Question

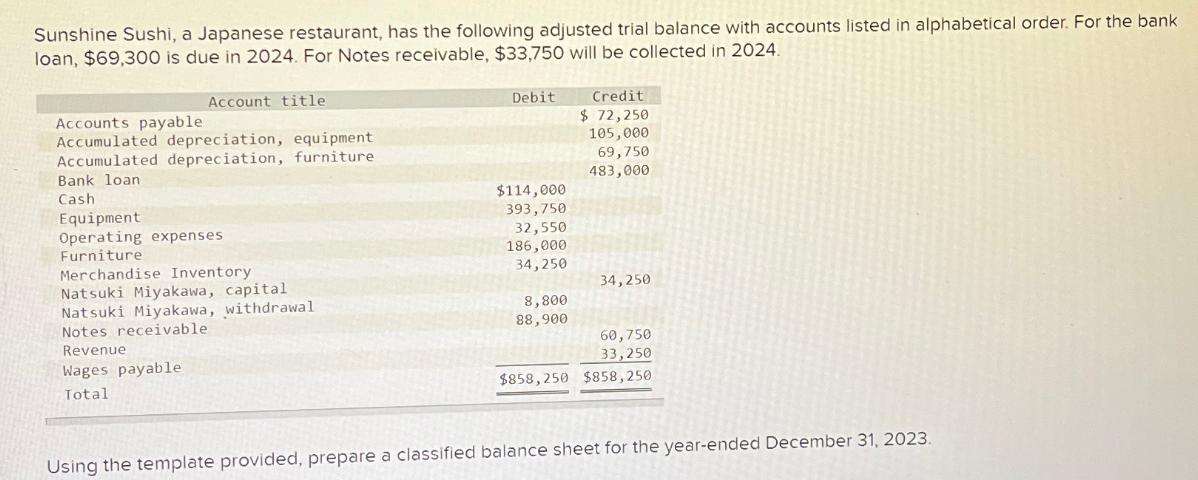

Sunshine Sushi, a Japanese restaurant, has the following adjusted trial balance with accounts listed in alphabetical order. For the bank loan, $69,300 is due

Sunshine Sushi, a Japanese restaurant, has the following adjusted trial balance with accounts listed in alphabetical order. For the bank loan, $69,300 is due in 2024. For Notes receivable, $33,750 will be collected in 2024. Account title Accounts payable Accumulated depreciation, equipment Accumulated depreciation, furniture Bank loan Cash Equipment Operating expenses Furniture Merchandise Inventory Natsuki Miyakawa, capital Natsuki Miyakawa, withdrawal Notes receivable Revenue Wages payable Total Debit Credit $ 72,250 105,000 69,750 483,000 $114,000 393,750 32,550 186,000 34,250 34,250 8,800 88,900 60,750 33,250 $858,250 $858,250 Using the template provided, prepare a classified balance sheet for the year-ended December 31, 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume I

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

16th Canadian edition

978-1260305821

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App