Answered step by step

Verified Expert Solution

Question

1 Approved Answer

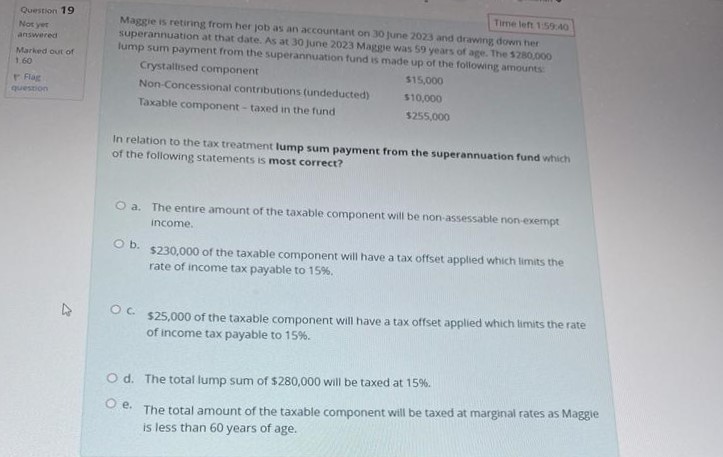

superant iot as an accountant on 3 0 June 2 0 2 3 and drawng down her lump sum payment from the sup at 3

superant iot as an accountant on June and drawng down her

lump sum payment from the sup at June Magge was years of age. The $

sum payment from the superannuation fund made the for

Crystaltised component

NonConcessional contributions

Taxable component taxed the fund

In relation to the tax treatment lump sum payment from the superannuation fund which

of the following statements is most correct?

a The entire amount of the taxable component will be nonassessabte nonexempt

income.

b $ of the taxable component will have a tax offset applied which limits the

rate of income tax payable to

c $ of the taxable component will have a tax offset applied which limits the rate

of income tax payable to

d The total lump sum of $ will be taxed at

e The total amount of the taxable component will be taxed at marginal rates as Maggie

is less than years of age.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started