Answered step by step

Verified Expert Solution

Question

1 Approved Answer

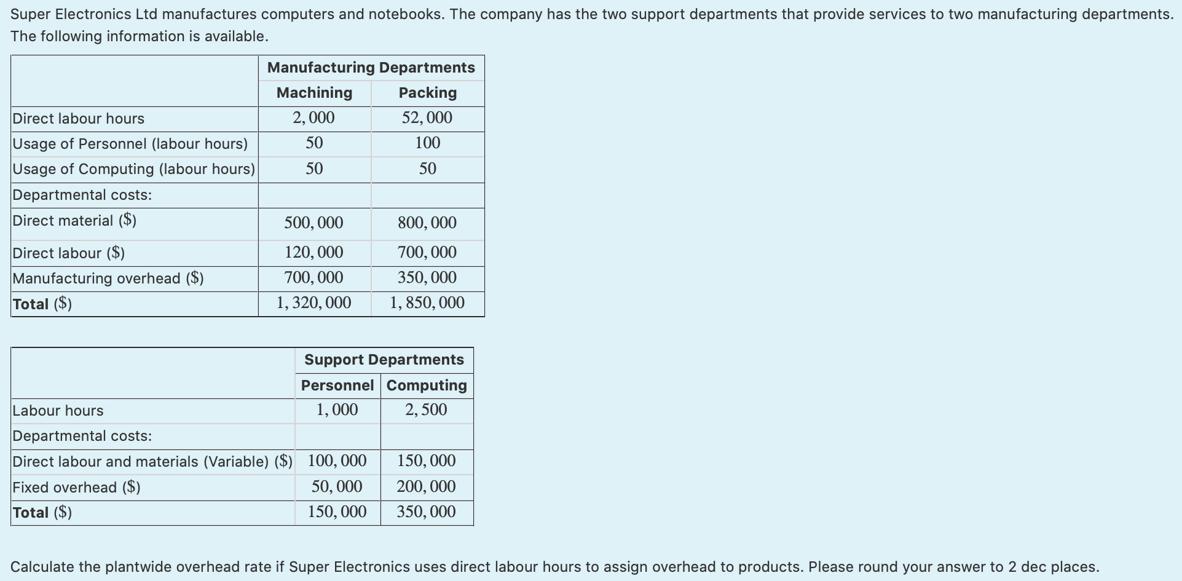

Super Electronics Ltd manufactures computers and notebooks. The company has the two support departments that provide services to two manufacturing departments. The following information

