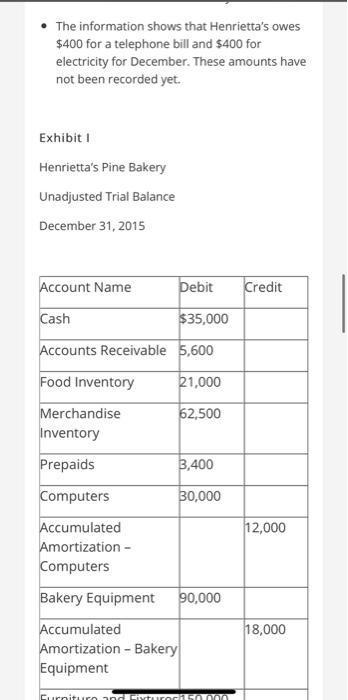

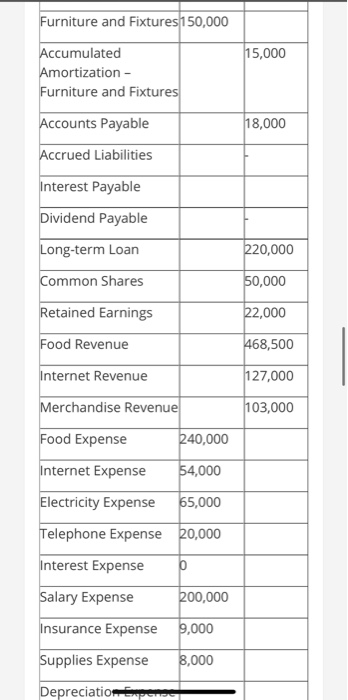

Supplementary Information The amount currently sitting in prepaids arose due the insurance policy last year. Geoff didn't know how to correct it, so he left it. This year's insurance policy was purchased on November 1 for $9,000. The policy runs from November 1 to October 31 of each year. Geoff has a note that he owed $900 in wages to his employees for the period ending December 31st. The loan was incurred when the bakery was opened. The loan carried an interest rate of 8%. The interest is payable two months after year end and the principal is due in 2019. Henrietta's will sometimes book special events with small organizations that are allowed to pay after the event has taken place. On December 29th, a small company had a gathering at the bakery. The company was billed $1,089 and has 30 days to pay it. Geoff has not yet recorded this in his financial records. Henrietta's declared a dividend of $5,000 on December 30th. Geoff didn't know how to record amortization for the year and so left it for you to record. Amortization for all assets is charged using a straight-line method by taking the cost of the asset and dividing it by its expected useful life. The assets have expected useful lives as follows: o Computer: 5 years o Bakery equipment: 10 years o Furniture and fixtures: 20 years The information shows that Henrietta's owes The information shows that Henrietta's owes $400 for a telephone bill and $400 for electricity for December. These amounts have not been recorded yet. Exhibit 1 Henrietta's Pine Bakery Unadjusted Trial Balance December 31, 2015 Account Name Debit Credit Cash $35,000 Accounts Receivable 5,600 Food Inventory 1,000 62,500 Merchandise Inventory Prepaids 3,400 Computers 30,000 12,000 Accumulated Amortization - Computers Bakery Equipment 90,000 18,000 Accumulated Amortization - Bakery Equipment Curniture and ituroci so Furniture and Fixtures 150,000 15,000 Accumulated Amortization - Furniture and Fixtures Accounts Payable 18,000 Accrued Liabilities Interest Payable Dividend Payable Long-term Loan 220,000 Common Shares 50,000 Retained Earnings 22,000 Food Revenue 468,500 Internet Revenue 127,000 Merchandise Revenue 103,000 Food Expense 240,000 Internet Expense 54,000 Electricity Expense 65,000 Telephone Expense 20,000 Interest Expense b Salary Expense 200,000 Insurance Expense 9,000 Supplies Expense 8,000 Depreciatiomece Internet Expense $4,000 Electricity Expense 65,000 Telephone Expense 20,000 Interest Expense b Salary Expense 200,000 Insurance Expense 9,000 Supplies Expense 8,000 Depreciation Expense Rent Expense 60,000 1,053,500 1,053,500 Based on the information you have prepare the adjusting journal entries, an adjusting trial balance, the statement of earnings (income statement), statement of financial position (balance sheet), and statement of retained earnings. After you have completed the statements, prepare the closing journal entries and the posting closing trial balance. Ensure you show all of your work, and prepare proper journal entries and properly formatted financial statements. Note to students: Issues are hidden within the case. It is your responsibility to read the case facts and identify the critical issues required for discussion and analysis. Evaluation