Answered step by step

Verified Expert Solution

Question

1 Approved Answer

super stuck in this pls help! 12 pts- Calculations and results. Show your calculations and write all results in complete sentences. Be specific as possible.

super stuck in this pls help!

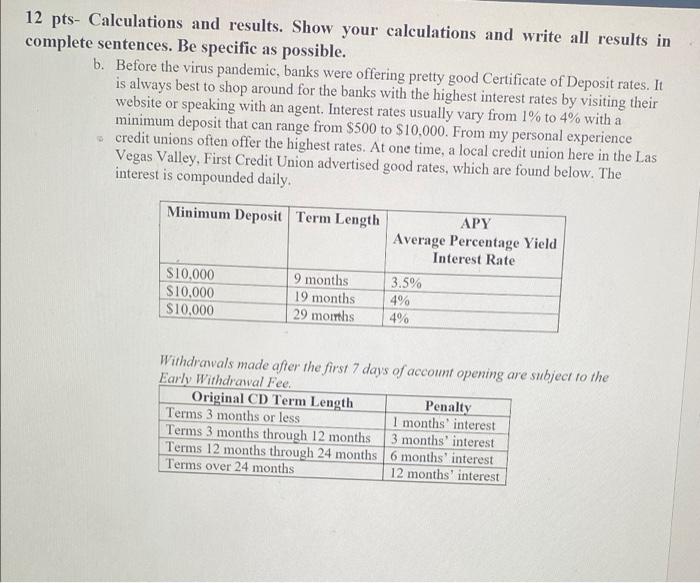

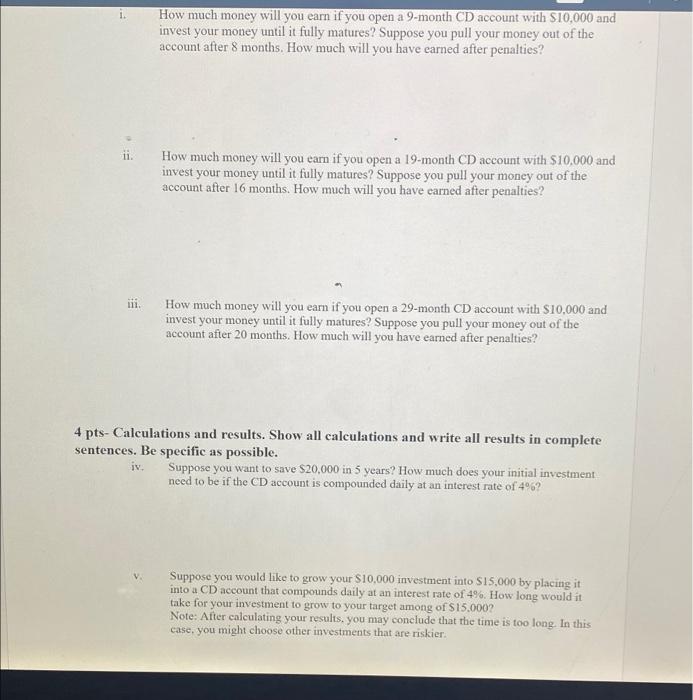

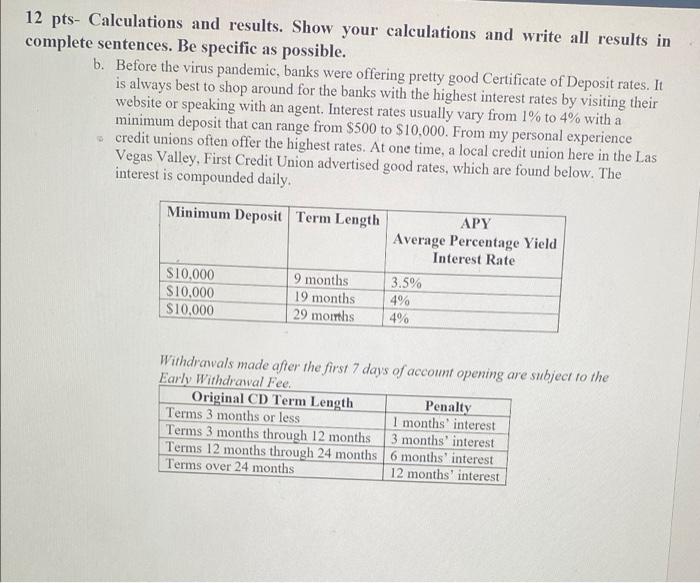

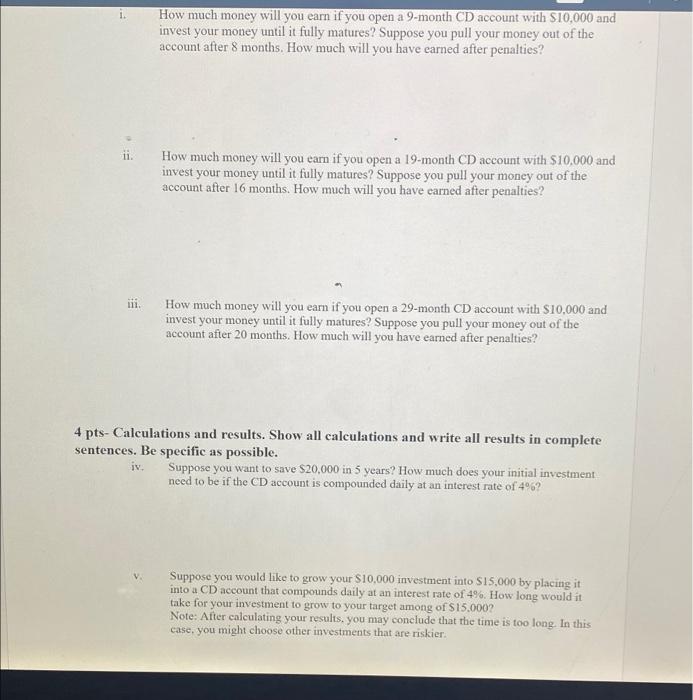

12 pts- Calculations and results. Show your calculations and write all results in complete sentences. Be specific as possible. b. Before the virus pandemic, banks were offering pretty good Certificate of Deposit rates. It is always best to shop around for the banks with the highest interest rates by visiting their website or speaking with an agent. Interest rates usually vary from 1% to 4% with a minimum deposit that can range from $500 to $10,000. From my personal experience credit unions often offer the highest rates. At one time, a local credit union here in the Las Vegas Valley, First Credit Union advertised good rates, which are found below. The interest is compounded daily. Minimum Deposit Term Length APY Average Percentage Yield Interest Rate $10,000 9 months 3.5% $10,000 19 months 4% $10,000 29 months 4% Withdrawals made after the first 7 days of account opening are subject to the Early Withdrawal Fee. Penalty Original CD Term Length Terms 3 months or less 1 months' interest Terms 3 months through 12 months 3 months' interest Terms 12 months through 24 months Terms over 24 months 6 months' interest 12 months' interest How much money will you earn if you open a 9-month CD account with $10,000 and invest your money until it fully matures? Suppose you pull your money out of the account after 8 months. How much will you have earned after penalties? ii. How much money will you earn if you open a 19-month CD account with $10,000 and t your money until it fully matures? Suppose you pull your money out of the account after 16 months. How much will you have earned after penalties? invest iii. How much money will you earn if you open a 29-month CD account with $10,000 and invest your money until it fully matures? Suppose you pull your money out of the account after 20 months. How much will you have earned after penalties? 4 pts- Calculations and results. Show all calculations and write all results in complete sentences. Be specific as possible. iv. Suppose you want to save $20,000 in 5 years? How much does your initial investment need to be if the CD account is compounded daily at an interest rate of 4%? Suppose you would like to grow your $10,000 investment into $15,000 by placing it into a CD account that compounds daily at an interest rate of 4%. How long would it take for your investment to grow to your target among of $15.000? Note: After calculating your results, you may conclude that the time is too long. In this case, you might choose other investments that are riskier. P Page c. Consider parts i-iii, discuss which investment seems like the best option given your financial obligations/spending habits and state your reason for your choice. Consider the