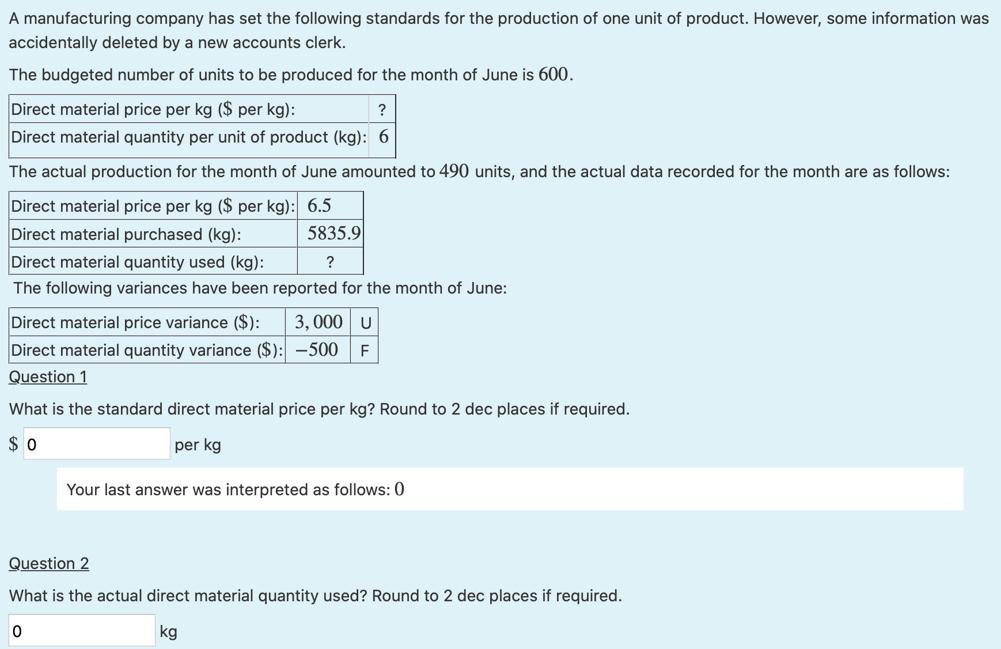

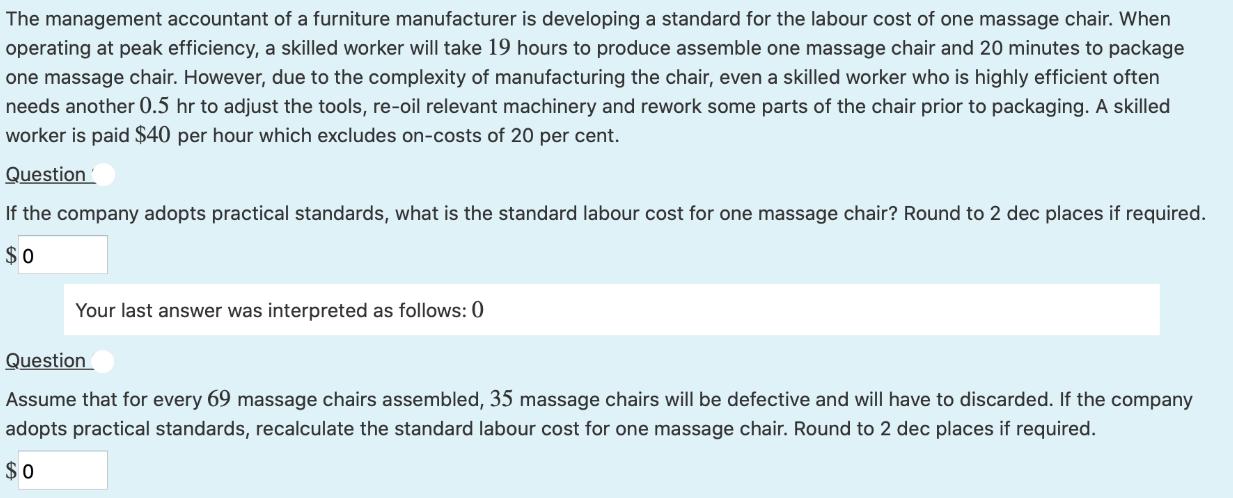

Super Electronics Ltd manufactures computers and notebooks. The company has the two support departments that provide services to two manufacturing departments. The following information is available. Direct labour hours Usage of Personnel (labour hours) Usage of Computing (labour hours) Departmental costs: Direct material ($) Direct labour ($) Manufacturing overhead ($) Total ($) Manufacturing Departments Machining Packing 2,000 52,000 50 100 50 50 500,000 120,000 700,000 1,320,000 800,000 700,000 350,000 1,850,000 Support Departments Personnel Computing 1,000 2,500 Labour hours Departmental costs: Direct labour and materials (Var ble) ($) 100,000 Fixed overhead ($) 50,000 Total ($) 150,000 150,000 200,000 350,000 Calculate the plantwide overhead rate if Super Electronics uses direct labour hours to assign overhead to products. Please round your answer to 2 dec places. A manufacturing company has set the following standards for the production of one unit of product. However, some information was accidentally deleted by a new accounts clerk. The budgeted number of units to be produced for the month of June is 600. Direct material price per kg ($ per kg): ? Direct material quantity per unit of product (kg): 6 The actual production for the month of June amounted to 490 units, and the actual data recorded for the month are as follows: Direct material price per kg ($ per kg): 6.5 Direct material purchased (kg): 5835.9 ? Direct material quantity used (kg): The following variances have been reported for the month of June: Direct material price variance ($): 3,000 U Direct material quantity variance ($): -500 F Question 1 What is the standard direct material price per kg? Round to 2 dec places if required. $0 per kg Your last answer was interpreted as follows: 0 Question 2 What is the actual direct material quantity used? Round to 2 dec places if required. 0 kg The management accountant of a furniture manufacturer is developing a standard for the labour cost of one massage chair. When operating at peak efficiency, a skilled worker will take 19 hours to produce assemble one massage chair and 20 minutes to package one massage chair. However, due to the complexity of manufacturing the chair, even a skilled worker who is highly efficient often needs another 0.5 hr to adjust the tools, re-oil relevant machinery and rework some parts of the chair prior to packaging. A skilled worker is paid $40 per hour which excludes on-costs of 20 per cent. Question If the company adopts practical standards, what is the standard labour cost for one massage chair? Round to 2 dec places if required. $0 Your last answer was interpreted as follows: 0 Question Assume that for every 69 massage chairs assembled, 35 massage chairs will be defective and will have to discarded. If the company adopts practical standards, recalculate the standard labour cost for one massage chair. Round to 2 dec places if required. $0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets tackle each question one by one First ImageQuestion Calculate the plantwide overhead rate Plantwide overhead rate is calculated by dividing total manufacturing overhead costs by the total number ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started