Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Superior prepares adjusting journal entries yearly. The information for your adjusting entries (prepare adjusting entries on the worksheet only): a. The insurance expense balance

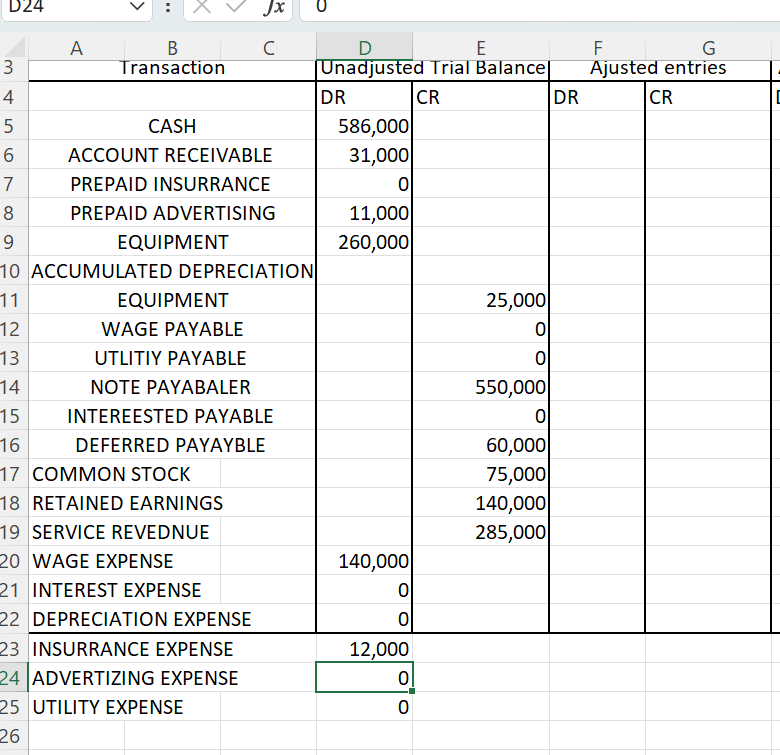

Superior prepares adjusting journal entries yearly. The information for your adjusting entries (prepare adjusting entries on the worksheet only): a. The insurance expense balance represents a one-year policy purchased on September 1, 2023. The policy covers the period from September 1, 2023, through August 31, 2024. b. The $11,000 balance in the prepaid advertising account represents $5,000 in advertising for 2023 and a $6,000 prepayment for advertising in 2024. c. The equipment was purchased in 2022 for $260,000 and is being depreciated using the straight-line method over a ten-year useful life. The estimated salvage value is $10,000. d. At year-end, wages of $11,000 should be accrued. e. The company borrowed $550,000 on October 1, 2023. The principal and interest will be repaid on March 31, 2024. The interest rate on this note payable is 6%. (Round to the nearest dollar). f. The deferred revenue account represents $60,000 in advance payments. As of December 31, 2023, 40% of this amount has not yet been earned. g. Superior has not yet accrued a $5,000 utility (electric) bill for December of 2023. 2. Use the adjusted trial balance you completed in part 1 and prepare the following financial statements: a. A 2023 income statement. Assume no income tax expense for the year. You do not need to divide operating expenses between selling expenses and administrative expenses. A sample income statement is provided on page 71 of your textbook. Do not include accounts on an statement that are unnecessary. For example, Superior will not have cost of goods sold on its income statement. D24 Jx A B C D 3 Transaction E |Unadjusted Trial Balance| 4 5 DR CR CASH 586,000 6 ACCOUNT RECEIVABLE 7 PREPAID INSURRANCE 8 PREPAID ADVERTISING 9 EQUIPMENT 10 ACCUMULATED DEPRECIATION 11 EQUIPMENT 12 WAGE PAYABLE 13 UTLITIY PAYABLE 14 NOTE PAYABALER 15 16 31,000 11,000 260,000 25,000 0 0 INTEREESTED PAYABLE DEFERRED PAYAYBLE 17 COMMON STOCK 18 RETAINED EARNINGS 19 SERVICE REVEDNUE 20 WAGE EXPENSE 550,000 60,000 75,000 140,000 285,000 140,000 21 INTEREST EXPENSE 22 DEPRECIATION EXPENSE 23 INSURRANCE EXPENSE 24 ADVERTIZING EXPENSE 25 UTILITY EXPENSE 26 0 12,000 0 0 G Ajusted entries F DR CR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started