Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Superior Skateboard Company, located in Ontario, is preparing adjusting entries at December 31, 2020. An analysis reveals the following: a. During December, Superior sold

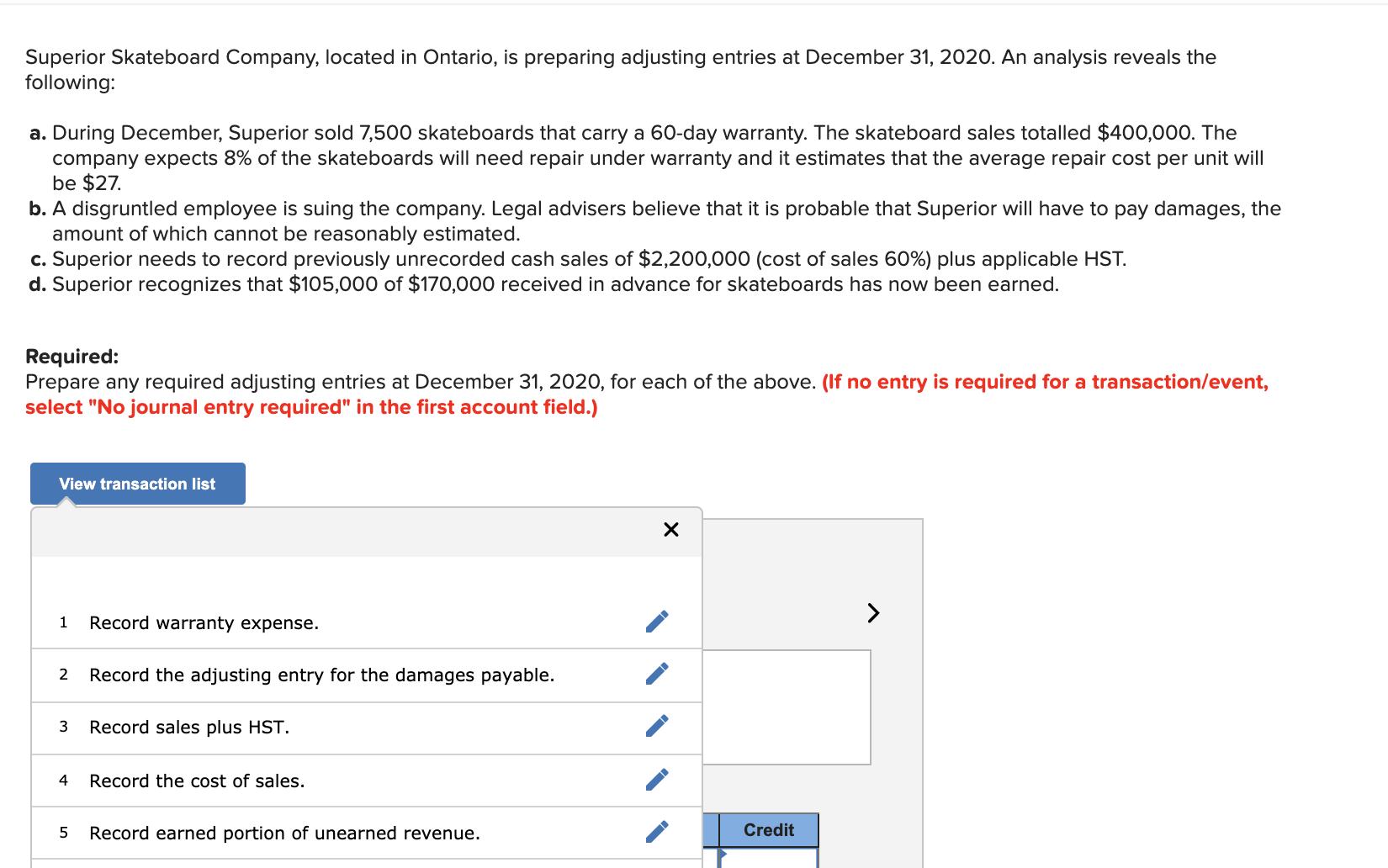

Superior Skateboard Company, located in Ontario, is preparing adjusting entries at December 31, 2020. An analysis reveals the following: a. During December, Superior sold 7,500 skateboards that carry a 60-day warranty. The skateboard sales totalled $400,000. The company expects 8% of the skateboards will need repair under warranty and it estimates that the average repair cost per unit will be $27. b. A disgruntled employee is suing the company. Legal advisers believe that it is probable that Superior will have to pay damages, the amount of which cannot be reasonably estimated. c. Superior needs to record previously unrecorded cash sales of $2,200,000 (cost of sales 60%) plus applicable HST. d. Superior recognizes that $105,000 of $170,000 received in advance for skateboards has now been earned. Required: Prepare any required adjusting entries at December 31, 2020, for each of the above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list > 1 Record warranty expense. 2 Record the adjusting entry for the damages payable. Record sales plus HST. 4 Record the cost of sales. Record earned portion of unearned revenue. Credit

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6360173c67977_233560.pdf

180 KBs PDF File

6360173c67977_233560.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started