under each of the three economic scenarios before any debt is issued. (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a-2. Calculate the percentage changes in EPS when the economy expands or enters a recession. (A negative answer should be Indicated by a minus sign. Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b-1. Calculate earnings per share (EPS) under each of the three economic scenarios assuming the company goes through with recapitalization. (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2. Given the recapitalization, calculate the percentage changes In EPS when the economy expands or enters a recession. (A negative answer should be Indicated by a minus sign. Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Recession EPS Normal EPS Expansion EPS a-2. Recession peroentage change in EPS Expansion percentage change in EPS b-1. Recession EPS Normal EPS b-2. Expansion EPS $ $ S 5.07 7.50 8.94

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started