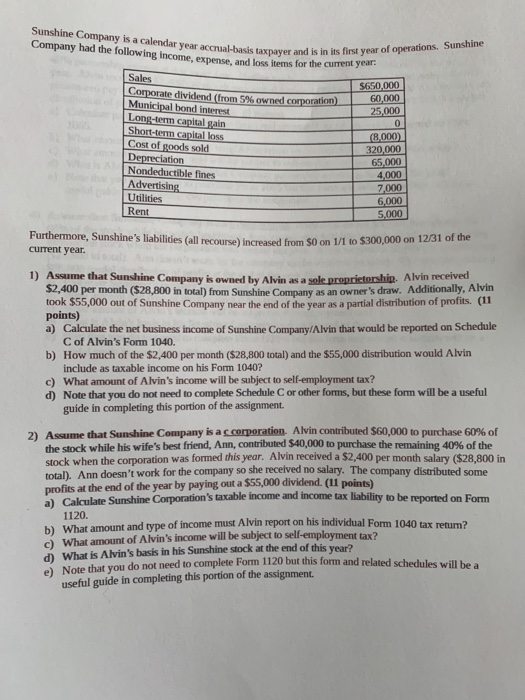

Sunshine Company is a calendar year accrual basis taxpayer and is in Company had the following income. Pxense and loss items for the current payer and is in its first year of operations. Sunshine Sales Corporate dividend (from 5% owned corporation) Municipal bond interest Long-term capital gain Short-term capital loss Cost of goods sold Depreciation Nondeductible fines Advertising Utilities Rent $650,000 60,000 25,000 0 (8,000 320,000 65,000 4.000 7,000 6,000 5.000 Furthermore, Sunshine's liabilities (all recourse) increased from $0 on 1/1 to $300,000 on 12 current year. any owned by Alvin as a sole $2,400 per month ($28. m 1) Assume that Sunshine Company is owned by Alvin as a sole proprietorship. Alvin received $2,400 per month ($28,800 in total from Sunshine Company as an owner's draw. Additionally, Alvin took $55,000 out of Sunshine Company near the end of the year as a partial distribution of profits. (11 points) a) Calculate the net business income of Sunshine Company Alvin that would be reported on Schedule C of Alvin's Form 1040. b) How much of the $2,400 per month ($28,800 total) and the $55,000 distribution would Alvin include as taxable income on his Form 1040? c) What amount of Alvin's income will be subject to self-employment tax? d) Note that you do not need to complete Schedule C or other forms, but these form will be a useful guide in completing this portion of the assignment. 2) Assume that Sunshine Company is a corporation. Alvin contributed $60,000 to purchase 60% of the stock while his wife's best friend, Ann, contributed $40,000 to purchase the remaining 40% of the stock when the corporation was formed this year. Alvin received a $2,400 per month salary ($28 800 in totall. Ann doesn't work for the company so she received no salary. The company distributed some profits at the end of the year by paying out a $55,000 dividend. (11 points) al Calculate Sunshine Corporation's taxable income and income tax liability to be reported on Form 1120. b) What amount and type of income must Alvin report on his individual Form 1040 tayo c) What amount of Alvin's income will be subject to self-employment tax? d) What is Alvin's basis in his Sunshine stock at the end of this year? Note that you do not need to complete com 1120 but this form and related schedules will be useful guide in completing this portion of the assignment