Question

Supermarket customers load their carts with goods totaling between $5 and $250 uniformly (and continuously) distributed; call this the raw order amount. Assume that customers

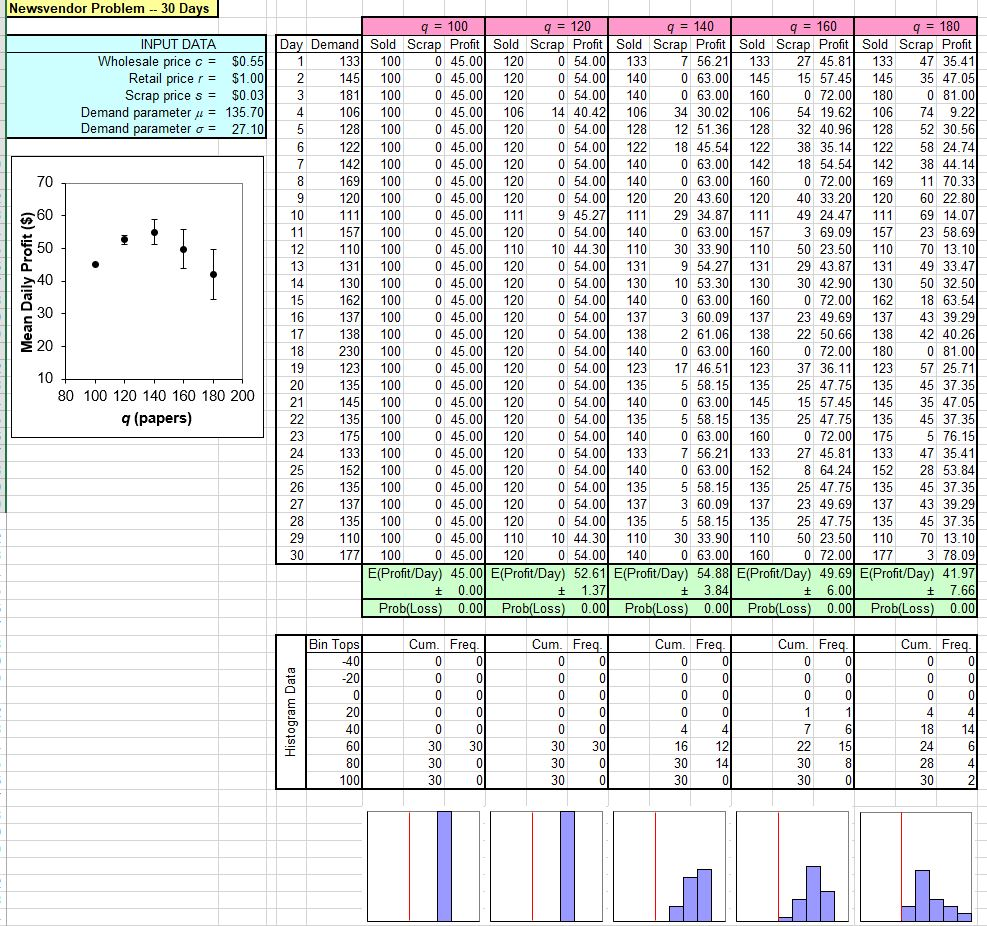

Supermarket customers load their carts with goods totaling between $5 and $250 uniformly (and continuously) distributed; call this the raw order amount. Assume that customers purchase independently of each other. At checkout, 63% of customers have a loyalty card that gives them 4% off their raw order amount. Also at checkout, 18% of customers have coupons that give them 7% off their raw order amount. These two discounts occur independently of each other, and a given customer could have one or the other of them, both of them, or neither of them. To get to their net order amount (what they actually pay) construct a spreadsheet simulation to simulate 100 customers and collect statistics on the net order amount; these statistics should include the average, standard deviation, minimum, maximum, and a histogram to describe the distribution of the net order amounts between $0 and $250. To make the requested histogram, you can either mimic what was done in the newsvendor spreadsheet simulation, or use a different approach via whatever built-in Excel facilities you'd like. (HINT: To decide whether a customer gets a loyalty discount, explore the Excel IF function with the first argument's being a random number RAND() distributed uniformly between 0 and 1; do similarly to decide on a coupon discount.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started