Question

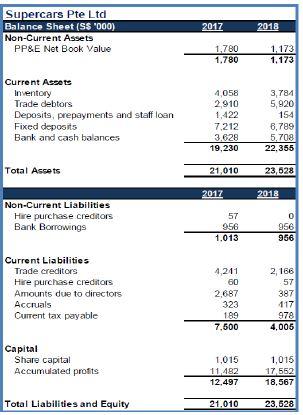

Supercars Pte Ltd was established in 2010. The principal activities of SPL are sale of cars, automotive spare parts and repair services. Its balance sheets

Supercars Pte Ltd was established in 2010. The principal activities of SPL are sale of cars, automotive spare parts and repair services. Its balance sheets and other relevant information are provided below.

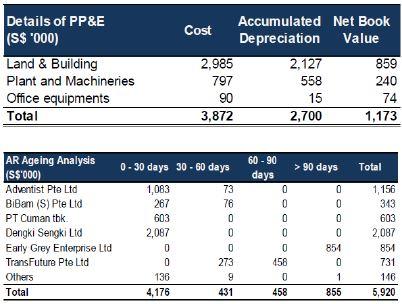

SPL commissioned Jones Lang Lasalle to conduct a valuation on its land and building located in Jurong and Batam. As of 31.12.2018, the Fair Value of the land and building was estimated at S$1,800,000. SPL represents that all the plant & machineries were bought in 2011. The replacement cost for new machines similar to SPLs plant & machineries was estimated at S$1,200,000. The debt owing by Early Grey Enterprise is currently older than a year. This customer is currently facing financial difficulties. The FC of SPL has been chasing for the payment since a year ago.

(a) Perform a valuation of SPL as at 31 December 2018 using the cost approach (or net asset approach). List down the reasons why you believe this approach is/is not applicable. (b) Compute the weighted average cost of capital of SPL and show how you derive it. Then walk through your rationale and basis. Assume Market Value of Debt to Market Value of Equity is 21.64%.

2017 Supercars Pte Ltd Balance Sheet (S$ 000) Non-Current Assets PP&E Net Book Value 2018 1.780 1.780 1.173 1,173 Current Assets Inventory Trade debtors Deposits, prepayments and staff loan Fixed deposits Bank and cash balances 4,058 2.910 1,422 7,212 3.628 19,230 3,784 5,920 154 6,789 5,708 22,355 Total Assets 21,010 23,628 2017 2018 Non-Current Liabilities Hire purchase creditors Bank Borrowings 57 956 1,013 956 956 Current Liabilities Trade creditors Hire purchase creditors Amounts due to directors Accruals Current tax payable 4,211 60 2.687 323 189 7,500 2,166 57 387 117 978 4,005 Capital Share capital Accumulated profits 1,015 11.482 12.497 1,015 11.552 18,567 Total Liabilities and Equity 21.010 23.628 Details of PP&E (S$ '000) Land & Building Plant and Machineries Office equipments Total Accumulated Net Book Cost Depreciation Value 2,985 2,127 859 797 558 240 90 15 74 3,872 2,700 1,173 > 90 days Total AR Ageing Analysis (S$ 000) Adventist Pte Ltd BiBam (S) Pte Ltd PT Cuman tbk. Dengki Sengki Ltd Early Grey Enterprise Ltd TransFuture Pte Ltd Others Total 0-30 days 30 - 60 days 1,083 73 267 76 603 0 2,087 0 0 0 0 273 136 9 4,176 431 60-90 days 0 0 0 0 0 458 0 458 0 0 0 0 854 0 1 855 1 156 343 603 2,087 854 731 146 5,920 2017 Supercars Pte Ltd Balance Sheet (S$ 000) Non-Current Assets PP&E Net Book Value 2018 1.780 1.780 1.173 1,173 Current Assets Inventory Trade debtors Deposits, prepayments and staff loan Fixed deposits Bank and cash balances 4,058 2.910 1,422 7,212 3.628 19,230 3,784 5,920 154 6,789 5,708 22,355 Total Assets 21,010 23,628 2017 2018 Non-Current Liabilities Hire purchase creditors Bank Borrowings 57 956 1,013 956 956 Current Liabilities Trade creditors Hire purchase creditors Amounts due to directors Accruals Current tax payable 4,211 60 2.687 323 189 7,500 2,166 57 387 117 978 4,005 Capital Share capital Accumulated profits 1,015 11.482 12.497 1,015 11.552 18,567 Total Liabilities and Equity 21.010 23.628 Details of PP&E (S$ '000) Land & Building Plant and Machineries Office equipments Total Accumulated Net Book Cost Depreciation Value 2,985 2,127 859 797 558 240 90 15 74 3,872 2,700 1,173 > 90 days Total AR Ageing Analysis (S$ 000) Adventist Pte Ltd BiBam (S) Pte Ltd PT Cuman tbk. Dengki Sengki Ltd Early Grey Enterprise Ltd TransFuture Pte Ltd Others Total 0-30 days 30 - 60 days 1,083 73 267 76 603 0 2,087 0 0 0 0 273 136 9 4,176 431 60-90 days 0 0 0 0 0 458 0 458 0 0 0 0 854 0 1 855 1 156 343 603 2,087 854 731 146 5,920Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started