Answered step by step

Verified Expert Solution

Question

1 Approved Answer

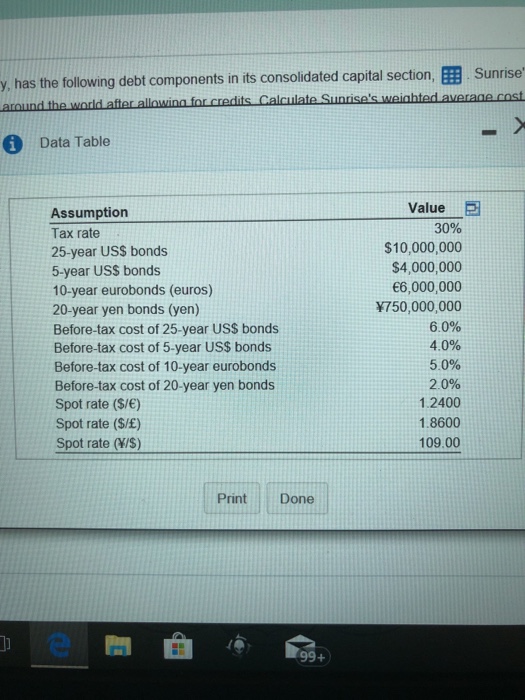

Sunrise Manufacturing, Inc., a U.S. multinational company, has the following debt components in its consolidated capital section. Sunrise's shareholders' equity is $50,000,000 and its finance

Sunrise Manufacturing, Inc., a U.S. multinational company, has the following debt components in its consolidated capital section.

Sunrise's shareholders' equity is $50,000,000

and its finance staff estimates their cost of equity to be 20%.

Current exchange rates are also listed in the table. Income taxes are 30%

around the world after allowing for credits. Calculate Sunrise's weighted average cost of capital. Are any assumptions implicit in your calculation?

What is Sunrise's weighted average cost of capital?

(Round to two decimal places.)

"This calculation assumes there is no expected change in the exchange rate over the life of the debt issue."

Is the above statement true or false?

False.

True.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started