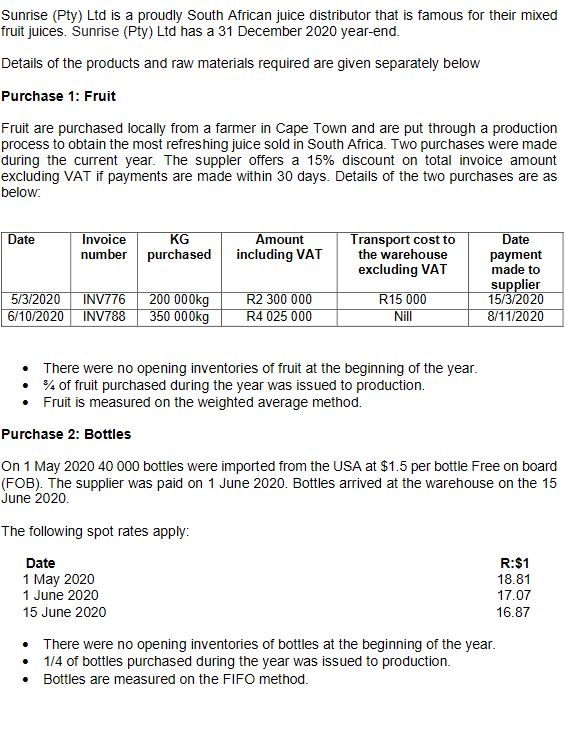

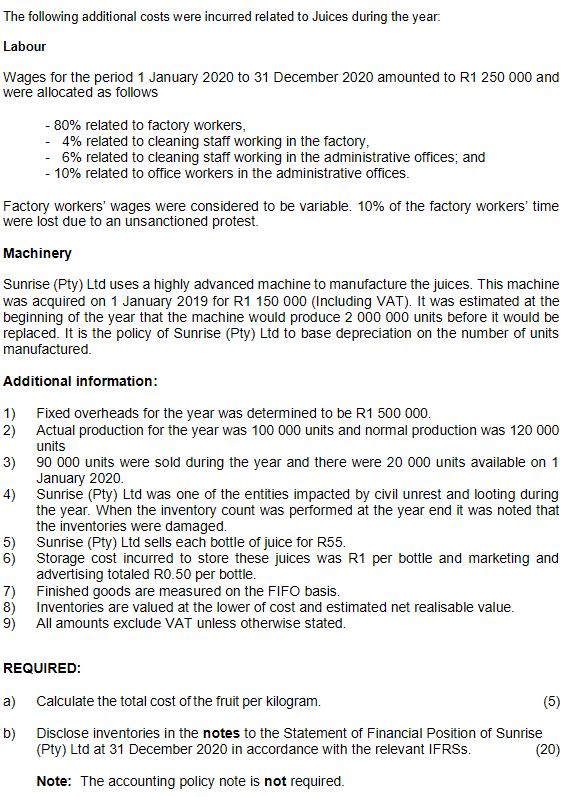

Sunrise (Pty) Lid is a proudly South African juice distributor that is famous for their mixed fruit juices. Sunrise (Pty) Ltd has a 31 December 2020 year-end Details of the products and raw materials required are given separately below Purchase 1: Fruit Fruit are purchased locally from a farmer in Cape Town and are put through a production process to obtain the most refreshing juice sold in South Africa. Two purchases were made during the current year. The suppler offers a 15% discount on total invoice amount excluding VAT if payments are made within 30 days. Details of the two purchases are as below. Date Invoice KG Amount Transport cost to Date number purchased including VAT the warehouse payment excluding VAT made to supplier 5/3/2020 INV776 200 000kg R2 300 000 R15 000 15/3/2020 6/10/2020 INV788 350 000kg R4 025 000 Nill 8/1 1/2020 . There were no opening inventories of fruit at the beginning of the year. 4 of fruit purchased during the year was issued to production. . . Fruit is measured on the weighted average method. Purchase 2: Bottles On 1 May 2020 40 000 bottles were imported from the USA at $1.5 per bottle Free on board (FOB). The supplier was paid on 1 June 2020. Bottles arrived at the warehouse on the 15 June 2020. The following spot rates apply: Date R:$1 1 May 2020 18.81 1 June 2020 17.07 15 June 2020 16.87 There were no opening inventories of bottles at the beginning of the year. 1/4 of bottles purchased during the year was issued to production. . . Bottles are measured on the FIFO method.The following additional costs were incurred related to Juices during the year Labour Wages for the period 1 January 2020 to 31 December 22 amounted to R1 250 000 and were allocated as fllOWS 80% retated to factory workers, 4% related to cleaning staff working in the factory, 6% related to cleaning staff working in the administrative ofces; and 10% retated to ofce workers in the administrative ofces. Factory wonters' wages were considered to be variable. 10% or the factory workers' time were lost due to an unsancticned protest. Machinery Sunrise (Pty) Ltd uses a highly advanced machineto manufacturethe juices. This machine was acquired on 1 January 2019 for R1 150 DDU [Including VAT). It was estimated at the beginning of the year that the machine would produce 2 pop oob units before it would be replaced. It is the policy of Sunrise (Piy) Ltd to base depreciation on the number of units manufactured. Additional information: 1} Fixed overheads for the yearwas determined to be R1 500 000. 2} Actual production forthe year was 100 coo units and normal production was 120 boo unhs 3} so Got} units were sold during the year and there were 20 con units available on 1 January 2020. 4} Sunrise {Pty} Ltd was one of the entities impacted by civil unrest and looting during the year. When the inventory count was performed at the year end it was noted that the inventories were damaged. 5} Sunrise (Pty) Ltd selis each bottle of juice for R55. 6} storage cost incurred to store these juices was R1 per bottle and marketing and advertising totaled $310.50 per bottle. ?} Finished goods are measured on the FlFO basis. 8} Inventories are valued at the lower or cost and estimated net realisable value. 9] Ail amounts exclude VAT unless otherwise stated. REQUIRED: a} Calcuiate thetotat cost ortrre fruit per kiiogram. (5) or Disclose inventories in the notes to the Statement of Financial Position oi Sunrise {Pty} Ltd at 31 December 2020 in accordance with the relevant IFRSs. (2o) Note: The accounting policy note is not required