length of time, penalties for early withdrawal and interest earned over time. Would you consider investing in a CD in "real-life?" Why? 4 Pts- Reflection. Write at least 4 sentences. A of 3 12 pts- Calculations and results. Show your calculations and write all results in complete sentences. Be specific as possible. b. Before the virus pandemic, banks were offering pretty good Certificate of Deposit rates. It is always best to shop around for the banks with the highest interest rates by visiting their website or speaking with an agent. Interest rates usually vary from 1% to 4% with a minimum deposit that can range from $500 to $10,000. From my personal experience credit unions often offer the highest rates. At one time, a local credit union here in the Las Vegas Valley, First Credit Union advertised good rates, which are found below. The interest is compounded daily. Minimum Deposit Term Length APY Average Percentage Yield Interest Rate $10,000 9 months 3.5% $10,000 19 months 4% $10,000 29 months 4% Withdrawals made after the first 7 days of account opening are subject to the Early Withdrawal Fee. Penalty Original CD Term Length Terms 3 months or less 1 months' interest Terms 3 months through 12 months 3 months' interest Terms 12 months through 24 months Terms over 24 months 6 months' interest 12 months' interest How much money will you earn if you open a 9-month CD account with $10,000 and invest your money until it fully matures? Suppose you pull your money out of the account after 8 months. How much will you have earned after penalties? ii. How much money will you earn if you open a 19-month CD account with $10,000 and t your money until it fully matures? Suppose you pull your money out of the account after 16 months. How much will you have earned after penalties? invest iii. How much money will you earn if you open a 29-month CD account with $10,000 and invest your money until it fully matures? Suppose you pull your money out of the account after 20 months. How much will you have earned after penalties? 4 pts- Calculations and results. Show all calculations and write all results in complete sentences. Be specific as possible. iv. Suppose you want to save $20,000 in 5 years? How much does your initial investment need to be if the CD account is compounded daily at an interest rate of 4%? Suppose you would like to grow your $10,000 investment into $15,000 by placing it into a CD account that compounds daily at an interest rate of 4%. How long would it take for your investment to grow to your target among of $15.000? Note: After calculating your results, you may conclude that the time is too long. In this case, you might choose other investments that are riskier. P Page c. Consider parts i-iii, discuss which investment seems like the best option given your financial obligations/spending habits and state your reason for your choice. Consider the length of time, penalties for early withdrawal and interest earned over time. Would you consider investing in a CD in "real-life?" Why? 4 Pts- Reflection. Write at least 4 sentences. A of 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started